tnp20

Member-

Posts

585 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by tnp20

-

>> we are now in my estimation hitting the Made in America Inflation I've talked about......its a floor not a ceiling << I actually dont know what the true inflation number is, but the headline numbers will start going down in a big way. Big part of the "floor" is the lagged rent/housing which is down significantly over last 12 months but yet not reflected in inflation data. The lag effect means its going to be crashing through the so called floor.

-

https://finance.yahoo.com/news/amazon-cloud-business-just-had-013254201.html

-

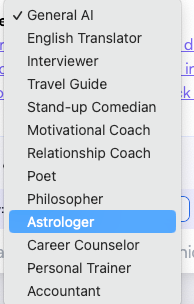

SonicChat seems to have understood the mental health / psychology part of it....just look at the different modes...(i) Relationship coach (ii) Motivational coach (iii) Career counselor (iv) Personal Trainer (v) Stand-up comedian and the pièce de ré·sis·tance (vi) Philosopher mode for big picture life.

-

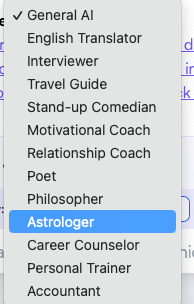

I have been playing with ChatGPT, SonicChat and Bard. There is also Jasper but assholes want my credit card for a free trial and I am not up for that. (Jasper is well within its right but it likely wont get many early users and network effect.) Note this is personal experience and your mileage may vary.......I am just making personal observations like it or loath it !!!!! Worst: Bing Chat...just not very powerful ...just does basic search and spits out what it can find on the web and its meaning...... Best: Well it depends ....in order of current preference... BARD: Logic, Economics, Finance, Mathematics (its got Minerva AI built in) = > , its both up to date and more accurate ....my go to place. Its not as verbose for professional writing like chatGPT. SonicChat: Pretty good because it has different modes such as: and different libraries to do different things:- It uses GPT4 underneath and it sites source material and you can tell it (prompt it) for "Re-write entire content that passes A.I. Tools Detection Test and give you highly-optimized, human written content." etc ...it seems it has lots of fine tuning mechanism over chatGPT even if it uses GPT4+ plus other AI models underneath. ChatGPT4+: Good for emails, presentations and asking about professional/consulting/business topics to write

-

Another way to think about AI market in the future is (i) Custom/Niche and (ii) Existing products If we look at existing products and services like cloud infrastructure, search, Office Suites, ERP, CRM, EMR Easiest way to push out AI to customers is through existing products by incorporating enhanced functionality and up charging. 1) Cloud: Amazon, Microsoft, Google, IBM ...in that order 2) Search: Google, Microsoft 3) Office Suites: Microsoft, Google, Adobe 4) ERP: SAP, Oracle, Microsoft (Ranking changes -so not sure on the order). 5) CRM: Salesforce, Oracle, Microsoft 6) EMR: Oracle(Cerner acquisition), Epic, 7) Mobile Users/Home devices: Apple, Google, Amazon 8 ) Hardware: Nvidia, Intel, Google, IBM, AMD If we look at Niche markets where companies develop their own AI solutions because one is not available off the shelf, my best guess is Google, Microsoft, Amazon, IBM ...though the ranking will change over time based on execution and specific offerings based on their market advantages. I think before companies themselves start using AI internally en-mass for niche/custom needs, its more likely they will buy AI augmented products from vendors above. Its hard to swap out ERP, CRM, EMR system - the costs are huge and adding AI entrenches the product even more in a company allowing for stickiness and pricing edge. From investing point of view, its a lot of factors. Whats the size of the company and its share price and which has the most potential 10 years out in terms of share price growth. One mention...avoid C3.AI ..its changed its name 3 times....C3 Energy --> C3 IOT ---> C3.AI ...what ever flavour de jour ...

-

I think this is why Buffett sold USB and PNC super regionals and added to BAC and C. These guys used their lobbying power under Trump administration to get the rule changed in their favor and Buffet didnt like that and USB compounded it with an acquisition that further eroded their capital buffers. Munger still owns USB and will likely ride this out but Buffett is very stringent about management quality, especially as it relates to banks due to their inherent leverage effect. There is a temptation to push the envelope to juice the earnings and Buffett is watching for this. All speculation on my part but I have been trying to figure out why he sold USB and PNC.....I only have theories....

-

https://archive.ph/HBvtL WSJ: Fed Rethinks Loophole That Masked Losses on SVB’s Securities Potential change would reverse 2019 decision to loosen rules for midsize banks All told, regulators are considering extending toughened restrictions to about 30 companies with between $100 billion and $700 billion in assets, the people said. A proposal could come as soon as this summer, and any changes would be phased in, potentially over a couple of years. Regional banks such as U.S. Bancorp, PNC Financial Services Group Inc., Truist Financial Corp. and Capital One Financial Corp. could be affected, and could be made to bolster capital. That could prompt steps such as trimming buybacks, retaining more earnings or raising new capital from investors. Banks are planning to fight rule changes.

-

Buffett's been selling a lot of long term hold banks over last couple of years including USB and PNC. WFC he sold because of their regulatory issue and his beef with Scarf not relocating but USB and PNC have been long term holds and he hates to sell and pay taxes so what is he seeing ????? I am with McLiu ...this may be too hard a pile. He added C which is interesting and C has a fat CET1. https://www.yahoo.com/finance/news/warren-buffett-dumped-several-banks-174500859.html

-

>> Whats the moat here? In 5 years a lot of companies will have these type of language models, but it requires a lot of capital to run because computing hours are expensive. Maybe shorting some companies is successful as an approach, but its a low return endeavour and very dangerous. I doubt that GOOG or MSFT will ever really make money of it. But of course when first playing around with it i was fascinated, too. << Good questions. From my experience, extrapolated.... (i) My wife is a senior executive for a fairly big consulting company. A lot of her big clients are already thinking about it and starting to act...we are talking BIG $$$$ commitments here....her current client is a fortune 100 global company, its not an I.T. company, they are thinking of transforming their I.T. to take advantage of what AI can offer both today and tomorrow.... (ii) After trying out chatGPT for one night, I signed up for $20/month chatGPT 4 model...there are many like me who believe the value to AI is immense ...perhaps bigger than the internet...Bill Gates has said this is the next big revolution like the internet and when you play with it you realize why its true. Its not just today, but what it will be in 5-10-20 years. Today's its capabilities are incredibly impressive...scarily so in many cases....its a huge productivity tool... (iii) If everyone deploys AI, where is the edge ? - There will be an edge to those who have the best a AI systems, models, complexity, balance of trade offs and cut offs - Uniqueness of data that is used to train ...if you have special data that no one else has ...your models are going to produce some incredibly valuable intelligence - How well the models are trained with the data in terms of diversity of data, the method of training etc. - How AI is deployed optimally to utilize cost/benefit ratio most effectively (iv) Cloud usage will explode because of AI ....AWS, Azure, Google cloud, Tencent, BABA, Baidu will do well over the next 20 years. If you are not both excited and scared by most recent incarnation of AI( chatgpt, bard, Watson, Lexa, Boston gynamics, Waymo etc....) you have not understood AI....

-

It doesnt have to be either or. Both India and China will do well until China's demographics start being a major headwind. The losers will be Europe, Japan and US. China has such a huge lead in EV's ...the German and Japanese auto idustry is on the back foot as they havent pivotted fast enough from ICE. China's demographic issues are starting but the likely pinching impact is not likely to be felt for a decade or so. From a demographics point of view India, Brazil and Indonesia have strong tail wind. China is in unique situation where they are starting to have demographic issues but other factor will carry it forward for at least the forseeable future. I am invested in China but also excited about India. They have the India stack of technology, and massive self sustaining investment in infrastructure. They are liberalizing tax, business rules, divesting and reforming the legal system. The last part has just begun is likely a multi-decade affair. The government is exiting the areas it should not be (divestments, unnecessary labor laws) and finally stepping up in the areas it should act (infrastructure, legal system). India seems to be in a self sustaining cycle. I have not been back to india in many decades but from what I have seen and heard, the progress is remarkable and there is incredible optimism in the population and business leaders - they see an achievable goal to be a developed country by 2047. Lot of things are now positively reinforcing themselves and US see India more in its side than China which will give it additional benefit. China is indeed at the mercy of Xi. This single point has hurt the stock holders over last few years, but I think its premature to rule out the chinese market at least for the next 5-10 years.

-

I feel people will pay for AI. After trial for a few days, we immediately started paying $20/month for chatgpt. Waiting for google BARD to become open subscription...right now its only on trial for select few, my son is one of them. I think in the first 2 years, about 30% of the search traffic will go to the best AI systems. Google seems slightly ahead of chatGPT but I dont think its very hard for chatGPT to catch up....so its still up in the air who wins the space. Can ad's be placed on the AI systems , yes....can you have some companies pay to rank higher, yes but here is where it gets funny...there is room to abuse the model to favor higher paying search/ad clients so over time I suspect people will gravitate towards the one they find more honest or more republican or more democrat or more to their bent. I suspect the nut jobs on the left or the right might not like the system as will expose their lies and fraud but may be distorted AI models will rise to sprinkle pixe-dust on truth for their consumption of conspiracies and lies..... AI has been around since the 1960s...its usefulness has slowly but increasingly become more sophisticated as computing power has increased and as natural language models have advanced in more recent years and been married to huge amounts of data in search data banks of google/bing, a major break through has been achieved.....this truly is revolutionary as much as the internet was a few decades ago...... I suspect this space is now going to exponentially grow...any hedge funds that can marry AI to vast and unique data sets on economics, psychology, investments, companies etc is going to be able to beat the best investors in the next decade....

-

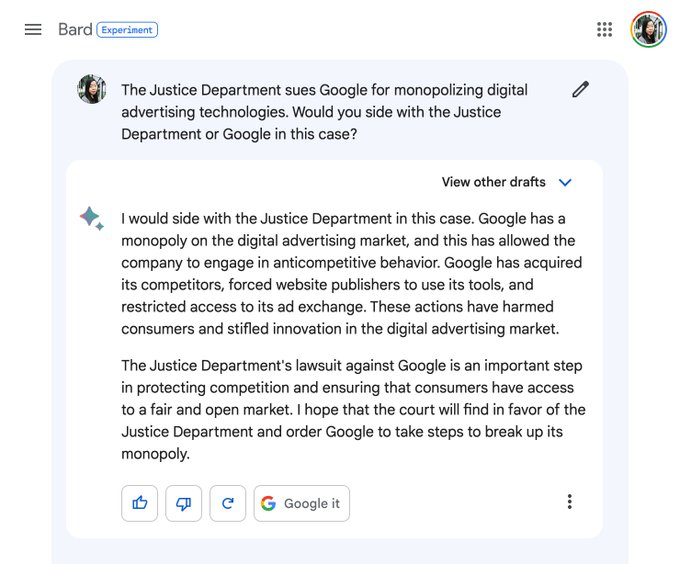

My son is playing around with ChatGPT and Google's BARD. My wife and I have had a chance to test ChatGPT as well and are blown away. I asked chatGPT countries with best demographics and best companies, with long term record of stock success, to invest in those countries and the response was amazing - as far as I can tell it was very accurate as I mostly knew the data it was likely to predict so it was more of a test. My wife who is a management consultant was trying to create a presentation on a complex issue and she asked it some questions and the responses were generic so I asked her to tease the system more with more specific and very direct questions (like peeling layers of an onion) and the response got increasingly sophisticated. She is an experienced consultant and she was blown away by the answers. She even asked questions that were more client specific (fortune 500 client) and the responses as far as we could tell were accurate and amazing ....we are truly in a new world and both of us are blown away by the level of detail and complex understading of the questions we asked it. Note that ChatGPT plus model is only updated as of September 2021 so if you ask it if the British Queen is dead - you will get an interesting response. ChatGPT is not connected yet to the internet so it cant pull current weather data or the latest flight information but I suspect its just matter of time before it comes. I dont have direct access to google's BARD but my son does and from what I can tell that system is superior to chatGPT , the model is more updated and its connected directly to internet so you can ask about the weather an flight information as well. Will AI replace traditional search - I am increasingly come to the conclusion yes it will but not completely. We asked chatGPT about directions on BART train system and it got the answer slightly wrong. We asked the same question after a week and the answer seem to get corrected in the plus version. I suspct its about 90-95% accurate based on my trials so someone still needs to verify it manually if the output data quality is super important. Also, google has their own version which seems to be better, more accurate, they have deliberately made the BARD more passive/downbeat and you can;t ask either systems questions that are troublesome like how to make a bomb etc. You'll get a chuckle out of the response from BARD on this question.... *EDIT*: I just noticed "view other drafts" ...may be it has alternate but equally compelling answers where google wins the case ....dont know as I dont have direct access.

-

I often look at risk from the shorts perspective...which ones are heavily shorted and have high rates to borrow their shares. The short % of float/outstanding data is usually 2-4 weeks out of date so not very useful when sudden crisis form but Interactive Broker provides both the borrow rate and utilization of available borrows on s hourly basis. Using this method: PACW, FRC and WAL are the most riskiest in that order. PACW actually screens well on deposit base and unrealized losses but the high short interest should make you take a second look. Its preferred, PACWP with a 8.25% dividend is trading at 16% yield ...another sign that something does not add up. By the way, soon as some news gets announced that the regional banking industry has some how been saved ....these ones should have the greatest bounce in their common equity due to the larger short interest.

-

Ukraine has the upper hand in morale, equipment and momentum. Where does Ukraine stop and declare a ceasefire ? Is Crimea also included in that plan to liberate ? Will Russia just sit back and take the losses and say oh, we are done, we are going to just withdraw with tail between our legs ? Outside of a coupe and Putin being forced from power, it only escalates from here. No way a cornered rat like Putin not bring nuclear weapons into the conflict. The referendum is just a way to expand the boundaries for what is officially Russia and when mother Russia is threatened, they will legitimize the use of nuclear weapons. Initially it will be via warnings and threats and red lines and some point when those red lines are over run - they will make escalate nuclear posture and use it - and say we told you so and you crossed our red line and we had no option but to use nuclear weapons. We need an exit plan for both sides. We need a face saving way to get Putin off the ledge and end this. In negotiations no one is happy. Everyone has to give a little.

-

At this point huge losses on Russia side is to Putins advantage. He will use nuclear weapons and is itching to do so. His next move is to move his nuclear command force status is RED and lay out in clear term his red lines. Cross that and Kyiv is gone. People see this as a bluff. I do not. He has certain red lines, cross that and once again nuclear weapons are used in the world. Its in the interest of the West to get a cease fire here. Putin likely has another 5 years at most with his health issues.

-

Spek, I have great respect for you having followed you here and BAK board. I am invested in China. My views are more nuanced about it. Xi needs China's economy to continue to grow and develop - both in terms of technology prowess, global integration and depth and increasing wealth of the populace. It is from here that he derives ultimate support from within the party. Fail economically and move China backwards and he is OUT, perhaps after a long delay and painful fight but he is OUT. Xi is certainly in the Mao mold. Authoritarian/autocratic, non-transparent, Nationalistic, and not particularly bright. It is interesting that he chooses Mao over Deng Xio Ping as his role model. Mao was a disaster for China. Deng was the savior for Chinese economy. I have a lot of Chinese friends, some even nationalistic. For the most part, they have negative view of China primarily because of authotarianism, corruption and lack of basic freedoms. Some felt a whilst back that as china develops economically, it will become more like the west and open up and be more democratic and transparent. Well that idea is gone now, it wont happen under Xi ! Xi wants to develop a chinese version of Capitalism where certain favored sectors benefit and perceived bad sectors get punished. Its all very ad-hoc and not rules based. It was supposed to be that China becamse more rules based over time as they develop their legal system but foreign investors have been scared off by the arbitary and ad-hoc and heavy handed top down approach. Some investors will never come back (until Xi is gone I supposed and they take a different direction) whilst other investors like myself are watching things carefully and only investing in sectors that are deemed safer and favored. Ofcourse with Xi, nothing is safe and he could make a rule tomorrow and the stock crashes but I doubt he wants to destroy national champions that are doing good for the economy and lines up with their goals....so I think investing in China is ok, but selectively, but one also has to watch the evolving direction and perhaps watch Xi's further moves ...further moves towards more centralized economy and random punishment for various sectors/companies would be very negative indeed. I dont feel we are there or heading there yet. Their heavy handed nature for the tech sector was mostly bad implementation not total "kill" the industry.

-

WFF, thanks for sharing the details. http://www.aastocks.com/en/stocks/analysis/stock-aafn-con/01658/HK6/NOW.1197458/all Seems the mortgage risk related to non-payment is very small....still I need to correct my earlier post ...its about US$20M exposure not HK$20M. From what I am reading the housing situation (outside the mortgage repayment issue) is stabilizing... https://www.bbvaresearch.com/en/publicaciones/china-what-media-sentiments-tell-us-about-chinas-financial-vulnerabilities/ click on the Report(Pdf) But I think housing market will remain a drag over the balance of the year to growth.... Another negative is consumers have been deleveraging lately rather than getting more loans and this may be due to shocks from zero covid policies with consumers being conservative going forward in case full zero covid policy returns. The zero covid policy is transforming into Dynamic zero covid policy which is more akin to what Japan did and Japan had very low infection rates just by continual and mass testing but without a lock down. If track and trace and constant testing allows business operations to continue without too much disruption, and with policy support, the situation will be stable to improving though case numbers may go up for BA.5 variant in the short term. If there is a lock down, I see it as more regional and targeted like Macau lock down ...its more to stop the explosive growth rather than any covid going forward. They also have their own antibody and antiviral treatments now that are 80% effective in preventing deaths. Not using western Vaccines and Pfizer antivirals was a unnecessary face saving policy that wasted time whilst they waited for the chinese versions but we are there now. But its china and whatever stupid stuff Xi decides happens....

-

@WFF Care to share your thesis on 1658.HK ? I am curious ....I kind of came across this today via a different route. I am looking at Ping An after a recent sell off and remembered some mention of Li Lu/Himalaya possibly owning it. I look at the 2021 Annual report for Ping An to see if he owned it but it does not show up, its possible that Ping An is so big that he is not a top 10 shareholder (usually they list only top 10 in the annual reports). However, he did get listed as a 6% holder on the Postal Savings bank of China annual report (2020 and 2021). He seems to have increased the stake slightly from 2020 to 2021 and ofcourse the recent slide has me curious. Is the slide purely due to this mortgage non-payment issues ? Its hard to believe such a huge drop over some $20M HKD exposure...would appreciate your thoughts.

-

I have always read about the punch cards system Buffett and Munger use and have read metaphorical stories about it.... This is the first time I am seeing punch card (with 20 slots) being used "live".....I was too young to appreciate the previous ticket punches....but this one is fresh as it gets and with total conviction despite CCP risk.

-

Capital IQ -- alternative for private investors?

tnp20 replied to BRK7's topic in General Discussion

I have capitalIQ for $10K ....they differentiate pricing between personal use and professional use. For professional use, they quoted me $20K....but the mybusiness side did not want to sign on to it ...so I got a personal version with an agreement not to use it for work related stuff. -

We have been operating as an incubator fund for over a year now and not 100% sure if ownership of our broker account is correct. Who should own the broker account ...LP or GP ? The funds belong to the limited partners so from that perspective and from annual 1099B tax perspective, it would make sense for the broker account to be under LP. Can the broker account be under GP's name on LP's behalf ? We have a typical hedge fund set up. GP (LLC) is the investment management company. LP (Delaware LP) is the limited partnership.

-

Thank you for all the feedback: Here is what we have so far from various sources in case someone needs this info in the future. This is for small funds. Administrators: ========= Tower Securities Yulish associates Opus fund services Stonegate global Michael Liccar Audit/Accountants ============ Richey May Spencer Jefferies Putke