-

Posts

297 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by maplevalue

-

One of the reasons I like the stock. FFH should benefit from a higher rates environment, which is not true of many stocks (particularly tech which has been driving much of the recent gains). You get to own a higher rate hedge at a compelling discount to book.

-

Depends on the market. In emerging markets the index is stuffed full of state owned enterprises who may not necessarily be all that concerned about maximizing shareholder value, so active management is probably advantageous in that scenario. I also am a bit skeptical of indexing given the enormous flows into index tracking products over the past couple of decades. What might happen if that flow reverses (or rates start to rise)?

-

My suggestion was something that is simple, easy to understand, and the poster could just 'set it and forget it'. Hedging the exposure more closely, but more complex, is to sell US 30yr treasury bond futures; added complication is figuring out what the right hedge ratio is and having to roll the contracts every so often.

-

I would strongly recommend against some options strategy on a fixed income ETF, largely because there are fairly simple instruments you can use to directly hedge interest rate exposure without resorting to some complicated option play where it is unclear what the exact relationship between rates and the payoff will be. Probably the easiest hedge to implement is to sell Eurodollar futures (the Canadian equivalent is BAX futures). The price of a Eurodollar future declines 1 cent for every 1 basis point increase in the expected 3m interest rate at some date in the future. For example if you sold Dec 2025 Eurodollar futures you are protecting yourself for a higher overnight interest rate in December 2025 (https://www.cmegroup.com/markets/interest-rates/stirs/eurodollar.quotes.html). In terms of other ways to hedge rates, you could always look at buying bank stocks or low priced Canadian rate-reset preferred shares. Both should probably benefit as rates rise.

-

Really depends on risk preferences. I would lean fixed mainly because the scenario where the government runs a big deficit and you get inflation with little growth -> higher rates, would be so incredibly painful for Canadian economy. In that scenario you really don't want your mortgage payment going up materially.

-

Some interesting comments on China around 13:30

-

https://www.bnnbloomberg.ca/watsa-out-as-head-of-blackberry-compensation-committee-1.1663163

-

NTDOY (adding some comments in the thread)

-

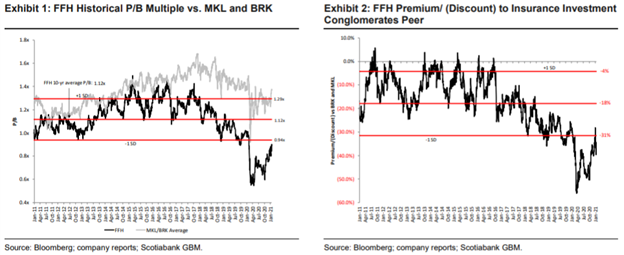

+1 as well. Here is a chart from back in February (P/B even lower now). Sure there are issues, but should P/B be that much lower than pre-COVID...I would say no.

-

A headline like that + potential trading around the start of a new quarter -> makes sense we get a strangely outsized move today.

-

Cathie Wood: Next Big Risk Is Deflation

-

This is essentially what Bridgewater has been saying. Buy things which benefit if nominal GDP goes higher and sell nominal bonds against it.

-

Yes of course BAML which is a leveraged entity is not comparing MBS to multifamily. But for 'real money' investors they would definitely be comparing them. Take for example the RBC Balanced mutual fund (somewhat representative of what the average person/institution would own). 65% equity, 35% FI with 71% of the FI in government bonds...so 71% of the FI allocation is more-or-less guaranteed to lose money in real terms...not sustainable! If rates persist here you will see more entities seek 'fixed-income like' securities like MF rentals instead of government/corporate bonds. RBC Balanced Mutual Fund

-

@Gregmal You are spot on. My background is in fixed-income and I bought my first multifamily REIT this year! Multifamily rentals produce cashflows very similar to that of inflation protected bonds. The main difference is that if you take the cap rate + inflation expectations it far, far, exceeds the expected return on inflation protected bonds, or pretty much any investment grade bond. As real yields stay low you will see more and more asset managers who previously had large fixed income allocations follow the 'cash is trash' theme and shift into this space. Some recent examples from Canada: CPP join venture to build multifamily rentals - March 2021 OTPP owned Cadillac Fairview partners to develop/acquire multifamily rentals - June 2019

-

Not news but do not think this has been brought up with respect to Fairfax on this thread yet. One of the promises from the Liberals (who are poised to be reelected) 2021 platform Seems like it's unclear how it will apply to international profits vs. domestic profits. Some of the recent weakness in CAD financials has been attributed to this. Fairfax I assume would be subject to this.

-

Tools for calculating returns across accounts

maplevalue replied to rayfinkle's topic in General Discussion

Quicken. I had to do this because over time I had moved brokerages, account numbers changed, and wanted to include partner's accounts. You have to import everything in which is a pain, but once its setup you only need to update it with new trades. Some brokers, like IB, let you import your account information directly into it. It then lets you calculate IRRs for each year (i.e. your 2013, 2014, 2015 IRRs), as well as a total IRR. IRR is probably the right measure to use for performance. As well if you want to calculate 'simple' returns it will tell you for each period (monthly/quarterly/annually) what the starting value was, inflows, outflows, and ending market value, so then you can calculate a simple return yourself. -

If you are a student you may have access (through your library) to Mergent Online. This database has a section called Investext which has analyst reports for many publicly traded companies. Looking at initiating coverage reports on stocks you are interested in a good way to get started.

-

Very unlikely in my opinion. My best guess is that the TRS is constructed so that right now there is some investment bank long the exact number of shares Fairfax has the TRS for. If the price goes up the bank wires money to Fairfax, if it goes down the bank demands payments from Fairfax. On net the investment bank's position is neutral.

-

How do you identify the seller in a large block trade?

maplevalue replied to 3259's topic in General Discussion

In Canada you can see the volume, buying bank, and selling bank for trades on the TSX (e.g. https://money.tmx.com/en/quote/FFH/trade-history). I believe the US is similar. In terms of the clients behind the trade the only people that would know that are the sales-traders at the investment banks that did the trade (possibly these people won't even know). -

1 Canadian Stock That’s So Cheap, it’s Embarrassing: https://www.fool.ca/2021/08/31/1-canadian-stock-thats-so-cheap-its-embarrassing/ Truly embarrassing!

-

After Powell's comments at Jackson Hole US10Y real yields at -1.09% (https://www.cnbc.com/quotes/US10YTIP). I may sound like a broken record, but with rates this low there is simply no alternative to stocks. Interest rates may change, but individuals' need to earn a decent return to meet their savings goals do not. Let the bull market continue!

-

Putnam Investments acquiring Toys’R’Us Canada from Fairfax: https://www.bnnbloomberg.ca/putnam-investments-acquiring-toys-r-us-canada-from-fairfax-1.1641921 Farmers Edge Announces 200k Share Purchase by Fairfax Financial Holdings: https://www.businesswire.com/news/home/20210818005642/en/Farmers-Edge-Announces-200k-Share-Purchase-by-Fairfax-Financial-Holdings

-

Here is a selection of threads posted on General in the past several months (some of them by you): All of these threads, and this one, have the same theme of "the market is too high", "rates are too low", "what we have now cannot last". That is, all of these threads represent the consensus fear among investors that the market is overvalued. Markets time and time again tend to have price action which moves exactly opposite to what consensus opinion is, and we have seen it again this year as in the midst of huge levels of uncertainty the SP500 is at an all time high. I truly believe the pain trade is for the market, expensive as it is, is for it to continue becoming more expensive. Since the pain train often is the direction of travel, we are likely to go higher!

-

Market Disconnect is One of the Craziest I've Seen in 23 Years!

maplevalue replied to Parsad's topic in Fairfax Financial

Obviously it pops a few days after earnings since the market is waiting for the COBF Fairfax 2021 thread analysis before transacting. -

Gundlach discussing Fed stimulus' impact on stocks near the start of this video. US10Y real yields back plumbing the lows of -1.08%.