tnp20

Member-

Posts

585 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by tnp20

-

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

It is so early in this game ...this is a 30+ year revolution unfolding ....innovation happening so rapidly that I can not keep up on a daily basis - I am signed up for like 20 AI newsletters.... Today - microsoft came out with a 1 bit model (normal is 16 or 32 bit)....lower the level of quantization , faster and more efficient it is with what was thought to be loss in accuracy but thats not the case YOu guys have seen Openai's SORA mode www.openai.com/sora now you can take a picture and turn it into a talking picture. The media industry is going to be revolutionized .... -

I hvave been using perplexity for the last 6 months. Its petty good. Specially its ability to provide source material links to verify its not halucinations. Its also good because you can change the underlying model it uses for your prompt....I have the paid version so I can use GPT-4 turbo..there is auto mode where it picks the model for you. Also if you can get access Anthropic and notebooklm.google.com are also good for PDF documents as input.... Use cases so far:- (i) General search but more complex query (ii) Resume - asked it how good a match resume was to the job description and how to tweak it to get a better match (iii) Financial chat board and message board summrization - some stocks have 100s of posts per day - I am able to print it to PDF and load it into one of the AI models and summarize it and also ask it more specific questions that may have been discussed (iv) many others that I can't talk about

-

I feel like we are running out of true heros....last of the good breed are dying and I dont see any replacement that comes even close. Charles Feeney too not too long ago... I feel they may exist in other countries as you need certain conditions to forge men like these.... Conditions of good ethics, hardship, hardwork , enormous opportunity set ahead, and above all less materialism and delayed gratification. Which country should we look ? I think both India and China have conditions for such wise men to emerge. I can hear the US centric whine..."but they are shit holes"....grass hopper has much to learn.

-

OpenAI is just a distracting side show.....ignore the drama and keep eyes on the prize.... I know few people who are using Auzre AI cloud special access program ...this is early AI stuff beyond OpenAI....microsoft may not need OpenAI...this stuff is very good....and many other model will surpass whatever OpenAI will come up with....such as Google's Gemini , Anthropic's claude and I am sure Amazon is throwing massive dollars at it not to fall too behind. Google is best positioned (since it makes its own AI chips) , along with who ever can get access to those fast NVIDIA chips ...as you need lots of silicon to train Trillion token systems.... LLMs will end up the way of the dodo...multi-modal foundational models is the new thing...human AI is not all about text...its about language, vision, sound, touch, motion, physical world, mathematics, reasoning, ...an AI model that succeeds in all these domains as well as be very good in language will be the winner.....and gets closer to AGI....we are seeing early glimpses of that with Google's gemini...though it wont be true AGI just yet.

-

AGI is less than 10 years away....Google about to release Gemini multi-modal model ...5 Trillion tokens....GPT has some catch up to do... I play with Anthropic ...has a 200,000 token context window....you can load up all the Warren Buffett letters from the 1950s and it becomes a Buffett expert/brain and can answer any questions knowing all that context...next step would be to use that Buffett criteria and use RAG queries into something like Koyfin, FactSet, Bloomberg and also get company specific data such as press releases, Analysts conferences, CCs and it can probably get close to Buffet level of stock selection.

-

Talking of Data......the most obvious ones to benefit from data and tools are... (i) Oracle ...Oracle is making a big push into AI cloud has bought a lot of NVIDIA chip...they will offer Ai tools to take existing data and make it accessible via RAG (Retrieval Augmented generation) rather than train the models on it. So RAG is different from training the models on the data. RAG mechanism is where AI is trained to know what data is, what format it is in (not that it cares about format), where it lives and how to go get it using natural language and present it in what ever way the user wants. This is different from the model being trained on the data but it will be an important tool in the overall scheme of things. RAG can access different varieties of data from different sources and weave it together as needed. (ii) Databricks ....watch these guys ...they are making the right moves and are pre-IPO.... (iii) Snowflake ....they play in the cloud data space....this is the one that was bought by Berkshire's lieutenants. ...

-

Much is made of how China is knee capped in the AI space by the USA chip restrictions....yes it is an issue but there are ways to over come it.....also if you look at the research paper and other papers coming out of China...they may be even ahead of us in AI.... The reason Nvidia is ahead is because of their massively parallel architecture and fast data transfers in between chips and memory...their GPU/Tensor chips can do floating point matrix multiplication very fast ... Over time people realized that they dont need the huge floating point accuracy for the weights in the neural networks and even 4-bit (instead of 16 bit) architecture is sufficient to be very good ...there are now many smaller models optimized for 4-bit architecture that can run on home grown PCs. You can achieve massively parrallel architecture with lower performance chips if you can some how tie them together so they can communicate faster in between....so a Chinese lower spec AI cloud machine may be 10 times bigger than a USA equivalent but they can get the same job done in roughly the same time frame as the USA machine...this has implication on upfront costs and energy utilization but chinese may not care and take a brute force approach to staying competitive with model size and complexity whilst they catch up in chip technology....also the inferencing may not matter if their energy costs are substantially lower - from solar, wind and other green energy. For sure, they will be handicapped, but they can do a lot to keep that gap small whilst they catch up on the chip technology.... There are also developments in optimizing the models to run better faster ...right now most have taken the brute force approach but there is much to be gained just from spending time and energy on optimizing. For example some of the recent smaller models are better than much large models from 2 years ago...etc. China Will Be At Forefront of AI, Alphabet’s Pichai Says https://archive.ph/qcXqV Despite what they said in BABA conference, I think BABA and Tencents are also good AI bets...

-

From an investing perspective....this is all fight for the future of AI and who will dominate....nastier the cat fight the bigger the prize at the end.... We will need enormous cloud data centers running enormous AI and AGI models in the future...what we have today is a mere fraction of what we will have in 10 years..... Placing bets on Microsoft, Google and Amazon is winning bet....despite the multiples which if you look out in 5 years will be well within norms.... The other winners.....AMD, Nvidia (yes valuation is an issue so go slow on this one), Intel and other startups like Bittorrent if they become public. Of course Semi plays ....ASLM, TSM, KLA and INTC are also great bets...if you have a 10+ year view. This is basically David Tepper and Dan Loeb portfolio adds over last few quarters ...probably other smart investors too.... Chip makers may be the biggest beneficiaries ....why ? (i) Just the huge growth of chips required for AI clouds globally - likely arms race between USA and China despite chinese handicap of not having USA chips (ii) The power requirement for these chips will be enormous - both for training large foundation models and also for inferencing once trained....so ever faster replacement cycle for these chips....so growing market with a 2-3 year chip replacement cycle to take advantage of faster processing and lower powe consumption of newer chips...google and microsoft and amazon are already working on more power efficient chips to make inferencing these AI models cheaper as they will need to scale this up massively.

-

Technocrats are trying to do the right thing but they are all scared of Xi so not doing what is really needed, just enough for show. Xi is telling his people to eat bitterness and get ready for extreme scenarios. Having said that sentiment is so bad, that there are some green shoots and things are beginning to improve....if Xi doesnt put his foot in his mouth again, things should improve naturally....if he says something stupid from his "ideology book", all bets are off. Current "football" he is kicking around is the healthcare sector. Healthcare entrepreneurs have lost billions in last few months and hedge funds are shorting chinese helathcare. Foreigners are burnt to a crisp. Many wont ever come back to China given other better options. It all comes down to Domestic investor and. their billions in savings and animal spirits ...which by itself can do the trick if they can get some confidence back.

-

US and China to launch economy and finance working groups to stabilise ties https://archive.ph/NV4KQ https://home.treasury.gov/news/press-releases/jy1760 If this mechanism works, I think we will have moments of progress( economy and markets) punctuated by Xi's constant stupidity.

-

https://podcasts.apple.com/us/podcast/beyond-markets/id1552236298?i=1000628002104 I follow this guy as his predictions have been fairly accurate...worth a listen.

-

This is a bit off topic but last comment. There is a bit of politics here as it relates to leadership so be forewarned. Will China take over USA as number 1 economy in the globe ? It all depends on the leadership of both countries in the coming years. Xi has changed the course of China that has made it less attractive for foreign investors and foreign entrepreneurs and brilliant innovators around the world. If this direction continues, China is unlikely to take over USA (and USA led order), however Xi has at most another 10 years and of course China can course correct back on the old path (before Xi ) but by then demographics starts acting as a head wind so it becomes more difficult. Even with perfect execution and more reasonable Xi, the odds are low except if USA really screws the pooch, which by the way is not out of question on the current trends in USA. The current state of leadership and politics in USA is loosing friends all over the world. The MAGA crowd and nutty republicans in house and nutty left is doing a great job in threatening our democracy and constitutional way of life and also scaring important foreigners and allies with the crazy rhetoric. It could be a phase and USA has always got its act together when faced with a real challenge (China currently) and perhaps it bounces back and gets back on right track but for USA to continue to beat China, it needs 3 things: (i) Trust of important allies ..Japan, Germany, India, France, Indonesia, Brazil ( support for dollar and support for US led world order/miltary) and (ii) Continued full force immigration and attraction of the best talent and entrepreneurs in the world (iii) Open society and free markets. None of this is a given, and the thread of history can go in many directions. My best guess is despite the worst of leadership in the USA, there are enough entrenched advantages that we can take a lot of damage before we start loosing on the 3 important things above and give China an opening. But the investment case for China, and Chinese companies is not if its number 1 GDP, but its the case of despite negatives modelled into the narrative, how will these companies perform. Many great Chinese companies are so undervalued that even if China grows without being number 1, these companies do well and investment in them produce good returns. Many US companies are so over valued that despite USA remaining number 1 GDP these companies many not do as well because it has to work off the over-valuation. Tencents and BABA have the (i) E-payments business (ii) Cloud/digitazation business and (iii) AI business which will have tail wind for many years to come.

-

Its an excellent article. They have the means to do it, except Xi likes to score own goals. The biggest questions of all about the future of the Chinese economy concern politics, both domestic and global. Domestically, does China have a leadership that wants to continue with rapid growth or is it now inclined to view stability as more desirable? Is it prepared to take the steps needed not just to increase demand now, but to tackle the structural problems of over-saving and over-investment, over-reliance on the property market, excessive leverage, and so forth? Is it prepared to give private businesses their head once again or is it determined to keep them under firm (and inevitably daunting) control? Can it convince the Chinese people that, after the traumas of Covid, they can be confident in the future once again? Adam Posen of the Peterson Institute of International Economics has argued powerfully that they cannot. I am not convinced. They changed in the late 1970s on a far bigger scale. Of course, the leadership also changed. Will it this time, too? Or is it fixed for years ahead?

-

Chinese blockade of Taiwan would likely fail, Pentagon official says https://www.yahoo.com/news/chinese-blockade-taiwan-likely-fail-164637572.html This is in line with my assessment...my thoughts are a decade or two before they are even ready militarily. By all accounts, Xi is not so smart mafioso who has blundered strategically on multiple fronts. He may blunder again and attack prematurely but it would be the end of Xi or CCP or even the world depending on how is unfolds. But knowing he craves stability and control, its unlikely he goes down this path. Xi has pissed off and scared off foreign investors needlessly and iron in the brain means he is too stubborn to reason and listen to sage advice from his smart advisers specially when it comes to things that conflict with his ideology. Some amazing businesses in China are very cheap, but Xi remains the single most important factor in how the China investment story turns out in the short and medium term. Absent health issues, he is not going anywhere and there is no one powerful enough to challenge him.

-

Just curious....how many would invest in Saudi Arabia ....ARMCO for example ? Would you invest in Saudi Arabia and not China ? And if so what would edge Saudi Arabia over China ?

-

Incorrect. Your mathematical equivalent is 100% probability of betting $1 and likely getting $2. But what about a game where you bet $1 with a chance of earning speculatively $20 and there is 1 in 5 chance (20% probability)...if you do it 5 times, you are likely to get 4 times your return instead of a double. I high light the word likely....as Its all probabilities, nothing is certain in life ...and the ultimate underlying reason for that is quantum mechanics. The issue is your expertise in correctly handicapping. One mans 1 in 4 is another man's 1 in 2...its what makes an investment market.

-

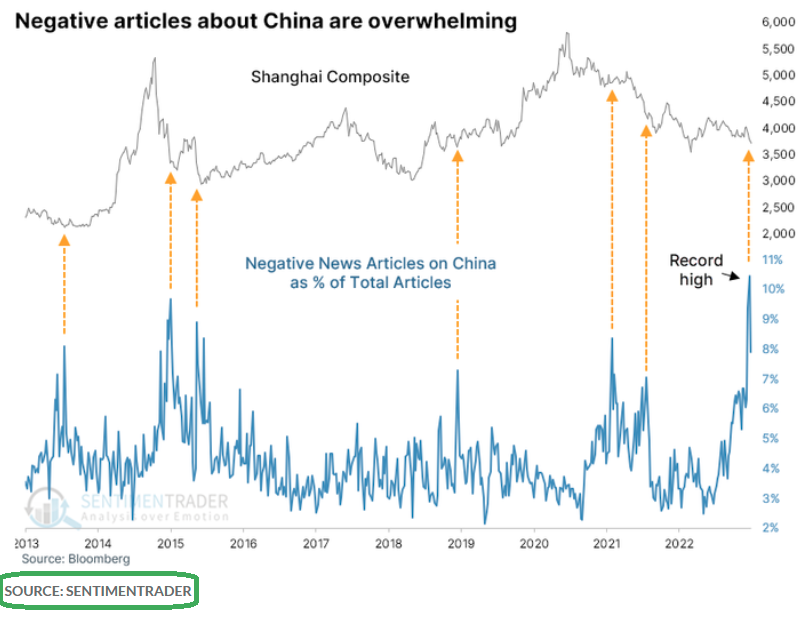

I had said earlier that I am seeing the news flow change in terms of negativity being less.... I saw this today confirming my own observations....can't vouch for what the stocks will do but news flow is less negative now...

-

Thanks for posting that article. Yeah "Xi" is screwing up badly and elders are worried about future stability and support for CCP ....there are 4 scenrarios I see.... (i) XI gets removed. This is low odds. (a) New guy worse - disaster for China and possibly the global economy - this is a super low odds here. (b) New guy slightly or materially better - some confidence is regained with respect to China initially and further as more confirming and positive data comes in (ii) Xi doesn't get removed - most likely (a) He maintains his destructive course and even double downs - economy worsens and stability is threatened - this would result in (i) above sooner or later. (b) He pulls back like he did with his Covid policy and presses his sub-ordinates to go all out on the economy - economy recovers in the near and medium term and stocks get a relief rally/sugar rush at minimum. (ii)(b) is most likely from a logical point of view otherwise pressure on Xi will be tremendous. And then the second striking factor is that the central government has essentially no debt. Central government debt has different definitions, but including the railway ministry, it’s 25 percent of GDP, which is a fraction of the debt of the U.S. federal government. It’s a fraction of the debt of France. It’s well below the debt of Germany, which is by far the most frugal of the major advanced economies. https://nymag.com/intelligencer/2023/09/will-chinas-economic-slump-hit-the-u-s.html If this is true, they have plenty of fiscal space to juice economy IF THEY WANT TO. And having the capacity is the hard part, the will to do it is just a soft decision part that can be switched on or off easily. If they didnt have the capacity, it would be a different story. This means local government debt can be soft transferred to the central government alleviating local government debt burdens....

-

This is like religion. No one is going to convince the other side. There are fair points on both sides...you place your money on various global chips on the table and reap what comes as a result.

-

If you were around 500 years ago..this statement would be.. 2500 years of Asian ascendency > 40 years of Western European miracle. Two points... (i) Most recent victors write history and destroy/suppress the losers history (ii) Center of power Pendulum swings over centuries ...

-

This is an old stat thats is often bandied about. Not only can most people read and write but many of those 20% counted as unable to read will speak broken English to you. They all watch western movies. On the other end of the scale the shear number of STEM graduates in India each year are huge. There are 23 IITs (MIT equivalent) where the entrance exams is equivalent or harder than MIT (known as JEE). The reason is just shear size of the population and even at lower percentage number compared to the west, there are enough super smart folks to go to tech development in India but is more often the case go abroad for more money. USA + India will be powerful alliance as a counter force to China. If you watch the news flows, they are both playing nicely with each other and expanding cooperation and relationships. It has incredible bi-partisan support in both houses of congress and this trajectory is likely to continue. My wife is quarter Chinese and rest Vietnamese. I love the Chinese people, they are very hard working people. Singapore and Vancouver are examples of how Indians, Chinese and Asians in general can work together to build something more unique and powerful. But Xi is a big obstacle and the trust he has destroyed with the neighbors gave the USA a huge strategic opening. Long term I am a globalist, and I hope there are less of these regional power plays and more about improving quality of human lives and improve scientific knowledge and understanding globally. I hope Xi has a short life and China can go back to their previous trajectory. Whilst they may not adopt a complete Western model, they may adopt lot of things that bridge the gap and perhaps we can learn something from them too and adapt rather than throwing everything about their way of life. India and China were powerful nations some 700+ years ago and so they will become import poles in the globe with the US/West in the times to come.

-

China was on a good trajectory before Xi. Lot of my long term Chinese friends thought that the country would open up more and have some form of democracy even with CCP in power. If that had continued and if we could project out 20-30 years, one would see China playing nice in the US led world order developing their economic , technological and political chops quietly without the needless friction and then slowly exerting their political influence by building alliances in the neighborhood and with the emerging power brokers. Once Xi came on stage, first thing he did was he alienated all the neighbors (some of them future power brokers) and he took China in a different direction that no one expected. How Xi came to power is a fascinating story ..its more akin to a gangster muscling his way through rather than a strategic visionary being selected because he will Make China Great Again. He has taken a "go it alone" strategy thats nationalistic thinking he can develop all this critical technology all by himself and could care less about alienating neighbors and future power brokers. He also put USA in his cross hairs before they were ready. He scared foreign capital needlessly. This is an ideologue who is neither a true visionary or grounded in reality.

-

West won the war against USSR. When faced with a more strategic challenge, a Western led order will rise to the occasion and beat China. Why ? Focus on the big items:- (i) Top 3 economies in the world will be USA, China, India over the next 30 years. You can bet India will not be in China orbit ever. USA+India alone will be enough to outdo China. India has demographic benefits, the STEM majors, and excellent schools in IIT (modelled on MIT) and IIM (modelled on Harvard). (ii) I agree that USA STEM is abysmal. But, its top Universities are excellent and full of STEM students from India, China and Russia....many patents are by these very some folks at the forefront of research. Even if Chinese had good schools, I doubt many foreign students want to go to china becuase of both language barrier and lack of freedoms imposed by CCP (which were evidently in display during COVID with their draconian measures). The CHinese students that come to the USA, by and large stay here. (iii) China faces not just the USA, but USA and allied countries like Japan, Germany, Korea, France, UK, Switzerland are current technology and biotech powerhouses, each has strengths in different areas but united as a group is more powerful than CHina. India likely will be an emerging one in about 20 years. The whole MRNA vaccine war was interesting. China did not accept the western MRNA vaccines despite being superior and beneficial. They preferred to prod along to develop in-house. MRNA was technology from Germany, USA and France...so it reiterates the point that alliance combined will always be more powerful than China lone. Xi's vaccine nationalism was parmount stupidity, especially when he could have shortened the needless lockdowns.

-

We are following the right strategy...arming Taiwan, building up alliances that face China that will increase the cost to China. If you look at China's friends globally, these are mostly low quality (economic and technological) friends and so at best its ambitions will be limited to reginal power play. In terms of regional military capability ---> US + Alliance(Japan, Indian, Korea, Pjilipines, Vietnam) > China It is true today and will remain so for decades to come. India is openly nuclear. Japan, Taiwan, Korean have both the technical capability to go nuclear and the raw materials (from extracted weapons grace Uranium from Nuclear power plants). Anyway which you analyze this, you wonder why Xi is playing a poor Chess game even if he is thinking 50 years ahead. Long term success of China will depend on "High-tech" innovation ...and probably I should qualify that as "High-tech innvation in strategic areas that matter" and undoubtedly they will make some progress...but it can not match and will never match the western led order and shared knowledge worker pool. No one wants to go live in China and set up high tech start up. On a positive note....Just anecdotal evidence....I am seeing lots of usually negative media sources on China turn less negative or even outright positive with green shoots....

-

Its a min-panic...$500B infrastructure spend this year (likely somewhat wasteful)....but they need to hit their growth targets....this is a mini-stimulus...should at minimum result in sugar rush into next year....