-

Posts

15,659 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Russia-Ukrainian War - Political

Spekulatius replied to changegonnacome's topic in General Discussion

I dont predict anything other than the European leaders having very little influence on the outcome here. Russian gas is done and could be turned off at any moment, so they need to find alternative means to keep home heated the industry going. Lack of power wont be the issue, there is enough spare generation capacity in the grid to keep the light on. -

Buying real assets denominated in Euros

Spekulatius replied to Red Lion's topic in General Discussion

European stocks are very cheap right now and many have sizable business in the rest of the world. They also benefit from low Euro if they export in the US. I think there are great opportunities investing in Europe right now, similar to the Greek debt crisis back on the day. The risk of recession is real but a lot this is priced in. I would look at exporters and those with world wide business as well as some local champions. -

I haven’t listened to this episode (and wont), but if the couple spent on ~28% of their income on housing, thats about what I spent when I bought my first house. I think it is highly likely that purchasing the condo isn’t the problem, they go broke because they spent too much on other stuff. Festivals for example are hideously expensive and over priced nowadays. Thats where I would start cutting back.

-

Russia-Ukrainian War - Political

Spekulatius replied to changegonnacome's topic in General Discussion

Just one mans opinion: -

@StevieV I showed the iron ore chart just to show how closely correlated the direction of equity prices is with the underlying commodity. Its not because I think it should trade like this. Same seem is true for energy, to some extend, although I think there are more confounding factors. I agree I have a myoptic view of these sectors. I have invested in energy and commodity stocks longer than many are alive here and have had more misses than hits. In particular l, I have lost money when I was wrong about the price or the underlying commodity almost EVERY SINGLE TIME. I gave up on commodities in 2014 when oil prices started to decline and really haven’t done anything in this sector there since. This has nothing to do with ESG but more that I found it impossible to predict the direction of commodity prices and every time things looked certain it turned out that it wasn’t though. People here thing that we cant add supply but I disagree. If prices stay high I think some stuff will happen that nobody here accounts for. Just to add one possibility, do you guys think that the US is the only location with shale deposits? Why would that be? Europe has shale deposits for sure, but they may wont use then am although I am not sure that countries like Poland etc may get to that point. Argentina has a huge shale deposits (Vaca Muerta) that rivals the largest US deposits and is just about starting to get exploited . There are likely dozens of deposits like this that nobody knows yet about. These bulk of these countries doesn’t care much about ESG either. Then there is Venezuela which is coming back (even with the government morons in place) and if you have s change all of a sudden a fee million barrack of supply will come on in a relatively short period of timeframe. I would go so far to say that one political decision in or about Venezuela could kill your oil bull thesis right there, because think this country alone could lift as much oil than Russia potentially. that would be a disaster for prices most likely because Russia really hasn’t reduced their oil exports yet, just the destination has changed.

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

@Blugolds11 Great list. My simple rule that every western with Clint Eastwood is good. I disagree on the True Grit remake, I liked that one a lot. Some newer westerns one that I really like are: “ Hell and high water” and I also think that “No country for old men” could count as a contemporary western. Then we got the “ Power of the Dog” (probably not everyone’s taste, but a great movie). I really enjoyed the “ Ballad of Buster Scruggs” novellas, but then again I am huge Coen Brothers fanboy (hence my liking of True Grit). -

Why would there be a shift in attitudes? The ESG folks are still growing and if you listen to the younger generation, they are not going to go back to the old days. Some of the other investors like me don’t buy commodity stocks when the commodity is high, they have seen it all. Many don’t buy commodity stocks because they have been burned several times over. I don’t think there that many incremental buyers actually. The only thing you can rely on are capital returns. In that respect, the miners like RIO, BHP seems to be ahead of the oil stocks here. You want to see a clear capital return framework with cash dividends, not buybacks. Buybacks are nonsense, because they only occur at high share prices when the companies are flush. If you dont believe me, look at how many oil companies bought back stock in 2020, there are virtually none. Buybacks are always buy expensive, buy nothing when cheap. If companies would just concentrate on paying dividend per formula on excess cash flow, it would be way better for investors. Thats why I like PBR, despite the political issues. If SU and CNQ starts to do the same thing and just issues double digit yielding dividend per formula from their earnings (lets say 60% of their net earnings), I would be a whole lot more interested and put some in my tax deferred accounts. Right now, there is virtually no oil stocks that provides a better distribution yield than my ORI holding for example.

-

XOP contains crappier companies than XLE so what I imagine happens is that in every downturn (2015, 2020) , some go bankrupt or in dilution hell, so the equity in those is toast. There is no recovery from your equity being toast and only partially from dilution at the bottom. That is why I imagine those ETF undercover m the underlying equity. The other reason is that while equities follow directionally spot prices, its not (and should not be) a one to one correlation. Equities should rationally trade based on LT cash flows, not on spot prices. LT cash flows depend on the prices in the future and the expect stunk for those are reflected in the crude future a few years out. Right now a quick loom shows that crude futures for Dec 2025 futures trades for ~$70/brl and that is why E&P companies are valued as if crude trades at around these values. I have no view whether these assumptions are correct. If you do think these prices a will rise, you should think about trading specific crude futures rather than oil stocks, imo, .

-

@LearningMachine - OPEC only controls about 37% of the crude supply and they have not shown any ability to control the prices - otherwise the crude prices would not be that volatile. https://www.statista.com/topics/1830/opec/#dossierContents__outerWrapper Iron ore has 3 large producers VALE, RIO and BHP and the largest customer is China (but end consumers are elsewhere because a lot of the iron from China gets re-exported as goods). I think Iron ore has a price floor around $75/ton at which point anyone except the big three does not make any money. That's what I like about iron ore - it is more a natural resource based commodity than a political one. It's also relatively cheap now (iron ore trading around $100-105) historically while energy is quite expensive. I also don't like with energy that the low cost producer (Aramco) is not investible for me.

-

I have stated in the past that in order to be successful investing (or speculate) in commodity stocks, you need to be right about the direction of the underlying commodity. Sure there are company idiosyncratic issues, but for the most part, it is the direction of the underlying commodity that determines the outcome. Here is an example I pulled together from an another sector - mining. RIO is a miner but predominantly , their most important commodity is iron ore(roughly 75% of their cash flow). Now if you create a chart of the underlying commodity and the RIO share price, you will find that they correlate quite well: The conclusion seems simple - you need to buy RIO (or Iron ore futures) when Iron or is cheap. RIO is pretty good because they are a low cost producer with BHP and Vale so nobody really can underbid them at the low points without taking heavy losses. So RIO is unlikely to go out of business. I think pretty much the same applies to all other commodity stocks. The only way to relatively sure way to win is to buy when the commodity is cheap. if you own a low cost producer that can't go out of business, there is almost no way you can lose money short of an exogenous event (nationalization, fraud, severe operational issues with mines etc). I also think that it makes little sense that a miner with long life resources trades up so much with iron or spot prices, but I can't argue with Mr Market and I don't make the rules. Anyways, make of this what your want. I think it applies well to energy and oil stocks as well. but there are other factors at play here, as the market structure seems to be a bit foggier than with iron ore. For once with Oil, the low cost producer is Aramco and other Gulf states, not the ones the people typically buy. Aramco can be bought, but has political risk and trades also based on that. FWIW, I think RIO is starting to look attractive here.

-

Bought some USB.

-

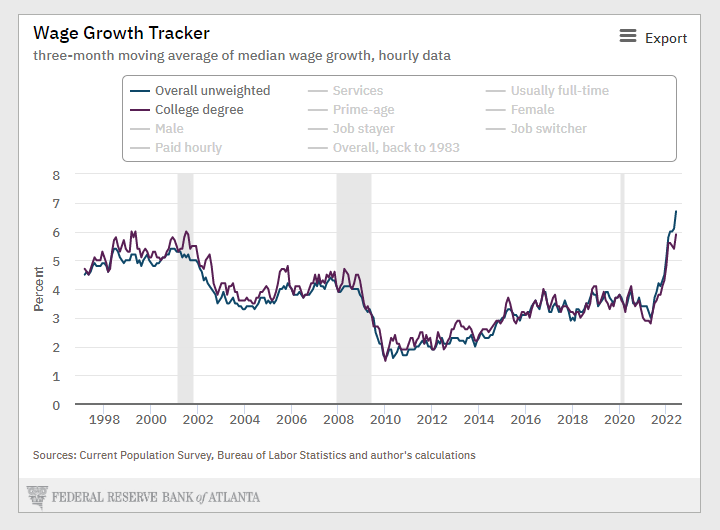

Yep, current wage of wage increases is 5.5-6% overall, which trails inflation of 9% YoY. That's a 3-3.5% loss in purchasing power on average. Stimi checks (which did not count towards wages too) are gone as well . So the vast majority of people probably has 3.5-6% less income (counting the stimi checks last year towards income). With the consumer spending being 70% of the economy, how can we avoid a recession here? I don't see it. Now the consumer is flush and has some excess cash which is going to be spent (we know what it is because the savings rate is pretty much at a record low) but that only last that long and is probably gone for the lower 50% at that point.

-

The Bundesbank (as long as the DM existed) had the Single Mandate of price stability as well. This is not the case any more with the ECB now in charge of the Euro. I like the single mandate better because I do not really think that central banks can fix structural issues in the economy like unemployment. My sense is that if you try to do this, eventually you destroy the money and still haven’t fixed the structural ailment. We are seeing the extreme of this in Turkey where Erdogan seems to be hell bent to run both his currency (Turkish Lira) as well as his economy into the ground with his unconventional central bank policy. In practice, even the Bundesbank was beholden to politics back in the day but their independence did serve as a counterweight to populist policies affecting the stability of the currency. As for the Canadian dollar, I suspect it doesn’t move against the USD because the Fed will decide on a similar 0.75% move or perhaps even a 1% move on their next meeting. Just a reminder that back in 1980, we had a 5% move at some point.

-

Core inflation does contain inflation, rents, lot's of services etc. Let's play the guessing game - assume inflation cools off, but core inflation sticks around at 5-6% the remainder of this year. Bullish or bearish? I think it's the latter. What is the Fed is going to do in this case?

-

It's possible, but I think the Fed may have to do more. My guess is we have seen the peak in CPI but the sticky components (or core inflation) may not back down. That could be a disaster too. Just check the 70's if you think that's the playbook. Inflation was not consistently high - it varied quite a but, but tended to surprise people on the upside and that's not a good thing. Just putting it out there. I don't think I am smart enough to predict what is going to happen.

-

Oooff, probably the top for inflation, but watch out for core inflation data: https://finance.yahoo.com/news/june-cpi-preview-inflation-likely-surged-to-new-40-year-high-last-month-215233961.html “Core” CPI, which excludes the volatile food and energy components of the report, rose 5.9%, compared to 6.0% in May. Roughly 6% core inflation suggests 6% risk free interest rates if it becomes entrenched.

-

If the choice is to go with 100% energy stocks or zero, I would pick 0%. there are way better ways to protect against inflation than buying energy securities.

-

Tech will be the beneficiary when interest rates stop rising or even go down again, Imo.

-

Interesting chart from JP Morgan’s quarterly investment letter regarding energy cost. I am surprised how bad coal and nuclear is on the cost curves https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf The more I think about this, the fulcrum energy is NG and not crude oil. Crude oil will more likely than not come down a bit, but I think NG prices will stay elevated due to demand from Europe, mainly because the Ng from Russia has been taken out of the market for a while.

-

One of the great articles about Market correction and what to do with them from Morgan Housel: https://www.fool.com/investing/general/2013/08/19/what-i-plan-to-do-when-the-market-crashes.aspx I think one of the most important parts is to have a plan that makes sense and to stick with it. The permabears often suffer from thesis drift. If they correctly predict a market correction of let say 33% - once the market reach the price target they will say “Now look at this or that, fundamentals are worse than zi predicted etc etc” and the new target is 50% down or whatever. Then when the target isn’t reached they blame the central bank, the plunge protection team, QE+money printing or whatever and claim the market is just about to collapse. There is always something, but the above is a clear plan that I think makes sense and is a useful framework. You can modify as needed.

-

Russia-Ukrainian War - Political

Spekulatius replied to changegonnacome's topic in General Discussion

Putin is not going to mess with NATO territory, I but he will go into other places where he can. target smay be Caucasus, Kazakstan , he is already in Syria, maybe mess with states around the Persian gulf. He wants to resurrect Russia as a superpower. He is also absolutely ruthless, probably the most ruthless leader since Hitler. Zero moral compass. Claiming that Ukraine would be better off his he had conquered it diss not seem to agree with Ukrainian people which I think are probably the people who know best. On the war, if current conditions exist, the Russian will grind it out and win, if you call it that. We probably have to support them in the long haul, rain their troops on western weapons and supply them in sufficient quantity , train their pilots on F-15’s - the whole nine yards. -

I did a similar bet in 2007 when peak oil was all the rage. I betted a case of Sonoma county wine that crude would go below $50/ brl within 10 years. I never collected the bet though, moved out of area and I guess my counter-party forgot too. I betted simply based on my assumption that a lot of crazy things happen in commodity markets. I actually would make that bet again that crude will be below $50 within the next 10 years (2032) at some point.

-

How come Sees Candy isn't sold wholesale?

Spekulatius replied to ratiman's topic in Berkshire Hathaway

Quite frankly, Lindt or Ghirardelli beats Seas Candy. The company is worked for in CA had a sale for a discount on Xmas and I bought a box once and wasn’t impressed. I never bought one again. I don’t think this 3 day rule makes any sense, chocolate sits much longer I bet. I think somewhere along the line, they underinvested in Seas Candy or they might be giant in the Candy business right now. May be the alternative was just better than organic or inorganic investments in this business. -

What are you listening to ? (Music thread)

Spekulatius replied to Spekulatius's topic in General Discussion

I am a fan of Aimee Mann's work and like many of here records. The last one (Queens of Summer Hotel) is a bit different - almost like a musical of sorts: -

Russia-Ukrainian War - Political

Spekulatius replied to changegonnacome's topic in General Discussion

Ukraine is not part of the EU either. The EU has delivered weapons to the Ukraine as well as monetary aid. They are also taking in millions of refuges - the US does very little on that end. Lots of countries are contributing to the effort - not just the US. The money spent here is well spent, imo. If Putin wins here (whatever that means) he is going for another adventure and it's going to get more expensive and will cost American lives to stop him.