Sweet

Member-

Posts

1,529 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by Sweet

-

Absolutely. Although one difference, according to many on the left and many media outlets, anyone to right of someone like Bill Maher is far-right. Margaret Thatcher would be considered a fully fledged fascist these days.

-

Are you talking about the Queen Parsad? The Royal Family haven’t had any political power for a very long time - UK, Canada (not sure about Fiji) - Parliament makes the laws. Not sure what you mean about them dictating the fate of your family. It’s been parliaments for a great many years that calls the shots, well before 1982 in Canada, 1867 I understand.

-

Musk and Ackman still are liberals it’s just there is a section of the liberal left that went far-left and went crazy.

-

Execution is less important than what DEI means to people. Execution is downstream of whatever your DEI belief happens to be. If you believe DEI means fairness, equal opportunities and celebrating a diverse workforce the it’s hard to execute that and mess it up. If on the other hand you believe DEI means deciding there aren’t enough x,y,z identities, ethnicities and racial groups, and that needs to be corrected by ‘positive discrimination’ then there is no way to execute that fairly. And the problem is that many of these institutions believe in the later but package it in ways that give it a positive spin. On Rhodes, the student body tried to get his statue pulled down.

-

Same. Familiarity with the business is undervalued - food chains you visit, shops you shop at, companies you use - makes it easier to hold when you have a good grasp of what the company does.

-

Not getting at you Spek, but I swear every year they find some new data-mined metric that predicts the markets are going to perform poorly.

-

The testimonies of the University Chairs at Congress in December about anti-semnitism put Ackman on the war path. He wrote the below about DEI: https://www.thefp.com/p/bill-ackman-how-to-fix-harvard?publication_id=260347&post_id=140327600&isFreemail=true&r=hur45

-

I have a problem trusting these small caps. I was playing around in Finviz and there def cheapish companies. A quick screens can be comparing current PE with forward PE - both should be low - this weeds out a lot of companies with one off earnings or some other shenanigans. But I just don’t know enough about them to buy, I like to see and know a bit more about a company than just seeing a filing or some metrics. Anything I’ve just bought in the past based on metrics and financials alone turned out to be a crap investment. ie. JXN, DAC,FCNCA (not a microcap though)

-

Depends. Yes those are winners but they are a huge portion of the index. Apple is sitting at 30 PE on flat revenue. Nvidia is 64 PE with huge growth expectations. There is too much of the index hinging on those 7 companies which in my opinion are quite richly valued already - it’s a double whammy. I’d prefer to hold the SP-500 less those companies.

-

How do they manage / weight VIOO? My concerns with the ‘small cap’ ETFs is they cut the winners. For example, let’s say the next NVIDIA is hidden in there, does it get cut above a certain market cap? That would seem like a dumb thing to do. I agree that I like looking here than the SP-500 because of the Mag 7 dominance, but concerned about how the portfolio is managed. Cutting companies because they are no longer ‘small cap’ would be counter productive.

-

Came across this the other day, a paper from Oxford Uni called ‘Dissolving the Fermi Paradox’. Forgot to post it. Of course I’ve no idea how likely this is as the next person but seems well thought out: https://arxiv.org/abs/1806.02404#:~:text=The Fermi paradox is the,universe we in fact observe. Would be disappointing if it turned out to be the correct solution.

-

You can’t possibly look at the performance of the FTSE 100 since 08 and say it was fine until Brexit. It was terrible before and it’s terrible after. European indexes have been terrible too from that time. Overlay just about any European index on the SPY and it’s pretty much the same story.

-

Some truth to that though, they are perma low multiples. Economy has been stuck since 08 really, as has much of Europe.

-

That was my thought too because he had a large new holding in it: https://whalewisdom.com/filer/saber-capital-managment-llc Thermal coal doesn’t much interest me, and as I’ve learned from investing in energy, expectations that management will pay out nearly always disappoint.

-

I like John Huber’s writing, he makes the complex simple. I don’t have a subscription though. Anyone know what company he is referring to? https://basehitinvesting.substack.com/p/a-royalty-on-the-growth-of-others

-

Thanks GFP. It’s too hard for me so decided to just move on.

-

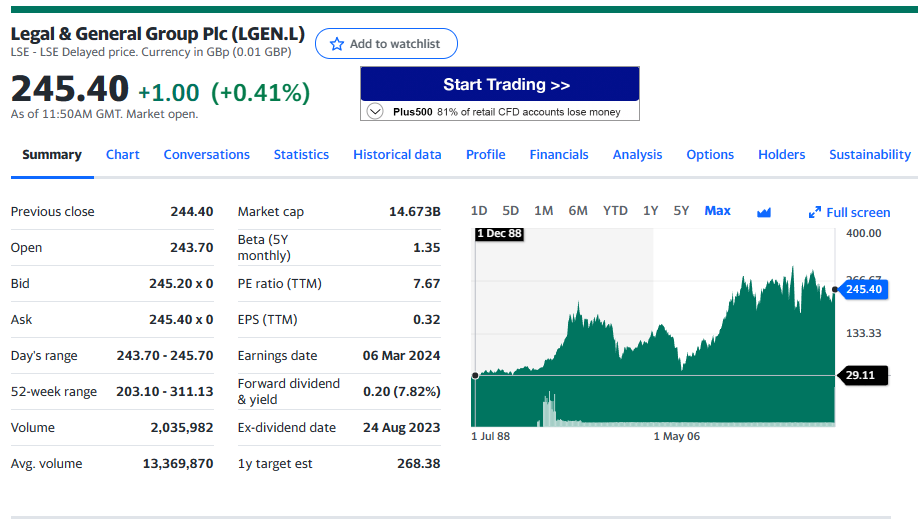

Has anyone looked at the UK company Legal and General? It is an insurance company (among other things) and has a fat dividend and a relatively low PE. It has negative revenue in the past few years, something I cannot get my head around. The details of this company are over my head unfortunately.

-

Extremely volatile initially and extremely good for speculators initially, but it would probably moderate and find a range like anything else.

-

Exactly. You pick your spots. There were large banks trading as low as a PE of 6 just a few months ago.

-

He may be calculating it differently, I checked other sources and the difference appears to be consistent

-

Yes you are saying that multiple expansion is to be expected given the tailwind and also saying that changes in interest rates, taxes etc can move the needle both up and down in terms of multiples. We are in a different era from the 20s-50s etc. Just so many different moving parts these days and much more money chasing the stocks through passive indexing and the like. My post is only to point out that things aren’t that out of whack to historical standards.

-

In terms of PE we aren’t too far away from the from the ~35 year average of 19. Notable that the lowest PE since 1989 has been 13.

-

What Is the Best Investment That You've Ever Made?

Sweet replied to Blake Hampton's topic in General Discussion

The cost of membership of this board. I wonder how many baggers of my membership I’ve made in the short period of time I’ve been on the board.