MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

I don’t follow your logic at all. How do you value a business if not on discounted future cash flows? The future cash flows are what matters, not the accountant’s view of history. Like how do you own Fairfax without focusing on the earnings power of the business? And have you considered the possibility that Fairfax shares have just traded at a big discount to intrinsic value for most of the past 30 years? You don’t even need the stock to rerate - you just need the company to agree and keep buying back the shares below intrinsic value. Even if it never rerates you end up with a great outcome and that’s exactly what’s happened here! Im still convinced a major reason FFH still trades how it does despite the obvious step change in normalized earnings power over the past few years is that even the smart money is focused on an essentially irrelevant accounting construct more so than in any other business I’ve ever come across.

-

I just added for the first time since Sept 2020. I'm not a trader and I'd let it sit there for ~4 years = ~17%+ CAGR and seemingly cheaper nowadays. I still own ~10x as much OG FFH but I love the setup in this one too now.

-

Great post. Yeah this little drawdown has me missing the good ol’ days a few years ago where everyone just knew Fairfax was shit so didn’t bat an eye when the stock went down, b/c of course it would - Prem was a bum and rates would be at 0 forever and they’d keep losing hundreds of millions shorting. Some might need to lighten up their position a bit and/or touch grass!

-

We are talking about a 10% ish drawdown. This happens like twice a year. If this is causing you pain and suffering, you’re probably too big in Fairfax. I thought Charlie was talking about the ~50% portfolio drawdown that we’ll all go through at some point.

-

Isn’t that only true if credit (and equity) spreads widen out? Unless it also gets cheaper for new supply to come on and soften insurance, the fair multiple (discount rate) for FFH might go much higher (lower)! It’s a long duration business even if not priced like it!

-

It’s statistical noise - but also isn’t Fairfax still restricted in buying back stock until today or tomorrow?

-

The answer is probably “volatility” but I also own HIFS which was up 6% today (and 30% over a few weeks) seemingly because the yield curve is finally coming close to de-inverting. I wonder if it’s as simple as the marginal buyer/seller thinking Fairfax loses as short term rates come down, combined with the fact that they’re in the quiet period so not buying back stock?

-

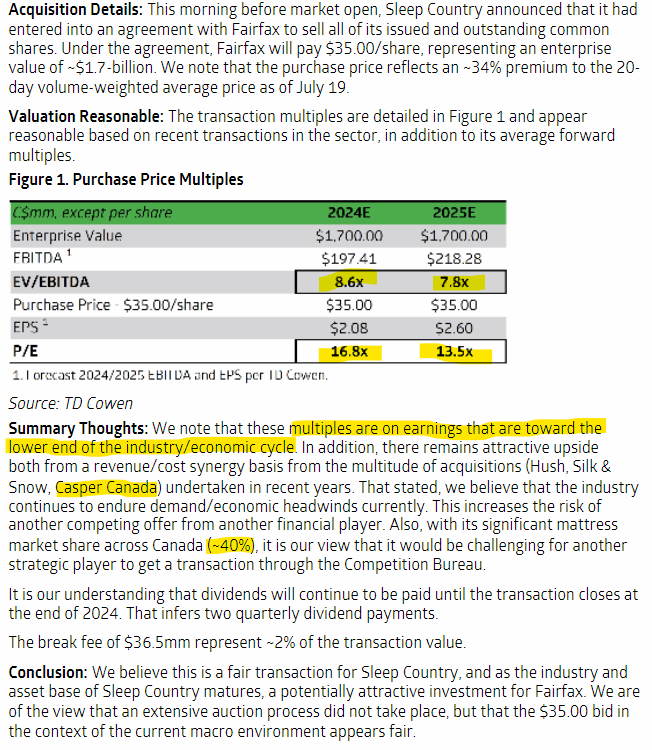

Is ZZZ a good business? It doesn't screen that cheap vs ROIC which is nothing to write home about. Can someone please explain why this is a good use of capital? Do Canadians not buy mattresses online? I'm a bit baffled.

-

Tidefall LP - Q1 2024 Letter.pdf Our guy @hardcorevalue did a nice job highlighting the opportunity here in his Q1 letter.

-

Wow. Is that really a ~75% premium?

-

Is that amount of incremental price-insentitive demand for shares (~5%?) typical for a major index inclusion? I do think you're probably on to something with how tightly held the shares are by long-term shareholders.

-

Bueller? Bueller?

-

Can anyone explain why specifically index inclusion would be a major catalyst for Fairfax? I’ve seen a bunch of examples recently where stocks have gotten into major indexes and then dropped, or vice versa. Is there something about Fairfax and/or the Canadian markets that makes it an especially strong thesis?

-

Wondering what the board makes of this... Prop Cat Is Significantly Underpriced This Year https://iansbnr.com/prop-cat-is-significantly-underpriced-this-year/ "One of the great mistakes of the financial crisis was mortgage underwriters and investors thinking they would be OK because their models told them what a bad outcome looked like and that they would be OK under that outcome. The problem, of course, was the models accounted for 'normal' stress and not an extreme stress. I fear the same thing is happening this year in the prop cat market. Underwriters are ignoring the elevated risk of a historically active season and continuing to price off the cat models. You would price the odds of who wins the Presidential election differently before the debate vs. afterwards in response to new information. Well, we have lots of information that suggests it won’t be a normal hurricane season, so why are reinsurers pricing cat treaties like it is a normal year?"

-

Boom times are back for container shipping https://www.economist.com/business/2024/06/27/boom-times-are-back-for-container-shipping "If the Red Sea remains rough until later this year, the extra demand [from rerouting around Africa] could more or less soak up the growing fleet, whose capacity is poised to expand by 8% this year. If the Houthis stand back sooner, it would leave many of the new ships idle. What of future years? Vincent Clerc, Maersk’s chief executive, concedes that overcapacity is again one possible outcome. Already many of Maersk’s rivals are using the unexpected windfall to order new ships. But Mr Clerc remains optimistic that oversupply can be avoided if shipping firms delay taking vessels from lessors and scrap older ships sooner—not a bad idea as they green their fleets to meet emissions targets. Although things are likely to stay 'volatile and unpredictable', that could still mean 'a decade of robust market conditions' for the industry. Spoken like an old salt."

-

Even if it’s from FFH, that’s like half a day of earnings, right? Maybe I’m too cynical, but that seems cheap enough for good PR in a important country for them.

-

Thanks. I assume you are referring to the Ensign Energy TRS @Hoodlum.

-

Wait, when did that happen?

-

Probably better than Google Trends but worse than Prem buying $150mm personally

-

Hot take: EBITDA is a completely valid metric to use for some businesses *ducks*

-

"But when you see tons of aggression all over the book from the publicly observable financials, you really must question what else is going on. And we didn't really touch on the insurance operations, which we're also looking into." Sounds like another buying opportunity might be incoming.

-

Nice summary. ~12% per share compounding should be achievable with these structural advantages and rounds to a ~10x return over a couple decades. That's why I'm here. I hope they drop the ~15% goal as they get larger and just tell investors that as value investors they'll take what the market gives them.

-

Yes. This is still my biggest position by a lot. It has gotten up to about half my retirement accounts. I’m talking about taking it down to 30-40%, still my biggest by ~2x. Still think it’s easily worth $2-3K and I would not sell if this were close to a normal core position. I wonder if others with big positions since 2020-21 are looking at this similarly. I don’t think it’s fair to completely dismiss the fact that he’s selling, even if it’s a relatively small sale and for a logical reason. Sure it’s for liquidity and tax planning - I get that - but would he be selling if the stock still traded at 0.7x p/b? I personally have a really hard time believing that. But since (I think?) you asked… yeah I guess I’m looking for capital to add a bunch to HIFS - which I’m convinced is a similar setup at this point, a top quality, well run, 30+ year compounder now trading around book and ~6-8x normalized earnings in large part due to an almost certainly temporary situation in interest rates (in HIFS case, ongoing yield curve inversion). An attractively skewed ~2x type of expected return over a couple years - like the current setup in FFH IMHO!