-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

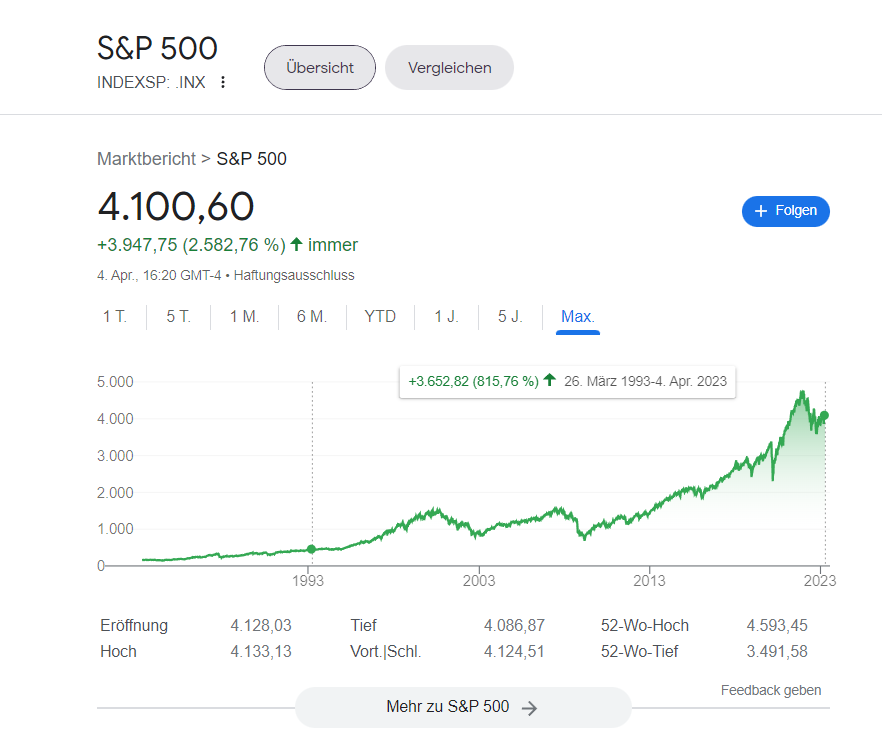

Country success goes over individual shareholder success, to a degree yes. But China understands they cant grow alone so i think that this incredible disregarding of investing in china and the ,,china is uninvestable,, is just false. Growth at all cost is what brings this country forward, not billions in dividends that go to few billionaire shareholders but real growth for common working people. This story of zero profits is also just false, valuations in china are partly ridiculously cheap, if these come up bar with the US the returns are very decent. And many businesses had stellar returns. High GDP growth will mean good shareholder returns, as long as those businesses dont become predatory! The individual businesses treat shareholders similiar to US, just look at tencent, there is no difference with dividends buybacks and culture. Whats different is the willingness of the government to regulate and also their ability to regulate. In the US many businesses can engage in predatory practices, pay ridiculous wages to people, abuse them, shatter unions, bought politicians that harm the majority of working people. In China there is from one night to the other immediate action and tough regulation, the american shareholder then comes with ,,socialism,, and ,,no shareholder rights,,. I dont think its true and many regulations are very smart. If you bought shares in tencent 15 years ago, the story will be the same and also for the future. The only difference is again, the governments ability to regulate markets for the good of the economy. In China practices like FORCED yearly increased wages of 15% in several coastal provinces made many businesses move to the countryside for cheaper labour. The government can pull levers to grow underdeveloped parts much more than the US. They CCP administration has smart people sitting there looking at the US, what works and what doesnt work and then they can immediately start implementing without needing votes and all of that. It gives them an edge, especially in long term planning. China is already a dictatorship and authoritarian, doesnt necessarily have to be bad as long as the leader organizes that his people are taken care off so they dont revolt. The CCP knows this very well and Xi JinPing is someone who takes common prosperity to the heart IMO. Is it likely that tencent, JD, Baidu will be businesses that will be better and worth more in 10-20 years. Look at how much china can grow their country. 1.5b people, a government willing to growt the economy as hard as they can, pulling levers in countries all along asia, africa, europe. They invest where they can, and they invest very well. Its a no brainer for me to include some of these names at reasonable position sizes. Guy Spier has Baba and Prosus, Pabrai has Prosus, Munger has Tencent and Baba, there will be many more who own these assets for a reason. India is great, China is great, they will both be bigger economies with more and more influences in the future!

-

This was a good clip to describe the point of view of africa and african-chinese relations vs germany now

-

The Video of Frank Sieren changed my oppinion on china a lot, sad its only in german.

-

I personally am a fan of Jung and Naiv, their videos are generally of very high quality, they ask critical questions, the people on the show are important politicians and one gets a great overview of their competence. Id say that they are too left in some areas and underappreciate capitalism (if capitalism works) but also invite viewers that give a good counter view (Ulrike Hermann, pro capitalism but also radically green). Cheers to my fellow germans @Aurel!

-

If you want another recommendation that is as interesting as the interview with Frank Sieren: This is also a bit linked to the content of china: Economic policies and growing the economy. As counterintuitive it might sound to some economists, wage pressures increase economic growth and efficiency innovations. That american business like amazon tries to pay as little as possible might be good for them and shareholders but not for GDP growth and competition that leads to the consumer and society winning. Common prosperity is the term for a market that benefits the society as a whole and not the shareholder. As @Parsad pointed out, the chinese have a different view on how much business is allowed to control. That can mean that shareholders dont come first as it is the case in the US. If these policies will lead to a better economy and higher prosperity for the general public remains to be seen, i am personally very bullish on china and i think the people in power there are very well educated and have levers the US cant push, therefore all this counter talk and blaming. China is in a position where they can gain more power than the US, also because of their governmental long term control. I think if one would want exposure to chinas growth and developments in Asia, Prosus is the best vehicle for it. Tencent is under scrutiny at times but they know what the CCP wants and the risk of them being targeted severely is low. The idea of the ,,satisfied,, customer is a good one and i think that shareholders will be rewarded to some degree. The low price and long runway will probably more than compensate for the risk of more severe regulation and redistribution of wealth (which will actually benefit tencent in the longterm because of the general GDP growth for china).

-

Vanguard All World, Set it and forget it! Its something you can own, if it doesnt exist anymore, civilization wont

-

Phenomenal businesses that don't require any capital

Luke replied to LearningMachine's topic in General Discussion

-

Phenomenal businesses that don't require any capital

Luke replied to LearningMachine's topic in General Discussion

Which tobacco companies do you own? I was interested in the industry too -

Only for german viewers or english subtitles, one of the BEST videos i have seen about china. Frank Sieren lives in Peking for more than 20 years and informs german news agencies about developments there, holds talks about china etc.

-

Phenomenal businesses that don't require any capital

Luke replied to LearningMachine's topic in General Discussion

Perhaps he just rounded to 10T to make the number easier to digest? For sure Microsoft, Apple, Tencent -

Thank you, i didnt know the holdings are as such, will have a look

-

Nice one, whats your take on Porsche SE, compared to ferrari they are a weaker brand but valuation wise there is a huge difference too? Could you tell me a bit about the thesis? Dividend Growth and transition to e cars/e fuel? How much runway do we have? I am interested in the brand for sure!

-

More Nintendo, now 5% Position

-

Then share your portfolio with us :D!! Is it something like BRK, Fairfax, Alphabet, Meta and this Retailer with a Crypto Arm? Cheers Parsad!

-

Thats what they say but they do compounded at a decent IRR without tencent i remember from presentations

-

I love Prosus, constellation software looks super expensive at first glance? What's the thesis here? 20-30% annual growth for the next years? They need to triple earnings to be valued at almost 25x. Don't see how this is an interesting business at that price.

-

I sold Intel and LVMH completely and will shift the proceeds to Nintendo/BN/Alphabet. 20% gain on LVMH and i think there is better value elsewhere. Intel at -4% but after doing a lot of research on TSMC, i dont want to bet on intels comeback for now.

-

@crs223 I really think you would like tencent/prosus too. As @sleepydragon pointed out, they have some of the best engineers and capital allocators in the world. They have one of the best views on asian markets, can buy minority stakes in promising small businesses, invest globally etc. Its one of my highest conviction ideas for the next 10-20 years. Prosus could do better than tencent with their own spawner engine but youll be fine either way!

-

Hey Friends, Just curious what you guys own. This is my current portfolio. Brookfield is just BN.

-

More Nintendo

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

Luke replied to thepupil's topic in General Discussion

@LearningMachineJust watched a video about Vonovia, German Reit. Stock Price completely collapsed, Liabilities 4x marketcap, Longterm Debt 3x Marketcap. Leveraged cheap in low rates and now is faced with a new environment. German Rents are growing much more slowly than US due to regulation. They also could face lots of costs due to green regulations. Dont know how long they financed but prices are going down down down too for properties. Looks scary. -

I sold ASML completely and shifted proceeds to nintendo, its just better value and i think can beat asml IRR wise, bought at 395 euros and sold at 620 euros a share

-

Added to prosus and tencent, the quarter was really decent, management is stellar and runway+tailwinds are huge. very bullish

-

i dont have positions bigger than 20% and only with very high conviction, Nintendo i want to make 5-10%