backtothebeach

Member-

Posts

646 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by backtothebeach

-

You're probably right, but planning to lighten up at a certain multiple and then not doing it is what? Anyway, I don't think it was a bad moment to reduce concentration risk, and I still have loads.

-

Selling 1/6 of my irresponsibly overweight FFH.TO, sniff. Months ago I planned to lighten up once it hit 1.1 * BV. I think it is pretty close to that on soon to be reported BV. Trying to be prudent, but feels like leaving money on the table.

-

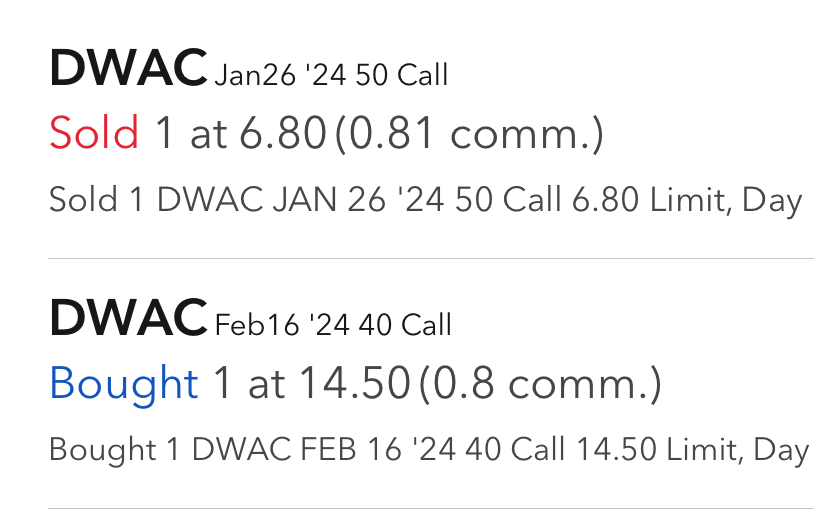

Lol, only 1 contract for fun. Just rolled down the short $50 call to the $40 strike for extra credit. Now only $5.50 net cost. Can I get $5.50 out of 3 more weeks of the $40 strike? Maybe. I probably should not clutter up the board with this stuff.

-

I think DWAC is going to be volatile for a while, and is unlikely to drop straight back down. Put on a little gamble today. Implied volatilities are through the roof.

-

Doesn't sound like Charlie at all IMO. Short sentences, borderline rude to the questioner, lacking wit. "I think old-fashioned intelligence works pretty well."

-

Buffett/Berkshire - general news

backtothebeach replied to fareastwarriors's topic in Berkshire Hathaway

Excellent. Berkshire now fully owns the largest truck stop/highway travel center chain in the U.S. How can that not be good. Price paid is water down the bridge. -

POLL- S&P 500 2024 Return Estimates by the board

backtothebeach replied to Luke's topic in General Discussion

Yep. We've all heard Buffett and Munger say it countless times. Yet the prediction game (short term market direction, interest rates, macro economy) is oh so tempting, even on the "Corner of Berkshire..." Years ago on a different board, one of the more undiplomatic posters wrote "predictions are garbage". For some reason that stuck in my mind and I frequently remember it. -

POLL- S&P 500 2024 Return Estimates by the board

backtothebeach replied to Luke's topic in General Discussion

This poll is missing an option. The one that Buffett would choose. -

I Need a Laugh. Tell me a Joke. Keep em PC.

backtothebeach replied to doughishere's topic in General Discussion

-

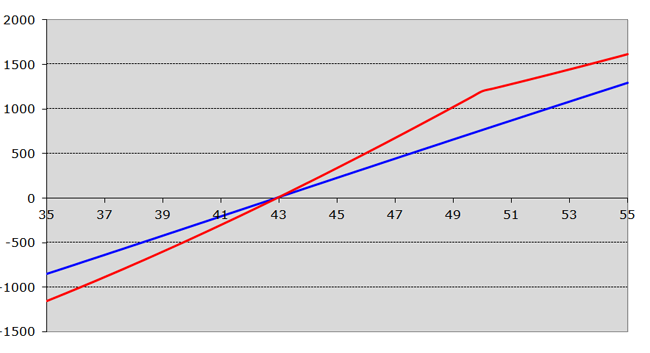

@lnofeisone your assessment was spot on, comparing risk graphs for January 17, 2025, with no changes in implied volatility. blue risk graph: -short Jan'26 45 put +long Jan'26 42.50 call red risk graph: -short Jan'25 50 put +long Jan'26 42.50 call

-

I think I was just looking for a synthetic long close to zero cost and with a low breakeven. I like your alternatives, especially the second one that introduces a calendar element and possibly a lot more flexibility in year two.

-

EBAY synthetic long: -short Jan'26 45 put +long Jan'26 42.50 call for a credit of $0.20 per share. A cash efficient way to go long. You miss out on the 2.5% dividend though.

-

2.98 x 0.31 = 0.9238 Minus 7.6% in total over two years. Math is a bitch...

-

vs. Berkshire it seems.

-

Today Charlie would have celebrated his 100th birthday. I don’t know if he is celebrating somewhere else, but I’m sure many people are thinking of him and celebrating him in their minds today.

-

74% in USD. Last year when I was looking at my port value, every other day I was thinking “this is insane”. Holding a large percentage of FFH and buying more on dips was the biggest driver, but I also sold tons of OTM and ITM puts on ATVI, OXY, CLF, STLC, CVE, OBE, BRKB and others, did some diagonal option spreads and some arb trades. All in all being imprudently leveraged with over 200% long if you add up long and notionally long through short puts. That said, “you only need to win the game once“, so after 10 years of investing/trading like a madman with a 19.9% CAGR (was it worth it?), I am looking forward to being more passive. Biggest challenge is going to be to get over my market addiction. I don’t use social media, so clicking back-and-forth between watchlists on IB and checking COBF for new posts has been my dopamine source for quite a while. I may start a new thread about this.

-

Regarding book keeping: I calculate monthly returns looking at the month-end values of my portfolio. The YTD or annual return is the monthly return compounded. If I take out money I try to do it at the beginning or end of the month and subtract it from the starting value or add it back to the ending value of that month. It would be the opposite for inflows. Example: Let's say I start with 110k, and take out 10k on one of the first days of the month, I just pretend I started the month with 100k. Or, with a lot of inflows or outflows you can net them out and adjust both the starting and ending balance by half the value. Nothing too fancy, everything else would be too much work for negligible extra precision.

-

Congrats! Very impressive, considering this was without employing margin/leverage (I think). Thank you for maintaining this forum!

-

A happy and healthy Christmas and New Year to all!

-

The ratio dropped back to the low 1520s on Friday. Now, if I could only time my arb trades as well as these posts.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

backtothebeach replied to doughishere's topic in General Discussion

Poor Ron -

What Is the Best Investment That You've Ever Made?

backtothebeach replied to Blake Hampton's topic in General Discussion

HODLing Berkshire, through stock, ITM calls, short OTM puts and short ITM puts, for 10+ years. -

A to B ratio spiked again to ~1535 today.

-

Mixing interesting data with inaccuracies, grandstanding and making outlandish predictions for effect. Somehow reminds me of Munger’s “If you mix raisins with turds, you still have turds.”

-

I Need a Laugh. Tell me a Joke. Keep em PC.

backtothebeach replied to doughishere's topic in General Discussion

Israeli satire: