Spooky

-

Posts

533 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Spooky

-

-

11 hours ago, Viking said:

@Spooky I think you are missing the point of my post. I don’t say this to be a jerk /confrontational.“Which investments in Fairfax's portfolio today are wonderful companies (i.e. high return on assets and growing) that can just keep compounding at high rates of return for the next 20-30 years?”

Here is a re-post of what i said earlier:

Investors waiting for Fairfax to buy ‘Coke’ or ‘American Express’ in 2024 will likely be sorely disappointed. For two reasons:

1.) Buffett’s brilliance wasn’t buying Coke or American Express. It was exploiting the set of circumstances that existed at the time, which served up Coke in 1988 and AMEX in 1990.

2.) Like Berkshire when it made its many brilliant moves, most investors probably won’t see it when Fairfax actually does it.

Moving forward, i expect Fairfax to use ALL the capital allocation levers at their disposal. You list one above - and i do expect them to do more of that. But i also expect Fairfax to do lots of other things. Some will likely be non-traditional. What they do will largely be driven by volatility and what opportunities get served up.

But in terms of ‘buying quality at a reasonable price’, on the equity side, I think their investment in BIAL would be a good recent example. Buying Allied World in 2017 for $4.9 billion would be a good recent insurance example.

Fairfax’s equity book as a whole has improved significantly in quality over the past 5 years. The best example is Eurobank. Is it a quality bank today? Yes. Is it cheap? Yes. Is it poised to deliver excellent returns over the next 5 years? Yes, i think so. Is Eurobank like Coca Cola or AMEX back in the late 1980’s? No, of course not.

You appear to give the two examples i provided (effectively buying back 23% of shares outstanding at 30% of current intrinsic value and a saving/earning billions from active management of their fixed income portfolio) as not really counting. I humbly disagree. Of course, that’s what makes for a great debate.

When I say i think Fairfax resembles a much younger Berkshire Hathaway, it might help if i spell out what that might mean from a return perspective.

If my thesis is correct, below is what i think is possible. (Of course, my thesis could be completely wrong - and this would mean my return expectations below would also be completely wrong.)

Since inception Berkshire Hathaway has materially outperformed the S&P500 (dividends included). I think Berkshire’s outperformance might be 2x.

I think Fairfax is poised to materially outperform the market indices over the next 5 years (I would take an average of the S&P500 and the TSX60). I think Fairfax’s outperformance could come in at 2x better. Similar to Berkshire Hathaway’s long term average level of outperformance.

How will Fairfax do it? I think the set-up today for Fairfax looks a lot like a much younger Berkshire Hathaway. In my post above, i highlighted 14 factors that i thought were similar.

For me this is more qualitative/philosophical type thinking than quantitative/precise type thinking. And this makes it very hard to discuss/debate - because everyone comes at it in a very different way.

Thanks for the response Viking. I agree that Fairfax buying back a significant amount of its shares below intrinsic value is excellent capital allocation. I also like that they are fishing where the fish are in Greece and India etc. There are many different ways to nirvana. Berkshire exploiting the opportunities available to it certainly contributed to their success but it was more a factor of their philosophy and changing their investment approach as they got larger - moving away from Ben Graham style value investing to buying wonderful companies at reasonable prices and recognizing the inherent advantages in just letting their investments compound over long periods of time. Also, some of Buffett's best investments were just sitting in plain sight available to anyone like when he bought Apple. Does Fairfax need to make this switch too? I'm not sure. I would like to see them shift more of their portfolio out of bonds to equities - focusing on cheap, safe, high-quality stocks combined with the consistent use of leverage through float. Hopefully the investment landscape co-operates.

-

2 minutes ago, SafetyinNumbers said:

I did. They have the same business model and size but very different set ups. I think Fairfax’s stock is an easier bet now than Berkshire”s stock was then based on the set ups. That’s the point I was trying to make.I hope you're right. We just need to be careful about believing it because we want to believe it.

-

14 minutes ago, SafetyinNumbers said:

The only things similar about Berkshire in 1995 and Fairfax is the market cap. The investments/share, float/share, premiums/share, surplus capital and P/B are all quite different.Didn't you just write an article alluding FFH is following in the footsteps of BRK which "shot up 27 times after it reached the size Fairfax is now"?

-

5 hours ago, Viking said:

Comparing Berkshire Hathaway with Fairfax Financial - some thoughts.

When Buffett first bought AMEX and Coca-Cola were they viewed at the time like they were brilliant investments? No, of course they weren’t. It often takes a decade or longer - after the purchase - to evaluate/appreciate a brilliant capital allocation decision.

Example 1

From 2018-2023, Fairfax invested $2 billion and now owns 15.5% of a high quality company. The average price paid that was about 1/3 of its current intrinsic value (conservatively valued). They bought high quality at an exceptionally low price. And they backed up the truck - $2 billion is a lot of money (at the time, common shareholders equity was around $13 billion).

But the story gets even better. In late 2020/2021, Fairfax got exposure to another 7.5% of the very same high quality company. This time they paid about 28% of current intrinsic value.

In total, they ‘purchased’ about 23% of this company, paying on average about 30% of current intrinsic value. This investment is poised to compound at mid to high teens in the coming years.

Hello people… have you been paying attention? (Yes, the company they bought is called Fairfax.)

Example 2

In Q4 2021, Fairfax sold most of their corporate bonds and dropped the average duration of their fixed income portfolio to 1.2 years. In Q4 2023 they extended the average duration of their fixed income portfolio to +3 years. What they did with their fixed income portfolio saved the company $3 billion? (or more?) in unrealized bond losses. Because duration was so short, the earn through from spiking interest rates was immediate in 2022 and 2023. Today they are earning $2 billion in interest income and it is now largely locked in for the next 4 years. They protected their balance, pivoted and are now earnings record interest and dividend income - the highest quality income stream a P/C insurer can have.

Fairfax’s financial profile (and future) has been permanently changed (improved) as a result of these actions. Ask AM Best if you don’t believe me.

The parallels with a much younger Berkshire Hathaway

“History does not repeat itself, but it rhymes.” Mark Twain

Investors waiting for Fairfax to buy ‘Coke’ or ‘American Express’ in 2024 will likely be sorely disappointed. For two reasons:

1.) Buffett’s brilliance wasn’t buying Coke or American Express. It was exploiting the set of circumstances that existed at the time, which served up Coke in 1988 and AMEX in 1990.

2.) Like Berkshire when it made its many brilliant moves, most investors probably won’t see it when Fairfax actually does it.

How do I know this? Because Fairfax has been making exceptional capital allocation decisions for years now. For a couple of these they got out their elephant gun. And they still get no (little) credit. And that is because the company continues to be misunderstood. The moves Fairfax has been making continue to be grossly under appreciated. Just like when Buffett made his great investments, investors need more time to fully appreciate the brilliance of what Fairfax has executed in recent years.

If lots of people on this board don’t see it… do you think the rest of the investor community does? That’s why the stock trades at 1.1x book value - crazy cheap.

The key lesson for investors

The world is different today - the set of circumstances is ever changing. Importantly, with normalized - higher - interest rates, volatility in financial markets is back. We had bear markets in stocks in 2020 and again in 2022. We had a historic bear market in bonds in 2022. And just look at what Fairfax has been doing. Most investors still can’t see what is right in front of their face. Because they are looking for the wrong thing.

Active management can have a huge impact on financial results. Now most P/C insurance companies don’t actively manage their investment portfolio. Fairfax does.

Fairfax today:1.) They are run by a genius - yes, anyone who can compound book value at 18.4% for 38 years is a genius. What is Prem’s greatest strength? Perhaps his ability to attract and retain talent, beginning with the creation of Hamblin Walsa 38 years ago and continuing with the guys running insurance like Andy Barnard.

2.) They are family controlled - importantly, this allows for long term decision making. Along the same line, this also allows them to take full advantage of volatility, even if it takes some time to work out.3.) They have Hambin Watsa - handles all capital allocation decisions.

4.) Capital allocation - They use a value investing framework. This appears to be evolving over time. Today, they appear to be placing more of a premium on management. And financial strength/profitability. ‘Quality at a fair price’ versus classic Graham ‘deep value’ type investing.

5.) They are highly levered to float. Its cost is better than free (they are actually getting paid to hold it) and it is growing in size.6.) Culture - insurance and investments are run on a decentralized model.

7.) They invest a large part of their investment portfolio in equities. Most traditional P/C insurance companies stick to fixed income investments.

8.) They are still a small company - this gives them a very large opportunity set.

9.) They have their elephant gun out.

10.) They are able to move with speed.11.) They have been generating an enormous amount of cash the past couple of years and this is set to continue in the coming years (net earnings of around $4 billion per year?).

12.) They are on a hot streak - when it comes to capital allocation.

13.) And volatility - more normal financial markets - is back. So lots of opportunities will be coming in the future.14.) Compounding - as always - sits ready to work its magic.

This set-up looks an awful lot like a much younger Berkshire Hathaway.

But what Fairfax does/how they execute will likely not look anything like what Berkshire Hathaway did back in the 1980’s. And that is because history does not repeat exactly. But it sometimes rhymes. And I think this might be one of those times.

Today, Berkshire Hathaway is like an aging elephant. And Fairfax is like a lion in its prime. And the drought (zero interest rates) has ended - and the savannah is once again teeming with game.

What I'm driving at is it is one thing for Fairfax to talk about buying wonderful / good companies and just letting them compound versus actually executing on that plan. I like the idea but right now when I look at Fairfax it looks more like a leveraged bond fund with a side of value investments rather than a Berkshire Hathaway in 1995. Which investments in Fairfax's portfolio today are wonderful companies (i.e. high return on assets and growing) that can just keep compounding at high rates of return for the next 20-30 years? When Berkshire buys back stock, you as a shareholder are getting a higher ownership percentage of the wonderful businesses they own. Certainly Fairfax has set themselves up well going forward, hopefully the investing environment co-operates and throws them some fat pitches. Let's see, I'll be watching with interest.

-

6 hours ago, John Hjorth said:

It's a good one, @gfp,

Or,

1. - like in posts above, where a dividend from Bershire is desparately needed for the shareholders, because Berskhire is underperforming, and the large positions in the portfolio desparately needs to be sold [AAPL, BAC, AXP, KO], while some seem to forget those positions are indeed financed by insurance float and also partly by basically massive, free and deferred taxes on giant unrealized capital gains. Talk of dividends of perhaps USD 250B or USD 100 B, while the insurance group as a whole at YE2023 has a max. dividend capacity of USD 31 B, and holding company cash and T-Bills at YE2023 is USD 22 B. Typically suggested by people who trade around quite a lot, and never tell anything about their own track record.

2. - 'Breaking' the whole thing 'up' by splitting it to atoms, to 'get the real values to surface', [likely by the use a particle accelerator at CERN to put the company in or something like that?]. Typically suggested by people who aren't aware of the central role of NICO in the group structure and all the implications of that and no understanding of the inner workings of insurance float.

Excellent post John - is there anywhere that I can look that has more information on Berkshire's corporate structure and where NICO sits?

-

1 hour ago, Gregmal said:

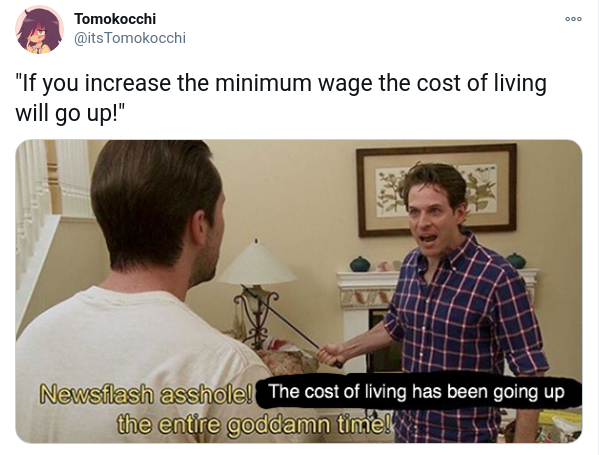

The Fed and many elitists will argue that the answer to that person being disgruntled about not being able to eat out, or it being more expensive to do so, would be to make it so that more people cant eat out and less people work at those restaurants. I dont even know how this shit flies. Well, I do, and again its because they can just say "inflation" and 90% of people dont question it or dig any deeper. But its crazy. As Ive argued before, by far, the biggest and most problematic inflationary impact on everyday people is housing being so expensive, and that is entirely because of the Fed and their interest rate crusade. If the Fed dropped rates back to 2-3% you'd see so many houses built that we'd probably have a sizable housing market correction in the next 3-5 years.

-

38 minutes ago, Xerxes said:

to flip this comment, we could ask if Berkshire had $25 billion market cap today in 2024, does one expect it to have a portfolio filled with “Coca-Cola's, Amex's, See's Candies, Apples” and the likes of it.

probably notBuffett bought $1B in Coca-Cola in 1988 so before they were the size Fairfax is currently. They also bought Amex a few years later in the early 90s. They had See's Candy much sooner.

-

I like Fairfax's setup here and have added some more to my position recently. But aren't we all jumping the gun comparing it to Berkshire and their position in 1995? To match Berkshire's track record going forward, Fairfax is going to need to significantly shift its asset allocation from 75% bonds to predominantly equities. As a Canadian company, will Fairfax be allowed to do this by insurance regulators (I'm ignorant on the rules here but there must be differences between the US and Canada)? Also, this shift presumes that there will be good opportunities to buy wonderful companies at fair prices that Fairfax can easily shift capital into. Is the investing environment going forward going to be conducive to doing this? Buffett himself has written that the investment arena is much more competitive now and there aren't as many easy opportunities as there were in the past. There are also many people out there now trying to implement the Munger playbook. Lastly, have we seen that Fairfax is able to identify and buy these compounders / wonderful companies? Where are the Coca-Cola's, Amex's, See's Candies, Apples in their portfolio today? Which companies in their portfolio have high returns on assets, are growing and have durable moats?

-

15 hours ago, ValueArb said:

I wasn't referring to Buffett, I was referring to what happens after he's gone. Clearly it's unlikely he'll ever issue any dividends because it's antithetical to his life long goal of making his "painting" as large as possible. He didn't even start buybacks until his 6th decade as CEO, but at least in that case it directly increases per share value.

What happens from here is really the huge question. The company is so big now, Buffett even wrote in the last letter that their era of eye popping returns is over. Breaking up the company after Buffett is gone would impair some of the advantages it has using insurance float to buy safe businesses. Paying a dividend would be counter to the desires of most of the shareholder base that Buffett has built up. No easy answers. However, there is still a possibility that in a period of financial turmoil Berkshire will be in a position to deploy a significant amount of capital. Given what is happening in the world today I wouldn't count out that possibility.

This WSJ article was pretty good: https://www.wsj.com/finance/stocks/warren-buffett-berkshire-hathaway-returns-investors-2e0acca9?st=y8ssqh77y6a8wpt&reflink=desktopwebshare_permalink

-

5 hours ago, Sweet said:

I really dislike that the Fed is what’s moving this market. All that seems to matter is read the inflation tea leaves, or rate cuts signals from powell, or market responding to a 9,871st fed speech of the week. And it will end up being a sell the first rate cut bs too.

Market movements seem to be based a lot more on vibes these days. People have become so short term focused, trading zero day options. There is a lot more volatility day to day. However, this gives those of us with a longer term perspective an opportunity to exploit the volatility they create.

-

On 4/26/2024 at 8:47 PM, gfp said:

It depends on the subsidiary and how the bulkheads are constructed. I believe a subsidiary of BHE, like Pacificorp for instance, can be put into bankruptcy without the other assets of BHE being risked, much less the parent company holding company. But I'm sure there are exceptions for nefarious asset stripping or fraud. I mean, look at JNJ and the Talc stuff - you don't see all of JNJ at risk.

If Berkshire's legal structure is set up properly it can insulate the parent from risks at the subsidiary / operating level. Generally the maximum you can lose in a corporation is the capital that you have put into it, there is no default right to go after the assets of a parent corporation or shareholders. There are a few exceptions: 1) parent company guarantees of debts / contracts at the subsidiary level; 2) piercing the corporate veil - a judge can look through the corporate form if a corporation is not run as a distinct entity of the shareholder (I doubt this is a risk for BRK, more common with small corporations with one or two shareholders); 3) certain regulatory regimes like GDPR can give you a penalty equal to a percentage of the global revenue of a company which is terrifying but I think this penalty would be levelled at the subsidiary which violated the rules.

-

On 4/16/2024 at 12:56 PM, juniorr said:

This was the big take away for me and made me add more stock

11.) Question: what has Prem learned from Charlie?

- Buying good businesses at fair prices.

- Strong track record

- Strong management

- “Looking for positions where we can compound for the long term.”

Given its large size today, are we seeing Hamblin Watsa shift their value investing framework to more of a ‘quality at a fair price’ and away from ‘deep value?’

Same. Like to see the evolution in their investing style happening.

-

3 hours ago, ValueArb said:

And in Japanese pockets, in Chinese pockets, in UK pockets, in Luxembourg pockets, in Canadian pockets, etc. About a quarter of the US debt is held by foreign investors, including a lot in foreign governmental hands.

So we don't owe the debt just to ourselves, and even looking at it that way its still unbalanced. The 1% own most of the debt, while we all will have to pay higher taxes to service its costs. About a quarter of the debt is intragovernmental. Some of it IOUs for benefits "owed" to social security recipients that were never adequately funded during their working years. And some of it is for the massive quantitative easing the Fed ran from 2008 till 2022, essentially IOUs for inflating the money supply.

So what happens in a few decades when our children realize how much of their taxes are going to service the debt and retirement benefits that had been underfunded? Do they just accept paying half of federal revenues in interest on the federal debt, to foreigners, to the 1%, to maintain retirement benefits at unsupportable levels? Or does the next RFK/Trump/Sanders sweep into office on a promise to force those evil debt holders to accept less?

This path has been trod many times in South America and it never ends well.

Sure but your original post was that the interest payments will be a drag on economic activity in the future. Counter-intuitively there is an argument to be made that raising interest rates is actually stimulative. Still 75% of this income going to American citizens and institutions will be spent or re-invested. It may be a drag if the interest payments force the government to spend less thus reducing GDP. The key question is whether the borrowing is to make productive investments which will increase productivity / GDP in the future.

Also, if the US were to switch from running deficits to a surplus that would be deflationary / potentially lead to another crisis like 2008 which has been talked about by Wabuffo and others on this board.

-

1 hour ago, ValueArb said:

I wouldn't compare over $1.5 trillion in annual interest payments like peeing in your pants to put out a fire. Gonna be a huge drag on the US economy for decades to come.

But this interest expense is interest income in people's pockets.

-

My view is this rate environment is much healthier than zirp.

-

Little nibble of BRK. Let's hope this market sell off goes a lot lower.

-

11 hours ago, charlieruane said:

Fascinating! Mind if I ask where you heard this?

Can't remember where I heard this unfortunately but here is an article talking about Buffett inheriting stock positions: https://www.cnbc.com/id/41868643

-

Ya apparently Lou Simpson begged Warren not sell their Nike position when he retired but Warren wasn't comfortable holding someone else's idea.

-

12 hours ago, Jaygo said:

Thanks for posting. I always wondered what would happen in a major human cat event. Say if the Pickering nuclear plant went radioactive or something. In that instance the damage would be in the trillions and most likely end Canada as an entity. Who pays for that? And how.

Nuclear events are generally carved out of insurance so the Government would need to step in.

-

3 hours ago, Saluki said:

This was exactly the issue in the Blue Chip Stamps litigation involving Berkshire many years ago. The issue was favoring one group of shareholders vs another and long term greedy vs short term greedy. I'm no expert on Canadian corporate law and how it differs from Delaware corporate law, but there is some value in not having sharp elbows when it comes to dealing with people.

Canadian corporate law is a bit different than Delaware - the fiduciary duty is to act in the best interest of the corporation but you have to consider the interests of all the stakeholders in your decisions. In practice, courts still give a lot of deference to boards of directors so as long as you can demonstrate you considered the stakeholders other than shareholders in the decision making process. It is not just straight maximization of shareholder value.

-

10 hours ago, Gregmal said:

I’m just generally over it and have given up. The last 4 years(starting with COVID, not Biden) I’ve just come to terms with the fact that the system is unbeatable. It’s not changing. You can only change what you have control over yourself.

Even my great little Northern NJ town that I moved to over a decade ago now…started as probably 60/40 conservative, but the thing is, no one talked about politics. No one really cared or lived with it influencing anything they did. Then we get COVID, and all these shoebox dwelling assholes I guess apparently realized they value some space and not having the government tell them where they’re allowed to go for a walk or shop, and then come out here thinking they’re hardasses with their dumb hate has no home here bumper stickers on their $90k Suburbans and guess what? Now all the red hats come out, we have antivax rallies outside the town square, every board of Ed election is now about tampon dispensers in the boys rooms and what’s available in the libraries….and it’s the same shitshow it is everywhere else I detest. Fuck all these people.

So like a grumpy old man I’m packing my shit and moving to where the only topics are what’s your t-time and how’s the investments looking? Just done with it all.

Ya it definitely feels like Covid accelerated everything becoming so political, didn't help that it forced a lot more people to spend more time on their phones / internet rather than interacting with real people in person. Seems like we haven't addressed the root cause of people being driven further apart to the extremes - Facebook and other media driving outrage / division for profit.

-

20 minutes ago, gfp said:

I wouldn't say this repurchase pace is "heavy." It will be interesting to see the split between A-shares and B-shares repurchased in the 10-Q. I think it is quite possible that Warren was offered a block of A-shares and he has shown a preference for retiring A-shares before he leaves the scene.

Fair enough but if you look at the total amount of Berkshire stock he repurchased in 2023, $9.2 billion, and then the approximately $2.2-$2.4 billion up to March 6th then the aggregate amount is pretty significant. It would exceed the value of Berkshire's Moody's holding as of the last 13-F and that is a top 8 public holding.

Just seems like his actions are somewhat inconsistent with the points raised in the annual letter. Maybe he is trying to talk down the share price so he can buy back more at a better price?

-

14 hours ago, Blugolds11 said:

I'm sure everyone already has seen it, but just incase someone missed it over the weekend.

Yahoo: Berkshire Hathaway speeds up stock buybacks

In its proxy filing on Friday, Berkshire said it repurchased the equivalent of 3,808 Class A shares this year through March 6, spending approximately $2.2 billion to $2.4 billion depending on the dates of the buybacks.

Nearly three-quarters of the repurchases took place after Feb. 12.

Berkshire repurchased $2.2 billion of its own stock in last year's fourth quarter, and $9.2 billion in all of 2023.

Its peak year for buybacks was 2021, when they totaled $27 billion.

Through Friday, Berkshire's share price was up 14% this year, about twice the gain for the Standard & Poor's 500.

https://finance.yahoo.com/news/berkshire-hathaway-speeds-stock-buybacks-185257424.html

Thanks for sharing. I find it interesting that Buffett is buying back stock so heavily given his pessimistic statements about Berkshire's future prospects. Maybe one of the few companies capable of moving the needle is Berkshire itself.

-

42 minutes ago, Gregmal said:

Can we create a news network that is not dishonest and actually labels its guests and fodder characters appropriately? Rather than “the guy who called XYZ crash”…wouldn’t “the guy who’s made 643 predictions with a 4% hit rate” be more appropriate? How about? “the guy who’s lost 30% over the past decade while underperforming the index by 300%”…instead of “famed short seller” can we get a more honest “guy who cries wolf a lot and if enough people are dumb enough to fall for it, buys the stuff he says he’s shorting”?

The CNBCs of this world are in it for the eyeballs. You might find this interesting, on page 5 of this JPM Eye on the Market they give an "armageddonist update". Obviously, once things have crashed, they all seem to predict further pain to come.

Tidbits

in General Discussion

Posted

Agree with this - it seems like a decent gauge of the "animal spirits" in the market.