nwoodman

-

Posts

1,146 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Posts posted by nwoodman

-

-

2 hours ago, Hoodlum said:

Some interesting comments from Eurobank on how they plan to use Hellenic Bank for India and Middle East business, once they acquire the Majority stake.

Fascinating. They have alluded to this previously but this is much more granular and removes any doubt as to who the facilitator is. It’s certainly not without its challenges but done well the upside is significant.

Fairfax the Facilitator…kind of has that ring to it like “Maximus the Merciful”.

-

@Crip1 it was more the final line “No technology investment for me!” that we were referring to. No arguments from me in terms of contrition, and even closure on an era.

-

8 minutes ago, petec said:

While I love the mea culpa, I really hope this isn't the lesson they draw. Nothing wrong with investing in technology - just maybe not the place to go looking for value among broken entities.

Agree it was kind of a strange way to conclude. Micron, Ki and even Digit would suggest that it is in their wheelhouse.

-

Minor add 7974 Nintendo

-

Really does read like closure and not just on BlackBerry…

“That brings me to a major mea culpa! We began investing in Blackberry in 2010 and helped John Chen become CEO in November 2013 by investing $500 million in a convertible debenture at the same time. Blackberry had come down from $148 per share (down 95%) and had $10 billion in sales. I joined the Board in 2013. Our total investment in BlackBerry early in 2014 was $1.375 billion ($500 million in the convertible and $787 million in common shares).

When John joined the company, BlackBerry reported a loss of $1.0 billion - in one quarter and most analysts were predicting bankruptcy! BlackBerry was indeed in difficulty! John saved the company by quickly bringing it to breakeven on a cash basis and then on a net income basis. No CEO worked harder but, unfortunately, John could not make it grow! Revenues for the year ending February 2023 were $656 million. John retired from the company at the end of his contract on November 14, 2023 and I retired from the Board on February 15, 2024. We got our money back on our convertible ($167 million in 2020, $183 million in 2023 and $150 million in 2024) plus cumulative interest income of approximately $200 million. Our common stock position as of 2023 ($162 million or 8% of the company) which was acquired at a cost of $17.16 per share was valued on our balance sheet at $3.54 per share. Another horrendous investment by your Chairman. To make matters worse, imagine if we had invested it in the FAANG stocks! The opportunity cost to you our shareholder was huge! Please don't do the calculation! No technology investment for me!”

-

Lots to digest but this comment on Atlas/Poseidon was super helpful for me

"Poseidon is expected to make net earnings in excess of $400 million in 2024 and $500 million in 2025. We carry our 43% ownership in Poseidon at $1.7 billion – 10x 2024 expected earnings or 8x 2025 expected earnings."

Any confirmation that it is going to be accretive and growing is very welcome

-

53 minutes ago, Luca said:

Holy S*** this is a great read, especially considering that sleezy MW shorter...Watsa seriously can be proud of what he built

Yep, he has stepped it up this year. Touches on just about everything that has been tossed around on this board and more. Outstanding

-

1 hour ago, petec said:

Not necessarily - the 50% includes buybacks. But it is still great.

Don't Fairfax have 1224m shares in total? If so, by 2026 the BVPS is expected to be E2.65 and rotbv 13% so it's more like 2.65*0.13*.5*1.09*1224=$230m. Lovely!

Agree with you and @Viking on the share count, I grabbed an old spreadsheet from my downloads folder, that will teach me.

https://www.eurobankholdings.gr/en/investor-relations/shareholders/shareholding-structure

A decent chunk of change that will improve their cashflow dramatically.

-

Eurobank moving to a 50% payout means close to $200m a year in cash coming to Fairfax. That is staggering. Buffett talks about the Coca Cola dividend, Euro bank will be in that league

1166m shares x €0.15 x 1.09 €/USS = USD 190.6

-

Eurobank Earnings are out

EPS of 0.31 for the year

Looking to transition to 50% payout over the next couple of years

“In a lower interest rates environment, Eurobank aims to generate resilient returns to shareholders, which will be further enhanced by the full integration of Hellenic Bank in Cyprus, capitalizing on the strong franchise in Greece, organic growth and strategic initiatives in Cyprus and Bulgaria. The ROE' is expected to reach 18% in 2024 and circa 15% beyond 2024, while the payout ratio will gradually increase towards 50% of profits in

20264. Eurobank, as a regional bank with diversified earnings stream, aims to ensure top line growth amid a lower rates environment, with non-Greek operations contributing c. 50% to the Group core profit in 2026. The 2024-2026 financial goals are as follows:

Edit: MS take on earnings attached

-

No particular insight but this looks like a “public hanging” to me. Not good, but I can’t see Fairfax stepping with a line of credit if this is more than regulatory violations.

-

Not sure what to make of this but the market has whacked them again today. Sounds like it has been ongoing and the RBI has had enough.

-

9 hours ago, backtothebeach said:

Interview with Perplexity’s founder and CEO:

https://podcasts.apple.com/us/podcast/invest-like-the-best-with-patrick-oshaughnessy/id1154105909

Excellent podcast. A lot to unpack but listening to it only reinforced the old adage “I can’t afford free”. I have money and are very happy to pay for a search/knowledge experience where it is serves results, that are high quality, more often than not delight and are easily verified. Aravind Srinivas’, laser like focus, on UX, is indeed what makes this great. The market can no doubt see the ramifications for Google and as he says:

“..the differentiation is going to come from us executing even faster and better, because unlike a big company, if you call them a big company (ref OpenAI), they're actually pretty fast. So we have to be even faster. So that is one thing I do think about. Unlike what most people say, I'm not really worried about Google, not because they cannot execute on this. They actually are way better engineers and researchers than us. It is their own business model.”

The other thought is that this is where Apple can shine and not just UX. This is an energy intensive endeavour. “High quality answer”/watt in the medium term could be a real differentiator. He touched on the importance of using relatively smaller, more efficient language models that are fine-tuned for specific tasks like avoiding hallucination, rather than depending on the largest, most complex models. He suggests that better "reasoning" capabilities in smaller models could be a key to making this approach more economical. On device could make a big difference here IMHO. Not to mention the privacy considerations and personalisation opportunities..

What an amazing time to have a heartbeat.

-

OT but Claude 3 just dropped and so was playing with it today. I actually thought this wasn’t too bad in terms of output:

Sure, I'll provide a basic attempt at all 5 valuation methods for Fairfax Financial. Please note that these are simplified examples and should not be considered a comprehensive valuation or investment advice.

1. Sum-of-the-Parts (SOTP) Valuation:

- Insurance and reinsurance subsidiaries: $20 billion (based on book value and peer comparisons)

- Investment portfolio: $30 billion (based on market value)

- Other assets and liabilities: -$5 billion

- Total SOTP value: $45 billion2. Comparative Valuation:

- Fairfax's P/B ratio: 1.2 (current stock price / book value per share)

- Peer average P/B ratio: 1.5

- Implied valuation based on peer average: $52.5 billion (1.5 * book value)3. Discounted Cash Flow (DCF) Analysis:

- Estimated 5-year cash flows: $5 billion (based on historical growth and profitability)

- Terminal value after 5 years: $60 billion (based on a perpetual growth rate of 2%)

- Discount rate: 8% (based on the company's cost of capital)

- Present value of cash flows and terminal value: $48 billion4. Dividend Discount Model (DDM):

- Current annual dividend per share: $10

- Expected dividend growth rate: 5% (based on historical growth and payout ratio)

- Cost of equity: 8% (based on the risk-free rate, market risk premium, and company-specific risk)

- Implied value per share: $333 ($10 / (0.08 - 0.05))

- Total implied valuation: $50 billion (based on the current number of shares outstanding)5. Adjustments for Unique Factors:

- Add a 10% premium for strong management and investment track record

- Subtract a 5% discount for exposure to catastrophe losses and market volatility

- Net adjustment: +5%Based on these simplified examples, the valuation range for Fairfax Financial could be:

- Low: $45 billion (SOTP valuation)

- High: $55.1 billion (Comparative valuation with peer average + 5% net adjustment)

- Average: $50 billionAgain, this is a basic attempt and should not be considered a comprehensive valuation. A thorough valuation would require more detailed analysis and assumptions.

-

25 minutes ago, SafetyinNumbers said:

Rebalancing occurs every quarter in March, June, September, December which makes Feb 29, the measurement date. The rebalance occurs on the third Friday of the month and they give two weeks notice via press release so that’s why I think we’re live tonight. I think the odds are under 25% though given the historical precedent of 20bps threshold in the 60 for kicking a constituent out.Ta, if that’s the case, then our AI overlord (unchecked) offers the following future dates if it doesn’t happen tonight:

“Based on the rebalancing schedule that occurs every quarter in March, June, September, and December on the third Friday of the month, with a two-week notice given via press release, here are the dates for 2024:

- **March Rebalance:**

- Rebalance Date: March 15, 2024

- Announcement Date: March 1, 2024- **June Rebalance:**

- Rebalance Date: June 21, 2024

- Announcement Date: June 7, 2024- **September Rebalance:**

- Rebalance Date: September 20, 2024

- Announcement Date: September 6, 2024- **December Rebalance:**

- Rebalance Date: December 20, 2024

- Announcement Date: December 6, 2024These dates align with the criteria of rebalancing on the third Friday of the specified months and providing a two-week notice before the actual rebalance occurs.”

-

Thanks @SafetyinNumbers. It all appears like the dark arts to me, especially the committee’s discretion. I understand that rebalancing is done quarterly, however could I trouble you to point me to where it specifically states that tomorrow is the decision making day?

Index inclusion is hardly central to the FFH thesis but I find the discretionary aspect a bit of an eye opener as far as indexing more generally

https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-tsx-canadian-indices.pdf

S&P/TSX 60 Methodology

The S&P/TSX 60 is a subset of the S&P/TS Composite. It has 60 constituents and represents Canadian large cap securities with a view to reflecting the sector balance of the S&P/TSX Composite. In using trading data to determine any matter relating to the S&P/TS 60, including index composition and calculations, trading data on the TSX and U.S. exchanges is reviewed.

Additions to the S&P/TSX 60

- To be eligible for inclusion in the S&P/TSX 60 index, securities must be constituents of the S&P/TSX Composite.

- When adding securities to the S&P/TS 60 index, the Index Committee generally selects amongst the larger securities, in terms of float QMV, in the S&P/TS Composite. Size may, however, be overridden for purposes of sector balance as described in item 4 below.

- When adding securities to the S&P/TS 60 index, the Index Committee generally selects securities with float turnover of at least 0.35. This is a guideline only and may be changed at the discretion of the Index Committee. In addition, this range may be overridden for purposes of sector balance described in item 4 below.

- Security selection for the S&P/TSX 60 index is conducted with a view to achieving sector balance that is reflective of the GICS sector weights in the S&P/TSX Composite.

- Minimum index turnover is preferable. Changes are made to the S&P/TSX 60 index on an as needed basis. The most common cause of deletion is merger or acquisition of a company. Other common reasons for deletion include bankruptcy, restructuring or other corporate actions. If a company substantially fails to meet one or more of the aforementioned guidelines for inclusion or if a company fails to meet the rules for continued inclusion in the S&P/TS Composite, it is removed. The timing of removals is at the discretion of the Index Committee.

-

-

I have been using this for a while too. It’s very difficult to go back to normal search, that’s for sure. The potted questions are a bit hit and miss at times but the referencing is brilliant. For technical engineering searches it has proved invaluable and easily justifies its cost.

For investment research it is OK to good. It sometimes dives into filings but more often than not gives the usual lazy Chat GPT response eg.“one would typically look into annual reports, SEC filings, and other detailed investor communications that outline the company's strategic investment decisions over time. However, these details are not provided in the current search results”

-

58 minutes ago, petec said:

Yes - I've been thinking this for a while.

Don't they have equity in Altius as well as warrants?

Spot on!

“The Warrants and the Preferred Securities were originally issued on April 26, 2017. Prior to the Transaction,

Fairfax directly or indirectly owned or controlled an aggregate of no Common Shares, 6,670,000 Warrants

and $100 million Preferred Securities, which represented 13.94% of the issued and outstanding Common

Shares as of April 14, 2022, on a partially diluted basis. Following the completion of the Transaction, Fairfax

will directly or indirectly own or control 6,670,000 Common Shares, which represents 13.94% of the issued

and outstanding Common Shares as of April 14, 2022, on a non-diluted basis, and Altius will have no

outstanding Warrants, Preferred Securities or resulting interest distribution obligations.” -

Highly recommend “Boy Swallows Universe’ - Netflix Quirky, dark and uniquely Australian. The 80’s soundtrack was worth it alone. Brought back some great musical memories. Will be watching this one again

-

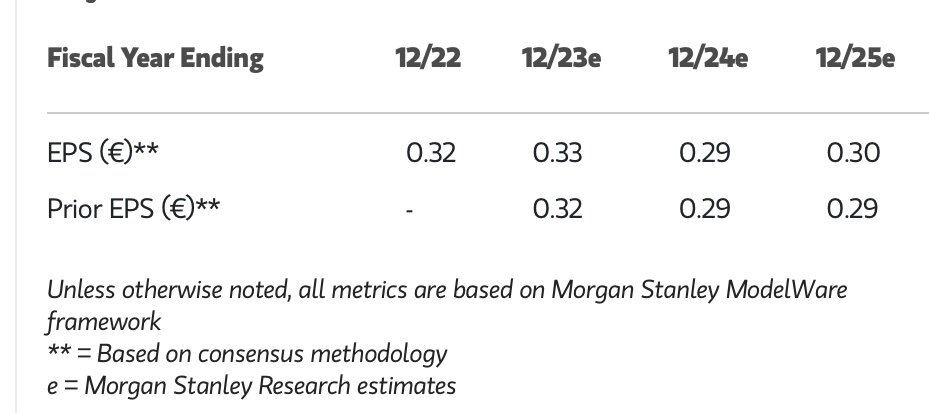

MS with a minor upgrade to Eurobank ahead of earnings. Revised PT €2.35 from €2.33

“We update our model ahead of 4Q23 results. We lower opex marginally to incorporate one offs related to floods in 3Q23 and restructuring cost. Our FY23-25 EPS is up by ~1.5% and our PT increases by ~1% to EUR2.35. We remain Overweight.

- A strong balance sheet means that Eurobank is one of the the most resilient Greek banks in our coverage. We expect performing loans to grow at a ~6% CAGR (pro-forma for Hellenic bank acquisition) in 2023-25.

- We forecast NIMs to decrease by 2bps in 2024 followed by a 13bps contraction in 2025 (pro-forma for Hellenic bank acquisition), as we expect the rate-cutting cycle to begin in 2Q24, thus driving asset yields lower.

- 3Q23 NPE ratio stood at 5.0%; we forecast it to reach 3.6% by 2025.

- We see the Hellenic Bank acquisition as accretive for the bank.”

So roughly a $2.5 bn equity position for Fairfax at an earnings yield of 15% for the foreseeable future. Every “little” bit helps.

-

https://www.fairfax.ca/press-releases/fairfax-announces-acquisition-of-additional-orla-shares-3/

“Orla and brings Fairfax’s total holdings, through its insurance subsidiaries, of such securities to 55,405,229 Common Shares (or approximately 17.58% of all Common Shares).”

$3.375 at the time of writing, makes this a $186m position. A bit more than a passing phase.

Between Orla and Foran it’s close to $400mn. Throw in the Altius warrants and it is close to $500 mn. Then take the Exco and Occidental positions that’s another $900m or so. Taken as a basket, you could almost argue that commodities is their third big equity idea after Eurobank and Poseidon/Atlas.

No idea about Exco, but the others seem to be long life assets and not just cigar butts.

-

-

46 minutes ago, ValueMaven said:

Where can I read about the history of FFH's ownership of Eurobank?

You could always try the EGFEY (ADR) thread. In a nutshell Prem tried to repeat the success with Bank of Ireland. It’s been a hard slog but is working nicely for shareholders now. Their perseverance with Eurobank has been brand accretive.

https://en.wikipedia.org/wiki/Eurobank_Ergasias

Fairfax stock positions

in Fairfax Financial

Posted · Edited by nwoodman

Thanks for this. Running the numbers through the machine offers the following progressions:

Debt-to-Equity Ratio:

2023: 1.82 (Total Borrowings $8,046.7m / Equity $4,415.9m)

2022: 1.47 (Total Borrowings $6,078.6m / Equity $4,128.9m)

2021: 1.41 (Total Borrowings $4,971.1m / Equity $3,517.6m)

Interest Coverage Ratio:

2023: 2.08 (OP $782.3m / IE $375.6m)

2022: 3.19 (OP $751.4m / IE $235.4m)

2021: 3.87 (OP $762.2m / IE $197.1m)

Return on Assets (ROA):

2023: 2.94% (NP$403.0m / TA$13,713.0m)

2022: 5.51% (NP $622.3m / TA $11,302.4m)

2021: 3.79% (NP $400.5m / TA $10,569.6m)

Operating Margin:

2023: 43.0% (OP$782.3m / Revenue $1,820.7m)

2022: 44.3% (OP $751.4m / Revenue $1,697.4m)

2021: 46.3% (OP $762.2m / Revenue $1,646.6m)

Net Profit Margin:

2023: 22.1% (NP $403.0m / Revenue $1,820.7m)

2022: 36.7% (NP$622.3m / Revenue $1,697.4m)

2021: 24.3% (NP$400.5m / Revenue $1,646.6m)

If interest rates were to decline then this looks to be a counterbalance to the interest income from the bond portfolio. As long as it can remain a profitable single digit grower while they consolidate the industry then that will be a good outcome. Happy to have this grind away and become “surprisingly” accretive later this decade.

Edit: other key numbers where the trend is not really your friend, but there may be some timing issues associated with the fleet build out. Ultimately Prem is forecasting 400+m this year and 500m next year, seems plausible.

Return on Equity (ROE):2023: 9.43%, 2022: 16.28%, 2021: 11.21%

Return on Capital Employed (ROCE): 2023: 6.19%, 2022: 7.32%, 2021: 8.11%

Return on Invested Capital (ROIC): 2023: 6.35%, 2022: 7.54%, 2021: 8.59%

From the letter:

"Upon completion of Poseidon's containership newbuild program, Poseidon is expected to deliver more than $2.5 billion of revenue and $1.9 billion of adjusted EBITDA.“

"Poseidon is expected to make net earnings in excess of $400 million in 2024 and $500 million in 2025. We carry our 43% ownership in Poseidon at $1.7 billion – 10x 2024 expected earnings or 8x 2025 expected earnings."