Spooky

-

Posts

533 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Spooky

-

-

Agree, it looks like he is mainly talking to pension plans that have certain required actuarial returns and have more favorable tax treatment for interest income. In his memo, he also had a strange comment about nominal vs real returns - seeming to suggest that some investors are seeking to hit nominal return targets not necessarily real returns.

-

I'd buy an S&P 493 index today over the S&P 500 over a long investment horizon. The biggest companies today won't be the biggest ones 30 years from now. Plus you get less exposure to the overvalued Tesla / Nvidia fad stocks.

-

On 10/8/2023 at 6:17 PM, TwoCitiesCapital said:

I mean...the 5-year return for GLD isn't that far off from the 5-year return on SPY.

Relative to value stocks, small- and mid-cal, and int'l, GLD is kicking ass. Can we really say that a positive view towards gold is wrong if it's outperforming MOST global equities over a 5-year period?

Are you looking at this with dividends reinvested? YTD the S&P 500 with dividends reinvested is kicking gold's ass (up about 13.5% while gold is down about 13.5%).

-

5 hours ago, MMM20 said:

A lot of this is macro speculation so take it with a grain of salt but Canada seems to be in a tough spot right now. Fairfax has been doing quite well vs the TSX recently and I would guess it is a better place to be in the short to medium term. Purchasing power parity has been eroding. Housing investment has been a higher percentage of Canadian GDP (~9% vs OECD average of ~5%) and Canadians have the highest household debt in the G7. The rise in interest rates is starting to bite, causing people to spend less since more disposable income is eaten by higher interest payments (At least this is what I am seeing with people in Toronto).

Financial stocks account for ~34% of the TSX 60 and the Canadian banks had been shifting a lot of their loan books to mortgages rather than typical commercial loans. I understand that roughly 20% of mortgages on the big banks books are now in negative amortization. A lot of the banks have been announcing layoffs. Also, our economy is still pretty resource dependent and with China and the world economy slowing down there is less demand for resources. Oil prices have also been softening and the Canadian economy is overweight energy. Canada also has a persistent productivity gap with the US of about 20%.

-

2 hours ago, Jaygo said:

It certainly makes it easier when the Canadian index has been really bad lately. The financials and utes that make up the top ten are getting sold daily. I guess the expectation is a major recession or depression in Canada that brings down the banks?

even CNR is at low multiples to the last 20 years.

Certainly feels like a reckoning is coming in the Canadian economy given the sea change in interest rates. A higher percentage of our GDP is reliant on real estate and we have the highest household debt in the G7.

-

On 10/7/2023 at 3:34 PM, UK said:

Here you are: https://www.bloomberg.com/news/articles/2023-10-06/podcast-gmo-s-jeremy-grantham-says-no-one-should-invest-in-the-us

The co-founder of GMO LLC says that, while this reckoning recently took a break, it’s now back with a vengeance. Grantham joins this week’s episode of Merryn Talks Money to make the case that—as a result—no one should be invested in the US. In particular, he warns of the Russell 2000, with its high level of zombie companies and horrible debt levels. He calls it “the most vulnerable area” to rising rates. Grantham notes that pretty much everything else is risky, too. With yields at current levels, it would be mathematically reasonable to think the US market as whole could fall by 50%, he contends. There’s trouble ahead if the “magnificent seven,” the few companies that have been carrying the index this year, lose any part of their magic. As for housing, Grantham says that isn’t safe anywhere. Look at the numbers and you’ll see the same crash in action, he explains. The speed of that crash depends on local mortgage markets and borrowing cultures—but the dynamics are the same: rates up, prices down. “Global real estate is universally overpriced,” Grantham says. Just like “farms, forests and fine art.”

Fits your description perfectly:)?

I saw him on an interview recently, seems almost going maniac, while talking about various doom porn things:). Maybe it is age related, I do not think he was always like that: https://youtu.be/aanwMfrSjP0?si=N7MYX-pHPiMFxFCO

Watch from 1:38 min:)

I can't get over the fact that Grantham said US capitalism / companies were "fat and happy" and the only thing working well was the US venture space. Meanwhile, that is where his super bubble turned out to be....

-

16 hours ago, crs223 said:

I don’t think Buffett believes the US is heading in the wrong direction (although he did recently bemoan taxation of buybacks).

He's always saying to never bet against America. One thing he said in a prior AGM is that he bets in 30 years there are more US companies on the list of biggest companies by market cap than Chinese companies.

-

8 hours ago, WayWardCloud said:

No opinion on valuation but I noticed that Align Tech who makes the famous invisalign aligners everyone around me uses, has used or is considering using is down quite a bit. They seem to have a moat with first mover advantage, brand recognition and an existing relationship with most US dentist offices. The stock experienced a big bump up during COVID because people seeing themselves a lot on a webcam got self conscious about their teeth.

Anecdotal but my girlfriend went with a competitor's product since it was cheaper and undifferentiated.

-

36 minutes ago, tede02 said:

I agree that low inventory will put a floor on housing prices. Maybe they come down 10% but nothing like we experienced post GFC. I bought my first house in late 2008 and the situation was completely opposite, there were forclosures everywhere. Now there is nothing to pick from.

I think I timed the mortgage market perfectly with a refi in Aug/Sept 2021. I noticed how low nominal rates were AND how tight spreads got. Locked in 2.375% on a 30 year with no points. In hindsight, I wish I would have paid a point and locked in at 2%!

Congrats man, crushing it!

-

My problem with Ray is that he looks at the economic system like a machine where X -> Y when truly it is much more complex than that. Bridgewater got burned bigly with their big shift towards China in recent years.

-

Another little nibble of BRK B

-

Bought a small amount of BRK B shares.

-

6 hours ago, UK said:

Is there any more context for Dimon's statement?

-

Odd Lots has been on fire lately.

-

2 hours ago, james22 said:

But why would anyone look at only the past three years?

Because I was talking about investing capital in the frothy markets of 2021. I just using 3 year data as an approximation.

-

50 minutes ago, james22 said:

If he'd been in Tech for even just several years at that time, he'd have a lot to give back before hurting.

5-year returns:

VITAX (IT) +113%

BKR +69%

Buffett and Berkshire aren't irrelevant, but let's not kid ourselves.

Sure, but if you look at the past three years BRK still outperformed VITAX / VGT and the S&P 500 by a big margin (my quick analysis doesn't include dividends so this will change things a little). And VITAX is 40%+ Apple and Microsoft so performance has been pretty close to the S&P 500. The individual names my friend was pitching totally tanked (looking at 3 year returns what was his biggest holding is down 54% while BRK is up 75%) and there were a tonne of early tech companies / SPACs down 90%+ from the 2021 period. People were not exactly being rational and buying a tech index.

Really my point was that when people are counting BRK / Buffett out and market sentiment about the company is very negative it is generally a good time to buy.

-

On 9/16/2023 at 6:58 PM, dealraker said:

Some of you might be surprised that on the Berkshire forum back then the least popular individual wasn't those like me posting buy-and-hold (which we normally are the least admired and liked) it was ole Warren Buffett himself.

I love it when this happens and the market narrative is that Buffett is washed up. That's when I try and buy as much as possible. Back during the 2021 craziness a friend of mine of who is an investment banker in the tech industry told me that Buffett and Berkshire were irrelevant. I just look at how everything played out since then and chuckle.

-

16 hours ago, adesigar said:

I am looking at Bonds, Insurance, Oil, Tobacco, Asian Stocks, US Banks

Also thanks to CoBF am looking into Media companies and Retailers,

Good picks. Some media companies are getting the shit kicked out of them like Para. Also second US financial stocks. US small cap stocks also seem like a decent hunting ground.

-

On 9/2/2023 at 1:35 AM, 50centdollars said:

Canada's Competition Bureau is a joke. I don't understand the point of them. They approve everything.

Totally agree. They allowed the Rogers and Shaw merger to go through and the Telco space in Canada was already completely anti-competitive.

-

Thanks @gfp, I'll do some more digging. I've actually been wanting to read that Milton Friedman book as well!

-

Somewhat off topic - I've been thinking lately about something that Buffett said at the AGM with respect to the World War II period and the US federal government re-organizing the whole economy and government under direction from someone from Goldman Sachs to build its war time production. Does anyone have any good books or resources about this time period and the changes to the political system and economy that took place?

-

On 8/18/2023 at 8:06 AM, Gregmal said:

The hysteria never stops, the price targets just slowly get revised…generally upwards.

Stocks for the long run baby. Observing everything that has happened over the last few years just reinforces the view that no one can predict what will happen in the short term. The key is asset allocation and being invested in good businesses / assets over the long run. Always be buying the best thing in your opportunity set. -

Agree that one of the government’s jobs should be to break up monopolies to promote healthy competition, otherwise part of the capitalistic system breaks down with some companies extracting monopoly rents and driving up the cost of living (just look at Canadian banking, Telcos, etc.). Personally I am also anti union - this hampers North American competitiveness versus countries like China.

A big problem also seems to be regulatory capture where the winners / incumbents can dictate the regulation to stifle competition or give them advantages.

An idea that I like would be to give everyone a trust account when they are born with something like the Vanguard total US ETF that no one can touch until they are 18+. This would give everyone a stake in the economy and shift peoples mindsets to having an ownership mentality.

-

54 minutes ago, Luca said:

This is a very interesting post, I have been doing some research into this sort of "stagnant capitalism" thesis lately and find it interesting to consider in today's investing.

Some points:

1) All time high SP 500 profit margins, concentraded markets, M&A+Buybacks+Dividends instead of Investing (Microsoft, Apple, Alphabet, Amazon)

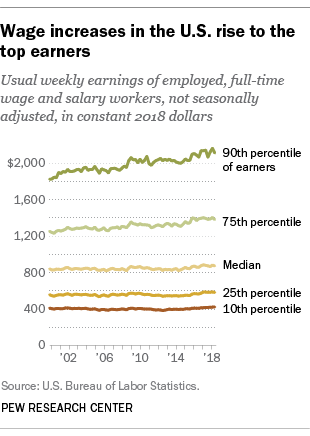

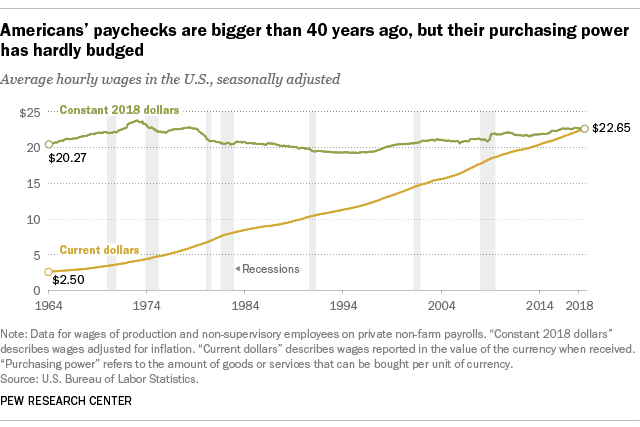

2) No wage growth for median percentile earners since more than 20 years and average hourly wages have seen 0 growth adjusted for inflation since 40 years

3) Top 90th percentile of earners captured massive gains of economic growth which won't end up flowing into the real economy (everyday goods pushing demand and following investment into production increase) but in luxury goods and even more assets, squeezing median and lower income workers out

I listen to Yanis Varoufakis sometimes (ex finance minister greece) and although I disagree with his proposed solutions (leaving capitalism), this sort of "stagnated capitalism" with trillions of euros that are not invested, no growth for majority, increasing concentration of companies, widening wealth inequality, separation of financial markets and real economy (SP 500 booming while median person not seeing anything) rings a bell here.

Its also a recipe for political disaster, right wingers rising up everywhere in the west etc.

Dont know how long this party can continue, maybe still for a while but there needs to be some intervention at some point, Standard Oil 2.0?

What does the board think about this sort of perspective?

Good post and I agree, this is a big contributing factor to the rise of populism across the political spectrum. Not really sure how we get out of this malaise, delegating economic policy to central banks and printing money has not really worked other than to inflate asset prices and drive further wealth inequality. Personally, my view is that there should be much more deregulation and free trade and governments should get out of the way to create the conditions for businesses and individuals to thrive rather than picking and choosing certain industries / companies to boost.

Undergraduate Student Looking to Begin Investing. Resources to get started?

in General Discussion

Posted

Start small, experiment and lean more heavily on ETFs at the start. Try and minimize transaction fees and taxes. Be careful about investing into individual companies until you have more experience and a grounding in fundamental analysis. Invert and think about not losing money rather than hitting home runs. Read and think as much as possible rather than act. Buffet and Co are trying to make one or two good decisions a year. I like two of Buffet's analogies: 1) imagine you have a punch card with 20 spaces available in your lifetime - each time you invest in a company you punch the card - makes you need to think very carefully about committing to an investment; 2) in investing you can sit at the plate and watch pitches go by forever waiting for a fat pitch - wait for a fat pitch and then swing heavily.

Some good books that really helped me: 1) Lawrence Cunningham's collection of Buffett essays; 2) Phil Fisher's Common Stocks And Uncommon Profits; 3) Howard Marks The Most Important Thing; and 4) Poor Charlie's Almanac;

In terms of online resources there are a lot of great lectures from Warren Buffett and Charlie Munger on YouTube (Warren's talk to the Florida University is a great one. So is Munger lecture on elementary worldly wisdom). There is also a whole series of Google talks from famous investors.