Xerxes

Member-

Posts

4,626 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by Xerxes

-

lol. Yeah. That is true. FIH own dry powder was used to buyback at $14 and $12. And I am heading less aggressively at $9. You just don’t know how low it will get.

-

The WW2 analogies are based on a snapshot point in time. If you add a time dimension to the analogies, a symblic Doolittle raid on Tokyo in April 1942 snowballed into Lemay firebombing of Tokyo in May 1945, some three years later !

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Xerxes replied to doughishere's topic in General Discussion

-

FIH recent rise is a catch-up proxy for those who missed out FFH’ Q4 last year rally.

-

Romulan warbird de-cloaking off the coast of Hawaii https://www.cnn.com/videos/us/2023/01/19/coast-guard-russian-ship-off-hawaii-liebermann-cnntm-vpx.cnn

-

Russia’ massive multi-time zone landmass which was competitive advantage during Swedish, French and Germanic invasions is a liability in this current context of an enemy not interested to mount an invasion but to wage asymmetric warfare.

-

nice ! the “lost decade” was not just about the equity hedges. Also the abnormal interest rate regime. oddly enough, FFH feels like Microsoft out of its Steve Balmer era and into its third act.

-

7) laser-guided precision buyback 6) B-52 carpet bombing buyback

-

-

For me the real story is not how much ammunition, shells and out of the box ideas Russia can conjure up to keeping lobbing toward its enemies, but rather how effective has been the use of SMARTArtillery by Ukraine for it to be able to punch above its weight*. *Above its weight measured by the sheer size of the arsenal.

-

Century ago ? .... How about just a few years ago ... You chose the farthest out datapoint to make your point. (granted I gave you that datapoint as ammunition) ... but my comment could be easilly apply to things that happened just a few years ago (not a hundred years ago). Rohingya genocide - Wikipedia Now suddently everyone in the West is a freaking peace-loving, crying out for victims, calling out to stop genocide. blah blah. Hypothetically speaking, How many of you, would be looking the other way, if it is your own government doing it some another party, ... or worse how many of you would be wrapping yourselves in the flag, .... or even worse, justifying it with whatever non-sense the media tells you to repeat. I have no problem if folks want to talk about economic aspect, geopolitical, humanterian aspect of this conflict in East Europe, or the history of it with its multiple points of view, that is all fair game. But I cannot stand hypocracy, and all that holier than thou bullshit, as if one was born yesterday. Perhaps, i am totally wrong, and there is zero hypocracy. Won't be the fist time that I was wrong. So I'll just say that generally speaking, agreed with your comment and point well taken.

-

https://www.reuters.com/world/europe/ukraine-says-russian-strike-pattern-suggests-it-is-low-ballistic-missiles-2023-01-16/ SS300 and SS400 are being used for ground targets. The gentleman who guests on the War on the Rock podcast was right on the money. Massive amount artillery shells were used in summer. As recently as Dec it dropped to 20,000 shells per day from as high as 60,000 shells per day last spring and summer. Now that the manpower is available it needs to fix its hardware deficit, which went to overdrive in mid 2022. https://en.defence-ua.com/industries/russia_spends_20000_artillery_shells_per_day_production_cannot_keep_up_with_such_rates_ukraines_intelligence_chief-5312.html

-

I would have no clue on the recent rally except that the stock may just be catching up to its real worth. I dont think stock rallies so much to catch the ex-dividend date. It is only $10 and low yield at these prices. My earlier comment about TRS, was that the counter-party by buying FFH shares directly off the market, they can hedge future deteriotion on their blown-out position. Example, as FFH continnues to rally in 2023, the counter-party needs to put more and more collateral/payment to FFH, that "temporary loss" can be offset by the slug of shares that it now owns that had apperciated in value. Of course, this is only a working theory, if the counter-party had proper risk management (and were not making a directional bet) they would have been buying those FFH shares around the same time as when they establish the TRS (and not now), such that they would risk-neutral.

-

It still baffles me how there could there still be a statue of King Leopold II standing, or why had it taken so much time to take them down. Atrocities in the Congo Free State - Wikipedia At the end of the day, it is all about the color of skin of the victims. West will moan and complain about its "spread of democracy" and do its mumbo jumbo, and do its patriotic Hollywood bullshit. No one wants to know about Sir Winston Churchill using chemical weapons to go after the Iraqi kurds. It is un-interesting and it undo- the British glorification. It is classified as "ohh that was a different time". What the f*ck does that mean. Your's "this was another time" was someone else; "this is happening now"

-

When you do a NPV on Russia you need to use their ‘discount rate’ not our Western ‘discount rate’ sort of speak, in their capacity to endure. How the whole thing (current situation) started (with Putin’ own miscalculation) is largely irrelevant. Russia cannot have NATO next door, doing what it does best, slowly but surely suffocating it. Sometimes slow, the 2000-08, sometimes fast, 2008-22, but always tightening the noose at every opportunity, even as it keeps smiling. It is a clear and present danger. You agreeing or disagreeing, or your sudden interest about democracy in Ukraine, has nothing to do with it and totally irrelevant. This is bigger than Putin and can easily outlive him. Despite Western obsession to have a central figure for its narrative.

-

Go after India !!!?!? Are we talking about the same West that pivoted to China post-Vietnam war during the Nixon-Kissinger-Mao-EnLai rapprochement in the 70s. With the very same Red China that fought bloody war with India near its border. The same West that supported Pakistan during the Cold War. Pakistan and the US were so close that U2 missions were even flown its soil. In fact, Kissinger even flew from Pakistan for its secret mission to China before it became public. The same West that keep subsiding Pakistan’ general and ISI, during the Afghan war. As always, there is the self-centred, all-about-me West, that remember what it wants to remember (through Hollywood), and forgets what is convenient to forget. India will get close to West overtime as their own pace. We need India. We want India. The only obstacle is West acting like it always does. Self-entitled and all-about-me. Relationships are hard to built and easy to fracture. It needs to be nurtured overtime. Folks in the West may go Aeroplane mode when it gets boring, but the world doesn’t stop turning. PS: general comment and definitely not toward you.

-

Pre-shale revolution (and sometimes after) Russian natural gas was indexed against the price of oil, but even that (I believe) was lower than natural gas prices in the U.S. pre-shale (talking early 2000s). Put yourself in that era. If U.S. was a major net importer (not exporter) of natural gas why would an industrial base that uses natural gas heavilly as input would locate itself there. Those industries moved to Europe which had natural has coming in from Soviet-era pipeline, reliably (then mentallity). Of course shale and LNG technologies changed all that. I do hope we wont see that exodus from Europe to the U.S.

-

Morgan Housel speech (and transcript) from MCC

Xerxes replied to Liberty's topic in General Discussion

Finish reading his book. Good fast read. The Psychology of Money: Timeless lessons on wealth, greed, and happiness: Housel, Morgan: 9780857197689: Books - Amazon.ca -

Consumer may be fine in 2022. Thanks to all the measures taken. That said, there will be a re-shaping of the European industrial landscape that has feeding itself on cheap natural gas as input feedstock. Most likely back to (or to) United States. I imagine 25 years ago, it was the reverse with a lot of industries moving to Europe given high pre-shale natural gas prices in the United States and elsewhere, and low and steady flow of natural gas from Russia. Add to it, Biden's protectionist Inflation Reduction Act, European manufacturing industry are rather squeezed.

-

It is not just about having hedges…. But how they were executed. still astonishes me how could a so-called “equity hedge” whose raison d’être is downside protection yields a $500 million loss in a year when the market crashed by 40% in matter of weeks !! it is one thing to moan about the rationale endlessly, it is another thing to point out the oddity in the way it was structured. Something changed within Fairfax, almost as if some folks in their risk management were not paying attention.

-

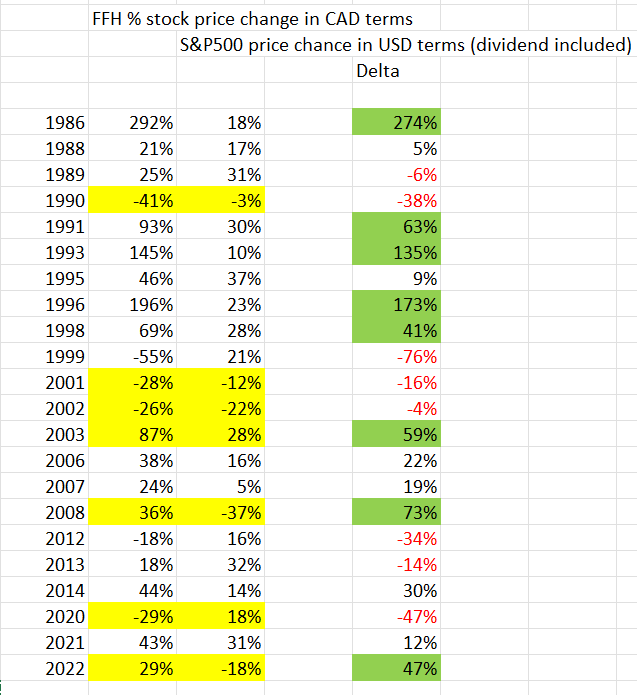

I like history, so let's take a historical view of the years its share price has more than 20% change and how did S&P500 performed in that same year. I have excluded all other years. Of the years kept, - Yellows are when we had a downturns (either in economy or stock market). - Greens are when the "Delta" between FFH stock return that year and S&P500 was more than 40% - Reds are the years when S&P500 outperformed FFH Not sure what conclusion to draw other than that, what has been said by Prem that coming out of back end of downturn, Fairfax does outperformed the broader indices. Sometimes that ourperformance has legs and goes over multi-years like (a) it did in the early 2000s, or (b) following the mild recession we had in the early 1990s which was a massive boon for FFH, as it fueled it all the way to 1999. Whereas other times (c), it gets cut very short, coming out of the 2008-09 GFC. The only difference between the (a) and (b) vs. (c) is that the latter started the "hedging/deflation swaps" era.

-

Let's look at the very same table that Prem Watsa always pointing us at: In the early 1990s recession, the share price went up a staggeting +145% and a dull +9% year after I have no clue why FFH went up 196% in the year 1996. Anyone know why ? In the early 2000s recession, the share price went up a staggeting +87% and a dull -11% year after In the early 2009s recession, the share price went up a staggeting +36% and a dull +5% year after In the early 2020 mini-recession, the share price went up a +43% in 2021 and probably a great 2022, given how close the "two recessions" are together. One Covid-based and the other Fed-based. Again, not talking about book value or how cheap it is. Just the counter-cylicality of the stock in the market environment that competes with indices.

-

Maybe it is the Fairfax's counter-party to the total return swaps who is rushing (after the fact) to buy Fairfax shares to hedge their blown-out counter-party exposure after it rallied. They have been taken to the cleaners by Watsa. --------------- Unrelated, in 2022, we had a bear market where major indices dropped 15-20%, while Berkshire went flat and Fairfax rallied. Putting aside, FFH's undervaluation and how still cheap it is, if 2023 turns out to be a bull market year for indices, do folks think Fairfax would continue to rally, or would it a "pause" flat year.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Xerxes replied to doughishere's topic in General Discussion

-

I am guessing you are not a fan of DRIP