KFS

Member-

Posts

184 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by KFS

-

FFH was trading at about 1.2 - 1.3x book as recently as October 2018. Looks like 1.3x was roughly average in 2016 and 2017 and during those years it was not any less complex or any less of a "controlled entity" so I don't see how this alone explains anything.

-

I Haven't Been This Excited About Going Against The Herd in Years!

KFS replied to Parsad's topic in General Discussion

The Most Dangerous Stock Market Ever - by Ross Hendricks - The Ross Report (substack.com) -

Interesting Evergrande/China Thread: https://twitter.com/INArteCarloDoss/status/1438944431734919175?s=20

-

Margin Debt: Down for the first time in 15 months...

KFS replied to KFS's topic in General Discussion

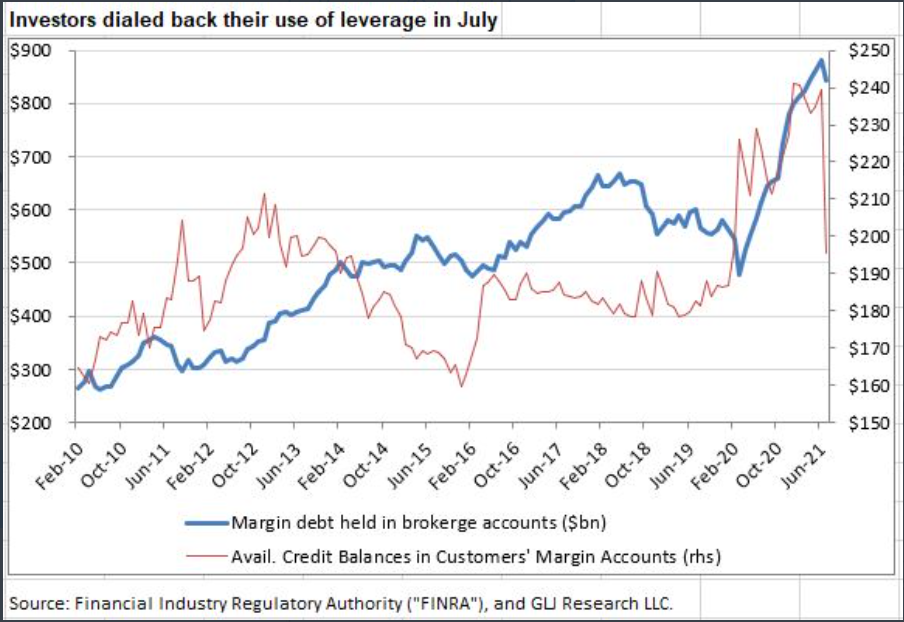

Perhaps an even more telling data point is the decrease of available credit in customers' margin accounts, which apparently dropped (plummeted) to $195 billion in July. Are margin brokers becoming more stingy with margin limits/requirements?.... With the S&P slightly higher over this period, it isn't obvious to me why they would be doing this. -

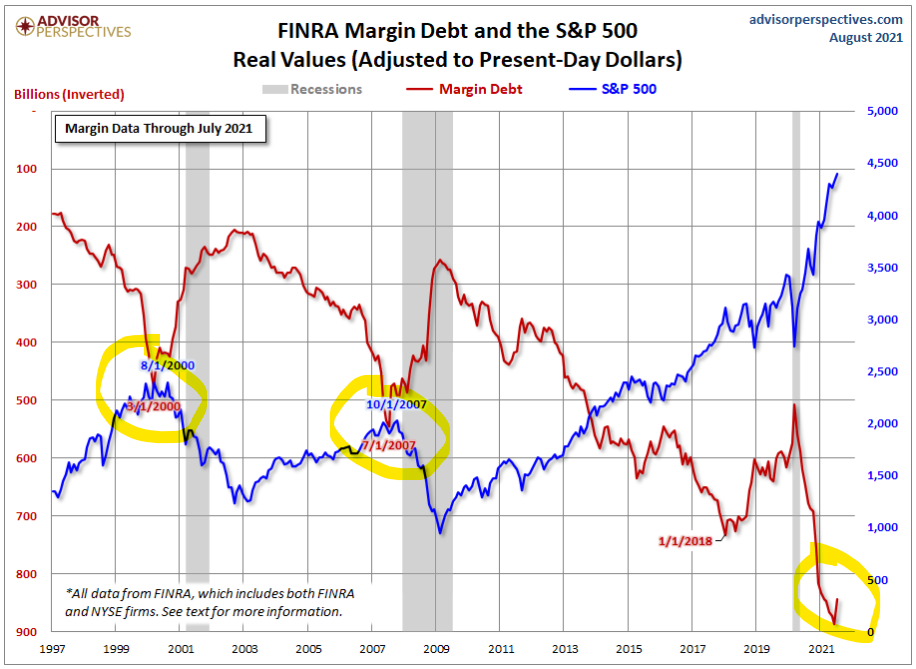

The most recent FINRA data through July shows a 4.3% month-over-month decrease of margin debt. After non-stop huge, rapid increases since March 2020, this is the first decline in 15 months. I'm surprised this topic hasn't received more attention, and while I'm not interested in making general market predictions, calling the market top, or alarming for an imminent crash - I do think this data is worth keeping an eye on.... Even if it's not terribly useful, it's at least interesting. The chart below tells a pretty clear story --- It's hard to ignore the link between stock market prices and margin debt--- 2000, 2008, and past episodes have this in common. I have recently been re-reading John Kenneth Galbraith's "The Great Crash 1929," and it is a topic he brings up constantly. Why does it matter? As Galbraith puts it, "when prices stopped rising - when the supply of people who were buying for an increase was exhausted - then ownership on margin would become meaningless and everyone would want to sell. The market wouldn't level out; it would fall precipitately." Per Galbraith, during the bull market of 1926 - 1929, margin debt would often be held at interest of 8%, 10%, or 12%. Margin rates today are a bit lower, but not by much. (The last I checked, Vanguard was offering margin at about 6-8%, depending on loan size.) History has shown that if/when market euphoria begins to subside, future expectations no longer justify these interest payments, and a drop in margin debt can correlate with a very sharp drop in market prices. Volatility should be expected, as people on margin are (for good reason) more likely to rush for the exits as markets level off and/or drop. Curious to hear opinions/thoughts from folks on this board. Is this a huge flashing red warning sign, or nothing to worry about? Source: https://www.advisorperspectives.com/dshort/updates/2021/08/12/margin-debt-and-the-market-down-4-3-in-july-first-decline-in-15-months

-

I know they were restricted during the first spike (Per Prem's comments during the call following that event), but was it ever really confirmed they were restricted during the second spike?

-

This may have already been shared elsewhere, so my apologies if this is a duplicate post. The Power of the Fed | Watch S2021 E5 | FRONTLINE | PBS | Official Site

-

Are you seeing real evidence of the hard market easing up already, or is this more of a speculation based on your past experience with cycles?

-

BB just rocketed up again - now up 40% on the day to $16. Ok, Prem, let's see those paper hands.

-

Yeah, fair enough, it's pure speculation. The prices were totally different for only a few days; the bulk of that period was closer to $12, so who knows. Time will tell. It could be wishful thinking on my part.

-

When Prem said, "If we checked once, we checked 10 times," or something like that on the last call, I interpreted that to mean he very much wanted to sell, but just couldn't. I could be wrong, but that was the way I took it. If that's the case, and he should no longer have any restrictions, it seems very likely he should be selling on this week's mania.

-

Here's a link to the "preview" BRK meeting if anyone is searching for it. Preview of 2021 Berkshire Hathaway Annual Shareholders Meeting (yahoo.com)

-

From what I've read on this forum lately, it appears I might currently be the only person here crazy enough to directly short Tesla. I have been adding long-dated OTM puts on TSLA as the risk vs. reward on these options is absolutely beautiful, in my humble opinion.

-

100% agree. The failures over the past 10 years are well understood and have been beaten to death here 100x. By the time many here are in agreement on what the front-view looks like, we will already be back to 1.3 x book value and this ridiculous opportunity will have passed.

-

Ben Graham is credited with saying something along the lines of "In the short-run, the market is a voting machine; in the long-run, the market is a weighing machine." Isn't it a little bit ironic that the powerhouse social media platform of the modern day retail investor -- Reddit -- is literally like a voting machine? Think about how Reddit works. It's a platform where users get to "upvote" or "downvote" each others posts if they like it or dislike it. If a post gets a bunch of upvotes it moves up the Reddit rankings and becomes more visible. More people see it, leading to additional upvotes. If a post gets downvotes, it quickly falls and disappears from view. If you asked Graham to imagine a worst-case literal "voting machine" to maximize this effect over people's thoughts and ideas, and over the market, it might have looked something like Reddit. I suppose similar comparisons can be made with other platforms - e.g. twitter, facebook, etc., but Reddit just strikes me as a very ironic "voting machine." Just a random thought of the day. Ok, back to work.

-

https://www.wsj.com/articles/if-tesla-bubble-bursts-catastrophe-wont-follow-11613221203?mod=searchresults_pos2&page=1 James Mackintosh: If Tesla Bubble Bursts, Catastrophe Won’t Follow Not all bubbles are equal. Britain’s bicycle-stock bubble of the 1890s holds lessons for today’s electric-vehicle mania.

-

Jason Zweig: How the Stock Market Works Now: Elon Musk Tweets, Millions Buy https://www.wsj.com/articles/how-the-stock-market-works-now-elon-musk-tweets-gamestop-millions-buy-11613147654?mod=hp_featst_pos3

-

I would give almost anything to have been a fly on the wall during this guy's charity lunch with Buffett. I can only imagine Warren's reaction. ;D ;D We are living through an amazing era. I just have to believe this "meme culture" philosophy will go down in history books and new versions of books like "a short history of financial euphoria" for future generations to study.

-

My brother-in-law, who previously did very little investing, has been talking about his latest stock pics, which he claims are "sure bets" based on his following of Dave Portnoy (barstool sports)… One of my employees (chemical plant electrician) has been talking about his Dogecoin and AMC buys. Both of these individuals are otherwise intelligent people, rational, not crazy, not gambling addicts, etc. It has become the new normal today. I do wonder if the additional stimulus $ over the upcoming months will add to the gambling. I won't rule out the possibility things will get even more crazy before the tide changes.

-

Fact check: Buffett did not donate to Biden; oil that would have been transported through the Keystone XL Pipeline will use existing infrastructure, not Buffett-owned railroad https://www.reuters.com/article/uk-factcheck-buffett-keystone-pipeline-idUSKBN2A22LR

-

Cathie Wood Has Wall Street’s Hottest Hand. Maybe Too Hot. https://www.wsj.com/articles/cathie-wood-is-wall-streets-hottest-hand-maybe-too-hot-11612544044?mod=djintinvestor_t A few highlights: "According to FactSet, 43.5% of ARK’s total equity holdings are in stocks of which the firm owns at least a tenth of all shares outstanding. At Vanguard Group, by contrast, only 9.7% of total equity positions are in such concentrated holdings. If ARK ever needs to sell any of those holdings, who will buy in enough bulk to keep prices from collapsing? "What might happen if the same investors who flung billions of dollars into ARK’s funds over the past year yank the money back out? “Not concerned about it,” says Ms. Wood. “I mean, Tesla a year ago was 10 times smaller than it is today.” (Tesla Inc.’s total market value was $77 billion at year-end 2019; this week, it exceeded $810 billion.) “That’s telling us, reinforcing our sense, that the market is beginning to understand the exponential growth opportunities out there,” which will create ample liquidity over time, she says. "At my request, Elisabeth Kashner, director of funds research at FactSet, analyzed the liquidity of ARK’s holdings. She calculates that if investors sold enough shares of ARK Innovation ETF to cause a $1 billion redemption, that would require 14.5% of the recent trading volume of its underlying holdings, on average, to change hands. For Vanguard Total World Stock ETF, by comparison, a $1 billion block sale would involve an average of only 0.6% of total trading volume in that fund’s stocks.

-

https://www.marketwatch.com/story/reddit-gamestop-booster-under-regulatory-scrutiny-11612457594 Our boy is under investigation?

-

I Need a Laugh. Tell me a Joke. Keep em PC.

KFS replied to doughishere's topic in General Discussion

Finally, an explanation that makes sense for Bezos resignation. https://www.theonion.com/then-you-ll-put-out-a-nice-press-release-stepping-down-1846189979 -

HODL?!? ;D Prem has diamond hands? ;D ;D

-

Would love to see them list 49% if they could get the same types of prices described as above. Not to cash out or support Fairfax business TBH, but to rapidly grow and take market share in the Indian markets. Given the hoops that Fairfax had to jump through before starting Digit (reduction of ICICI ownership), and given their stated focus and optimism of growth of the business in India, I'd honestly be surprised if they considered selling or listing Digit. Wouldn't this be a bit like "cutting the flowers and watering the weeds"? Then again, I suppose it wouldn't be the first time; the sale of First Capital a few years ago comes to mind. I understand the cash would be great for support of the hard market and buybacks, but I'm not so sure this is the best place to start. From the 2017 shareholders letter:: "ICICI Lombard is an Indian insurance company that we began in 2001 from scratch as a minority partner with ICICI Bank. Over the following 16 years, ICICI Lombard went on to become the largest non-government-owned property and casualty insurance company in India. Until fairly recently, our ownership interest was limited to 26% by government mandate. About three years ago, the government allowed the foreign ownership to go to 49%, which resulted in our going to 35% by buying 9% from ICICI Bank. Since then, given ICICI Lombard’s intent to go public, ICICI Bank wanting to control ICICI Lombard with at least 55% ownership, and Indian law requiring that the public own at least 25% of a public company, our ownership would be reduced to a mere 20%. As property and casualty insurance is our core business and we are very optimistic about the growth prospects in India, and as Indian law does not permit an ownership of 10% or more in more than one insurance company, we agreed with ICICI Bank that we would reduce our interest in ICICI Lombard to below 10% so that we could start our own property and casualty company in India, Digit. ICICI Lombard is a great company led by an exceptional leader, Bhargav Dasgupta, and we wish them much success in the years to come. We have thoroughly enjoyed our partnership with ICICI Bank and its CEO Chanda Kochhar and we wish them also much success in the future." Absolutely agree. They will own Digit for a long time, and rightly so. It might get listed though, to give the PE partners a way out. I don't think the sale of First Capital counts as selling a flower. I understand what you're saying, and it's a great business, but in the view of it's CEO Fairfax could not support its next phase of growth as well as Mitsui. Plus they got a great price and were able to keep a 25% profit share for no equity. Ok, I suppose listing Digit as a way out for the PE partners would make sense. Thanks.