Morgan

Member-

Posts

583 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by Morgan

-

That is totally fair. I’m cheap, but Tikr Is worth the $40/mo. It saves me so much time. They have discounts frequently as well.

-

Tikr.com does a similar job compared to Koyfin. There are also some great accounts on X.com that cover Japanese companies in English. @japansotckfeed, @AVIjapan, @CacheThatCheque. There are others as well.

-

Almost everyone from every demographic hates insurance companies. It's extremely unlikely this will cause any meaningful change, but something needs to change with healthcare in the US. That's why these memes are everywhere.

-

Completely beyond my ability to understand, but it's possible this is the foundation of a new wave of computing. It will likely take a very long time before it is at scale in the world though obviously. These kinds of projects from Google are a good reason not to break the company up. Almost no companies can pay for this kind of research for the years and years that it takes. Waymo is another good example. Very exciting future of course.

-

Yes agreed. It is sort of similar to apartment buildings. They always need work, especially if they're empty. A major difference with apartments, is after 15-20 years the mortgage is paid off and you still have a rentable building. After 20 years the boat is most likely a rust bucket. Thank you for sharing about Chouest. I'll read up on them.

-

Thanks @Longnose! I haven't read that book, but I should. I'll add these two books as well. They've been discussed on the board before. Dynasties of the Sea: https://www.amazon.com/dp/0983716331?_encoding=UTF8&pd_rd_w=ftcyq&content-id=amzn1.sym.7d2923e8-7496-46a5-862d-8ef28e908025&pf_rd_p=7d2923e8-7496-46a5-862d-8ef28e908025&pf_rd_r=Q9NAB426J42S73QJFY7N&pd_rd_wg=YcEqN&pd_rd_r=f2ca9bbd-c5b2-4b02-b452-b7fb2966e37f Maritime Economics: https://www.amazon.com/Maritime-Economics-3e-Martin-Stopford/dp/041527558X/130-0621233-9779564?pd_rd_r=f2ca9bbd-c5b2-4b02-b452-b7fb2966e37f&pd_rd_wg=YcEqN&pd_rd_w=UEPJZ&pd_rd_i=041527558X&psc=1

-

I'll add more: How do you make sure your ship isn't used to smuggle drugs? I assume the ship is confiscated after this? https://www.marinetraffic.com/en/maritime-news/15/maritime-security/2024/11702/largest-cocaine-bust-yet-worth-dollar250-million-made-in-the Battery powered ship - this is kinda cool https://www.marinetraffic.com/en/maritime-news/17/container-shipping/2024/9439/cosco-welcomes-new-electric-containerships-for-yangtze-river MSC is huge https://www.marinetraffic.com/en/maritime-news/17/container-shipping/2024/553/msc-set-to-cross-the-5m-teu-capacity-mark

-

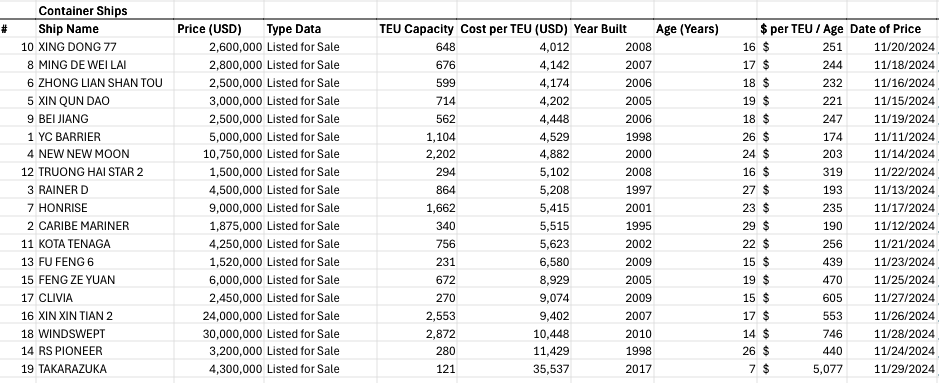

This is a little off the wall, but has anyone purchased a merchant ship or know anyone who has purchased a ship? Not raised money from investors and started a company, but actually one dude buying a boat and building a fleet? There are tons of ships for sale, tons of boat tracking (this is very cool) and good news sites. Sometimes things aren't very transparent and data can be hard to find or must be manually created from different sources. MSC was started in 1970 with a guy and one boat and now is the largest shipping company on the planet (I think). Net income is estimated to be $36b in 2022. Massive private company. For the last 5 years or so, the shipping industry has been (I think) abnormally profitable and the prices of used ships have gone up as well. So now it is not the time to jump in, but it is fun to learn. The most important aspect, like real estate, is getting in a good price. Once the cost structure is in place, it's not changing for a long, long time. Shipping news: https://www.joc.com/maritime https://www.tradewindsnews.com/ Ship tracking: https://www.vesselfinder.com/ https://www.marinetraffic.com/en/ais/home/centerx:96.4/centery:16.4/zoom:11 Ships for sale: https://www.nautisnp.com/ - lots of ships for sale There are also vessel brokers. Other Issues: - Ships seem to have a fairly steep decline in value as they age. I've read that ships generally are retired at around the 20 year mark unless there is strong demand, like there is now. - Changing requirements for greener fuels. What happens if you buy a ship and the laws change and it needs a new engine? Ouch. - Inspections over time and at various ports. I read the entire ship needs to be inspected, all the welds, mechanical, electrical at various periods of its life. I really don't know the regulations for this. Small sample of pricing data sorted by Cost per TEU: Here is a sample of a ship for sale from the list above. YC Barrier. From the pricing data, it is not at the bottom for $ / TEU, but it is at the bottom for $ / TEU / Age at $174, indicating it is near the end of its life. Listing: https://www.nautisnp.com/container-ships/geared/23361 Tracking : https://www.marinetraffic.com/en/ais/details/ships/shipid:300164/mmsi:352003979/imo:9151917/vessel:YC_BARRIER - check out the photos over the years to see the degradation of the ship. Anyways, I just wanted to share and get any input anyone has info on the small one guy shipping industry. Thanks!

-

Yes. Do you think he actually writes all of these himself?

-

Bezos/Amazon was in on this too. I was pretty hopeful something would come from this, but even they failed. Pretty shocking. Other than a total collapse of the healthcare system, I don’t know how we’ll ever switch to a national healthcare system.

-

I’m not a REIT expert. Occasionally things go up in value despite higher rates, but it is rare. I didn’t check your math, but it might be worth checking if management has incentive plans and what the targets are. It’s possible to boost the values a little bit here, a little there and a little over yonder and pretty soon the portfolio is worth a lot and maybe Wall Street will agree, the stock goes up and top management gets their payout. After all, who is to say a building is worth exactly “x” vs “x” plus or minus 10%? Especially over a 6-24 month period. There is also incentive misalignment with the appraisers. If they want to get hired for the next job, it is in their best interest to get close to management’s expectations lest they shop for a different appraiser. The same thing happened at the rating agencies during the GFC.

-

There are a fair number of people in the world with at least $100m cash (this doesn’t even include entrepreneurs raising money). This is what was spent to build the first successful rocket. None of them have come remotely close to the accomplishments of SpaceX let alone any of Elon’s other companies. Bezos is the best competitor, having spent $1b+ (10x more) and has achieved very little. The common claim that Elon is an idiot and it’s the engineering teams that do everything; obviously he has huge and incredible teams, but Elon (and his teams) are able to produce the best results by far compared to every other single organization on the planet.

-

This is so amazing it’s shocking it actually happened! This is a the dawn of a new age for mankind!

-

I pre-ordered it and am looking forward to it!

-

@Saluki thank you for continuing to post here. Lots of interesting stuff to review. Thank you!

-

When there’s a big spread on books, I just buy the cheapest one unless it’s for a gift. Sometimes I check out Wikipedia to see if there is more info on each edition.

-

Being up 593% is great until one bad year wipes all the previous years gains, which is what happens with most high risk funds eventually. It is a little crazy he says he's willing to invest in ponzi schemes. Surely he doesn't but this is just for marketing purposes?

-

Doesn’t he have any morals? How can he sleep knowing he’s taking such big risks with other people’s money? It is very reckless. It’s more unethical because he tries to hide his blowups.

-

Evidence for underground water on Mars

Morgan replied to rogermunibond's topic in General Discussion

I'm super excited for water on Mars! Hopefully SpaceX will achieve its Mars goals and gets crews there and start exploring and building! -

IIRC, Mongolia Growth Group raised $200m to invest in Mongolian real estate with the idea that values would increase similarly to values in Hong Kong. This is such a fundamentally bad thesis. Hong Kong is very land constrained while Mongolia is just open space forever. Furthermore, the real estate portfolio, with no debt, still was losing money. This is totally crazy. Their expenses were out of control. Then he created an insurance company inside of Mongolian Growth Group which never made any money. The only reason the stock has gone up that I’m aware of is because securities inside company increased in value (I will give him some credit on that), not from anything related to operations of the company.