Vish_ram

Member-

Posts

552 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Vish_ram

-

You can get this using FRED data. https://research.stlouisfed.org/fred2/graph/?graph_id=152517&category_id= The more I analyze the economic data, the more I'm convinced that market participants collectively do not pull themselves out of a bull market based on valuations. If you are in a bull market, irrespective of valuations, the market keeps on going up until Fed applies the brake. The braking action acts as a pin that pierces the valuation bubble. The market cap to GDP should be viewed in context of Fed's actions.

-

This is about wealth inequality. The pattern that I'm seeing is that any Stock market boom exacerbates the wealth inequality. Look at 1929 and recent 82-2014 booms. see http://www.economist.com/blogs/graphicdetail/2014/11/daily-chart-2?fsrc=scn/tw/te/bl/ed/somearemoreequalthanothers

-

sorry, i don't know much coding. but this one works =ImportJSON("http://api.stlouisfed.org/fred/series/observations?series_id=DGS1&api_key=bfa8a53421e527e0d002630712500fd9&sort_order=desc&limit=1&frequency=d&file_type=json","/observations", "noInherit, noTruncate") you need to pass the second parameter, you left it blank.

-

Get the google script ImportJSON from https://github.com/fastfedora/google-docs/blob/master/scripts/ImportJSON/Code.gs then in google spreadsheet, use this script and give the URL that fetches the JSON as a parameter. I used this to show data in econtracker.com

-

I spent 2 hours reading major portions of the book in B&N. His honesty was refreshing. This is biography, psychology, investment wisdom/methodology, career advice all packed into one. My main take away was that, you try to be true to yourself and have the right perspective.

-

Dumb Sears jokes, Troll posts, Mustache references and other crap

Vish_ram replied to adesigar's topic in General Discussion

here are a few options 1) treatment center for Autophobia (fear of being alone) 2) make shift kids soccer playground 3) Halloween haunted house (to capitalize on being desolate ) 4) Build prisons as this segment is growing 5) Retail museum to sell cool '60s retro stuff. This also boosts revenue ...... -

Only banks can officially lend. This includes central bank and commercial banks. If Joe lends $10 to Jill, then this lending doesn't show up in official books. Lending doesn't come from savers directly. It comes through the banks. #3 is partly wrong. Fed directly controls bank's lending by setting discount rate (rate at which banks can directly borrow from FED, this is generally frowned upon), controlling fed funds rate using open market ops (banks have to borrow the fed funds and use it as reserves) and Reserve requirement (% of reserves to be kept in case of loan default). Velocity is determined by economic activity. Higher activity increases velocity for a given money supply. The Fed can only indirectly control it by cooling the economy. Another caveat. FED is great in reducing the lending (akin to pulling a string) and FED is poor in increasing/stimulating lending (akin to pushing a string). FED can encourage lending by setting low rates, but the banks should decide to lend freely and above all ,the consumers/corp should feel good about economy to borrow. i.e. pulling is more effective in pushing.

-

I'm more worried about Asian countries that have much higher population densities and poor hygiene (India in particular). Its a question of time before it turns up in places like New Delhi and others. They need to contain it in Africa first. Hope we find a cure fast enough.

-

The income inequality is also muddled by wealth inequality. The risk takers (those having higher equity exposure) have been handsomely rewarded. I'm seeing many high income earners (docs making 300K+) afraid to invest and end up with less wealth. Bottomline, low wage earners got a double whammy. Productivity and politics on income side and FED on wealth side.

-

It is stunning to watch the median income graph. I wonder how long this can go before we see a revolution. This is bad news for Republicans.

-

What if he is going to prison for the safety of his family? You don't leave a criminal enterprise and go back to normal life.

-

There will be plenty of service jobs created. example - huge % of population in US will be morbidly obese. You need some help them change their bed pan, give them a sponge bath etc. The big % of young and unemployed (unemployable) will become (already did become) electronic addicts (years of playing clash of clans, and other games). There'll be more de-addiction centers than McD's. More jobs.. I can go on and on

-

If Wal-mart along with other companies are forced to increase minimum wage, then you'll have less income inequality. The lower and middle income wagers who are customers of walmart can buy more stuff (their spending relative to income is much higher). The wealthy would shop less at Tiffany. It may not be a bubble after all. It could be a wash too. Someone should prepare a Laffer curve for minimum wage to better understand the impact.

-

Oceanstone Fund news - James Wang has passed away

Vish_ram replied to west's topic in General Discussion

R.I.P. What a shocker!! His performance was awesome. if he had lived for another 10 years, he could have brought his AUM to a billion dollars. -

Your sister would have learnt something about the market, interest rates, fed etc after 11 years; something that the university can never teach. Now that's an education.

-

FDA finally approved Afrezza

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Vish_ram replied to twacowfca's topic in General Discussion

Thanks for the links Onyx1. I just found out that Tim Howard was the ex-CFO of Fannie Mae. I ordered his book on amazon now. http://www.amazon.com/Mortgage-Wars-Big-Money-Politics-Collapse-ebook/dp/B00GJNTO4U/ref=sr_sp-atf_title_1_1?ie=UTF8&qid=1403712820&sr=8-1&keywords=tim+howard+fannie+mae -

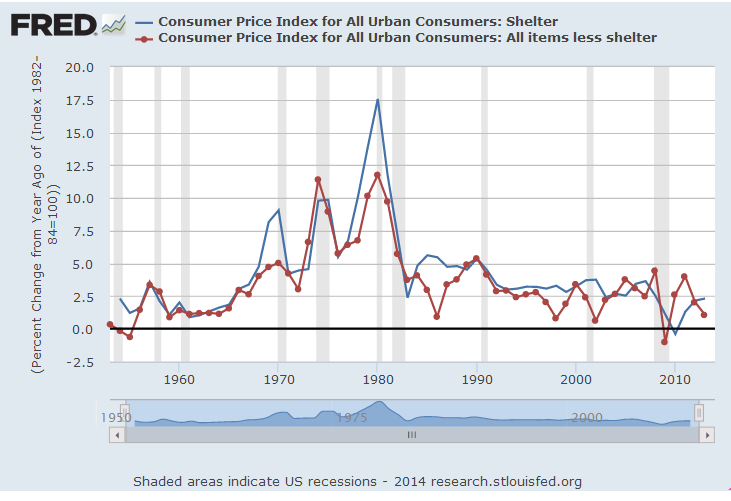

The author is incorrect; http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=E1d Check out the graph above where I'm showing both the CPI's. Both have fallen. The reason for less steeper fall in housing is due to the stickiness on way down (people freeze up and sell less when prices are down, the volume drops a lot). In the longer term, they play catch up most of the time.

-

To those that follow macro indicators, what indicators that you track can foretell a recession? I find yield curve inversion, employees in residential construction, negative growth in employees working in trucking/transportation etc to be good indicators.

-

http://money.cnn.com/2014/06/07/investing/stock-market-trading-oracle-ohio/index.html?iid=HP_LN How did he predict the 07 recession?

-

For many investors, a market returns with lower volatility (of the negative variety) is a big deal.

-

http://seekingalpha.com/article/2243613-make-70-percent-a-year-with-math I don't know why Harry Long looks pissed. Wont you be happy with this kind of returns?

-

Does anyone know if a US based RIA can manage assets for a canadian investor? Does Canada require any registration?

-

For helping me realize that you don't need money to be happy.

-

Forget investing, any lawful action is good for the society. Anyone having any interaction with society in lawful ways is good for the society. Next comes the Q, who is doing more good? Is Buffett doing more good than Buffett's barber? A big portion of Buffett's good should be attributed to his family, barber, professors, college, cops/firefighters in Omaha, tailor etc ..... Buffett used all the social capital that he could get.