-

Posts

6,531 -

Joined

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by rkbabang

-

Oh wow, I'm sorry, I didn't realize it was that bad. I'd still stay away from stocks at her age. I like the ideas above about CD ladders and maybe an annuity. My goal would be to make sure she has everything she needs or might need for the rest of her life and preserve the rest in safe assets/cash. Let whoever inherits what's left later decide what to do with it based on their age/goals.

-

I don’t know maybe leave it as it is? At $14400/year she can last another 41 years before running out of money. Maybe she should be spending more and enjoying herself at this point. She can’t take it with her. I’m not familiar with how bad stage 6 is, but I assume she can still enjoy things on a daily basis and do things which makes her happy.

-

It depends I don't really have a strategy, I just take it on a case by case basis. These were $20, Jan 17, 2025 expiry calls which I bought in early March (they were out of the money at the time). I was thinking that it was likely that CPNG traded in the $20s at some point this year. Since it is now trading in the 20s my thesis has been satisfied, so I took my profits and used a portion of it to increase my CPNG common holdings.

-

Yeah, I'm starting to learn to sell my options when they go up rather than getting greedy and wait for more. Many times in the past I've looked at large unrealized gains on my calls and did nothing, then they end up going back down and have me wishing I had sold. I've even gone on to eventually realize loses on options I could have at one time sold for hefty profits.

-

Sold CPNG calls that I bought a little over a month ago for a 146% gain and added to a few positions: CPNG common, FRFHF, JOE, MSTR, & EBAY.

-

Even if I was sure there was going to be a pull back to $60K-$65K, paying 15-20% federal capital gains taxes would stop me from selling with the expectation of re-buying. I'm just going to hold and keep DCAing. If we get a pullback I will increase my buying, but I will not sell. Not only is timing the market as much luck as it is anything else (i.e. gambling) capital gains taxes make it not really worth it even if you guess correct.

-

Great point. Situational awareness is the best thing most people can improve on. I learned this early in life. I had an incident in my teens where I was stopped at a stop sign in a city and someone opened my passenger side door and started getting into my car. I popped the clutch and hammered on the gas and the guy with only 1 leg in my car up to about the hip went flying head over heels. I never drove with my doors unlocked again. I'm buying this one. Thanks.

-

Mining gold to purchase Bitcoin.

-

There will always be some "best performing investment" over any time period. Hasn't it been something like MNST or something for the last 20 years? I've never owned MNST and never regretted it. Sure I regret selling NVDA after only 100% return a few years ago, and I regret selling Netflix at a spit adjusted $4 after a triple more than 15 years ago, but you aren't always going to be holding the best performing asset in the world over every time period possible. That says nothing about whether or not BTC is, has, or will be, a good investment.

-

Exactly. People talking about shitcoins and lumping Bitcoin in with them, it’s like if every time you tried talking about gold someone would bring up the price of tin and aluminum, talk about how their cousin claims he can use mercury to turn lead into gold, and caution you that they know 10 people who got scammed by fools gold and it’s all just a big scam.

-

They never did. History is written by the winner to make themselves look good.

-

Hillary engaging in clickbaiting too maybe? Trolling for likes? Or trying to spread lies? I don't know.

-

Yes, 99.99% of crypto really gives the other 0.01% a bad name. I wouldn't recommend putting real money into a dog with a hat coin.

-

Some Starship porn. This guy has some good photos of all 3 launches. https://www.johnkrausphotos.com/Galleries/Launches

-

You misunderstand my point. It isn’t that UFO “enthusiasts” should be believed or are more/less credible compared with the pentagon. My point is that the pentagon weighing in on the topic provides no new information, because they can’t be believed. You don’t know their agenda and why they might want you to believe a certain thing at this time. This would also be true if they suddenly said there were aliens. Unless proof is shown and verified there is absolutely no information in a government pronouncement other than “This is what we want you to think.”

-

Reduction of the 6% commission on RE transactions in the US

rkbabang replied to lnofeisone's topic in General Discussion

I’ve owned 5 houses since the mid-90’s (4 were existing houses, 1 I bought the lot and built) and I’ve never had a buyer’s agent. I’ve always contacted the agent who listed the house (or land) to show it to me. I’ve never understood the necessity for a buyers agent even in 1995 when doing your own leg work to find a property wasn’t as easy as it is now, now you should easily be able to find the houses which you want to look at and be able to contact the realtor who is listing it to show it to you. What is the point of hiring an agent? -

They can’t stand that someone with money and power doesn’t agree with their leftist BS. I saw a bumper sticker on a Tesla the other day that said “I bought this before we knew Elon was nuts.” That said to me much more about the owner of the car than it did about Musk. What Musk has accomplished is extraordinary. Getting to space isn’t easy. The proof of this is that to this day there isn’t another company or government anywhere on Earth launching, landing, and regularly reusing rockets. And there is nothing comparable to Starship. Nuts, indeed.

-

If you don't think there is just as much evidence of government lying as there are UFO nuts lying, then I don't even know how to respond. The only thing a government report tells you is that this is what that government agency wishes you to believe at this time.

-

I have no idea if they are here or not, or if they've ever been here or not, or if they have been here that they are from outer space or from somewhere else (interdimensional, time travel, etc.), but one thing I do know is that I don't trust the Pentagon to tell me the truth about what they know or don't know any more than I trust that the CIA didn't kill JFK. A Pentagon report is no information at all.

-

Yes, I watched the first 2 tries and I plan to be watching this one live too tomorrow morning.

-

-

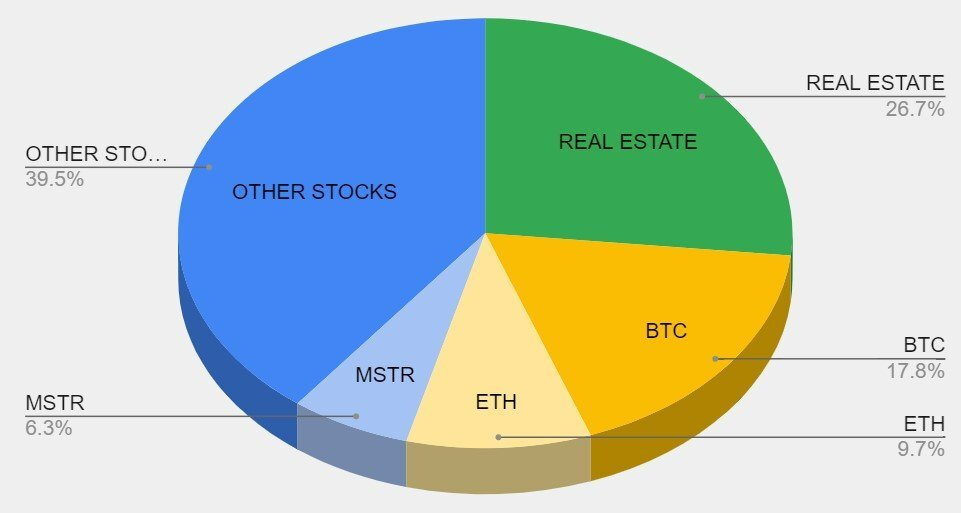

As of right now: BTC: 17.8% ETH: 9.7% MSTR: 6.3% 33.8% of net worth if considering MSTR as a crypto investment (which I do). 27.5% if only counting self custody crypto.

-

Also because of the new coins that have been mined since the last ATH in 2021 the market cap is well above 2021 highs.

-

You can also get robbed if you carry gold, which seems to me more likely than needing it for bribes. ”Venezuelan military personnel at the borders have a reputation for seizing the money of people who want to leave, but Juan’s, being in Bitcoin, was accessible only with a password he had memorized. “Borderless money” is more than a buzzword for those of us who live in a collapsing economy and a collapsing dictatorship.” https://www.nytimes.com/2019/02/23/opinion/sunday/venezuela-bitcoin-inflation-cryptocurrencies.html Also: https://brendait.blogspot.com/2022/03/what-asserts-should-refugees-carry.html?m=1

-

IF the ETF approved, will you make Bitcoin a NEW position?

rkbabang replied to james22's topic in General Discussion

Yes, it is like the difference between owing a gold ETF and holding physical gold in your safe. The ETF lets you speculate on price and trade in and out easily, but in a crisis (governments decides to make owning it illegal or starts confiscating it), or if you simply want to pay for something with it without authorities being able to block the transaction the ETF isn’t going to be of much use.