KFS

Member-

Posts

184 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by KFS

-

In 2017, first took a very small position only because it appeared that Fairfax's insurance business had improved significantly, and the stock simply looked very cheap. They had also mostly stopped the shorts/hedges which had held them back for years. In 2020, became far more interested in the company (beyond just a "cheap stock") after reading some very convincing posts here on COBF (much thanks to Viking and others). When Prem announced his purchase of ~$150 million worth of shares in 2020, I said "game on" and I decided to swing big myself. Bought my largest chunks of shares around $280 - 320 (US). ((I also had concerns that the huge amounts of Covid stimulus $ being pumped into the economy would eventually lead to higher inflation and higher interest rates, and FFH felt like a safe way to invest in something that would potentially benefit from higher rates. In hindsight, this was probably a silly "macro bet" mentality which would have been difficult to defend at the time. But there were plenty of other good reasons to invest!)) 2022 was particularly stressful, as my employer (at the time) was in the process of shutting down my plant (chemical plant operations mgr). Oddly enough, it turned out to be a wonderful problem, because after I left this job I had the option to "rollover" my old 401k into an IRA which gave me the opportunity to buy additional FFH shares with funds that had previously been restricted mostly to index funds. I was following this very board closely (mostly lurking and reading, rarely posting since I didn't feel I had much to contribute) and had been amazed the stock price had not increased much. Bought another large chunk at ~$460. Folks will call me crazy for doing this, but over the past 5 years my Fairfax investment has ranged between 60% - 90% of my net worth. Currently trying hard to re-diversify and get it back down below 50%, but I struggle to find investments where I have the same level of conviction. Slowly but surely I am diversifying, although I have a fair amount in my taxable account which I will probably never sell. It has been a life-changing investment for me and my family, and I can't say enough to thank people here. Cheers, Kevin

-

Fairly certain this fellow is a regular on this board. Well done. It's completely incorrect to associate growth in Fairfax with book value adjustment: expert - Video - BNN (bnnbloomberg.ca)

-

Block compares Go Digit to Lemonade to illustrate his assumption that Digit's market value has obviously plummeted "into the toilet" over the last few years. Lol.

-

Another video interview of Carson Block discussing the MW short..... Fairfax Financial: The Oracle of Nothing - Zer0esTV: Video channel for short sellers

-

Well said. Even there is merit to certain "accounting gimmicks" in the MW report, the impact feels pretty silly and pointless in the overall picture. Even if you discount the book by 30%, it is still trading cheaper than peers. And then you have other items like the big pet insurance sale ($1.4 billion in 2022 ??) that seemingly came out of nowhere. If anything, Fairfax might have been guilty of understating itself. Consider incentives/behaviors. In 2020, Prem stepped in with his own money and purchased a whopping $150 million worth of shares during the fear and uncertainty of covid. He knew the intrinsic value of the business. FFH has made significant buybacks. Since the recent runup in stock price, Prem hasn't sold any shares, the company hasn't issued shares, and they still hold the TRS position. This would be very weird behavior for a company that is allegedly desperately trying to overstate its value via "gonzo-mode financial engineering." The cash flow is what matters to me. With the amount of cash that will be gushing into FFH over the next few years, it would be pretty entertaining to watch the stock drop 30% only for the company to jump in with monster buybacks. One can dream.

-

I've received the same notification from Fidelity. 0.25% obviously isn't much, but could amount to a couple hundred extra bucks per month if you have significant holdings. What exactly is the downside to enrolling? (If there is one.) Is this easy money with no downside?

-

Fairfax book value or share price will touch US $ 2000 before 2027 end.

KFS replied to Haryana's topic in Fairfax Financial

Half way there! .... Take my hand and we'll make it I swear! -

-

Right-- That was kind of my point. These specific items are important to a degree, but overall investor sentiment is the driver.

-

FFH had a P/B of >1.2 as recently as 2018. It's not clear to me that any of the items above were fundamentally better for FFH at that time. Curious how one would explain this.

-

+31% USD --- Long FRFHF throughout the year and added opportunistically. (Cheers, @Viking) --- Long BRK —- Smallish positions of Fairfax India and MKL --- At various times during the year, short MSTR, AMC, GME, and TSLA (both directly and/or via puts).

-

Congrats Viking and thank you for the excellent analysis on this company over the past few years. I seriously can thank you and others enough (glider, petec, etc.) for all the work you guys have done and shared on this board. I had been a quiet reader of this board for several years, and made a huge purchase of FFH during covid, shortly after Prem's large personal purchase of the stock, and made an additional large investment earlier this year. At this stage, Fairfax has had a meaningful impact on my personal financial situation and has probably shaved several years off my expected retirement plans... (I do not have an ultra-high income -- a 36 year old chemical engineer working in operations at a nuclear power plant.) Fairfax has "accidentally" grown to about 66% of my overall portfolio. Normally, I would rebalance to reduce the risk of being so far overweight in one security, and I may still do that only as a matter of principle, but given the future prospects and intrinsic value of the company relative to the (still low) stock price, I could just as easily stick with the full position for now... I think we are just getting warmed up, and I'm very much looking forward to what the next few years will bring.

-

Yeah, I'm on board and will contact them as well. I've been pretty tempted lately to pull some money out of Vanguard just to be able to buy additional FRFHF...... I imagine if enough people threaten to pull money off their system they'll hopefully do something about it.

-

Excellent, thanks.

-

Fair point. I guess I tend to assume Bradstreet & gang would be able to make some intelligent decisions if/when the opportunities arise, but of course you may be right.

-

There are obviously many factors impacting Fairfax's stock price as discussed endlessly on this board, but I think it’s worth remembering FFH’s price/book ratio over the past several years -- like many insurance companies -- has been fairly well correlated with interest rates as you can see in the two 5-year charts below. Just looking at some random data points over the past 5 years: P/B 10-year % July 2017 1.15 2.30% August 2018 1.20 2.95% October 2018 1.25 3.15% August 2019 1.03 1.80% Feb 2020 1.00 1.50% (just prior to covid crash) April 2020 0.70 0.65% (just after covid crash) August 2021 0.86 1.28% March 2022 (today) 0.76 2.16% Today, with the recent increase in rates, it sure seems FFH stock has not responded in the typical way…. As perhaps other factors are weighing heavily on the stock, or the market is simply asleep in failing to acknowledge this rise and the impact it could have on the company’s earning potential. Today the 10-year yield is at 2.16% and rising, and yet the P/B is lagging behind, still ~0.76. FFH’s insurance business/float has increased quite dramatically over the past few years, and one would expect rates to be an even stronger factor going forward, yet here we are. Like I said, there are obviously many other things affecting the stock as you all know, but I think it’s worth being aware of this historical relationship vs. the apparent lapse today...

-

Untold Buffett/Munger/Berkshire Stories

KFS replied to longterminvestor's topic in Berkshire Hathaway

This is a gem. Thank you for sharing. -

LOL. One of my favorites is this picture of a couple in divorce court dividing up their collection of beanie babies one by one, ~1999.

-

Agreed. I tend to include all crypto in the meme/bubble basket which I'm sure will be unpopular with some people here. I have a very small position on MSTR puts.... if (when) bitcoin drops below ~30k, this turd is toast.

-

Is this the real reason Musk has been selling his TSLA shares?? lol.

-

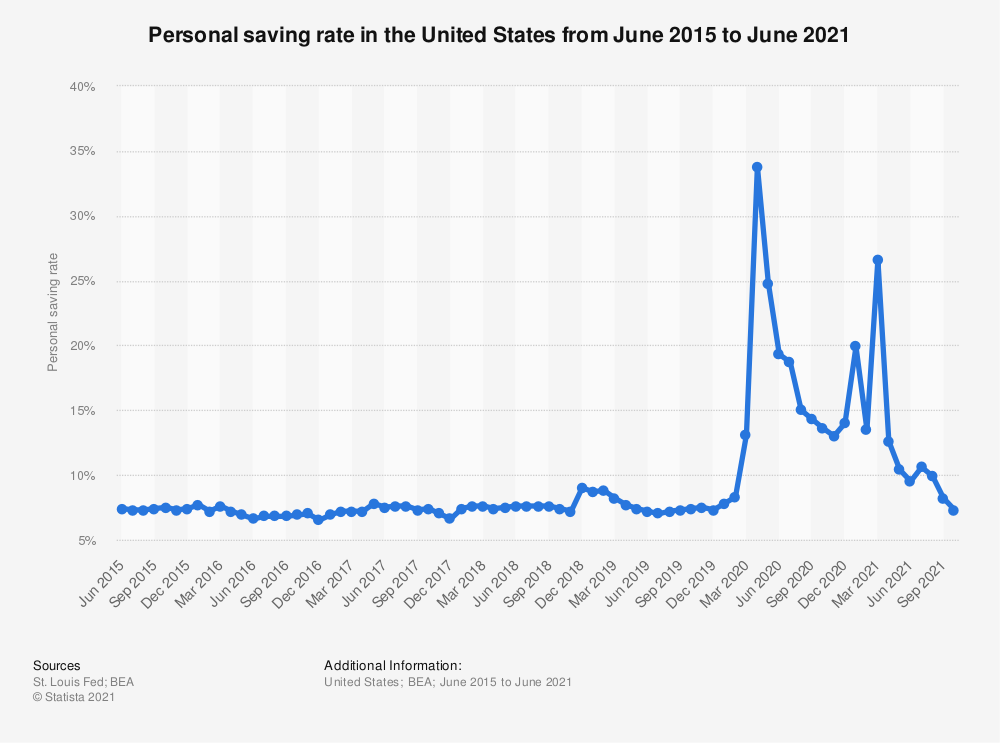

This One of the most under-appreciated facts IMO has been the surge of the personal savings rate that resulted from huge amounts of stimulus. The chart below aligns shockingly well with the meme/bubble era over the past 22 months. The savings rate finally returned to normal level around October 2021 to a rate consistent with the pre-covid stimulus era. As you said, we know the stimulus is done, and policy will begin to reverse as the Fed has made very clear recently with persistent inflation as the driving factor. No idea how or when it plays out, but it seems hard to imagine that the meme/bubble and other stocks which rocketed due to stimulus will not be impacted by the reversal of the very thing that drove them up in the first place. source: • U.S.: personal saving rate monthly 2021 | Statista

-

Very good (IMO) interview with Jim Chanos... Discussion of parallels with dot-com bubble, discusson of crypto, inflation, etc.

-

Yes, Vanguard (FRFHF) on 12/3.

-

Insightful as always - thanks Viking.