modiva

Member-

Posts

78 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by modiva

-

Thank you @Parsad for the commentary!

-

I have 30% weight in Fairfax India with an average cost of $11.5 and an average duration of 18 months. I intend to hold for long as long as the book value is growing every year and no major change in thesis.

-

I am investing in a private oil field in Texas, which has proven quality reserves with reliable monthly distributions, long-term attractive returns and significant upside potential. If anyone is interested to learn and/or participate, I am happy to share details. Please ping me privately.

-

Phenomenal results and outlook. Congrats to all the longs!

-

Thanks Viking and everyone for sharing notes. I couldn't come there in person and had to settle for live webcast which I enjoyed listening to. Besides all the things about strategy, numbers, market etc. I am impressed by their culture. How they treat their people, how they don't do layoffs, the long tenure of the leaders, and importantly how they sustain their culture across geographies and acquisitions. Culture is #1 determinant of long-term scale and success, and their success in this area further reinforces long-term conviction in Fairfax for me.

-

I like Epsilon and have 5% position. No debt. High Cash (about 35% of market cap is cash). Hedged till October (sell gas at high prices). They could buy back all their shares with current cash and 2 years of earnings (Assuming earnings remain same as the last year).

-

Fairfax and Fairfax India (50), Cash (30), remaining in BRK, PXD, EPSN, BAC, CME

-

Correct. By ownership, they have the right to develop and monetize the land. Higher value of the land translates to higher cash flow.

-

Fairfax India has ownership in 460 acres of land near the airport through BIAL. BIAL is currently valued at $2.6B based on discounted cashflow. The land alone could be valued at $0.5-1B, and potentially $2B once it is fully developed. This is based on retail lot pricing and commercial value is generally higher. Based on the current developments such as the 3D Tech Printing Facility, Taj luxury resort, Concert etc., and the vision for luxury retail, business parks, community etc. the value is reasonable. Basically, the land alone makes up 20-40% of current value and 80% of future value.

-

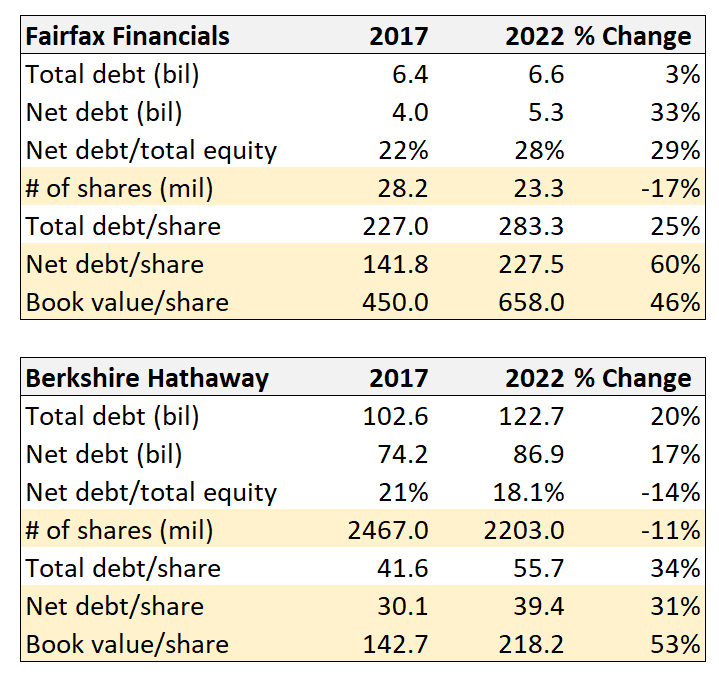

Agreed. For comparison, Fairfax's net debt is twice that of Berkshire's. Fairfax's net debt is ~35% of book, while Berkshire's is ~18% book. Total debt to book is 43% and 25% respectively.

-

BAC, EPSN, add to Fairfax

-

True it helped with more buybacks, but overall, their debt isn't translating to greater equity returns yet. The comparison is to show how BRK's debt is translating to greater equity returns (relative to FFH).

-

@SafetyinNumbers The key is if the returns on debt are better than otherwise. Let's look at the numbers for Fairfax and compare with Berkshire for the same period. Although, it is not apples to apples, exactly. I put together these numbers quickly from the annual reports so they may not be precise. During 2017-2022, Berkshire's book value went up more than Fairfax's book value, despite Berkshire's share count went down less than Fairfax's share count (and all the other good things such as increase in float etc.). Fairfax's net debt went up much more in that period. This doesn't make Fairfax's performance any less impressive. It is that the equity returns should be more than the debt increases. Perhaps there is a time lag, and we see outsized equity returns in the coming years, but they are not there just yet.

-

The annual letter is a great read and is why Fairfax is my core holding at >50% (including Fairfax India). The table below shows how impressive the performance in the last 5 years has been. The % change in the equity/share at 46% is the lowest compared to other metrics. It would have been higher if the leverage was lower. I am hoping that they make it a priority to bring it down over time.

-

I can see how it doesn't look dirt cheap from BV perspective. But from earnings perspective at 6x multiple, it looks dirt cheap considering the strength of the fundamentals. Especially with S&P 500 at 20x currently, or at 15x during times of past recessions. I don't know the historical BV to PE multiple for Fairfax, or for the insurance companies in general, it would be good to understand.

-

Thanks for sharing @Viking. It makes sense. Fairfax and Fairfax India together make up about 55% of my public portfolio. I plan to sit tight for some time. I think Fairfax India should reach $20 and Fairfax should reach $1,000, sometime in the next 2-3 years. I expect Fairfax India to reach $20 much sooner.

-

Wow. Thanks @Viking for detailed insights.

-

@RedLion Each land is purchased by a private fund where I am an investor and a general partner. A typical purchase is 500-2000 acres at a price point of $25-75M. Not all land is equal. The due diligence and thesis to determine what makes some land a high potential (5x potential in 3-5 years), with minimal downside is key. I can share details of a recent deal privately if you like.

-

38.5% YOY growth in 2022 across my public and private investment portfolio. Key drivers of the growth are: 1) Sold 100% of Tech at 5-10% below peak (long for 5-10 years) and invested the proceeds in private lands at a good discount. The land thesis comes down to strong demand/supply imbalances, real assets being true beneficiaries of inflation, and value addition plan as a catalyst. 2) Bet big on Fairfax Financials, which reached 60% of public investment portfolio at one point, but since then sold some to buy Fairfax India (currently, 30% of my public investment portfolio) which I expect to return 50-100% in the next 2 years, with minimal downside. 3) Smaller 5-10% size investments in Berkshire, PXD, ATCO (sold for some nice profit). What didn't go well: Smaller 5-10% investments in Baba and Prosus. Exited for loss.

-

Thank you Viking! I benefit from your generous sharing of your work.

-

Many large energy companies are increasing their CAPEX in 2023 which is bullish for the market. As the stocks look 6-12 months ahead, it is possible sign that the prices are likely to catch up to the stock prices (vs the other way round)?

-

Congrats. It is an amazing ride for the last 2-3 years. It promises to be just as amazing in the next 2-3 years. My target is USD 1000.

-

Thanks, that's a good framework.

-

Started position in ATCO

-

Buffett is greatest simply because of his soft power. He helped create (or cause) many greats by his actions, teachings and influence. Those greats helped (or cause) many others by their actions, teachings and influence. All this happened in one lifetime. Perhaps that will continue for generations.