TwoCitiesCapital

-

Posts

4,667 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Posts posted by TwoCitiesCapital

-

-

1 hour ago, mattee2264 said:

Still it is a little bizarre to see UK, Germany and Japan surprising markets with negative GDP growth and seeing their stock markets shoot higher. Either market is prophetic and looking through to a robust recovery in 2024. Or more likely the market figures bad news = quicker rate cuts and the rate cuts will produce the desired economic improvements.

This is concerning me as well. Was already on edge with the U.S. markets ignoring leading indicators, tax receipts, PMIs, composition of jobs, etc.

But now we actually have corroboration from other countries that this slowdown is global and still nothing. Lines go up.

Seems like this is going to be one of those things that appeared obvious in hindsight, but that markets were able to ignore in the moment. In the meantime, content to be heavy in bonds.

-

1 hour ago, Gmthebeau said:

and here we go again. Everyone who bought the 4% being blown up.

If long-term, rates go from 4% to 5.5%, which do you think will likely lose more? Stocks or bonds?

-

1 hour ago, valuesource said:

Jeezus....

You just can't win, can you. No mention of last year's profits being goosed by $1.2B from the per insurance sale....

1 hour ago, StubbleJumper said:The most obvious point is that there's basically one bil of unrealised gains on fixed income, and it is unlikely that those bonds will be sold any time soon. We will see a nice pile of interest and divvies over the coming years, which is outstanding. But the $997m of unrealised gains on the bonds is low quality of earnings.

No lower quality than the $1.2B in losses taken last year for interest rate moves. Most of these gains won't be given back because it's not reflective of premiums to par as much as it the reversal of prior discounts to par from interest rates running higher in 2022 as well as the amortization of those discounts as portions of bonds come nearer to maturity.

-

53 minutes ago, Redskin212 said:

I have been a FFH shareholder for over 20 years, regularly attending annual meeting and listening to most quarterly conference call. It is hard to explain, but I can hardly wait for the annual results release tomorrow and conference call Friday morning. To me this silly MW report has just hyped it up more for me.

Thanks to all, especially Viking, for all the recent posts - the wealth of learning is amazing!

I'm giddy myself

Is gonna be high quality earnings (not accounting/paper gains) and a killer report

-

49 minutes ago, Viking said:

@dartmonkey I think management has commented on the TRS in the past. I think they have said they hold it as an investment. Not complicated.

How do you evaluate an investment? By calculating intrinsic value. My guess is Fairfax can do this… for itself.

I don’t understand all the hand-wringing / urgency to ‘do something’ with the TRS position. Especially given the likelihood of mid to high teens ROE the next couple of years.

The hand wringing is largely just due to the liquidity drag it can potentially create. Just like I was paranoid about their duration until they got around to locking it in. There has been a history of mistakes made that we don't want repeated.

Fairfax damn near run afoul of covenants and cash @ holdings company before. Having to come up with cash to front the movement on 7% of it's shares every quarter is not chump change. Particularly as the share price has moved from $500s to $1000s.

This isn't like their other equity investments because those wouldn't necessarily require additional cash infusions to continue holding through a downturn. And as the financing hurdle rises, and as the stock price rises, the potential cash cost of holding a position through a downturn is rising significantly

For now, I'm comfortable with it. But I would prefer them to let it go too early than to be forced to let it go too late.

"Buy fear, sell dear". Selling dear by definition means it hurts to sell and you don't want to do it.

-

3 hours ago, SafetyinNumbers said:

A combination of the USD wrecking ball that outperforms all currencies for technical reasons over the long term and oil prices being down, especially in real terms from $110 in 2011.This.

All currencies have sucked relative to the USD over the last 10-15 years.

I've been surprised by the staggering amount in some countries that aren't really "hyper inflationary" and the currency drag is the predominant reason my EM value plays at 3-5x earnings didn't trounce the S&P.

The below aren't peak to trough - they're just rough approximations of the exchange rates that existed in 2011 compared to where they're at today.

Mexican Peso is down like ~40%.

Brazilian Real is down ~70%.

Korean Won is down ~20%.

Euro is down ~25%.

Australian dollar is down ~40%.

Yen is down ~50%.

-

50 minutes ago, Santayana said:

Wow, it really would be something if the report was on the behalf of Brett Horn. Claim Fairfax book is 20% overstated, hope for a drawdown of at least that much, and then Brett can point to his price target and say "See, I knew it was overvalued".

Jokes on us. Brett Horn hired MW just to have a second voice agree with him

-

2 hours ago, blakehampton said:

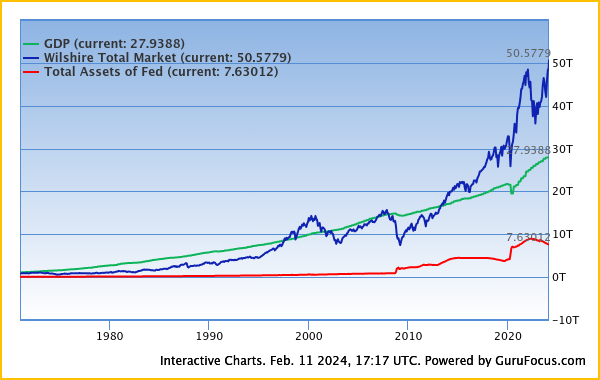

The Buffett indicator looks pretty scary relative to the past. The ratio of total market cap / GDP is currently 181%, what do you guys think about it?

Buffett has said in the past that this is “probably the best single measure of where valuations stand at any given moment.” In an interview, I heard Alice Schroeder say that he would like to buy when total market capitalization is at 70-80% of GDP.

This indicator is less relevant with multi-national companies that exist today. At one time, it made sense that the capitalization of companies in the US would be tied to the incomes/economy of the U.S. and could not meaningfully grow beyond that. This was the case for much of Buffett's early career.

But now? Companies do a ton of business overseas and are no longer linked to just American incomes (what GDP is measuring) allowing for higher multiples to U.S. incomes to persist. I doubt we see 70-80% again outside of some economic depression.

-

46 minutes ago, blakehampton said:

So I have seen "the stock market is not the economy" a couple of times and I have to say I don't understand. Wouldn't the stock market essentially be a delayed representation of the economy?

Yes and no. As mentioned by others, the index essentially represents the best of the best (not always, but a close approximation) and thus isn't representative of the "average". Also, a chunk of revenues/profits are derived overseas which may be less sensitive to the ebbs/flows of U.S. specific economy..

Historically, they are related but not perfectly correlated. If only because weakness in the overall economy tend to lead to weaker consumers which will hit even the best of companies, a slowdown in the US can cause slowdowns elsewhere globally given how much we import, and because as people are laid off there are fewer $ flowing to excess savings/investments to bid up shares.

But they rarely coincide perfectly - stocks often lead, and sometimes lag, the developments in the economy.

-

14 hours ago, james22 said:

Not quite here yet, actually.

1% of $168M, not $4T.

Fidelity Canada. And this allocation has been around for years and Canada has had a BTC spot ETF for three years now.

https://www.reddit.com/r/Bitcoin/comments/1ala1yi/fidelity_allocating_1_to_spot_bitcoin_in_their/

Still, so fidelity has been able to hold people's btc safely for 3 years without issues? promising

Good call - hadn't realized it was already in the Canadian models either so I suppose still good news to me, but certainly less impactful.

That being said, hard to say it won't be a road map for US models now that the ETF is approved.

-

What's interesting about all of this, to me, is the 10% move today had me buying shares and increasing my position by 10%.

But I wasn't increasing my position by 10% when we were at this price 4-6 weeks ago. Probably 1/2 anchoring bias and 1/2 knowing earnings announced next week are gonna be amazing

-

17 minutes ago, Hektor said:

IF the share price tanks, what is the impact on (of) TRS?

Cash would flow out of Fairfax to the counterparty. But this dip so far only takes us back to where we were in January, so nothing to be concerned with on Q1 at this point as it's just reversing cash that would have been due to Fairfax.

Plus, we've got blowout earnings coming in a week that may take us right back up.

TRS is only concerning when the economy actually tips IMO. Then you'll likely have falling asset values AND falling liquidity as it drains cash from Fairfax's coffers.

-

24 minutes ago, gfp said:

Well he would be smart to exit before the annual report comes out, that's for sure. I suspect his best exit opportunity in the shares was to exit on this morning's open but I assume he expressed this "short" in the credit default swap market so who knows how those spreads look (not me).

Fairfax has no options and trades in in Canada and OTC - this isn't a very good "short and distort" candidate to get others on the bandwagon.

Yea, I dunno about how he expressed the short, but I tend to agree with Greg's take here.

I'd prefer Fairfax without all of the inter-related transactions, paper gains, etc. because it definitely muddies the waters

That being said, the transactions that are the most questionable are tiny, the transactions he points at that are off-balance sheet debt have already been identified as such here and were obvious done to raise liquidity and stay compliant with bond covenants amongst other things, and ultimately I would argue it's probably a good thing Fairfax has these relationships and avenues for recognizing value when the market won't give it to him given the regulatory importance of book value and liquidity for underwriting.

Just glad I got to pick up more shares before what is likely to be an absolute smasher of Q4 earnings. Looking at $1+ billion just in fixed income gains/coupons - not even touching equities or insurance which we know also did strongly.

-

Thank you, Muddy Waters!

-

4 hours ago, TwoCitiesCapital said:

Just got my Celsius distribution today. Had a hair over 0.5 BTC there and ~4k of stable coins.

My distribution today was for 1.6 ETH. 85% loss in nominal terms compared to what the crypto would be worth today had I just held the BTC and stable coin in my wallet

No idea what the value of the private mining co is ,or when I'll get my shares and it'll IPO, but that is supposed to be the bulk of the recovery.

clawvacks from on going litigation could add a few more %, but it's looking ugly so far in comparison to my cousin was made whole in BlockFis bankruptcy

Just updating here:

Received a second separate distribution of 0.1055 BTC.

Not sure how they decided the make up of BTC and ETH for the recovery, but I wasn't expecting two separate payments.

Better than what was implied by my original post but still a far cry from the crypto lost

-

-

Just got my Celsius distribution today. Had a hair over 0.5 BTC there and ~4k of stable coins.

My distribution today was for 1.6 ETH. 85% loss in nominal terms compared to what the crypto would be worth today had I just held the BTC and stable coin in my wallet

No idea what the value of the private mining co is ,or when I'll get my shares and it'll IPO, but that is supposed to be the bulk of the recovery.

clawvacks from on going litigation could add a few more %, but it's looking ugly so far in comparison to my cousin was made whole in BlockFis bankruptcy

-

7 minutes ago, blakehampton said:

I don't know who would buy 10 years at a 4% yield. It seems to be an exceptionally bad deal when you can easily get 5-5.5% on your money short-term. I do know that the Fed owns a shit ton of 10-years and it seems like they are manipulating the market downward, I don't think anybody knows how that situation will end. On your point of DEO and MSGE, I don't disagree that there are deals in larger capitalization stocks, it just seems to me that they are very rare. How do you know that earnings will be this high going forward and that there will continue to be double-digit growth? I'm quite skeptical.

Is what you're seeing rational? This is of course very general, but do you think that people will do well getting in at these prices?

Why own the 10-year? Because a money market won't go up 10-15% if the Fed cuts to 2%. It's total actually falls as every day a portion of the money market resets to lower yields.

Govt duration is a primary hedge in most risk-off environments. 2022 was an exception given that it was an inflation scare and yields started at 0% at the start of it.

-

14 hours ago, This2ShallPass said:

Thanks. I have been following this through Berkowitz's letters for a few years but only got in about a year back, <1% position. Which preferred would you buy?

I purchased the ones that had the largest discount to notional that traded regularly enough for me to establish a position. At the time, that was FMCCJ and that is what I still own.

There are other more liquid shares at higher valuations as well as different coupons which some have theorized may make a difference in damage calculations and potential recoveries, but I haven't speculated about any of that.

-

9 hours ago, mattee2264 said:

Also interesting is that after the corporate profits recession in 2022 and 1H2023 the last few quarters have been very strong with 7.5% EPS growth in Q3 and with 80% of S&P 500 companies reporting Q4 is lining up to come in a little higher than that.

Along with the strong GDP figures looks more like an economic take-off than an economic landing. Although of course the caveat is that most of that earnings growth is probably coming from Big Tech.

This. Overall earnings growth is still not great for most other companies, even with easy comparables from the prior year contraction.

And it's all quite a bit worse when you adjust for inflation over the last 2-3 years to gauge the real earnings growth/contraction.

-

29 minutes ago, This2ShallPass said:

I have Fannie and Freddie stock. Followed Ackman's advice, buy them and put it in a drawer and don't look for many years. Which is a better play stock or preferred? I know Berkowitz owns the preferred, but there are so many of them I didn't know which one to get.

Btw, what's going on w Fannie and Freddie, they're up ~150% in the past year?

Yea, have been holding/adding since 2012. Has dwindled from a 10% position to a 2% over that time as this has taken way longer than I thought, the courts haven't been as kind as I thought, and I've allocated quite a bit more to other positions over time (and those positions have grown).

I have more confidence in the preferred given any value accruing to the common, requires certain assumptions on capital levels, how that is split between debt/equity, and the timing. And I have no ability to know the outcome for any of those three variables.

But if the common is worth $0.01, then my preferred are worth at least $50 and I'll 7-10x my investment at minimum.

As far as the run-up? Seems to be a 'Trump trade' as a bet on the outcome of the presidency. Not that Trump was particularly great for them last time around, but he's probably better than Biden if you want to see this handled.

-

The most recent 'What Bitcoin Did' podcast with Preston Push was interesting IMO.

Two accompanying slides stood out to me

The first showing $ cleared on-chain versus payments cleared by Visa/MasterCard. This doesn't reflect Lightning Network Transactions which I think is the more apt comparison, but definitely goes to show that Bitcoin is a force to be reckoned with in terms of clearing value.

The second showing price and time both in log-scale which is a new representation I haven't yet seen. Not sure I quite grasp the intention behind the log of time, but it's an interesting visualization of the tops/bottoms on the cycle, when it provides good value (like now), and the accompanying 'mooning' after the historical halvings.

-

48 minutes ago, wachtwoord said:

Appearently US bankrupcy law (?!). Everything is valued in US Dollars at the petition date and that is what debtors get to claim and not a penny more.

Celcius is the same. They may pay out in part in Bitcoin and Ethereum (and equity in some crazy "mining corp" that also retains a bunch of equity in Ethereum to "stake", utter nonsense as debtors are forced into an investment ran by incompentents) but everything is valued by the the Dollorized value at petition rate. That's why the recovery rates look so good (the only ones winning are the law firms that got to handle the bankrupcy, but I reckon that's nearly always the case).

PS: the Celcius CEO is also such an obvious scammer you can smell from a mile away.

Mayhaps. I'll know more when I get my payment due Celsius, but my cousin was in BlockFi and was made whole on his entire Ethereum stack - not the USD value on the date of their filing. So there definitely IS a difference somewhere.

-

44 minutes ago, Sweet said:

What has the stock market valuations in those countries got to do with US companies?Global GDP is growing despite the problems in Europe and China.

My only point is that yes the US economy is still the most important but the biggest companies are global in their footprint and that matters.

Name another country with the equivalent to the so called Mag7.

You said they weren't tethered to the US economy, but rather the the global economy, as an explanation for why the stocks might be doing well while the US economy overall wasn't.

I was just pointing out that they appear untethered from ANY economy seeing most of them aren't doing hot.

Fairfax 2024

in Fairfax Financial

Posted

Going to be honest - the share price reaction to an a amazing earnings report is a bit disappointing

Makes me wonder if 1) the market had it "right" and the earnings rally was what we saw in January or 2) if we're back to the days of the getting the earnings look for free and the stock responds 2-3 days later

Either way - I am somewhat shocked we didn't get a pop of 5-10% from market participants who haven't been following this as closely as we have.