tnp20

Member-

Posts

585 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Everything posted by tnp20

-

Good piece. Xi has scored too many "own goals". Without further economic prosperity CCP credibility and longevity is at stake. Xi is doing a lot of things that are threatening economic prosperity - some things can be easily reversed but other things are irrevocably damaged for long term. I have seen enough economic papers to say all options are on the table.... (i) Ideal growth story --> Innovative quality growth , but this will initially be very slow and comes in fits and starts , and for this they badly need confidence in the private sector which Xi has punished badly. It remains to be seen if confidence in the entrepreneur class and private sector comes back and if it comes back, it remains to be seen if they can innovate and produce quality growth. (ii) Rebalance story --> Their share of export versus domestic consumption is unbalanced. They want to kick start the consumption confidence and recovery but again past Xi policies have resulted in consumers opting for having a huge savings cushion against another one of Xi's stupid policies like zero covid. They dont want cash or consumption coupon handouts as Xi does not believe in welfare state. They would like to see more (i) Services consumption which tends to employ a lot of people which would help address the unemployment problem and (ii) Spending on the new innovation story so it further drives innovation and quality growth - areas such as EVs, greentech, biotech, AI. They have been handing out lot of tax breaks for EV vehicles and greentech. (iii) Panic Story ---> Growth really slows down and risk of recession/depression, they will ramp up unproductive infrastructure spend because it works and is fast acting but at risk of growing debt whilst producing unproductive assets. There is still some productive infrastructure they can build but is limited ...such as High speed rail lines across the country and urbanizing and developing tier 3 cities, but definitely less housing construction. I firmly believe if Lee Kuan Yew was alive today, he would use "iron in the brain" metaphor today for Xi ..as that would trump "iron in the blood". The dude is dumb and dogmatic making for policy disaster. Ofcourse he is also responsible for the geopolitics mess that resulted in alientating neighbours and also alienating foreigners. If China wants to win at innovation, he needs the worlds best to come to China. This is never going to happen unless USA/West becomes toxic to live in. China's economy will make progress despite Xi. Its stocks will do well despite Xi due to domestic investors (new play toy now housing is no more, and now retirement money is going into it) and CHina's VISA and Master card are a long play that will outlast Xi (who has another 10 years). But as with all autocrats he may complelely ruin the party for everyone and this will hit global stocks and growth, not just China.

-

https://archive.ph/7u13B China’s Consumer Sentiment Starts to Improve, Surveys Show This is with sniper shots. They are st

-

There are lots of these ....but I believe this is the wrong strategy...why opt for the Graham appraoch versus the Munger approach. Remember WB started with Ben Graham approach, met Charlie Munger and adopted the CHarlie Munger approach as that was superior. Monopolies with big moats and long runways. Visa and Mastercard of China and the likes. My view is if you go for China, go for the best positioned companies with reasonable valuation. What if China geopolitics settles down, worse fears of CCP does not pass and China is able to escape the midddle income trap and become a wealthy country by 2035. (Many commentators have said the demographics issues can be countered for many decades to come). If it all goes wrong - may be a more global issues including USA based companies with heavy China exposure and at minimum global growth would take a big hit. More likely scenario is muddling through with 3-4% slow growth. Its only slow in comparisson to their past but not slow relative to many western countries and by picking fast growing sectors - should be ok.

-

This is a brilliant comment indeed. Many long time China commentators such as Michael Pettis, Eswar Prasad, George Magnus, Stephen Roach are saying the same thing...China has some really tough decisions on the economy and these are political decisions. They have already started back tracking on a lot of Xi nonsense....but it remains to be seen if they can go the whole hog. XI above all craves stability and control so they can not afford sustained poor economy as that would lead to delegitimizing CCP and riots in the streets. Examples of back tracking... (i) Houses are for living versus now loosening policy to stabilize housing (ii) Punishing Private business/Entreprenuers that drive most of the innovation and jobs growth and favouring SOE versus now saying Private enterprises are equal to SOE and are vital to China's future. (iii) Common prosperity crap versus now saying getting rich by being entrepreneur is to be encouraged as that drives growth and employment which benefits society. (iv) Punishing capital markets versus now encouraging capital markets SO far they are holding firm on major fiscal boost to kick start the consumption part of the economy but that may be coming and they may even mix old unproductive infrastructure spend just to meet the GDP target and a restless population. To me questions and answers are obvious:- (i) What do they need to do and why ? Avoid instability via economic crisis and malaise (unemployment) to keep CCP in power. (ii) How can they do it ? Various new methods (new tech innovation & Consumption), new methods may take time and be slow but old methods (infrastrcuture ) are effective at boosting GDP and are fast acting but extremely wasteful - who cares about debt at this point, there is sufficient fiscal space for them to take on more debt (according to all the China followers )- forget local government debt, LGFV debt - central government has space - so just a left pocket, right pocket thing) (iii) What if economy goes off rails ? Debt is not a problem - its all internal - they can keep pumping money in different areas until it turns ... (iv) What is the right way to do it ? slow growth, transition, coordination, flexibility and vision (v) What is the best way to play slow growth ? Be in fast growing sectors within the slow growth economy (vi) Why invest in China at all when you can grow in fast growing sectors in US/West ? Yes by all means its not an either or, its an "and" story....China fast growers are at incredible valuation if you can get past geopolitics. (v) What do I expect out of this ? At a minimum sugar high in about 12-24 months....and may be some long term wins because they are in the right space at the right time....

-

It very possible Blurry swapped his BABA and JD to HK exchange shares in which case they would not show up in 13F. There are number of advantages of holding it on HK exchange especially as BABA spins off and does IPO on HK exchange - not sure what would happen to shares held as ADRs ...may be they get cash. I doubt he got cold feet in 1-2 quarters.

-

The Only Five Paths China’s Economy Can Follow Any economy broadly speaking has only three sources of demand that can drive growth: consumption, investment, and trade surpluses. For that reason, there are basically five paths that China’s economy could take going forward. China can stay on its current path and keep letting large amounts of nonproductive investment continue driving the country’s debt burden up indefinitely China can reduce the large amount of nonproductive investment on which it relies to drive growth and replace it with productive investment in forms like new technology China can reduce the large amount of nonproductive investment on which it relies to drive growth and replace it with rising consumption China can reduce the large amount of nonproductive investment on which it relies to drive growth and replace it with a growing trade surplus China can reduce the large amount of nonproductive investment on which it relies to drive growth and replace it with nothing, in which case growth would necessarily slow sharply These are the same five paths, by the way, faced by every other country that has followed the high savings, high investment model. Each of these paths creates its own systemic difficulties and each, except for the first, implies substantial changes in economic institutions that, inevitably, must be associated with substantial changes in political institutions. This may be why in the end every previous country followed the last of the five paths. https://carnegieendowment.org/chinafinancialmarkets/87007 This is a long piece from Dr. Pettis from last year but super insightful....Only paths 2 and 3 are tenable long term...they will still do path 1 but less and less so over time to ensure they hit their GDP targets and to keep the economy on an even keel whilst they transition to path 2 and 3. The issue is that even at 3-4% overall GDP growth long term...there will be companies in AI/Cloud/EV/Green Tech space that will growh exponentially as this is all new area....the risk being power structures and Xi.

-

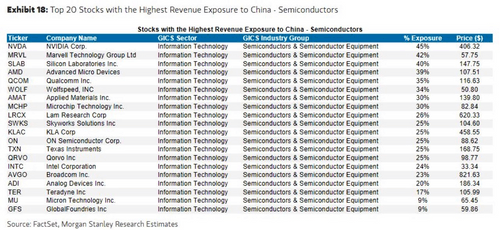

If you are short China, you shoul be short NVDA and the likes....NVDA valuation is through the roof....

-

^^^^ This piece is accurate on the ground picture ....in the short term its a crisis of confidence but in the long term is about the national chinese strategy and leadership of Xi. I think the crisis of confidence will be resolved over time and bad times will soon be forgotten but it always seems the darkest before the dawn. Crisis confidence needs a fiscal jolt to shock the system into a positive reinforcement loop and support for the housing to stabilize it. I am reading the deflation picture should abate over the next Q or so and comparison to Japan are not entirely appropriate. I have said before I am short-medium term bullish but long term negative on China primarily due to Xi. He is leading China in a wrong direction and he doesnt even realize it because he has surrounded himself with loyalists. Lee Kuan Yew's comments about Xi "He has iron in his blood" .....meant to imply he is steadfast in his decision despite head winds.... If Yew was alive today and watching XI's actions, he would say "He has iron in his brain too".....too rigid in ideology in face of contrary indications... iron in blood + iron in brain = steadfast direction but in the wrong direction without self correction ==> long term disaster.

-

Its a gray area but it needs to stay focused on economic effects of two systems short and long term. No one really knows how the two systems well evolve over time and are best guesses driven by certain principles. But to talk about Mississippi and UK ...come on...there was no mention of China. Thats clearly over the line ! There is a place to discuss Mississippi and UK ...thats in a separate thread. Similar concept could also apply if it gets to other areas of discussion that verge down a slippery slope. Lets not ruin these great boards.....ignore button would fix the issue as I have mentioned but lacking ignore optionality, would devolve into wading through endless off-topic stuff to get to relevant info.

-

This stuff is getting so off-topic !!!! Reminder: This is a China thread - to discuss both negatie, positive and informational/neutral. Lack of an "ignore" button on these threads means discipline is required or has to be forced by the administrator by punishing offenders.

-

The way I understand Evergrand Bankruptcy in USA courts (chapter 15) is that its a form of a pre-pack. They already have an agreement with the offshore bond holders on the form of debt restructuring and to make it all legit, this is the final step to formalize it. This is closer to the end of the step than the beginning. They have been at this for about 2 years now. There may be 1-2 more before it stabilizes with the remaining player strong enough not to need further restructuring.

-

You should not feel comfortable because I am on your side and you are challenged on all sides. You should feel comfortable because your independent research tells you so. People should stop reading media (stimulation as WB likes to say) , start talking to people on the ground and get many different perspectives as you can. The situation is always more nuanced than portrayed by the media. Media always has an agenda and "what bleeds leads" as they say so negative news are blown out of perspective and there in always lay the opportunity. My research says there are long term bargains to be had in China. Xi will be gone in a few years. Its possible they get a worse idiot after that but something tells me after Xi, they will err towards more mainstream person. Good business will continue to thrive. China needs foreign investors and their markets to work but they will do it on their own terms...whether those terms are sufficient for investors to make money is the question. Domestic investors have really no other place to go than the stock market these days and increasing stock market boosts confidence and consumption. This old WB video is good to watch when you are feeling lonely.... https://www.investmenttalk.co/p/i-might-not-swing-for-two-years?utm_source=substack&utm_medium=email#media-76e5a35e-4643-4149-a7be-7421550fb829

-

https://www.dataroma.com/m/m_activity.php?m=AM&typ=b Tepper Q2 buys. Looks like he is BULLISH on China and Chips (AI proxy/E-commerce/Cloud/Mobile proxy). Xi is at odds with lot of wise comments coming out China...he is the trouble maker but China will still be here long after he is gone. China will do well long term, no doubt about it, even if its growth rate slows down to 3-4% long term and despite the demographics. What is not clear is if foreign investors will do well. I happen to think they will and next 2 years will prove that. The China risk debate has bee hashed out on this board many times in great detail so I am not going to add more here. Select Chinese monopolies with enormous growth prospects are fish in a barrel right here. The timing is also "now". I am taking shots.

-

My bess guess is the impact of this is less than $100B...and if its hedged... it may be a muted impact as longs and shorts are closed. There have been lot of market structure changes in the last few years - nearly all have been positive with a view that they are setting this up for the stock market to be the new (safer) vehicle where Chinese money goes ....instead of housing. As with housing, the runway for stock could be both long and epic (bubble culmination). Realistically, china's long term GDP growth potential is closer to 4% with shorter burst rates of up to 5-6% but with low deposit and bond rates and housing not a good option, stock market seems like a good alternative. 3-4% sustained is still a pretty good rate for the market to do well.

-

BofA does not think its not a balance sheet recession ...its a growth recession. Their case is compelling. Different disease requires different (policy) prescription. china5.pdf

-

I am very familiar with the country. The ranking seems bizarre from my personal experience. There is no suppression of business and economy related news. However India is a very diverse country of many different religions and so they do suppress news that is inflammatory towards any religion to prevent religious riots. The Kashmir news is also controlled due to sensitivity of national/geopolitics. I am frankly quite amazed at the difference in local perception and western perception both for India and China. My suggestion is get on the ground realistic view of a country and look at things from their shoes rather than applying a Western lens and who said Western lens is the correct one. Imagine India and China constantly showing homelessness and political dysfunction in the USA as constant every day headline...you'd think the USA is a shit hole. As always many shades of gray and the primary shade of gray you are interested in (as far as these boards are concerned) is the one that impacts the investment case.

-

https://archive.ph/4PZfS This is related but an older piece... https://archive.ph/2bRkI This article implies more boom bust type style - so called sugar rush of government intervention and stimulus...

-

Is it a coincidence that China gets a property bubble top coincident with a stock market bottom ? Makes the money flow from one to another perfect for a multi-decade boom in the stock market. If we just look at the money flow aspect of the Chinese market, there are several tail winds:- (i) CHina has created IRA like accounts for pension savings - annual tail wind long term (ii) More non-IRA pension funds also being invested in stocks - annual tail wind long term (iii) EM index managers are underweight china - they will have to get correctly weighted - one off (iv) Sovereign wealth funds are diversifying some of their holding to CHina as it a number 1 or 2 economy some 20-30 years out. A balance between US, Europe, China, India (and possibly Indonesia and Brazil) makes most sense. - continuous tail wind (v) Now that property market is not where the money goes, the suitable alternatives are stocks, gold, commodities, antiques. - long term flows (vi) Chinese animal spirits are at rock bottom and once those get ignited with stock prices moving up, it will have a mo-mo/confidence effect. Chinese by nature are big gamblers judging by the Casinos I have seen. - medium term flows in and out (vi) Short covering - short term flows (vii) Yuan appreciation and lower dollar drives wealth creation and margin buying power. HKD stability and strength will drive further foreign inflows. - medium/long term flows (viii) Chinese Insurance companies will allocate more to chinese stocks. - long term flows (xi) Revenue expansion, margin expansion, profit expansion, multiple expansion - long term flows Xi is the risk. Xi can also light a fire to move the market in the right direction. Apparently national team is buying right now. You can either take the approach that this will result in Sugar Rush or that this is a long term decades long bull market. Both cases results in favorable outcome from here. 10-15% of Chinese own stocks. Figure in Europe/US is 35-55%.

-

https://archive.ph/rtLxo Good piece

-

http://www.aastocks.com/en/stocks/news/aafn-news/NOW.1280596/2 " Xi said the capital market should be enlivened to boost investor confidence." Lots of words...need actions and follow through....

-

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

This is a problem with chatGPT/Bard like AI where its gathered data from uncontrolled data sources (Internet and world corpus). Where you have control over the data you use to train it, you have a much greater control in the output both through further fine tuning and also through appropriate "prompting" which is sort of like guiding it to give better answers. This is an issue with any data source, even the best of the data could have underlying hidden quality issues but then the problem would arise in any model, not just AI...the old saying garbage in , garbage out. In this case, you would start off with controlled high quality data to train the model. If you discover weaknesses in the data or the model, you adjust and retrain. You also need fake data to avoid biases based on accurate historic data. For example, there havent been many women composers in the history books. This is accurate data. But if somehow AI makes a biased decision off that to identify men only candidates for a composer job, then this becomes a problem so clearly labelled fake data is injected to cure the bias problem, but the model also knows its fake data so other kinds of decisions are adjusted for the fake data to avoid giving wrong answers...its a complex subject. You can adjust models for complex discrepancies that prop up in the results ...as you would with other systems that are non-AI. -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

There are clear (and not so clear) dangers with this new AI. Its powerful and its also very scary in terms of some of the negative possibilities. Hence the rush to legislate it so early (since when has an industry been regulated so early on in the cycle ????). Not just legislation but agreements amongst national governments ...sort of nuclear arms control treaty or Geneva convention on war crimes or use of chemicals weapons etc. My post was in response to "This is hype". This stuff is powerful. In the wrong hands, its deadly serious. the Genie is out of the bottle...no way to put it back....and the revolution is coming...and we must ensure it stays within the safe channels. This is a very accurate piece ....though not complete...there are many dangers we have not even thought about... -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

There is whole complex debate going on to solve it even including injecting fake data to balance out profiling bias Anthropic backed by Google I think has the most pure model to cleanse it if bad stuff. Folks are too focused on knowledge embedded in the model. The real power lies not in the knowledge but the learning sponge that was created using the vast amount of data. The sponge can learn anything new no matter what data type. This means you can feed your pure data what ever that may be and train it to avoid bad results being spit out. If you feed it your propriety data that has nothing to do with internet garbage you solve mission specific problems. Who cares what the capital of Botswana is when you are trailing it to do voice recognition. this learning sponge was an indirect result of it being trained on vast quantities of unstructured data … eventual it figured out how to make sense of it all and encode it appropriately internally which made it ready to learn almost anything -

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

-

If the AI bubble like the Internet, in what year are we now?

tnp20 replied to james22's topic in General Discussion

(i) Right now hallucination problem is big. Just makes facts up. But it will resolve over time ...early teething troubles in my view..better quality of data, better promting methods and better questions - you may find it gives different answers if you ask questions differently so this is bit of "user" training as well on how to ask the questions. (ii) Maths and logic - bard is better than chatGPT but these are general purpose models - google is working on a switch model where it has multiple models within one large model and the model sends the query best able to answer that topic question ...ie maths model. Another approach is the plugin approach mentioned above. have [plugins for different things. google has this AI thing called Minerva - look it up. Early days. THings are not perfect and will never be perfect because humans arent perfect and it neurons models humans to some extent and these things are not like hard coded data and facts ...its more vector space driven and what things are in proximity of those vector spaces ...akin to approximation....so like humans the answer accuracy will be always probabilistic. If you want certainty, you hard code it - but then you have to deal with human introduced bugs...