LearningMachine

Member-

Posts

1,776 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

25% tariffs on Canadian and Mexican imports.

LearningMachine replied to SharperDingaan's topic in General Discussion

Maybe time to look at history when trade wars happened between US and Canada in the past. In the past, Canada chose to build stronger ties with UK, but that won't help now as UK economy is much smaller than US economy. Maybe stronger ties with EU would be more interesting this time. Imagine the scenario where the tariff does get put in place, and results in economic pain in Canada, and then there is an ask for a referendum in Canada on whether to join the US, wonder what the referendum results would be after the economic pain is put in place vs. now? If Trump doesn't put in exception for oil and gas to begin with, it will cause economic pain in the US, and US public support will go down. So, probability is high that exception will get put in place for oil and gas out of the gate or very quickly. -

Is the universal translator already here?

LearningMachine replied to rogermunibond's topic in General Discussion

Not fully real-time yet, but Google had demoed this with Google Pixel Buds Pro before the growth in LLM capabilities: https://support.google.com/googlepixelbuds/answer/7573100?hl=en -

Wow, BRK currently has more invested in treasuries & cash ($310.34B) vs. equity securities ($271.65B). Looks like it was the case from 2000 to 2006 as well, and then Buffett started deploying in 2007-2009. So, he has got lots of patience. Would love to hear stories from anyone else with that much patience in waiting while treasuries were yielding reasonably, and then successfully leveraging the opportunities when they came.

-

One thing that is a little harder to understand is that PP&E ends up being a liability not an asset especially with inflation, because when everything doubles in price, that PP&E has to be replaced at double what it cost. When you start taking into account the life expectancy of PP&E that will need to be replaced, you start realizing a lot of the cash coming in will have to be used to replace PP&E at inflated cost, with much less if anything left for shareholders than you originally thought. Buffett tried to explain it at http://csinvesting.org/wp-content/uploads/2017/04/Inflation-Swindles-the-Equity-Investor.pdf, but I think he hid the learning between the lines and in riddles instead of making it very clear. You can work through an example by imagining you have a business that just rents out a $1000 laptop for $300 per year. On the surface, it sounds great, but if inflation is running at 8.4%, and you have to replace it 5 years later for $1500, all the money you got out of the business goes into purchasing the replacement laptop (assuming you had to keep the cash for future capex instead of investing), with nothing left for you as an owner of the business. So, a terrible business. Even if you were to depreciate accurately 20% per year, you would only depreciate $200 per year, making you think that you had $100 in "earnings" each year, but at the end because of inflated cost, there was nothing you got out of the business. Even worse than you not getting anything out of the business: such a business can easily become a liability instead of an asset if the lifespan of the PP&E ends up being 4 years instead of 5 years that you originally thought. What would you pay for such a business? Instead of valuing the business as a going concern, I'd be willing to only value it for its liquidation value. Overall, you can also try to understand this by assuming that PP&E line-item is a liability that is going to grow at the rate of inflation based on the original cost. For businesses where PP&E is a much a bigger item that Cash flow from Operations, that PP&E replacement liability will grow much faster than Cash flow from Operations because it is a much bigger number than Cash flow from operations for capital heavy businesses. Over time, that liability will need to be funded out of Cash flow from operations, eating into FCF. The amazing thing to realize is that there are so many businesses that are effectively a form of renting out a $1000 laptop for $300 per year, and Mr. Market continues to value them based on "earnings" instead of liquidation value. Mr. Market is currently so excited about cloud companies, e.g. Amazon, but when replacement cost starts to show through on PP&E and no cash is able to come out of the business for a long long time, I think Mr. Market will realize eventually.

-

Biggest regrets of the older posters here?

LearningMachine replied to yadayada's topic in General Discussion

I agree with you on staying away from supplements. Those parts of Sinclair's statements don't pass FRE 403 for me either. More basic stuff like intermittent fasting and eating ultra low glycemic index foods, and the underlying evidence from his experiments for these pass FRE 403 for me. You can naturally do these basic things yourself with little risk and see the progress yourself over years as well. -

Biggest regrets of the older posters here?

LearningMachine replied to yadayada's topic in General Discussion

I consider each person and each piece of evidence from them on whether probative value substantially outweighs prejudicial value under FRE 403, instead of ignoring all of it as being prejudicial. I'd compare people in a field, and then try to find the best in a given field, who are more motivated by their desire to understand deeper or help humanity. For example, Berkshire selling stuff to shareholders at shareholder's meeting wouldn't put me off from reading Buffet's lifelong quest to learn & understand deeper. Munger selling his book wouldn't put me off either. Earnings from these are inconsequential. Munger possibly buying BABA in a way to signal to world while possibly holding it in his private investments would put me off a little, but I'd still run each of his other statements through FRE 403. Similarly, Esselstyn and Sinclair won't put me off from learning from their lifelong quest to learn & understand deeper. I'll still run each of their statements through the wringer and look at their evidence backing up each statement to see which pieces of evidence and statements pass FRE 403. To each their own in terms of how deep they want to learn & understand things, and whether they consider understanding deeper as esoteric and waste of time. -

Biggest regrets of the older posters here?

LearningMachine replied to yadayada's topic in General Discussion

Thanks @Spekulatius for sharing the podcast. Venki Ramakrishnan's suggestions in the podcast you shared on (1) exercise, (2) good diet, and (3) sleep are good ones as well. Also, Ramakrishnan is consistent with Sinclair on length of telomeres being one of the markers for measuring age of a cell. Sinclair went further to find other epigenetic markers to measure biological age as well. Making rats live longer by starving was earlier research before Sinclair's time. What Sinclair found to have an even bigger impact was intermittent fasting, that is, to give cells time to repair because he found that cells are either in repair mode or in burning energy/multiplying mode, and if you keep on eating multiple times a day, you don't give cells a chance to repair. Intermittent fasting is really easy to incorporate in your lifestyle. Try to not eat all day, and just have a big dinner. You will find that your body gets used to it, and you can do things that people decades younger than you can't. You will run into people who saw you decades earlier and wouldn't believe how you haven't aged while they have. Another thing that Sinclair found that is non-controversial is to cut down on sugar intake, including fruits that have high sugar content. You can easily find produce that is botanically considered fruits, but considered vegetables culinarily, as they are full of nutrients and don't burn out your cells with sugar, e.g. eggplants, squash, beans, chickpeas, peppers, tomatoes, peas, string beans, okra, olives, cucumbers, etc. You can also stop eating grains that can be easily converted to sugar as they have been a very recent addition to our evolutionary development. You don't have to take some of the controversial supplements that Sinclair is experimenting with. You can still do the non-controversial techniques of intermittent fasting and avoiding sugar-filled foods/fruits and foods that can be easily converted to sugar like grains, and start noticing a difference. -

Biggest regrets of the older posters here?

LearningMachine replied to yadayada's topic in General Discussion

Bluezones documentary is an ok surface level start, and then, it is worth going deeper into this topic because your longevity is at stake. Dr. Caldwell Esselstyn was a surgeon at the Cleveland Clinic. See https://my.clevelandclinic.org/staff/1181-caldwell-esselstyn-jr . He went a lot deeper into researching than an average person in the medical field because all males in his family were dying due to heart disease, and the colleague that he had shared the locker with had come up with CABG He felt CABG was the wrong solution. He felt heart disease was due to a chemical deposition problem and felt that CABG was unnecessarily solving it mechanically with so much risk to a person's life. So, he went way beyond what bluezones documentary does, that is, he went and studied the cultures where there was no heart disease, and looked into what they were eating, and then he took the sickest patients that medical system had given up on with multiple heart surgeries, and put them on his diet, their angina pain went away, their angiograms started showing arteries getting cleared up, and those patients ended up living decades longer. Similarly, Dr. David Sinclair is going into it much deeper than an average person in the medical field. See https://sinclair.hms.harvard.edu/people/david-sinclair . He first got rats to live longer using his techniques to reverse age. He came up with a mechanism to measure biological age, and then experimented what techniques got epigenetic markers to show the biological age was going lower, and telomeres were lengthening. So, these people have dedicated their lives to what they are researching, and going much deeper than an average doctor, and I believe they will end up lasting. -

Biggest regrets of the older posters here?

LearningMachine replied to yadayada's topic in General Discussion

Becoming heart attack proof Dr. Esselstyn dedicated his life to preventing heart disease and later became Clinton's doctor after Clinton's heart attack. According to his experiments and longevity results on patients, if you don't want to injure your endothelial cells, you shouldn't use even a drop of oil or eat any animal protein, including dairy and eggs. According to his diet, only things you should eat are vegetables, legumes, whole grains, and fruits. If you follow his diet strictly, he effectively guarantees that you won't die of heart disease. He is himself 90 years old and in fit condition. See https://www.amazon.com/dp/1583333002?ref=cm_sw_r_cp_ud_dp_0841MHKKQS656B88FKYG&ref_=cm_sw_r_cp_ud_dp_0841MHKKQS656B88FKYG&social_share=cm_sw_r_cp_ud_dp_0841MHKKQS656B88FKYG&skipTwisterOG=1 https://youtu.be/_AoWIfPixYo?feature=shared https://youtu.be/Or5uiAMznxo?feature=shared Reversing age Because almost all diseases are correlated with age, another thing to work on is reversing your biological age. Dr. David Sinclair at Harvard Medical School has dedicated his life to it. He is himself 54 years old and has reversed his biological age to be in 30s. See: https://a.co/d/4eEGFuk https://www.youtube.com/@DavidSinclairPodcast -

@bargainman, agreed. That is exactly what I was implying. Yes, testing still needs human trial, but effectively "duplicating" carbon-based human research-scientists onto silicon-based intelligence will make it way more efficient to find new drugs, and simulations should help pick those drugs that will pass human trials so that more of human trials would result in success. Also, a competitor doesn't have to wait until another competitor's human trial is done to start their trial if they have truly found something better within next 6 months because of increased productivity. So, if both competitors pass human trial, first one gets exclusivity only for 6 months. Also, it is not an all or nothing benefit. I think we should be able to see some incremental improvement in this direction over time. Thanks for sharing. You will get lots of heads up on oil. If 100% of 15M car sales in the US were electric today, it will take 18-19 years to replace all of 283M cars in the US on the road today. Even if Level 5 automation came today, it will take time for transportation as a service to take off fully. I understand it has started in SF and Phoenix, but we are no-where near level 5 automation yet. Also, 99% of the population in the world wants to live like the top 1%, i.e. have big mansions with great oil-based flooring, walls, roofs, carpets, oil based furniture, materials mined using oil, heated homes, heated water, cooking gas, etc. They also want asphalt paved roads, and want those roads to be cleaned using oil-based machinery. Even if all cars were electric today, to give bottom 99% of the population same life as that top 1% have after labor is not bottleneck, you need multiple times more oil just for petrochemicals. Vicki Hollub claims oil supply will go down before oil demand would. I think what she means is that you will get so much heads up on demand coming down that oil companies will stop investing more capex to keep production flat, and production will start falling, while leaving more cash for shareholders in the end game - cash that would have otherwise gone into capex.

-

I think LLMs is only one of the benefits of AI. For short-term for LLMs, moat is in data and existing user experiences that carbon based neural nets (humans) are trained on already. Tech itself will spread around with good engineers getting high bids from those who have the moat. META has already benefited from it in increasing relevance of its ads. Nvidia's customer base are companies with big pockets and when those customers are paying 10s of billions of dollars, they can easily spend a few billion dollars each to continue to invest to try to create their own AI chips. Will one of them be successful eventually? Time will tell. I think probability is significant that at least one of them will be successful eventually. Next huge value-add won't be in increasing relevance of ads, but it will be in another scenario. One of those will be to reduce # of hours of high-hourly rate knowledge workers. If you can save 50% of hours of 10M workers getting paid $100K per year, you have created $500B in value, and that is per year. At 10-20X multiple, that is worth $5-10 Trillion. To enable this scenario, you need access to data that those knowledge workers are consuming and producing already. You can deduce from there, who has access to that data and who already owns the user experience that these knowledge workers have been trained on. Longer term, who all will benefit is a little like trying to predict which 3 car manufacturers will be winner out of 1000s of car manufacturers in 1900, where almost all went bankrupt. LLMs is only a start. Another big industry to be disrupted is biotech, in discovery of new treatments and drugs. Counterintuitively, I think value of drug exclusivity rights will actually go down if innovation starts to happen at such rapid pace that a better drug is found by someone else that doesn't infringe an existing drug's exclusivity rights. Autonomous driving has been talked about a lot, but when level 5 really arrives, it will cause a sea change. Entertainment is ripe for disruption with AI generated short-videos, movies and even games. Longer term, innovation will continue to happen. Some assets will be bottlenecks and will continue to get valued higher, e.g. energy, and even commodities that have a monopoly controlling the limited supply, e.g. oil. The demand for these commodities could rise to unthinkable levels in terms of multiples of today as commodities will still be needed by the remaining 99% to increase their standard of living to match top 1% of today, when labor is no longer bottleneck. But, the value will only accrue to those commodities that have a monopoly over controlling supply.

-

I think this is true. I think we'll overestimate what AI could provide in the short-term, but will underestimate what AI could provide in the long term. Before industrial revolution, people couldn't have imagined all the things we take for granted today that take energy. Similarly here, imagine human desires were not bottlenecked by availability of human labor. For example, think about all the things that people in top 1 percentile can afford with human labor today, e.g. concierge to take kids around, help to keep home clean, human labor to rebuild a house on the lake and another cottage in woods, repair roads, build more roads, build more housing, jets to fly around the world, etc. Now, imagine all these things were not bottlenecked by availability of human labor for the remaining 99% of humans. All that would need more and more energy over time, and it is possible that growth rate in energy use will go up when we are not bottlenecked by human labor needed today to fulfill a lot of the human needs that top 1 percentile are able to satisfy today.

-

Totally agree. It ends up being that trees paying you $12 and ponds producing $15 go on sale only once in a while, and so you have to concentrate when the sale is going on. I was reacting to how folks on another thread might be thinking S&P 500 would be safer than diversifying across a handful of trees and ponds. So, I was trying to use an analogy with rocks to help land the point in a simpler way that keeps other non-essential things out, but I might not be landing it well.

-

Imagine you could buy a rock for $100 that has SPY or RSP written on it, and imagine that rock gave you $1.36 per year for SPY and $1.67 for RSP, and the rock has a history of increasing earnings at a mere 3% annually over long periods adjusted for inflation, as far out as since 1870 or since 1970 or since 2000 that took advantage of productivity increases from the Internet. See https://www.multpl.com/ . Who would be willing to buy that rock? Even if you were to stretch your imagination to imagine that $3.56 in so-called earnings within rock labeled SPY and $5.53 within rock labeled RSP were FCF and distributed to owners of rocks in terms of dividends or buybacks, would you still be willing to buy it?

-

And, people think they are diversifying when buying Mag 7 and S&P 500, when they all share a high severity & medium probability common risk of high growth expectations and P/E multiple, which when it materializes, some will call it a black swan event even though it is clear ahead of time that it is a common shared risk. You'd be safer to be in a handful of lower probability and lower severity independent risks that all won't materialize at the same time than Mag 7 & S&P 500 that are exposed to a common risk that when materializes will impact a lot of them.

-

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

@Cigarbutt, I think here too, Mr. Buffett doesn't want to risk losing 500-1000% of the investment in a specific utility due to uncapped jury damages, which could put mothership at risk. He wants statutes on the books to cap those damages for him to invest. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

@yesman182, yes, he could do that and I've mentioned that earlier as well. With the recent purchase, OXY has already indicated they are going to divest certain assets - remains to be seen if they shed the riskier ones. Given Buffet is involved, they probably would. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

The risk here is not about just losing 30% if only 30% is owned, but the risk here is about losing 500 to 1000% of the investment if 100% is owned. If BRK owns OXY as a subsidiary fully, in case of a deep oil spill, courts can pierce the corporate veil to reach BRK assets like they did in case of BP subsidiary to reach BP parent's assets. So, full $58B OXY purchase can create a $250B liability. Ajit explained how they make insurance bets at a recent annual meeting that they are willing to risk a certain percent of their capital. I think he said risking somewhere around 5% of capital on a bet. Risking $250B liability would be too much for BRK. When justifying BRK's purchase of BNSF, Buffett and Munger once explained how they looked at the highest damages that a BNSF accident had ever caused in the past, and had decided that they could live with that. However, they can't live with the highest damage that a deep water oil spill can cause. -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

Because owning it fully exposes to potentially severe liability risk, e.g. a spill in the deep water operations of Gulf of Mexico. I've mentioned this a few times before. Remember the BP oil spill. Buffett wouldn't want to expose the mothership to that type of liability risk even if it is low probability. -

I remember some of the cable investors have mentioned in the past how laying fiber doesn't make economic sense in today's high interest rate environment. The core message I took away from that discussion was that fiber pays at best only about mid-single digit unleveraged yield, and that doesn't make sense when interest rates are higher than that. @Spekulatius, if memory serves right, I think you might have been one of the participants in that discussion. I see people buying NNI and BOC where they are allocating capital towards fiber install. Can we jointly figure out what is the unleveraged FCF yield range on laying out fiber?

-

I agree you don't want to make macro guesses about economy and make investments based on those guesses. I also agree you want to keep on reading SEC filings & transcripts until you find attractive investments. However, that doesn't stop you from also doing risk management by making sure your investments will do reasonably ok in case any reasonable probability macro events were to happen, e.g. before Mr. Market realized interest rate risk, folks could have questioned what would happen to an investment candidate if inflation or interest rates were to hit 10%. In case of real estate, there is reflexivity and stickiness that humans are susceptible to. Thinking purely from a cash perspective under the hypothetical that whatever you buy, you have to hold forever, and can't sell to anyone. #1. If you bought a property yielding 6% unleveraged and locked in 2.5% interest rate for 30 years, you can calculate how much cash will come to you. #2. If you buy a property yielding 6% unleveraged now and lock in 7% interest rate for 30 years, you can calculate how much cash will leave you. You can now make an assumption that rents will keep on rising, and calculate which year you will start getting cash instead of giving cash You can also try to speculate that interest rates will come down, etc., but that would be hopeful speculation. If you were to calculate amount of cash you will get for #1 vs. #2 in next 10 years, there will be a HUGE difference, as much as 10X to 100X to 1000X to even 1000,000X depending on situation. However, when people in #1 scenario don't want to sell, it makes real estate prices seem sticky and reflexivity of real estate prices causes some humans to miss how HUGE the difference is between two items above, and they irrationally start doing #2. However, if prices fall a little that causes people to start questioning stickiness and reflexivity, and narrative starts spreading through social media and traditional media on how starkly different #1 and #2 are, it can cause people to stop doing #2. Whether and when this narrative spread could happen is hard to predict, but you could always try to calculate probability of this happening and watch metrics, SEC filings & transcripts that indicate probability increasing/decreasing, and be aware how your housing-related stocks would be impacted if that happened, and you could also be prepared to take advantage of it happening. In no way I'm saying you wait for that. You continue reading your SEC filings & transcripts and finding other investments, while keeping it at the back of your mind that this narrative spread might happen and an opportunity might come.

-

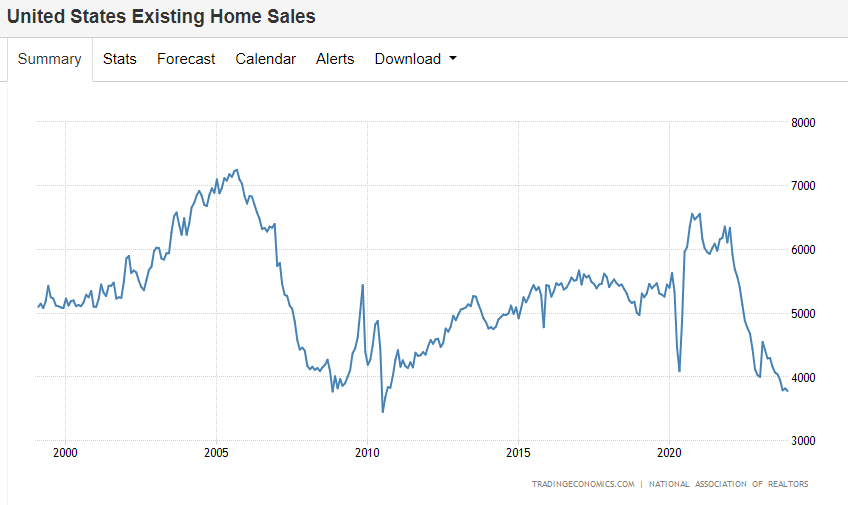

I've been reading transcripts of the builders as well, and waiting to see when existing home sales are below 2009, when would it start impacting them also. Same thing happened in 2009. First existing home sales started falling, then new home inventory started piling up, then builders stopped building, and then, unemployment started going up. So, these things take time. We need to patiently keep an eye for the domino effect to unfold. I think causation has pretty high probability at each stage, i.e. much higher interest rates had high probability of impacting existing home sales and boat sales, and that we are seeing already. Next step in the causation chain is the existing home sales being below 2009, also starting to show up in new home sales starting to fall. I think the probability is high for this causation link also. One thing that is different this time is that people are willing to move far away from their jobs, and so there is a chance, new construction continues, but if that happens, housing supply will go up a lot over time. Anyway, keeping an eye. I think probability still high that this causation link will materialize.

-

Surprised no-one is talking about this, but the signals of impact of higher interest rates are starting to show up in the real economy in home & boat sales but not in the stock market yet. Malibu Boat sales fell 37% year over year because buyers are going on the "sidelines". See https://malibuboatsinc.com/investor-information/events-presentations/default.aspx. Wonder how many construction & other workers will continue to be needed to build more homes, boats and other interest rate sensitive items. How long before it starts to show up in profits of more companies, and Mr. Market starts to notice? Source: https://tradingeconomics.com/united-states/existing-home-sales Source: https://fred.stlouisfed.org/series/MSACSRNSA Source: https://fred.stlouisfed.org/series/NHFSEPT

-

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

Sorry, I disagree. I think it would be easy to build a company to compete with Grab, Uber and Lyft. With Uber, you have to give Lyft and other entrants some more time. The reason it is easy is because product is homogenous, and a significant percentage of customers compare price. Proof based on induction would be that if you have a competitor start with 1% market share and slightly better value prop, e.g. better price, would some customers pick it? In marketplaces where the product is homogenous, some customers will end up picking it, causing the marketshare to grow from 1% to 2%, and so on. So, I believe moat of Grab, Uber and Lyft is weak, and subject to new entrants coming in. -

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

With Grab, if a competitor came up and had only 5% market share but a better price, do you think some customers would be willing to use the competitor on their homogenous product? If so, where is the barrier to entry and moat? Similar with Sea to some extent.