glider3834

-

Posts

965 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Posts posted by glider3834

-

-

3 minutes ago, glider3834 said:

Eurobank making a move on Hellenic

https://cyprus-mail.com/2023/08/23/eurobank-to-increase-share-in-hellenic-bank-to-46-5-per-cent/

Eurobank, currently holds 29.2% in Hellenic Bank, therefore after the completion of the Transaction, its total holding in Hellenic Bank will amount to 46.5%. Consequently, in accordance with the provisions of the Takeover Bids Law of 2007 in Cyprus, Eurobank will proceed, following the completion of the Transaction, to a mandatory tender offer for all the outstanding securities of Hellenic Bank not already held by it at the time.

-

-

unclear what the size of this acquisition is for Fairfax - article paywall protected

meadow foods - recent results

https://meadowfoods.co.uk/about/

MEADOW HAS GROWN OVER 30 YEARS INTO A £550M VALUE-ADDED INGREDIENTS BUSINESS SPECIALISING IN THE DAIRY, CONFECTIONERY, ICE CREAM, PREPARED FOODS AND PLANT-BASED INDUSTRIES.

-

GIG paid a div of close to US$50M in 1H23, which I think is one reason why increase in shareholders equity didn''t increase in line with US$82M profit in 1H23

-

6 hours ago, StubbleJumper said:

Well, yes, the Q2 does say that the holdco has $1B. But, when you look at the components of "cash", $358m are actually derivatives rather than cash equivalents, and another $147 are pledged for derivative obligations. So, if you look at the actual short term assets that the company could realistically use for its operations, there's roughly $600m that could be easily liquidated.

The revolver is extremely important to maintain. The question is whether you want to see the companies you invest in being reliant on revolving credit for general operations. Maintaining it is a very good idea because it can be invaluable for the proverbial black swan or to opportunistically acquire a major asset. But, it is a basic philosophical question of whether you want to see revolving credit being used for general operations.

FFH does have scads of operating income flowing every month, but it does not generally flow to the holdco, but rather the insurance subs. The insurance subs do have dividend capacity to flow money to the holdco, but the most significant dividend capacity is in Allied, Odyssey and Northbridge. The first two are competing where the market seems to be hardest, so how much of a dividend they would want to draw is an open question.

Over the next six months, the holdco will have cash outflows of $177 for Gulf, about $230 for the common divvy and about $25 for preferred divvies, plus whatever interest that needs to be paid on holdco debt. With ~$600m of true liquid assets, I found the statements about liquidity to be a little odd. If they float another $500m or $750m of debt, everything is good, but it does strike me that they are not as liquid as I would like to see.

SJ

So Fairfax had $2.7B div paying capacity in subs at end of 2022, given their operating performance over 2023 in 1H has exceeded the corresponding period in 2022, seems reasonable to assume we are north of $3B now. Adding that to the $1B or so of cash & investments at the holdco & we have over $4B.

With interest & dividend income pushing close to $500M per qtr - the rate of build in dividend paying capacity in the subs should accelerate going forward IMHO.

I think we need to have a look at volatility of results too - with Allied one of the key reasons for recent credit rating upgrade was that they have reduced their cat exposure so that potentially reduces volatility of underwriting profit - we can see that in Allied's lower CR.

Looking at NPW growth rates for Allied, Odyssey & Northbridge for 1H'23 YTD these were 9.6%, 5.2% & 4% respectively. For the same period in 1H'22, NPW growth rates were 21.8%, 31.3% & 11.1%.

So that looks like decelerating growth to me and that IMHO should be supportive of theses subs building their div paying capacity further.

I suspect they don't want to publish their div paying capacity on a quarterly basis before they do their reserving audit in Q4 & thats why we get it annually.

I do think tax planning would be a consideration, liquidating investments in the subs to pay the holdco would potentially trigger tax & they might want to avoid which is why when they are sending divs to holdco it is generally coming from sale proceeds from divested businesses - this is just my hunch.

Also credit ratings would be a consideration at the sub level - higher upgrades (eg recently for Odyssey, Crum & Allied) I would think would reduce borrowing costs and a higher rating also benefits their insurance business - so a good thing.

So the reasons why they are not sending more cash to the holdco I think go beyond supporting NPW growth although I agree that is a key consideration.

-

14 minutes ago, Viking said:

That was the number that slapped me upside the head when i was reading… WOW!I don't think PacWest deal is fully included either - was expected to close end of Q2 or early Q3 I think

The closing of the Transaction and the sale of each Loan is subject to the satisfaction of customary closing conditions (including Pacific Western Bank securing certain counterparty consents and waivers), and it currently expected to close in multiple tranches during the second and early part of the third quarter of 2023.

-

pretty decent jump on consolidated interest & dividends $464M in Q2 ( vs $382M Q1)

-

starting new thread for Q2 out next Thurs

-

10 hours ago, Viking said:

I need the help of board members. It can be confusing to understand how the business results of Fairfax's vast collection of equity holdings flows through to Fairfax's income statement and balance sheet at the end of each quarter. I have put together a 'cheat sheet' with 'rules of thumb' to help investors better understand this flow.

Does this look generally accurate? What is wrong? What is missing? Can the layout be improved?

Please feel free to rip it apart (you won't hurt my feelings). Comment on this thread or private message me. Thanks!

PS: it is one sheet, but I copied it with two pictures so it can be more easily read.

viking with Excess of fair value over book value number that Fairfax reports, I believe it excludes non-market traded, non-insurance consolidated subs like Sporting Life Group or AGT

-

15 hours ago, Viking said:

Mytilineos shares have been on a tear in 2023. Here is an short update of what it means for Fairfax.

Who is Mytilineos?

- Ticker: MYTIL.AT (trades on the Athens stock exchange)

- Stock price: $36.68 (July 26, 2023)

- Market cap: €5.07 billion

- Dividend = €1.24 = 3.4%

From the company’s web site: “MYTILINEOS Energy & Metals is a global industrial and energy company covering two business Sectors: Energy and Metallurgy. The Company is strategically positioned at the forefront of the energy transition as an integrated utility, while already established as a reference point for competitive green metallurgy at the European and global level. It has a consolidated turnover and EBITDA of €6.35 billion and €823 million, respectively, and employs more than 5,442 direct and indirect employees in Greece and abroad.”

Corporate presentation Jun 2023: https://www.mytilineos.com/media/k5lj10q0/corporate_presentation_june_2023.pdf

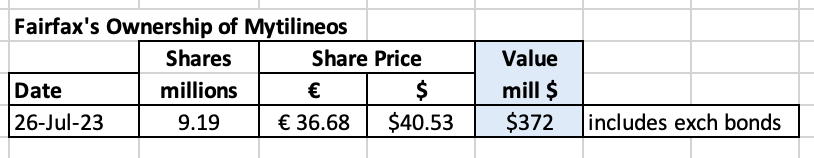

How much of Mytilineos does Fairfax own?

Fairfax owns 9.19 million shares (including the exchangeable bonds) with a value of $372 million. This makes the company a top 15 holding in Fairfax’s equity portfolio.

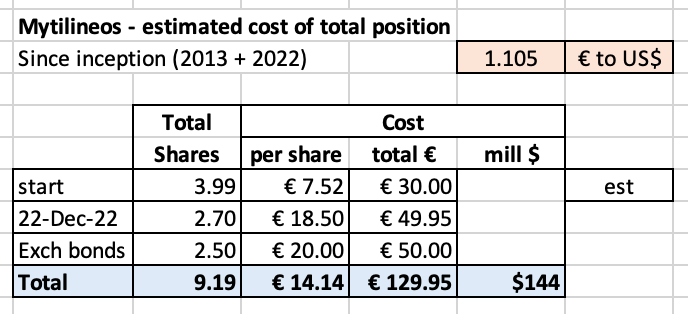

Fairfax made its first investment in Mytilineos in 2012 or 2013 (€30 million stake). In November of 2022, Fairfax owned 3.99 million shares. In December 2022, Fairfax more than doubled their stake:

- they purchased 2.7 million shares at €18.50.

- they purchased exchangeable bonds that gives them the right to buy another 2.5 million shares at €20.

Fairfax is now the second largest shareholder.

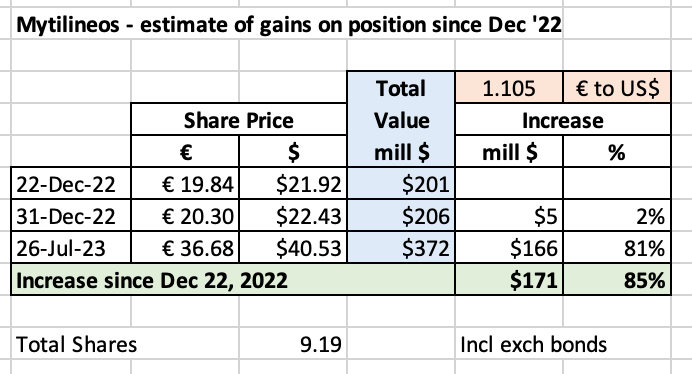

How has the investment performed since Fairfax added to their position in December, 2022?

Fairfax’s position is up $171 million or 85% over the past 8 months.

—————

October 21, 2013: Canada's Fairfax buys Mytilineos stake in second bet on Greece

December 13, 2022: Fairfax becomes the 2nd largest shareholder in MYTILINEOS

----------

Estimated cost to Fairfax of total position (very rough)

My estimate below of €14.14 is likely high. It does not include dividends, which Mytilineos has paid since 2018. And my estimate of €7.52 for the initial 3.99 million shares is a guess. Given the large size of the position, Fairfax will likely give us the correct number in a future annual report.

1H results out today

'Mytilineos recorded its historically best H1 year performance led by the energy sector, achieving another large increase in net profitability and consolidating high performance.

In particular, turnover increased to €2,516 million compared to €2,154 million in the first half of 2022, marking an increase of 17% despite the significant de-escalation of energy and metal prices. Earnings before Taxes, Interest and Depreciation (EBITDA) also recorded a significant increase, by 49%, to €438 million compared to €293 million in the corresponding period of the previous year, benefiting from the steady increase in the profitability of the Energy Sector and in particular the activity of Renewable Energy Sources (RES), which contributed the largest percentage (29%) to the Sector's EBITDA, as well as the supply of electricity and natural gas, as a result of the continuous internationalization of the company's activities.

Mytilineos achieved its historically best performance in the first half of the year led by the Energy Sector. In particular, in addition to the significant contribution of M Renewables (RES of Greece and abroad), which saw its profitability more than double (+117%) compared to the first half of 2022, the Energy sector was also favored by the substantial strengthening of the presence of Mytilineos in the supply of natural gas in the wider region of the Balkans and SE Europe. '

https://www.capital.gr/epixeiriseis/3729301/mytilineos-alma-61-stin-kathari-kerdoforia-to-a-examino/

-

5 hours ago, nwoodman said:

An outstanding report. The section on distressed investing in Greece (p.112) and the case study on the Greek company Terna Energy (p.159) may be of interest to FFH investors too. Mytilineos (Eur4.5bn) was rumoured to be pursuing a stake in Terna (Eur2.2bn) earlier this year but later refuted.

yes agree nwoodman - its a really brilliant study

While not a 10 bagger, Fairfax India has had close to 6-7xbagger with NSE India & after around 7 years! They paid $27M & on grey mkt valuation their 1% appears to have value close to $200M https://www.livemint.com/market/ipo/nse-ipo-creates-buzz-in-unlisted-market-shows-the-investor-interest-in-issue-11687254813352.html - what I didn't realise is they originally wanted to buy 5% & not 1%!

-

43 minutes ago, Viking said:

As i mentioned in my previous post, the closing of the Gulf Insurance Group (GIG) deal (Q4?) - boosting Fairfax’s ownership to 90% - will be an important growth driver of Fairfax’s 2024 results.

GIG recently updated their web site. They added a bunch of new information. Below is the link to a 40 page report that provides a great overview of the company.

- https://www.gulfinsgroup.com/Frontend/EN/GIG-Corporate-Profile-ENG.pdf?download=false

Here are the financial highlights (2022):

- Net premiums written = $1.7 billion

- Underwriting surplus = $164 million

- Total Investments = $2.4 billion

- Shareholders equity = $748 milion

- Net profit = 125 million (Q1, 2023 = $34 million)

The purchase price of the 46% owned by Kipco is $860 million. However, the true cost to Fairfax is far less, due to the time value of money. Fairfax will pay $200 million at close and then 4 annual instalments of $165 million. If we use an 10% discount rate, the cost to purchase Kipco’s stake when it closes in Q4 is closer to $700 million ($200+$149+$134+$120+$108).

This is a good example of solid capital allocation on the part of Fairfax. They are paying a premium for quality. That is interesting. They are also playing the long game with this purchase as it is a very strategic purchase for them that solidifies their presence in the MENA region. It is also anther example of using their current robust cash flow to take out a partner in a business they understand very well.

good point viking on PV of this transaction

I would expect it would be a net positive for Fairfax's underwriting profitability & overall CR

-

On 7/10/2023 at 9:54 AM, nwoodman said:

MS released an updated note on the Greek Banks (attached). Fairfax owns approx $2bn of Eurobank shares. Eurobank closed on Friday at EUR 1.55. Eurobank is not paying a dividend this year as the funds are being used to repurchase shares. From the Q1 press release

"Rewarding shareholders is now becoming key in our strategy. Specifically for 2023, the amount earmarked for dividend distribution will be used in an optimal way to bid for the 1.4% HFSF stake through a share buyback scheme. For next year onwards, we envisage a payout ratio of at least 25%, in the form of cash dividends and share buybacks. Overall, we are pleased that we consistently outperform our targets for several years.”

thanks nwoodman - still kicking myself over Piraeus when it was trading close to a PE of 2x a year ago -but I was already fully invested and seriously overweighted with Eurobank via Fairfax

-

11 minutes ago, Viking said:

@nwoodman thank you for providing the MS report. It motivated me to write an update on Eurobank.

Eurobank's stock is one again hitting all time highs (€1.595 today). It is now tied with Poseidon/Atlas as Fairfax’s largest equity holding. Time to do a review of what has been Fairfax’s best performing equity holding over the past couple of years. This review will focus on the numbers and will be mostly forward looking.

Who is Eurobank?

Eurobank is one of the largest banks in Greece (and the region). Its core markets are Greece, Bulgaria and increasingly Cypress. It is recognized as being one of the best managed banks in Greece.

- Q1, 2023 Management Presentation: https://www.eurobankholdings.gr/-/media/holding/omilos/grafeio-tupou/etairikes-anakoinoseis/2023/1q-2023/1q2023-results-presentation.pdf

Of interest, Eurobank, Eurolife and Grivalia (all Fairfax holdings) are all joined at the hip. More on this in another post.

Let’s start by looking at the big picture.

What are prospects for the Greek economy?

Greece is positioned very well right now. The Greek economy turned the corner a couple of years ago now. Tourism is booming. As is the property market. Prime Minister Mitsotakis (center-right) was just re-elected with another majority for a second consecutive 4-year term. This ensures the significant economic (pro-market) reforms to the Greek economy will continue. Greece is expected to have one of the better performing economies in Europe over the next couple of years. This is a very positive backdrop for Eurobank.

How much of Eurobank does Fairfax own?

Fairfax owns 32.2% of Eurobank (1.166 billion shares). A stake worth $2 billion today.

Timeline of key events for Fairfax and Eurobank:

- Dec 2014: FFH investment #1 in Eurobank of $444 million for 12.5% position

- Nov 2015: FFH investment #2 in Eurobank (recapitalization) of $389 million for 17% position

- Dec 2015: FFH purchase of 80% of Eurolife from Eurobank for $360 million

- May 2019: Eurobank recapitalization / merger with Grivalia Properties - Fairfax owns 32.4%

- July 2022: Fairfax increases stake in Grivalia Hospitality from 33.5% to 78.4% (from Eurobank) for $195 million

Importantly, Eurobank is Fairfax’s minority partner in Eurolife and Grivalia Hospitality.

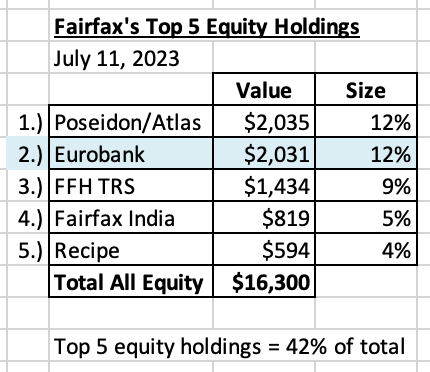

How important is Eurobank to Fairfax?

Eurobank is tied with Poseidon/Atlas as Fairfax’s largest equity holding. With a market value of $2 billion, Eurobank represents about 12% of Fairfax’s total equity holdings of around $16.3 billion.

For context, Fairfax has an investment portfolio of about $56 billion, with fixed income investments of $40 billion and equities of $16.3 billion.

What is the trend for earnings at Eurobank?

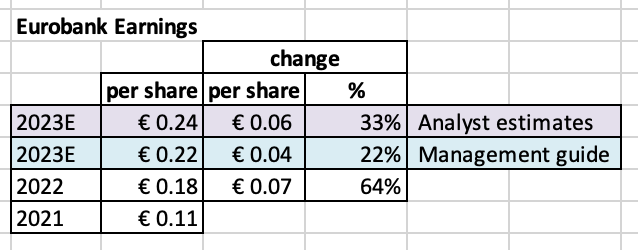

Earnings have been on a steady upwards trajectory in recent years. Management is guiding to earnings of €0.22/share in 2023. Management is conservative with their forecasts. Analysts are expecting earnings to come in around €0.24/share in 2023.

How has the stock price of Eurobank performed?

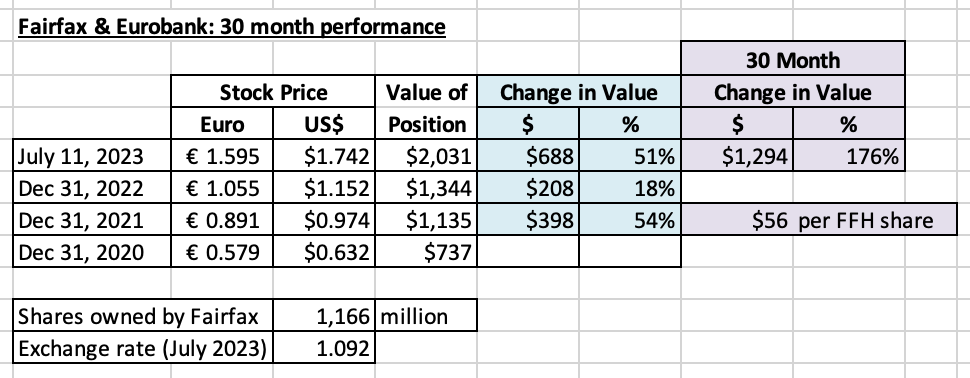

Eurobank’s stock price has been spiking higher - it is up 176% over the past 30 months. The market value of Fairfax’s position in Eurobank is up $1.3 billion over the past 30 months, or $56 per Fairfax share. Clearly, Mr. Market is recognizing and rewarding the improving fundamentals and results at Eurobank.

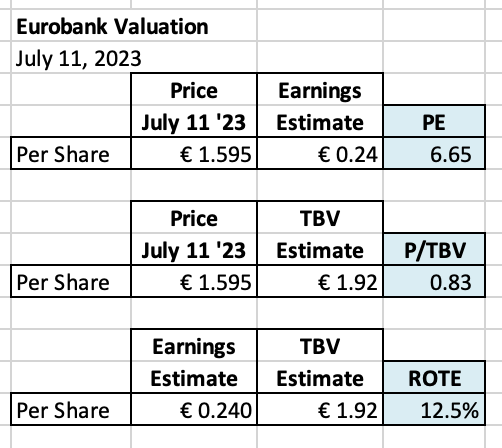

How is Eurobank stock valued today?

Despite the 176% increase over the past 30 months, Eurobank’s stock is still cheap (sound familiar?). The stock is trading at a forward price earnings of 6.65; price to tangible book value of 0.83; return on tangible equity of 12.5%.

Note: I used the analysts guide for EPS for 2023 of €0.24/share because it is the likely number.

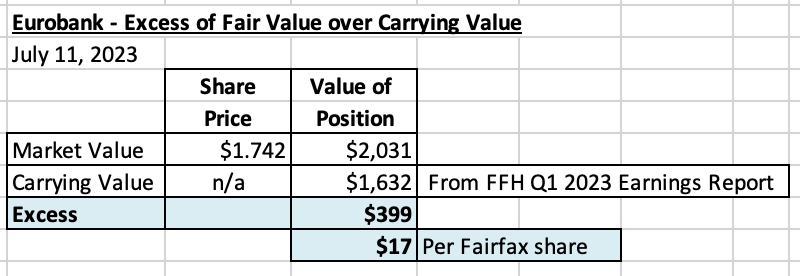

How is Eurobank valued on Fairfax’s books?

Eurobank is not a mark-to-market holding for Fairfax. Since Jan 1, 2020 it has been a consolidated holding (equity accounted). At March 31, 2023, Eurobank had a carrying value at Fairfax of $1.6 billion.

So as of today there is an excess of $400 million of market value over carrying value ($17/share pre-tax). This excess is not captured in Fairfax’s reported financial results (although they do highlight it in their commentary). This is a good example of where Fairfax’s book value is understated.

How do results at Eurobank flow though to Fairfax?

Dividends. Eurobank currently does not pay a dividend. They would like to but Greek regulators are dragging their feet (likely waiting for the other big banks in Greece to get their house in order). The plan is for Eurobank to start paying a dividend in 2024.

If the payout ratio is 20% this would likely mean an annual dividend of around €0.05/share. In this scenario, Fairfax would start receiving dividends of $61 million per year.

For context, Fairfax currently receives about $135 million in dividends per year from all their various holdings. A dividend from Eurobank would increase this amount by 45%. This would be significant for Fairfax. Something to watch for in 2024.

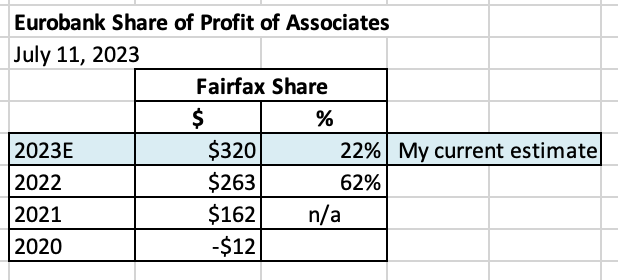

Share of profit of associates. Eurobank is a big reason we are seeing ‘share of profit of associates’ spike to over $1 billion per year in recent years at Fairfax. And as Eurobank grows earnings ‘share of profit of associates’ at Fairfax will only grow more.

How much has Fairfax earned from this holding since inception?

Fairfax is up about $935 million or 85% over the 8.5 years it has owned Eurobank.

Fairfax 2022AR Prem’s Letter: “The animal spirits are coming back to Greece and we think the Greek economy and Greek companies will thrive. Eurobank should benefit!! Our cost of 1.2 billion shares of Eurobank after the Grivalia transaction is now 94¢ versus a book value of approximately 135¢ per share post the transaction. At year end, Eurobank was selling at 68% of book value and 6.5x normalized earnings. We still believe it will be a good investment for us.”

Conclusion

Despite getting off to a terrible start in 2014, Eurobank has turned into a very good investment for Fairfax. This has only happened due to the hard work over many years from the Eurobank team in Greece, lead by CEO Fokion Karavias and Vice Chairman George Chryssikos. Having a long-term oriented, strong, supportive and patient partner in Fairfax also helped greatly.

Most importantly, Eurobank is poised to perform even better in the coming years. Given it is such a large holding this should benefit Fairfax shareholders greatly.

Making the initial investment in Eurobank also had important added benefits for Fairfax. It led Fairfax to buy 80% of Eurolife which has been an exceptional investment. It also led them to buy a 78.4% stake in Grivalia Hospitality (it is still early days on this investment). Importantly, Fairfax is viewed as being a trusted and strong foreign investor and partner in Greece.

thanks a great summary Viking - also if Eurobank decide to take control of Hellenic bank https://www.ekathimerini.com/economy/1215031/eurobank-eyes-control-of-hellenic-bank/ that could potentially also add meaningfully to their pre-tax profit growth https://cyprus-mail.com/2023/06/28/hellenic-bank-expects-pre-tax-profit-to-exceed-e200-million-in-2023/

-

3 hours ago, Tommm50 said:

This is an issue all major insurers who were doing business in the 60's and 70's are dealing with, these old "legacy issues". Asbestos is a great example. We are decades removed from when the insurance industry was blindsided by a tsunami of claims from the plaintiffs bar using the infamous "triple trigger" strategy.

It's very hard to estimate how much is left of this to go. If FFH reserved it at $896M in 2015 and, as you say, paid out $1.2B over the last eight years you can clearly say they under-reserved it 2015. If their 2022 reserve is still over $800M you could argue they are currently over-reserved. It would be instructive to see what the annual payouts were. Were they annually declining, increasing, or relatively constant. In any event my guess is it's a trivial number in the grand scheme of things.

yes Fairfax which started around 1986 effectively 'acquired' these liabilities via acquisitions of subs they made

On the positive side higher investment returns, asbestos liabilities becoming increasingly smaller relative to shareholders equity and Fairfax has been reducing its long tail exposure eg sale of Riverstone Europe

Riverstone US/TRG - Run-off - shareholder equity (31Dec)

2022 $405M (3% of FFH shareholder equity)

2012 $1,773M (23% of FFH shareholder equity)

-

full disclosure guys thats me dino was replying to

cheers

-

1

1

-

-

-

-

3 minutes ago, Munger_Disciple said:

That's outstanding @glider3834, great detective work!

-

On 7/4/2023 at 10:14 AM, Munger_Disciple said:

I was re-reading Prem's 2022 annual letter & he shows a table of gross premiums written and float from 1985 to 2022. I noticed that the ratio of float/gross premiums written has shrunk from 2.4 in 2010 to 1.1 in 2022. It used to be roughly 1.6 in the decade prior to 2010.

Dos this mean that Fairfax is writing a lot more short tail insurance these days compared to the past?

yes

my figures below - from annual reports

edit note: accidentally deleted so re-posting

-

37 minutes ago, glider3834 said:

With IFRS 17 accounting I would expect higher rates should also result in higher discount rate being applied to their insurance liabilities/ reserves and reducing PV of these liabilities, which should offset the MTM loss on their bonds.

Also any rates impact should be greater on their reserves which are longer in duration and larger in size than their bond portfolio.

I also think this IFRS 17 accounting shift is potentially one reason why they were comfortable entering into forward contracts to buy around $3B in Treasuries in Q1 and effectively lock in rate - as they don't need to be as concerned about BV impact from MTM.

I can't see why they wouldn't continue to make these types of moves if they like where interest rates are & they want to extend duration further. But lets wait & see what they do.

-

9 hours ago, Thrifty3000 said:

Looking at the interest rate sensitivity table from the Q1 report it looks to me like bonds will take a roughly $500 million hit.A 100 basis point interest rate increase would be a $700 million hit. I’m assuming rates increased roughly 70 basis points during the quarter.

Also, last year FFH had interest rate hedges that would have reduced the impact of rising rates. It appears they did not hold anymore of these hedges as of the end of Q1.

With IFRS 17 accounting I would expect higher rates should also result in higher discount rate being applied to their insurance liabilities/ reserves and reducing PV of these liabilities, which should offset the MTM loss on their bonds.

Also any rates impact should be greater on their reserves which are longer in duration and larger in size than their bond portfolio.

-

Just on cat risk exposure its worth considering Fairfax's corporate structure.

Fairfax subs have historically had different levels of risk exposure to different types of cat events - for example when Hurricane Ian occured, Brit bore 50% of the overall losses sustained by Fairfax. With the recent earthquake in Turkey, Odyssey Group sustained most of the losses from that event.

And intuitively it makes sense to do this rather than spreading the risk exposure equally. If you intentionally write more risk exposure to a particular type of risk/s/event through one sub ( and also managing risk exposure at an aggregate level), you are ring fencing most of the losses from the rest of your business (ie the other subs) through your corporate structure.

-

Fairfax stock positions

in Fairfax Financial

Posted

thanks for posting