Spooky

-

Posts

533 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Spooky

-

-

Once again the younger generations get screwed.

-

Now this is the news I want to hear haha. Love Krispy Kreme. When the first one opened in Mississauga with a drive through there were lineups for days.

-

Any new content in this book since the last version?

-

Bring it on I say. They have had so much time and thought so hard about putting the right pieces into place for this moment.

-

We will miss you Charlie. One of the wisest and most generous people on the planet, I learned so much from him. It's like losing a grandpa.

-

-

The comments section on the Barron's article are interesting, lots of folks seem like they will sell once Buffett is gone.

-

1 hour ago, Saluki said:

Massive government spending, putting the government as the "spender of last resort" would be the way out of it, but with the current political climate I don't see that happening.

Interestingly enough, if the US were to sharply decrease government spending that could be a big deflationary force.

-

Just saw these two articles in the WSJ this morning:

Looks like the supply side of the economy is less constrained - easing bottlenecks, more people available to work and possibly increases in productivity. For Black Friday many popular gifts are cheaper than last year at this time.

It will be interesting to see where things go from here - in the long run, AI and automation could potentially allow us to create goods at significantly cheaper prices.

-

One of the problems with the prior near zero interest rate regime is that it prevented creative destruction. Hopefully we keep a more normalized interest rate regime that wipes out some of the zombie companies.

-

I've never been wealthier, and I just sat on my ass most of this year, adding to some names here and there but letting my 97% long stock portfolio do its thing.

-

37 minutes ago, Parsad said:

Actually one of his most under-rated roles was Ridley Scott's "Kingdom of Heaven" where he played King Baldwin and he had a mask on for the entire movie because of leprosy. When I first saw it, I didn't realize it was him until the credits! Great movie! Also does a great job showing why the Middle East conflicts will never end.

Cheers!

Excellent movie. Jeremy Irons was also great, as usual.

-

-

What we really need is a step change in productivity to improve people's quality of living. Maybe a combination of AI and automation could get us there.

-

3 hours ago, UK said:

If China “really commits to rule of law and market reforms, I do think the confidence will slowly but surely come back, then the animal spirit will be rekindled.”

I wish this were the case but it seems to me like they have been moving in the opposite direction. We might need to wait until new leadership emerges.

-

9 hours ago, samwise said:

Thanks @Spooky.

agreed that mothership is much more diversified . Interesting idea that concentrating in a single vertical would require higher multiples. Could you please point me to the letter are you referring to?Mark's letter from March 25, 2010.

16 minutes ago, thowed said:Do you have any shares in the Polish subsidiary? I looked at it & it seems interesting, though fairly illiquid, & I didn't get a fill when I put a (cheap) bid in on a down day.

Thanks for the discussion on this - if I'd been more on it, probably should have added to Lumine recently, but maybe there'll be another chance in the next year.

I haven't looked at that company in much depth, I'm not very familiar with the Polish exchanges / governance.

-

-

Channelling Phil Fisher, my view on a wonderful company like Apple is that the right time to sell is never.

-

3 hours ago, samwise said:

@Spooky I have a big position in CSU as well (nowhere close to 50% though). And am considering increasing it with some new money. But I feel like TOI , LMN could have more runway and upside with the same culture and practices. Wondering if you agree? With such a large CSU position you must have considered the baby CSUs.

Awesome. Feels to me like this environment will be pretty good for CSU in general going forward. So I also have a number of TOI and LMN shares that I received in both spin-offs. My plan is to just keep these as well as the shares of any other possible spin-offs and not sell them for a really long time, maybe I'll get lucky and one of them will generate returns similar to the early days of CSU (Mark L mentioned he hopes his kids are still holding LMN shares in 50 years).

Personally, since I am holding such a large position in CSU, I like the mothership - you get an extremely well diversified stream of cash flows across many many software verticals / industries as well as geographies with minimal debt. Also, CSU still maintains a pretty hefty economic interest in both of the spin-offs, so if they do well CSU also does well. My goal with this position is to achieve above average results with a high probability of success / minimal risk of being wiped out. Also, I'm hoping / expecting more spin-offs in the future which could unlock more economic value.

That being said, I could see the two smaller entities generate higher returns than CSU going forward just given their smaller size. One, Topicus, is more of a regional / European focused CSU and the other, LMN, is focused on a specific vertical. It's funny I was actually re-reading Mark L's letters again this weekend and one of the early letters talks about two potential strategies a) the "many verticals" strategy and b) concentrating on a fewer number of verticals - with b) Mark hypothesized this would likely lead to paying higher multiples for larger acquisitions and paying strategic premiums to accelerate the number of tuck-in acquisitions.

I'm not sure I really answered your question but hope this is helpful.

-

43 minutes ago, UK said:

Seems like a short transcript with not too much new in there. Hopefully they release the full thing.

-

14 minutes ago, gfp said:

You know how people get when the S&P goes down... Don't neglect your daily dose of Wabuffo

Praise Wabuffo

. I've been considering getting back on Twitter just for him.

. I've been considering getting back on Twitter just for him.

Seems like a pretty good time to keep your head down and keep buying.

-

Why is everyone so pessimistic. The US prints an impressive GDP figure and it's all doom and gloom.

-

On 10/17/2023 at 5:24 PM, spartansaver said:

I'd say the opposite, lean into big ideas. You'll learn what works and what doesn't. I learned very early on about leverage and operational issues because I had a big position (at the time) in a company I followed someone else into. If I'd done 30 different small ideas I don't think lessons would've been taken. You can stand to learn at this point without mistakes costing you a lot. Books are good but experience is best.

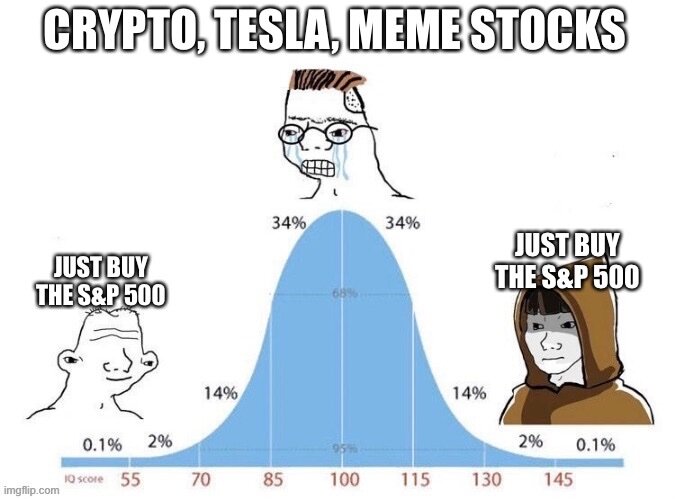

Sure, you can afford to take more risks when you are younger since you have time to recover. However, the biggest advantage you have right now is a long runway to compound returns. If you stay invested / in the game, don't make any big mistakes and let your investments compound, even small amounts can turn into significant sums of money over time.

-

This chart has me wondering what is going on in Brazil...

Have We Hit The Top?

in General Discussion

Posted

Feels like everyone is jumping the gun assuming the Fed will just pivot and start cutting rates early next year. We would need to see some real deterioration in the labor market to justify lowering rates in my opinion. My gut feeling is they hold rates here longer than people would like.