tede02

Member-

Posts

707 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by tede02

-

This is a very interesting article describing how the fundamentals are in place for the cylce to turn. I'm always fascinated by cyclicality and the basics of supply and demand. There's also an interesting point in the article distinguishing the office recovery from the residential recovery post-GFC. The point is office is more likely to echo the bifurcation in retail space where there are still dying malls across the US but modern "experience" properties are doing exceptionally well. Will be interesting to look back 3-5 years out. https://www.cnbc.com/2023/11/26/the-looming-office-space-real-estate-shortage-yes-shortage.html

-

The other thing I always take away from the lists is the wealth was created by extreme concentration in a business (vs. gold, real estate, bonds, commodities, crypto, etc.). Great companies have produced the most wealth by a long-shot.

-

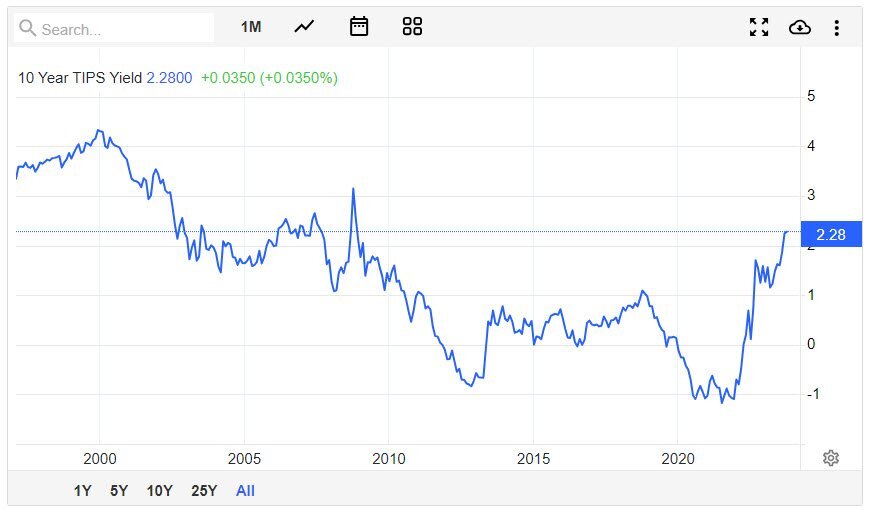

I bought a fair amount of TIPS when real yields surged over the last few months. But I'm starting to wonder if nominal treasuries (bought at the same time) will end up being better over 5-10 years. Inflation really appears to be coming down whether you're looking at the CPI or ongoing reports from retailers that are consistently seeing sales weakening (Walmart, Home Depot, Best Buy, etc.). Additionally, rents are flat and even contracting in some data which isn't yet reflected in the CPI. Also seeing weakness in commodity prices (oil in particular). Another two months of this will create a pretty convincing trend.

-

I think I mentioned this previously, but DCMB still looks interesting. It's basically a portfolio of CMBS managed by one of the best firms in this space (Doubleline). The portfolio is virtually all AAA with an average YTM of nearly 7% and duration of 1. Probably will add to my holding as some T-bills mature.

-

One opportunity I've found for individuals in fixed income is with new-issue brokered CDs. As I understand it, a broker (like Fidelity or Schwab) will put an offering on their platform that doesn't settle for up to 30 days into the future for example. The opportunity exists when there is a big move in rates. For instance, the 5-year treasury was just under 5% at the beginning of November. Rates took a hard swing down and now the 5-year treasury is hanging around 4.5%. CDs are usually close to treasuries. But on Fidelity's platform, you can presently buy a Wells Fargo non-callable 5-year CD that yields 5.05%. It doesn't settle out until 11/21. I grabbed some this morning.

-

-

One of my favorite companies! They fly under the radar pretty good. I got super lucky and bought quite a bit for me and some family members in February 2009. Not quite a bottom tick but pretty close. I've sold along the way up and just kick myself in the ass. Been looking to opportunistically re-build my holding.

-

Goin whtitetail hunting in central Minnesota.

-

This seems like semantics. If the Fed is expanding its balance sheet to buy the debt that the treasury is issuing to finance the deficit, is that not money printing?

-

Repriced today with a 1.3% fixed rate. TIPS still seem better at what amounts to a 2.5% "fixed" rate (ie real yield) on longer maturities.

-

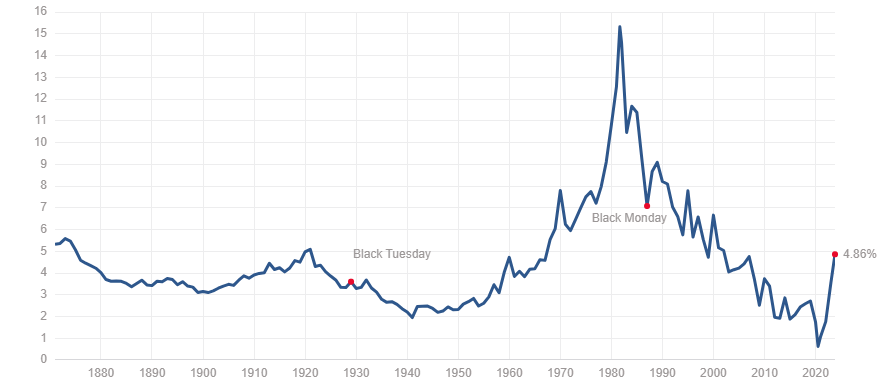

Rates definitely could go higher. But one thing I found interesting was something one of the PGIM fixed income guys told me. If you look at a 100+ year chart of the 10-year, the only time it was significantly above 6-7% was in the 80s during the Volker years. Outside of that period, long rates have overwhelming been under 6% over the past 150 years. That said, I don't personally have strong conviction either way. As rates have jumped and broken through their highs this year, I've just opportunistically grabbed some small dollar stuff. If long-rates fall 100-200 bps, I'll earn a nice capital gain. If they go higher, I'll just collect my coupon and keep buying.

-

I'd recommend starting with Peter Lynch's One Up On Wall Street. It was written for a general audience so it's easy reading and provides a great foundation for understanding the market and what individual stocks represent. If you're completely new to the game, you may find Buffett's letters somewhat technical. Joel Greenblatt's "Little Book that Beats the Market" is also a good one to get started. And I would agree that there is endless stuff to watch on YouTube. Buffett did a series of interviews with Charlie Rose in the mid-2000s. They were influential early in my investing career.

-

Yield on the 10-year plunged before I could grab a few over 5%. Damnit Ackman! LOL.

-

This is a really good point that I think is not well understood. There's probalby few people worried about deflation but the risk (of declining principal on TIPS) does exist for some of the older issues that have all the built-in inflation. I've been thinking about this because some of the issues I've bought are way above par. We could get deflation in a hard landing but I'd bet it wouldn't last given the pattern of fiscal and monetary responses to crises since 2008. The other basic thing I like about owning individual bonds, particulary longer duration, is you always have option to just hold to maturity if rates move up and you're sitting on capital losses. Pupil alluded to this in one of his points, but there is no maturity on a fund so there's more risk of principal loss. There are a lot of bond funds that are down well into the double digits over the last 18 months. Not much investors in those funds can do except hope rates decline.

-

The huge increase in networth (household equity) has got to be a driving factor in the economy's resiliency and the gradual slowdown of inflation. It's nuts when you think about housing alone which basically went up 40% since early 2020.

-

Added a little to my 10-year holdings and 5-year TIPS today. Keeping my purchases small. I'm gravitating toward a barbell approach with money market on one side and stuff that matures in 5-10 years on the other. But my barbell is much heavier on the money market side. I'm too chicken to make a big bet on duration.

-

This doesn't surprise me given that most office real estate is leveraged 50%. A 25% decline in price hits the equity by 50%. It's going to be rough waters for some time. Most buildings probably don't economically work in this rate environment unless they're at least 80% leased.

-

All good points. I looked up where the 10-year nominal treasury was in 2000 vs. CPI. The spread at that time was around 400 bps. That also explains to me why real yields were so high at the time. Let's say CPI is 3.5% this year. The 10-year is only 110 bps over that which makes TIPS look quite attractive by comparison.

-

That last chart is pretty crazy.

-

Why do you think the real yield on TIPS has popped up to the high end of the 20 year range? Further, why were TIPS real yields at 4% from 1999-2001? Are TIPS just moving in response to nominal yields also developing a spread over inflation?

-

Absolutely! My wife and I had our eye on a property which was literally across the road from our old house. Had a purchase agreement in Feb 2020 then the world started falling apart. OMG I was nervous. But things worked out and I'm basically living on what's as close to "the dream" property as I could imagine. 35 acres with a mix of woods and pasture and hay fields. Hope to be here for 40+ years as long as our health holds up. My oldest daughter (7) asked me one time, "Dad, when are we going to move." My answer...hopefully NEVER! LOL.

-

I agree that low inventory will put a floor on housing prices. Maybe they come down 10% but nothing like we experienced post GFC. I bought my first house in late 2008 and the situation was completely opposite, there were forclosures everywhere. Now there is nothing to pick from. I think I timed the mortgage market perfectly with a refi in Aug/Sept 2021. I noticed how low nominal rates were AND how tight spreads got. Locked in 2.375% on a 30 year with no points. In hindsight, I wish I would have paid a point and locked in at 2%!

-

This is exactly what I've been thinking about. If we get a hard landing, probably will have some deflation. I've bought TIPS and regular notes because I don't have strong conviction either way. I hope we get a soft landing but who the hell knows.