tede02

Member-

Posts

707 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by tede02

-

Long rates keep drifting up. Will we see 5%?! It's fascinating. I keep dripping a little cash in whenever we get a material move. Been buying some longer duration most recently. If there's one thing I've learned on the equity side the last 5-years, I'm always WAY TOO EARLY.

-

For sure. Leverage (and duration) is why some of the funds are down over 50% from their highs. I feel for the unwhitting that owned these things before rates started moving up.

-

Nuveen has a number of CEFs that got clobbered over the last 18 months. I've dabbled a little bit. There are a number trading at double digit discounts to NAV and pay over 10% current yield.

-

For trust money, treasurys are about as good as they've been across the curve anytime the last the 20 years. If you're worried about recession, nominal yields on bills and notes are basically 5% plus or minus 50 bps. If you're worried about inflation, REAL yields on TIPS are 2.5-3% which has piqued my interest for my bucket of safe money. I got a good laugh when Jeff Gundlach said the new mantra for individual investors is "T-bill and chill." LOL.

-

I know what you mean. Growth seems to be hanging in there. That said, I think if I were on the Fed board, I would be in the camp of lets hold rates steady and see what happens. The pressure is building with mortgage rates around 7% and auto loans in the same ball-park. Credit cards north of 20%. Consumers can deal with it in the short run by just doing nothing. But as people need to update their vehicles, move or just incur large expensese they were accustomed to borrowing for with cheap credit, it's going to bite more and more as each quarter ticks by. We'll see what happens.

-

I'll take it! The last 12-18 months have been amazing to follow. Consensus has been wrong over and over again. I got out of PFIX earlier this year when it looked like long rates had since peaked. Big mistake! My humility is only allowing me to buy 5-year TIPS in case yields actually move higher for longer. But if real yields hit 3%, I'll probably dabble in some 10-year on money that I would otherwise just have parked in cash/I Bonds, etc.

-

Long yields jumped again. 10 year is closing in on 4.5%. Shorter duration TIPS are 2.5-3% real yield. I'm dumping my I Bonds and moving to TIPS.

-

My gut tells me 2023 will be the bottom for office REITs unless we get a big economic downturn in 2024. Sentiment has been so negative. But who knows. I'm not making any big bets. It's tough to gauge what the next 1-2 years looks like. Corporate America is calling everyone back. Yet, my neighbor who works for Wells Fargo and is in a position to know, told me that despite the call back to the office, the company is cutting its office foot print. This is just one anecdote but it made me think weakness will persist probably for several years as leases expire and companies trim down to what they've realized they actually need in the post-pandemic world. Maybe that means cutting 5-10% of leased space across corporate America. One thing I've learned in markets is how price is always set at the margins. In other words, relatively small changes in supply or demand of anything can really disrupt a market.

-

I'm wondering when the market is going to get jolted because long yields keep edging up. In-fact, the earnings yield on the S&P500 has dipped below the 10-year treasury. These things can always go longer than you think but the pressure on equities is going to keep building if rates continue to creep up.

-

Yes, absolutely. The quip about return on cash was personal to me. IE the money I used to buy the TIPS would otherwise be in cash or treasuries.

-

LMAO! I thought the exact same thing.

-

I bought TIPS for the first time this week with real yields over 2% (chart is slightly out dated). When you think about earning a 2% real yield on cash, that is pretty damn good historically. aven't been in this range much historically.

-

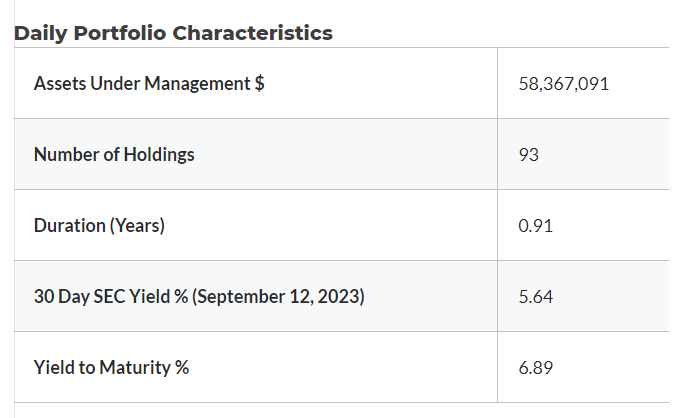

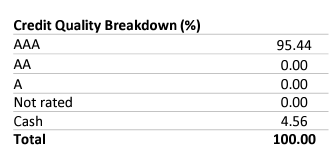

On Jeffrey Gundlach's quarterly call this afternoon, at the very end he made a quip about one of their ETFs that caught my attention. One of their newer offerings is DCMB. Basically buys CMBS. Gundlach said if you want to beat money market funds over the next year without taking much risk, buy DCMB. Portfolio is 95% AAA with a duration of 1 and a YTM slightly under 7%.

-

I'd suggest identifying firms/money managers you admire/or interested in working for and write them an old fashioned letter. Firms are always looking for talent and there are plenty of people that are willing to give a young ambitious person an opportunity to get started. There is something about receiving a physical letter. Hell, I wrote Warren Buffett in 2007 with essentially the same question and he wrote me back (He had "no ideas" regarding value oriented investment firms in the Twin Cities).

-

I've come to find preferreds interesting and overlooked by the markets. I think part of it has to do with retail investors not understanding them and also the fact that low volume may keep large institutional buyers away. I like them as a way to get both income and some equity like returns when something is beaten down, with less risk. For example, I own both the common and preferreds in SRG. My common investment is going to be a big loss. But my preferred investment is going to end up as a strong double digit annualized return with my average price being around $18 vs. $25 par plus the $1.75 in annual dividends I've been collecting. I also grabbed some SYF preferreds in March when the banks sold off. The price is basically unchanged today. The preferred sells for $16.30 vs $25 par and pays $1.40 in dividends (over 8% yield). In March, the common looked cheap but I hadn't done deep analysis on SYF. I figured the preferred was a safer way to get some exposure (albeit was a small bet).

-

Mayo Clinic shifting interest rate risk to pension participants

tede02 replied to tede02's topic in General Discussion

@Blugolds11 I basically concur. I was thinking the exact same thing with respect to rollovers in recent years. I'm sure many pension plans ended up writing some huge checks that their actuaries never anticipated (when rates were rock bottom). My reading between the lines is this is all about shifting interest rates risk onto the employees. I've been in the financial services industry for 15+ years and sadly, virtually every time I've seen a company messing around with its retirement plan, it isn't good for the employees. -

Last week I was asked to evaluate a pension change the Mayo Clinic is rolling out. Employees currently have a traditional defined benefit pension plan. The plan states a participant's accumulated benefit via a monthly dollar amount. Someone earning $100,000 annually accrues a $117 benefit each year (they'd have a $1,170 benefit after 10 years if their salary stayed the same), etc. However, Mayo is changing the plan so participant's benefits are accumulated as a lump sum that they can choose to roll over at retirement or convert into a monthly benefit. They are essentially trying convert their pension into a quasi 401k that can be annuitized. The catch is the MONTHLY benefit wouldn't be known until a participant elects to start drawing benefits. Thus, it would be similar to purchasing an annuity in the open market. The monthly payment would be completely dependent on where interest rates are when they elect to start. Mayo is telling participants that the benefit to them (for making this change) is they know exactly what their lump sum amount is at all times. But, this looks to me like the pension plan is trying to shift the interest rate risk onto participants. In theory, if interest rates were unchanged, the plan formula is supposed to create an equal benefit to the current methodology. But I'm thinking participants may be better sticking with the defined monthly benefit. They know exactly what they'll get at 65. If interest rates happen to fall, they have the optionality to take a lump sum. If rates are high, the lump sum isn't as attractive but they still have their monthly benefit which isn't impacted by rates. Current participants have the option to opt in or stick with the traditional pension formula. I'm trying to think of reasons why I'd want to opt in to the newer formula. It seems like the only scenario where I'd rather have a known lump sum (the new formula) is if I was very confident interest rates were going to be high.

-

I've never bought TIPS but I'm seriously thinking about it. I was going to dig into it more this week to make sure I understand the basics. What's striking is how the media narrative has dramatically shifted over the last few weeks as rates have gone up. Now I see headlines everywhere that "rates are higher for longer," etc. I don't think anybody has a clue.

-

I should expand on my comment. My wife would always start with the baby in the crib. Similar to what spartansaver said, if the baby cried, at some point she would make a judgement call and let the baby sleep in bed if diaper was clean, baby wasn't hungry, etc. Now with a 4 and 6 year old, I fully agree that a regular routine is key.

-

My now 4 year old was challenging. My wife and I ultimately started sleeping in separate rooms so the baby could sleep in the bed with her. I give my wife a lot of credit. She did a lot of reading to figure out the best approach. And her conclusion was allowing babies to "cry it out" was psychological torment. She explained it to me that a baby's brain can't reason. They're crying for any of many reasons. They need something even if it's just security. One author also pointed out that until very recently in human history, babies/kids would sleep with their parents for a long time (and probably still do in certain parts of the world). That resonated with me.

-

Here's a really good discussion with one of the congressmen pursuing this issue, Jared Moskowitz. He brings up a key point that intrigues me...that being, there continues to be a major push-back by the department of defense and intelligence agencies against any inquiries into this issue. It begs the question, why? Most recently, one of the whistleblowers was subject to a major hit piece in the Intercept about his struggles with PTSD following service in Afhganistan. The author of the piece actually acknowledged that intel/defense sources guided him to the dirt so he could put it out there. Again, it raises THE big quesiton, why? If everything the whistleblower Grusch said (under oath by-the-way) was just a made up story, why would you try to not only stop the hearing from happening in the first place, but then go even further and attempt to smear his reputation in the press? It doesn't make any sense. There's clearly something that these organization are trying to protect. Maybe it has nothing to do with aliens. Perhaps it's some massive misappropriation of funds. Whatever it is, congress is getting closer. Like Burchett said, you know you're getting close to the target when they start shooting at you and that is exactly what's happening. .

-

I've been nibbling on 10-year notes when the yield has pushed north of 4%. But this is small dollar stuff. It's money that would otherwise be in some-type of cash equivalent. If rates fall, I'll celebrate the capital gain. If rates rise, I'll shrug my shoulders and hold on. I'll call it a barbell approach.

-

Bond yields are moving back toward their highs. Will be interesting to see how equities respond.

-

I understand the point about needing evidence to verify. Of-course. However, it's increasingly looking like the pentagon is sitting on a load of data including optical, radar and satellite, but is fighting tooth and nail from releasing anything. Frankly, it seems to be a good strategy for them. As long as little to nothing gets out and into the public domain, the narrative of "there is no evidence" can perpetuate (as a half-truth). It's self reinforcing. What piques my curiosity is the current UFO office (AARO) has up-to-this point downplayed the hundreds of cases they are reviewing. The narrative is, "most of the cases are mundane, we can explain 95% of what we're seeing, etc." OK fine. Then lets see what you have. Why would pictures of balloons and floating plastic bags need to be classified? If it's OK to release drone footage of a Russian jet or the Chinese balloon, then the "protecting capabilities" argument doesn't hold up. My read on this is the pentagon just wants it to go away in the worst way. They know if they release anything, it feeds further public interest and chips away at the "no evidence narrative." What's intriging is how stiff the resistance is. What are they sitting on? The good news is it looks like senators including Schumer, Gillibrand and Rubio know a lot more than the public which is why there's a bi-partisan push to start opening things up.