glider3834

-

Posts

963 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Posts posted by glider3834

-

-

-

-

@SafetyinNumbers I am just looking at this Allied World acquisition of 0.5% in Jun-23

Looks like Fairfax paid $30.6M

It appears (see below) the Non-controlling interests carrying value was $27.6M - so the difference was $3M - so my take is that is P/BV of ~ 1.1x (is that right or am I missing something?)

-

58 minutes ago, Viking said:

@Luca I like all three investments. See below for comments.1.) BDT has been an outstanding long term investment for Fairfax.

“We continue to invest with Byron Trott through various BDT Capital Funds. Since 2009, we have invested $978 million, have received $979 million in distributions and still have investments with a year-end market value of $683 million. Byron and his team have generated fantastic long-term returns for Fairfax, and we very much look forward to our continued partnership.”

2.) ShawKwei looks like it has been a solid long term performer. The fact Fairfax is adding new capital suggests they like the prospects.

“Since 2008 we have invested with founder Kyle Shaw and his private equity firm ShawKwei & Partners. ShawKwei takes significant stakes in middle-market industrial, manufacturing and service companies across Asia, partnering with management to improve their businesses. We have invested $536 million in two funds (with a commitment to invest an additional $64 million), have received cash distributions of $217 million and have a remaining value of $504 million at year-end. The returns to date are primarily from our investment in the 2010 vintage fund, which, though decreasing 8.8% in value in 2023, has generated a 12% compound annual return since 2010. The 2017 vintage fund, which has drawn about 84% of committed capital to date, increased 23.1% in value in 2023 but has a compound annual return of 3.5% since inception. We expect Kyle to make higher returns on monetization of his major assets.”

2.) Grivalia Properties gets an incomplete from me today. It is a bet on the jockey play. George Chryssikos has had the Midas touch for Fairfax in Greece - making them +$1 billion so far. I am inclined to give Fairfax the benefit of the doubt on this one - my guess is it works out ok. We should know much more in 2024 as more resorts come on line.

“Grivalia Hospitality, under George Chryssikos, had a strong year of execution as two assets, including its largest, opened for business. The One & Only resort in Athens is a flagship in ultra-luxury hospitality and we are the proud owners. If you haven’t booked your summer vacation yet – you know what to do! 2024 will see one additional asset come into operation – which will take the operating portfolio to five. These include Amanzoe in Porto Heli, ON Residence in Thessaloniki, Avant Mar in Paros, One & Only and 91 Athens Riviera in Athens. Focus now turns to operational and service excellence for these resorts with Greece forecast to receive a record number of tourists in 2024. George has another five high end hotels in development over the next few years. George has an outstanding track record in real estate and as I said last year, he has already made us $1 billion! We expect George to repeat that accomplishment with Grivalia Hospitality over time! At year end we carried Grivalia at €513 million for our 85% stake.”

For Grivalia there are clearly tailwinds in this luxury hotel traveller space in Greece so its a question of whether they can execute that to the bottom line https://news.gtp.gr/2024/03/29/luxury-hotels-in-greece-see-revenues-rise-in-h2-2023/- their One & Only hotel I believe is the most expensive hotel on Athens riviera so they are catering to a very specific traveller niche https://greekcitytimes.com/2024/03/27/grivalia-hospitality-athens-riviera/

-

'Ki’s partnership with Beazley, alongside the existing multi-year partnerships with Travelers and Aspen, and growth plans for Ki Syndicate 1618, will see Ki materially increase the follow capacity it is able to offer in 2024, the firm claimed.'

-

-

58 minutes ago, nwoodman said:

looks like they put most of their position on Q3'22 , Q1'23 https://www.dataroma.com/m/m_activity.php?m=FFH&typ=b

not sure their avg cost but Micron was trading in a band from low 50s to low 60s - so if we assume high 50s cost & their position in MU unchanged since Q4'23, would be 2x based on AH pricing

-

8 minutes ago, Hoodlum said:

Fairfax is offering $1B in 30yr notes at 6.35%. Is this replacing existing debt or do they have other plans for this?

https://www.fairfax.ca/press-releases/fairfax-announces-pricing-of-senior-notes-offering-03-19-2024/

Good question for AGM

-

8 hours ago, SafetyinNumbers said:

Any sector that doesn’t screen well for quants i.e. not quality, is pretty cheap I think. I like SCR in particular because Waterous is incentivized to get the stock up to do accretive acquisitions. Right now, it’s really hard for heuristic investors to own SCR but If they execute the plan, they start ticking boxes which will increase the number of potential buyers. The share price is just supply and demand after all.

The dividend announcement will help in three ways. In energy, investors want debt/cash flow < 1x, they want a capital return policy and they want liquidity. The dividend ticks 1 and 2. The dividend should attract yield investors who don’t mind buying on upticks providing multiple expansion and liquidity.

With a higher share price, SCR will be able to make accretive acquisitions and extend the tax shelter beyond 2026. This will also increase liquidity and give SCR a chance to get into the S&P/TSX. That’s the plan from what I can tell but we’ll see if it actually works or if buying shows up in anticipation of the dividend announcement closer to the date. I think six months away is too much for event driven investors. That are a lot of places to put money to work these days.

-

56 minutes ago, SafetyinNumbers said:

SCR management is trying to help! They put out its reserves today and included a 4 page letter to accompany it explaining how quickly and accretively they have grown since Waterous took over in 2017 which is also presumably when FFH made its investment.https://www.strathconaresources.com/wp-content/uploads/2024/03/2023-Reserves-Overview_Final-1.pdf

i thought this table was particularly interesting from a comp valuation basis. They show it trading less than half of NAV. I can see this management’s approach to capital allocation and investor communication eventually get a premium multiple.

interesting

interesting

-

On 3/6/2024 at 5:28 AM, SafetyinNumbers said:

They also own Strathacona (SCR.TO) based on disclosure on the conference call that there was a mark-to-market loss on a Waterous LP investment. SCR is closer to a 20% FCF yield at $80 oil with capital return expected to start in H2 following debt reduction. Looking forward to seeing the annual report to determine how much they indirectly own. Wouldn't shock me if its a $300m+ position.

will check this out thanks

-

I was hoping for a bit more guidance on how they are carrying BIAL & we got that from Prem in the annual letter

so my understanding from this is that implied normalized free cash flow (ex Airport City) for the whole of BIAL is ~US$263M ie Equity value US$2.5B divided by 9.5x (assuming here that Prem is talking about Free Cash Flow to Equity Holders (FCFE) ie after interest payments)

I am guessing by normalised they are assuming the airport is operating at 100% of capacity? Would that assumption be reasonable? I believe T2 is expected to hit that level ~ 2026 based on AERA consultation paper forecast.

-

12 hours ago, Viking said:

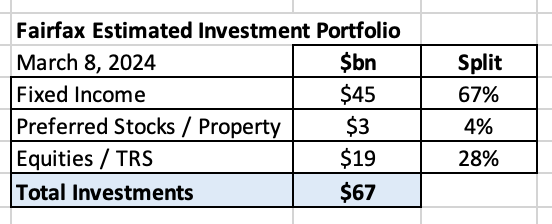

As of March 8, 2024, my guess is Fairfax has an investment portfolio that totals about $67 billion, with the split being roughly as follows:

In this post we review the holdings in the equities ‘bucket.’ To value a holding, we normally use current ‘market value,’ which is the stock price at March 8, 2024, multiplied by the number of shares Fairfax owns. For private holdings we use Fairfax’s latest reported market value, which was Dec 31, 2023. Derivative holdings, like the FFH-TRS, are included at their notional value.

Additional notes:

- Mytilineos *: includes exchangeable bonds

- John Keells *: includes convertible debentures

What holdings are missing from my list below? AGT Food Ingredients and new purchase Meadow Foods (2023) are two that come to mind. I just have no idea what they are worth. Let me know if you have an estimate.

Ok, let’s get to the fun part of this post.

What are some of the key take-aways?

Below are mine. What are yours?

1.) Fairfax has a pretty concentrated portfolio

- The top 3 holdings make up 36% of the total

- The top 10 holdings make up 56% of the total

2.) Steady improvement in quality of the top holdings over the past 6 years: What happened?

- New money has been invested at Fairfax very well (FFH-TRS, buying more of existing holdings)

- Some high quality businesses have continued to execute well (Fairfax India, Stelco)

- Some businesses, after years of effort, have turned around (Eurobank).

- Some businesses that were severely affected by Covid have emerged stronger (Thomas Cook India, BIAL)

- Some businesses were restructured/taken private (Exco, AGT) and are now performing much better.

- Some low quality businesses were sold/merged/wound down (Resolute Forest Products, APR, Fairfax Africa).

- Some low quality businesses have shrunk in size due to poor results (BlackBerry, Farmers Edge, Boat Rocker).

The important point is the quality of Fairfax’s largest holdings have steadily been increasing. And this should result in higher overall returns from the equity portfolio in the coming years.

3.) What rate of return should this collection of equity holdings be able to deliver in 2024?

-

12% return x $19 billion = $2.3 billion

- share of profit of associates ($1.05 billion)

- dividends ($200 million)

- ‘other’ consolidated non-insurance co’s ($100 million)

- investment gains ($650)

- for associate holdings, change in excess of carrying value to market value ($300 million)

This looks like a reasonable target for 2024, looking at the solid prospects/earnings profiles of the current holdings.

4.) A slow shift away from mark-to-market holdings. Today, less than 50% of the total portfolio is held in the mark-to-market bucket. Back in 2019, my guess is closer to 80% of the total portfolio was held in the mark-to-market bucket.

- This shift should have the effect of smoothing Fairfax’s reported results moving forward, especially during bear markets. As a reminder, in Q1, 2020, Fairfax had $1.1 billion in unrealized losses (when the equity portfolio was much smaller). As more holdings shift to the ‘Associates’ and ‘Consolidated’ buckets, it is the trend in underlying earnings at the individual holdings that will matter to Fairfax’s reported results and not a stock price - earnings are much more consistent than a stock price. Lower volatility in reported earnings should help Fairfax’s valuation (as volatility is considered bad by Mr. Market).

- This shift will also start to create a Berkshire Hathaway problem for Fairfax: over time book value will become an increasingly poor tool to use to value Fairfax. Why? The value of the ‘Associates’ and ‘Consolidated’ companies captured in book value each year will fall short of the increase in their true economic value. Fairfax India is a good example of this today. Eurobank is a holding to watch moving forward.

Bottom line, Fairfax looks very well positioned today. But the story gets better: like the past 6 years, I expect the quality of Fairfax's equity holdings to continue to improve in 2024. That will improve future returns. And, like a virtuous circle, the growing cash flows will be re-invested growing the companies even more.

Thoughts? Am I missing something? What number below is most wrong? Why?

thanks viking

smaller private holding but Sporting Life/Golf town might be close to a top 30 - carrying value of US$61M (C$82M) or 4xFCF - potential market valuation??

revenues up ~50% since 2019

curious if anyone has checked out any of their team town sports stores - thoughts/feedback?

-

1 hour ago, Viking said:

What a simply amazing year for Eurobank. Transformational. Their website is painfully slow right now? Below is a link to their full year results presentation. I think Eurobank is sandbagging their 2024 estimates. And that is the sign of a strong management team - underpromise and overdeliver. That is the same playbook they used in 2023 and 2022. They do not feel any pressure to be overly aggressive with financial targets.

I am looking forward to seeing details of what the 25% payout (of 2023 baseline earnings) will look like - what the split is between dividend and stock buybacks.

Eurobank is a $2.5 billion position for Fairfax today. A 15% return = $375 million; 20% = $500 million. This investment has quickly turned into a home run for Fairfax. And i think it is just getting started. A double in the stock price over the next 4 years is not a crazy target.

worth noting too they have assumed their Hellenic stake stays at 55.3% thru 2024-26 as part of their 2024-2026 guidance so there is potential upside if full takeover gets approved

-

-

3 hours ago, gfp said:

Last year it was published March 10th. (a Friday after the close)

Last year agm was 20 Apr - this year 11 Apr - i wonder if that affects timing of release?

-

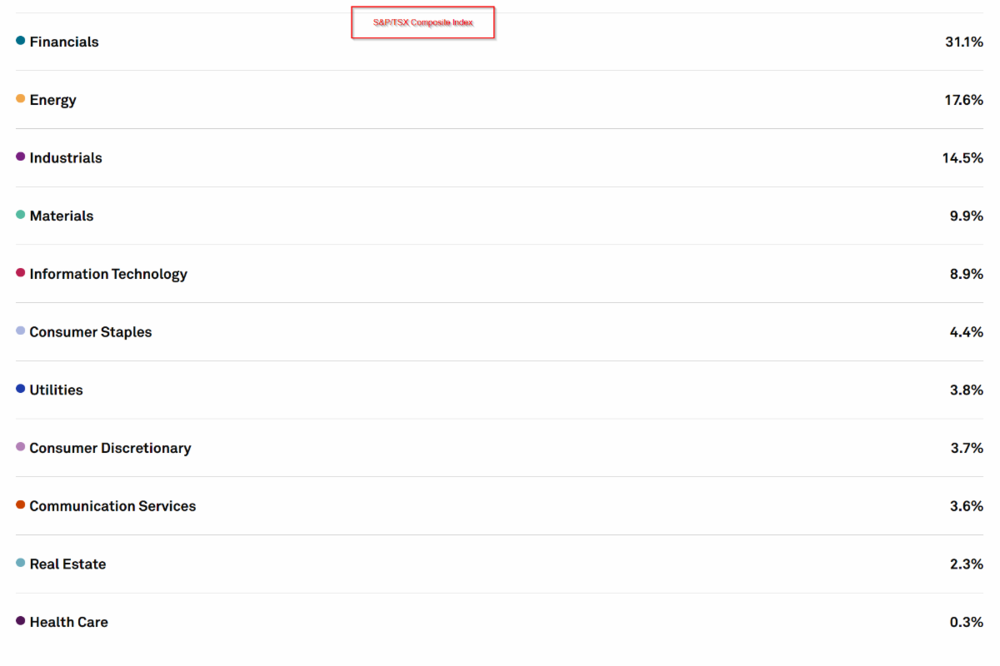

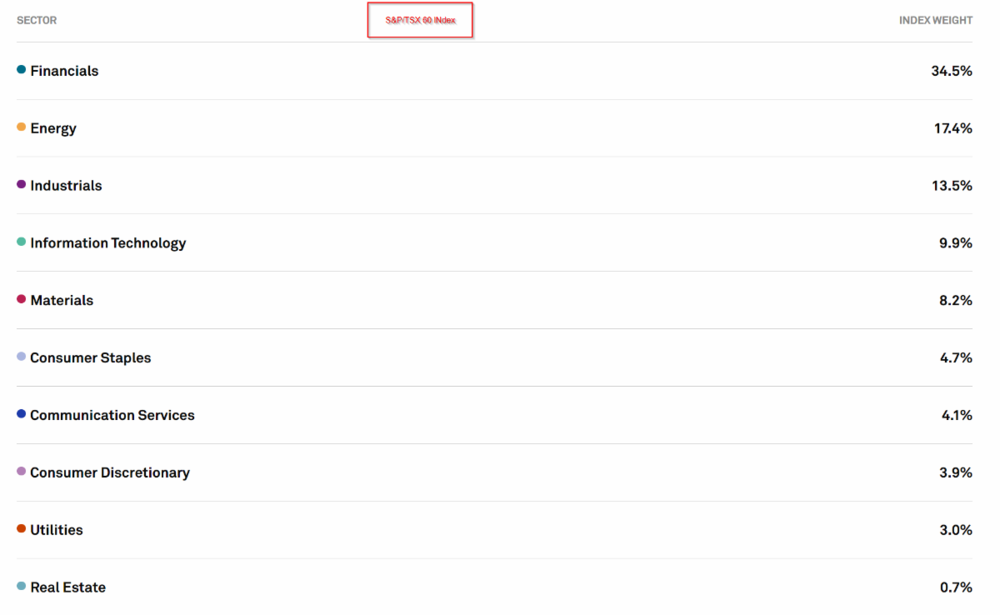

the most underweight areas in TSX60 (vs TSX composite) appear to be in real estate or materials from what I can see

https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/#data

https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-60-index/#data

-

6 hours ago, Bryggen said:

So, do we know for sure the news is false? Can anyone confirm? I was surprised by it. Thanks! Bry

https://www.sec.gov/Archives/edgar/data/915191/000094787124000176/xslF345X05/ownership.xml

-

2 hours ago, Cigarbutt said:

The link you mention also discusses the potential advantages of specialty lines. One of the keys for the transformation (survival) of Crum & Forster about 25 years ago was the rapid move out of commodity lines to more specialized lines with very obvious positive underwriting results. The specialty market has been growing faster than the general market and FFH has followed. When using a similar proportional table as the one you've included above (using the last 8 to 12 years), specialty lines (as defined by FFH) have grown a lot but not significantly versus total premiums at large.

For some years now, S&P Global has produced a ranking with the last one being:

"The U.S. Property and Casualty Insurance Performance Rankings are based on statutory financial results collected and compiled by S&P Global Market Intelligence. They are determined using 13 financial metrics from 2022 statutory filings grouped into six buckets: rates of return, underwriting profitability, balance sheet expansion, investment performance, prior-accident-year reserve development and premium growth."

S&P Global describes how the above rankings show that some relatively small players have been able to grow profitably a lot from a small base and expanding into specialty markets. They also describe that FFH was able to grow profitably both their niche specialty segments and also their much larger portfolio of commodity-like products.

i would venture to say that there is some 'moat' in there, especially when considering the now longer-term track record.

good pick up cigarbutt cheers!

-

On 2/24/2024 at 4:04 AM, Cigarbutt said:

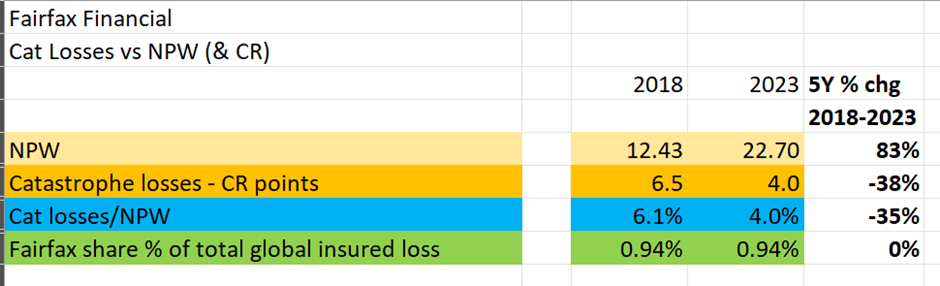

My understanding is that FFH aims to maintain average catastrophe points to 6 combined ratio points or lower (something like that) and it appears that they are taking real actions to achieve this.

Peter Clarke did make point on a CC they are looking to grow premium while keeping their cat exposure about the same, so over time their cat loss should effectively be falling as percentage of overall net written premium and their combined ratio.

And I think that is starting to show up in the numbers too, I did this table below which illustrates.

Some comments on this table above.

1. Over the 2018-2023 period, Fairfax's share of global insured cat losses looks to have varied between 0.8% in 2020 to 1.0% in 2022. However, in the table above based on Munich re's estimates for global insured cat losses for 2018 & 2023, Fairfax's share of total global insured cat losses was almost the same in each year.

Munich re has global insured natural cat losses at US$80B in 2018 (Fairfax share US$752M or 0.940%) https://www.reinsurancene.ws/munich-re-pegs-2018-insured-cat-losses-at-80bn-double-the-30-year-average/and US$95B in 2023 (Fairfax share US$897M or 0.944%) https://www.reuters.com/business/environment/quakes-storms-cause-95-billion-insurance-losses-2023-munich-re-2024-01-09/

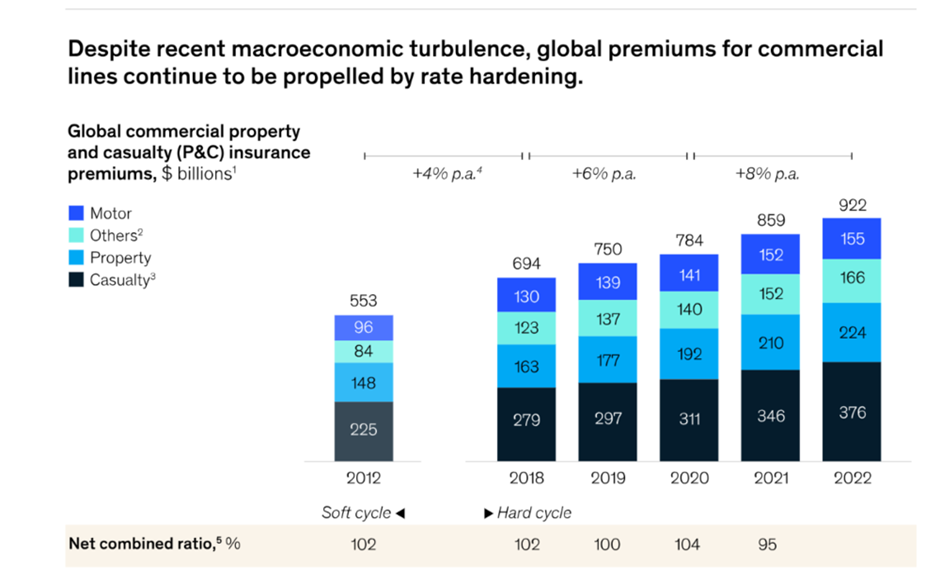

2. Fairfax's growth in net written premium over the 2018 to 2022 period was 76%. Over same period, appears that Global commercial P&C premiums grew 33%. So Fairfax appears to have more than 2x the industry growth rate, yet appears based on numbers above to have not done so by increasing cat loss exposure at same rate.

3. Just bear in mind with all above numbers & comments , these are based on Fairfax's results in last 5 years and Munich re estimates of industry cat losses. This information is useful, but of course, future loss or cat loss experience for Fairfax or Industry or both cannot be guaranteed.

4. Key point with above, we are looking at Fairfax's cat loss experience where global industry cat losses in 2 periods are not too dis-similar in size - in 2023 they were around US$95B or 19% higher than 2018 at US$80B . If global cat losses were say 50% higher in 2023 vs 2018, then cat loss impact for Fairfax in CR points is going to be much greater and cat loss/NPW ratio higher. Of course, the flipside is that with every terrible cat year comes pressure for harder insurance pricing, which if it transpires would then be likely to show up in future combined ratios.

Also just a reminder -please don't rely on my numbers or comments in this post or any of my posts - always check them & do your own due diligence - my comments here are opinion and for entertainment, and this is not financial advice.

-

4 hours ago, Viking said:

My math says Eurobank paid an average of €1.78 to acquire 55.3% of Hellenic Bank over the past couple of years (awaiting regulatory approvals to become majority owner). In 2023, Hellenic Bank earned €0.88/share. Tangible book value at Hellenic Bank is €3.54/share at Dec 31, 2023, up 35% year over year. This is looking like a great investment by Eurobank.

- https://www.hellenicbank.com/-/media/hbc/announcements/2024/february/12m2023/commentary-en.pdf

+1 - hopefully Eurobank can get remaining approvals to be able to offer for 100% - also Hellenic's capital ratios look decent in the 20s & NPEs have been de-risked into the low single digits - also regulators have put on hold any dividends by Hellenic pending acquisition by Eurobank

' Furthermore, despite high earning, the bank said it cannot proceed with the declaration of dividend for full year 2023 “due to regulatory restriction.”

“At this moment the restriction is in place due to a series of reasons. We at this transitional phase amid a takeover which the regulators have deemed that capital should remain with the organization instead of being distributed as a dividend,” Rouvas said.'

-

-

4 minutes ago, ICUMD said:

reported last year, but Air India are ramping up their fleet too

-

11 hours ago, jeyfox said:

cheers - you might want to also update with 2023 below

what does the Fairfax India CR relate - I assume thats not FIH?

Just with Allied, Fairfax recorded only half a year's premium in 2017 so that throws the combined ratio for 2017 and also warps the avg CR number as seasonally the cat losses are usually concentrated in 2H.

In terms of CR I would look at averages in 5 year increments as well as trend in underlying CR along with qualitative info eg over last 12 mths Brit has been significantly reducing its property cat exposure

Q1 2024

in Fairfax Financial

Posted · Edited by glider3834

hopefully they will unpack a bit more detail on profit from associates (below comments are opinion not advice cheers)

- Both GIG and IIFL Finance contributed to associate profit in 2023 but not in Q124 because GIG moved to consolidated insur sub & IIFL Finance to Common Stocks

-Helios looks to be a 4Q unrealised, investment loss due to lower expected mgmt fees from TopCo investment due to higher rates.

-Stelco results in next quarters expected to improve on 4Q23 (reported I believe in Fairfax 1Q24 on one-quarter lag)

- Potential catalysts for earnings at Eurobank (HB acquisition) & Poseidon (delivery & chartering of new ships) in future periods

- BIAL EBITDA grew 50% 9M to Dec23 (vs Dev22) showing cash flow generation growth but not sure how BIAL profit share contribution under IFRS in Q124.

- hopefully we have some more detail on share of profit from Fairfax India Associates & Other non-insurance in Q1