-

Posts

1,846 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

For active managers, the math is stark. Out of thousands of mutual funds, literally only one beat the Nasdaq 100 over the last five, 10 and 15 years. It did so by boiling down stock picks to about two dozen companies and riding almost all of them to gains.

...

The futility of playing against benchmarks like the Nasdaq 100 was underlined in a report last month by Bloomberg Intelligence, then got a widespread public airing by investor Chamath Palihapitiya, who said indexes provided superior gains “without you having to do any work or diligence.” Turns out intellect and hard work are pretty useless, too, thanks to dynamics that have increasingly come to dominate the active-management debate.

...

“We buy small positions and don’t sell,” Ron Baron, who has been running the fund since its 1992 launch, explained from his office. “The process is to try to find great businesses that have competitive advantage.” Case in point: The fund first invested in Tesla in 2014. By 2020, it was about a third of the portfolio, Bloomberg data show, which finally prompted the team to reluctantly trim its position to assuage concerned clients. It hasn’t bought any additional shares since, but the electric car maker is now 41% of its long positions again. Its second-largest holding is Space Exploration Technologies Corp., a private company also run by Elon Musk. The rest include everything from Charles Schwab Corp. to Marriott Vacations Worldwide Corporation.

-

Commercial vessels have entered Ukraine’s main port of Odesa without asking permission from Russia for the first time since the war began—showing just how much the balance of power has changed in the Black Sea. By imposing an asymmetrical war that relies on domestically produced naval drones and missiles, and that targets Russians ships in their own home bases, Ukraine has eroded much of Russia’s vaunted naval superiority. Now, it is taking the battle to Russia itself.

-

24 minutes ago, Luca said:

"Fighting is done by the willing force of Ukrainians, supported by 90% of its population".

Where do you have the data from to make these conclusions? As far as I am aware, they are FORCING men to kill or damage themselves for this war. (https://www.zeit.de/zeit-magazin/leben/2022-03/ukraine-russland-krieg-maenner-widerstand-flucht). They are picking up men straight from the streets, forcing them to fight, the exact thing Russia is doing to their citizens. Are the 90% of the population who are for the war safe in germany and don't have to fight? (women). How are they now doing research about the state of this country when there is maximum chaos?

Why should Germans bear more of the financial burden than say other European countries? Top 10% of taxpayers already payed 5000€ per person last year if you calculate current costs for this war. Russia has nuclear weapons, ukraine wont win and we also wont win a nuclear war. We should stop sending all these weapons to an aggressive Ukrainian nationalist leader and let russia and ukraine figure it out.

Everything is so damn well orchestrated that as a passive spectator you can not not cheer for ukraine, of course you only see the heroic moves from ukraine and the evil moves from putin and its soldiers.

Luca, I really suggest you to read or believe less of the propaganda by Russia or China!

I knew it was not good idea to point a finger:), but maybe because Germany still does not spend even 2 per cent from GDP as per NATO requirement, while Poland is already on its way up to 4 per cent? Not to mention, that the whole damned situation was also perhaps encouraged quite substantially by the policies of Germany (and former US administration) in the last 10 years. But I beg you not to ask elaborate me further, this was bad idea already:). In general I love and wish success for Germany as much as US!. Also looking forward to see permanently stationed German brigade in my country as soon as possible:)

-

5 hours ago, Xerxes said:

For those interested, the ChitChat Podcast run 3 episodes in late summer looking at three cannibals.

AutoZone

Lowe’s

Discover Financial.

Thanks. Is it this one: https://youtu.be/gpxl2exX9uY?si=FpD6A8ecxjI61bQS ?

-

6 hours ago, Dinar said:

Who is going to pay for all of this? Ukraine needs $50bn per year to fight and probably a trillion for reconstruction. There is not a chance in hell the US will come up with $25bn per year for the next five years.

Since I am entitled to a different opinion...:)

If US spent almost 1T or 50 B per year in this case for God knows what reasons, I would argue it would be almost no brainer to spend half of this sum yearly for some time in Ukraine for a many good reasons. Not least that the large part of the current support is via older military equipment, due for replacement, but more importantly, because fighting in this case is done by the willing force of Ukrainians, supported by almost 90 per cent of its population. Europe in general and Germany in particular should bear more of the financial burden though.

-

11 hours ago, ValueArb said:

I think there is a great detail of doubt. Accidental explosions produce similar damage as intentional explosions. No one has any credible motivation to sabotage the pipelines, Gazprom has a long history of similar accidental pipeline explosions due to its incompetence, there is little incentive for investigators to say it wasn’t sabotage, and I haven’t seen any evidence they investigated the possibility of an accident or even had the proper industry tech experts involved.https://www.wsj.com/articles/nord-stream-sabotage-probe-turns-to-clues-inside-poland-4ed20422

https://www.nytimes.com/2023/03/07/us/politics/nord-stream-pipeline-sabotage-ukraine.html

-

13 minutes ago, Viking said:

When it comes to housing, Canada is facing the perfect storm.

1.) First we blew a housing bubble that is probably bigger than the the US housing bubble that popped in 2008. So we have crazy high prices.2.) All mortgage rates here are variable, with crazy low teaser rates. Those teaser rates are now resetting, with most resetting in 2024 and 2025. The parallels with US housing in 2006-2007 are frightening.

3.) Bubble high real estate prices + 6% mortgage rates = $3,000/month to rent a one bedroom. That is the math for a new investor. Rents on new rental units coming to market have doubled in the past 2 years.

3.) Rents in Vancouver are controlled by the government. Same for older housing stock in Toronto. So in the same building two of the exact same units can rent for $1,500/month and $3,000/month. So no renters can afford to move today - your rent is going to double if you do. The rental market is effectively frozen.

4.) Supply always has been tight and vacancy rates in Vancouver and Toronto have always been extremely low (2% or less).

5.) Demand- the number of international students has increased in recent years from a run rate of 200,000 per year to about 800,000 today. The net add has been 600,000. Why the increase? International students pay up to 6x the amount for tuition compared to a Canadian student. International students are driving the budgets of universities now. The provincial/federal governments usually fund education but international students have now become the golden goose for most institutions. Provinces and feds love it because they can spend $ on other priorities. Of course, no one asked if we have the housing to support an increase of 600,000 people.

- the Federal government also decided recently to boost immigration to 500,000 per year. GDP/capita has been falling for years in Canada. Fix? More people. Total GDP grows (easy way to paper over the problems under the surface).

- temporary foreign workers. We also have a shortage of workers so we have also been bringing in 200,00 or so foreign workers each year.

When you add the three together… Stats Canada just admitted they have undercounted the number of new people coming to Canada by 1 million people.

6.) Supply. The Bank of Canada is trying to slow the economy to get inflation under control. How? Higher interest rates. This lowers activity in interest rate sensitive parts of the economy, primarily housing. And it is working. New building permits are down a lot. New construction is slowing. Fewer units will be coming to market looking out a couple of years.

So we have a really messed up situation. Market was already super tight. Supply is constrained. Demand is through the roof and growing - the governments are not changing any of the rules (students, immigration, foreign workers) - at least as of today.

Housing looks like it is going to be the dominant issue in this country moving forward.

I understand. But it still looks more like a growing pains, than some insurmountable problems. Mostly everything is fixable. People are still flocking to North America like crazy, not without a reason. Were else on earth is a better place?

-

25 minutes ago, Viking said:

Below are a few quotes from the article. The tide is going out in Canadian real estate and we are beginning to understand who has been swimming naked. The additional problem for real estate investors in Vancouver is rent increases are dictated by the provincial government (2% in 2023, 1.5% in 2022). Older housing stock in Toronto is rent controlled (i think). If rates stay high (which is what it looks like) a lot of ‘investors’ in Vancouver/Toronto are going to learn that leverage can be a bitch:1.) much higher interest rates - variable rate mortgage

2.) falling housing prices

3.) limited ability to increase rents

“The problem facing Canada’s real estate investors, whether they’re buying a new property or they have a floating-rate mortgage on one they already own, is that the math simply doesn’t work at today’s interest rates. Modeling by the Bank of Montreal shows that in Toronto, anyone using a mortgage with a standard 20% down payment to buy a rental property at today’s prices, charging today’s rents, would be signing up to lose about C$1,000 (roughly $738) each month.

These cashflow calculations have been negative since 2016, but investors were generally willing to overlook that because part of those payments were paying down the mortgage’s principal, thus building equity in the investment. But in the last year, the cashflows have gone so deeply negative, it even offsets those equity gains, the BMO modeling shows.“

“Rental amounts aren’t going up fast enough to cover for the huge increase in interest rates,” he said. “Effectively what we do is we flush out all the people who are holding their breath. That’s what we’re starting to see here.”

However, what is also interesting:

And while such distress does seem to be fueling an increase in properties available for sale, there’s still such a shortage of inventory that prices haven’t substantially fallen. It’s all threatening to further aggravate the shortage of all housing types in Canada, hurting homebuyers and renters alike. “Everything is in a really bad place right now,” said Danielle Levy, a real estate broker in Toronto who works with both buyers and renters. “People aren’t able to afford the rent. People are not able to afford paying their mortgage. People are not able to fulfill their goal to purchase a home to start a new life with their families. We need a lot more supply in the market.”

It seems this is also the case in other previously hot markets, like Australia, Great Britain etc. This article points to some interesting reasons:

Like:

In many English-speaking countries, inspired by Victorian worries about “slums”, planning laws tended to prioritise detached houses. For urban planners, such as Ebenezer Howard, density was seen as akin to crowding. In packed industrial hotspots, “downzoning” and slum clearance were used to flatten cities and spread them out by force. The writer George Orwell was sceptical of the proceedings: “If people are going to live in large towns at all they must learn to live on top of one another,” he declared. But he reckoned that many workers in Britain did not “take kindly to flats”. Today far fewer citizens of English-speaking countries live in flats than elsewhere. In England 80% of people now dwell in houses, and just 6% in flats in buildings taller than three storeys. In France 44% of people live in apartments, as opposed to houses. In cities including Dublin, Los Angeles and Sydney, sprawl is running out of road. At the densities allowed by law, almost all of the land within a reasonable commute of city centres has already been “built out”. Instead, new subdivisions are built in separate towns, perhaps 50 or 60 miles away from the core, with residents typically facing punishing commutes by car to work. (In Britain these workers typically leap over the “green belts” around cities within which construction is mostly illegal.)

Anyway, maybe except for the Sweden and some regional markets, so far housing prices seems to be holding up or even begin to rise again in some places.

-

-

-

2 hours ago, John Hjorth said:

Investigations and reports were carried out by Denmark and Sweden, because the explosions took place in the Baltic waters of these two specific countries. Russia asked for permission to participate in these activities, which was turned down and denied.

What was brought forward and released by the Danish Minister of Foreign Affairs Lars Løkke Rasmussen was that this was indeed sabotage, but he woulden't get into specifics about who was under suspicion, and reports made classified.

Reason for this as mentioned by @Luca above.

[Pretty un-Danish approach, likely an approach chosen under pressure from allies, I speculate, all with a very "fishy" odor to me personally. Personally to me also, we all have a right to know what this actually was, as a part of the whole picture of what has been going on.]

There is no doubt this was sabotage.

The Guardian [October 18th 2022] : Nord Stream 1: first underwater images reveal devastating damage

If I had to bet at the gunpoint, I would bet on: https://www.economist.com/europe/2023/06/20/ukraines-spymaster-has-got-under-the-kremlins-skin

"Yet his bravado is not universally welcomed. Leaked documents show that the cia had to intervene to stop General Budanov from ordering an attack on Moscow on the anniversary of the invasion in February. Sabotage and the raids inside Russia since have heightened worries among Ukraine’s allies about provoking a nuclear power."

-

1 hour ago, sleepydragon said:

I have feelings too, the stock hurts me too much. got to cut loss and end the relationship

Sometimes energy loss because of these "thesis drift" situations just isn't worth it. It is pity stock doesn't cares or know how you fell though:)

-

-

1 hour ago, dealraker said:

There's guy in my investment club who chants buy what goes down the hardest because it comes back the hardest. He's a CPA (big small town firm) and somewhat of a silly nut case (his CPA son has been all over the local media for defrading small businesses he's a part shareholder of- he's a high class drug addict). But in his tax free account which he shows us, in the down times, the bad times not the good, he's sold Brk to buy other things. And yes it has worked very well for him as he's well ahead of if he had just held Brk. But again, he's sold Brk to buy other stuff during big market sell-off's when at least initially Brk is slower to go down.

Together with China's big tech (and some added leverage) I sold more then half of my very over sized (>60 per cent) BRK position last year to buy UMG, META, GOOGL, AMZN and to add substantially to FFH and JOE, and a few smaller things. DIdn't plan for this, but after unexpectedly quick reversal, I am almost out of magnificent and similar stuff, except for still owning some 60 per cent of initial META position. But after exiting margin first, instead of bying back BRK, this year I mostly only added to JOE and even more so to FFH. So for the first time FFH is larger position for me than BRK and substantially, so I hope that the statement about their quality stands:)

-

On 9/16/2023 at 3:21 PM, dealraker said:

Recently on another forum that I read because it was the only forum 25 plus years ago and I really enjoy forums, the crowd was blowing out of Berkshire to buy Dollar General. The DG type stocks are precisely what I would never buy at any price at any time. I consider whatever advantage or moat-no-competition sustainability they have to be completely temporary. But they guys with DG, although they are down terrifically, are in my view nowhere near Parsad in skill....but they are seeking that big alpha outcome. Ben Graham said, "The worst investor mistake is in late cyles to sell quality to buy lesser quality at chaper prices."

I know nothing about DG, but generally I think this is very true and important. It is also one of the main mistakes I unfortunately had to learn from myself, especially if that lower quality also involves leverage. Ironically for me it also involved moving somewhat from BRK to make such a mistake a last time. Now I am almost afraid to touch it in order to buy "something better":)

I have saved this quote as one of my top checklist item: "The chief losses to investors come from the purchase of low quality securities at times of favorable business conditions"- Benjamin Graham

This is maybe also very interesting to consider in terms BRK vs FFH, as currently their valuations is still quite diverge, while quality is seemingly converging. I think and hope that the term "low quality", especially speaking of their insurance operation, is not applicable to FFH anymore. So far I did not yet sold any BRK to buy FFH, as there were better candidates.

-

“At the time of economic pressure, there are quite obvious concerns at the top leadership,” said Katja Drinhausen, head of the politics and society program at the Mercator Institute for China Studies in Berlin. “Using collective fear as a way to build political and social cohesion is a very dangerous game to play.”

-

Apple Inc. partner Foxconn Technology Group plans to double its investment and employment in India, highlighting an accelerating manufacturing shift away from China as Washington-Beijing tensions grow.

...

The investment plans of the Taiwanese company, also known for its flagship unit Hon Hai Precision Industry Co., include a 300-acre site close to the airport in Bengaluru, the capital of Karnataka, Bloomberg News previously reported. That plant is likely to assemble iPhones and expected to create about 100,000 jobs.

-

“You are in a market where if you think about a stock from an investment point of view, it rises 40% before you even decide to buy it,” Bhan told Bloomberg News in an interview at his Mumbai office. “That is clearly reflective of froth,” said Bhan, who oversees the equivalent of $17.4 billion in equity assets under management.

-

https://www.wsj.com/business/retail/twinkie-hostess-brands-smucker-deal-4cc72302?mod=hp_lead_pos9

Ten years ago, the unthinkable happened: Twinkies disappeared. Hostess Brands, maker of the golden, cream-filled sponge cake, declared bankruptcy for the second time in a decade. The company closed its factories and began liquidation proceedings, sparking a run on supermarkets as shoppers filled their carts with Twinkies, Ho Hos and other edible specimens of Americana they thought they might never be able to buy again. What happened next was a dramatic comeback that few could have anticipated. Two investment firms rescued the snack cakes, paying $410 million for Hostess’s brands and kicking off a decadelong fix-up job. Then came a dogged quest for efficiency and a determined search for the next Twinkie, all of which culminated this week in a deal to sell Hostess to J.M. Smucker for $4.6 billion.

-

9 hours ago, Viking said:

Like Indiana Jones, today we are going to set out on an adventure in search of long lost treasure. Something that most investors appear to have forgotten about. What do the legends tell us? Does it really exist or is it just a myth?

What am i talking about?

P/C insurance float (I’ll just call it ‘float’ moving forward).

Float is such a big (and important) topic we are going to tackle it in two posts. The first post (below) will focus on the theory - what it is and why P/C investors should care. The second post will then apply the theory to today using a real company - Fairfax Financial. My plan is to have the second post completed and out on Sunday.

Ancient history

Thirty years ago, talking about float was all the rage for P/C investors. Read old articles on investing in P/C insurance companies and a discussion of float will usually be front and center. And the champion of float from that era was, of course, Warren Buffett and his company Berkshire Hathaway.

So what happened?

Why has float apparently settled into into the dustbin of history and become a relic of the past?

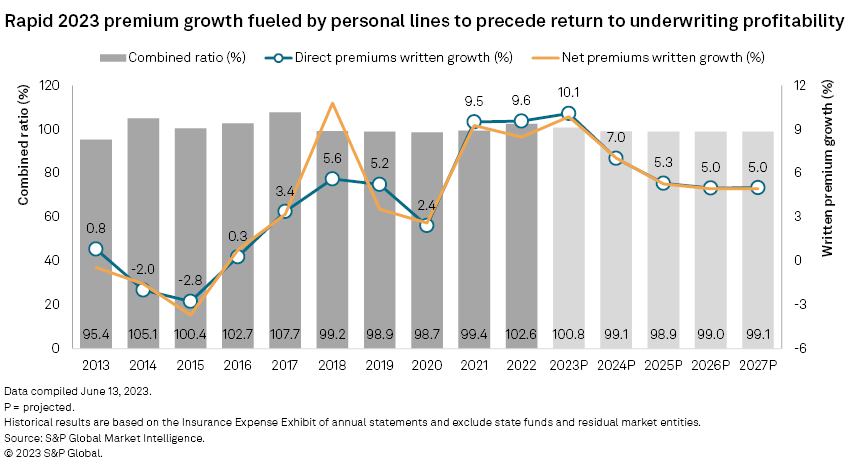

- Due to competitive insurance markets, industrywide underwriting profit has remained illusive for the past decade. At the same time, top line organic growth slowed to a crawl.

- Returns on investments fell: P/C insurers put most of their investments into fixed income instruments. In their battle with deflation, global central banks took interest rates all the way into negative territory. The US 10 year treasury traded at a yield below 0.60% in August of 2020 and traded with a yield below 1.5% for much of 2021.

S&P Global: US P&C Insurance Market Report

Float lost its value

Breaking even on underwriting for a decade while returns on investments plummeted made having float far less valuable than at any point in recent history.

Another smaller factor: over the years, P/C insurance has become a much smaller part of Berkshire Hathaway’s business model. What did Buffett have to say about float in his 2022 letter to shareholders? Float is mentioned 4 times in one short paragraph - telling investors to go somewhere else if they wanted to learn more. Does this sound important to you? So ‘float’ also lost its biggest cheerleader.

Does this mean… Float is dead? Long live float?

No, of course not. Just because float is no longer appreciated (or followed) doesn’t mean it doesn’t matter. In fact, for those paying attention, the world has changed again. The conditions that made float a big deal 30 years ago have returned:

- Insurance has been in a hard market since about Q4 of 2019 - above average insurance companies are seeing improving underwriting results (cost of float) and significant top-line growth (supply of float) over the past four years.

- Global central banks now have an inflation fight on their hands - and ‘higher for longer’ is becoming the new mantra for interest rates. Fixed income yields have spiked higher across the curve. The 10 year US treasury closed today with a yield of 4.32%, a level where it last traded at in 2007. As a result, returns on float are improving greatly.

Both of these developments make having float today extremely valuable.

Except remember… pretty much everyone has forgotten about float.

What’s old will be new again.

Well, my guess is this is about to change. I think investors are going to get interested in float again.

What is going to cause the change?

A new generation of investors are about to discover something Warren Buffett hit on when he bought National Indemnity back in 1967: float, under certain conditions, can be a license to print money. Those ‘certain conditions’ have returned. And in recent years some insurance companies have started up the printing presses and are now starting to print money. More than anyone imagined possible.

==========

P/C insurance float: the basics

Let’s first do a quick review of float. Float is deceptive. It is kind of like compound interest as a concept. It is easy to define but very hard to actually understand.

Who better to teach us about P/C insurance float than the old master, Warren Buffett himself.

Float: the basic building block to use to evaluate a P/C insurance company

Back in the 1990’s, Warren Buffett was using P/C insurance as the core engine to drive Berkshire Hathaway’s profit growth. GEICO was purchased in 1996 and General Re was purchased in 1998. Given P/C insurance’s importance to Berkshire Hathaway shareholders, Buffett provided the following as a guide to help them understand P/C insurance as an investment.

BRK 1998AR: “With the acquisition of General Re — and with GEICO’s business mushrooming — it becomes more important than ever that you understand how to evaluate an insurance company. The key determinants are:

1.) the amount of float that the business generates;

2.) its cost; and

3.) most important of all, the long-term outlook for both of these factors.”

Well, Warren appears to be saying float is the most important thing to understand when evaluating an insurance company. Interesting, given how little press float gets today from analysts and investors.

What is float?

BRK 1998AR: “To begin with, float is money we hold but don't own. In an insurance operation, float arises because premiums are received before losses are paid, an interval that sometimes extends over many years.”

Float is money a P/C insurer has that it can use to invest. It is an asset but it is a liability (not equity). It is kind of like a very sticky deposit at a bank (a deposit is also a liability for the bank).

Because float is a liability, it is also leverage. Like all leverage (i.e. debt), float can be both good or bad - and this depends on the cost paid over time to hold the float.

What is the cost of float?

BRK 1998AR: “Typically, this pleasant activity (the insurance business) carries with it a downside: The premiums that an insurer takes in usually do not cover the losses and expenses it eventually must pay. That leaves it running an "underwriting loss," which is the cost of float. An insurance business has value if its cost of float over time is less than the cost the company would otherwise incur to obtain funds. But the business is a lemon if its cost of float is higher than market rates for money.”

Underwriting determines the ‘cost’ of float.

This point is critical. Over time, if an insurer can produce an underwriting profit on its insurance business that means the cost of its float is actually a benefit - that is better than free. That means the insurer is actually getting paid to hold the float. This is far better than ‘the cost the company would otherwise incur to obtain the funds.’

Float is a pile of money that an insurance company can actually earn two income streams from: underwriting (if float is obtained at a benefit) and investing.

Sounds like Buffett was on to something.

To summarize: according to Buffett, a good P/C insurance company:

- Has a large amount of float

- Is a good underwriter - is able to generates the float at a favourable cost (ideally a benefit)

- Has a good long term track record - of both growing float and as a solid underwriter

Buffett’s secret sauce: P/C insurance float

Buffett’s genius has really been two pronged:

- Use P/C insurance float as an ever-increasing low cost (free) source of capital/leverage used to push profits even higher.

- These growing profits were then continuously reinvested into great companies/equities (outside of insurance) that have also become compounding machines over time and pushed profits even higher.

OK. So there is a quick review of float, explained with the help of Warren Buffett.

To help us understand float even better, let’s look at it now from a balance sheet perspective.

==========

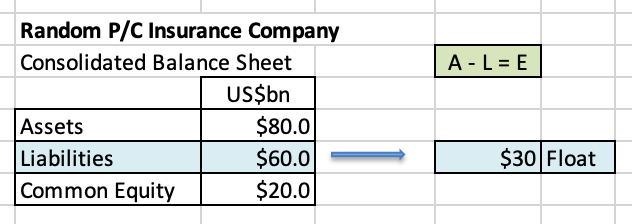

Float and the balance sheet

Let’s create an imaginary insurance company - called Random P/C Insurance Co - and create a fictitious balance sheet.

Our company has $80 billion in assets, with $60 billion in liabilities and $20 billion in common shareholders’ equity. Of the total liabilities of $60 billion, float is $30 billion. The summary of the balance sheet is below:

We are also going to assume common shareholders’ equity = book value.

We are going to make up more numbers below. We are using numbers that make our calculations easy. Please don’t focus too much on the exact numbers. Instead, focus on the information they are trying to convey - especially about leverage.

Cost of float

Let’s assume our insurance company is a slightly above average underwriter with a combined ratio (CR) of 96 - this translates into a ‘benefit’ of float (better than free - our company is actually getting paid to hold their float).

Return on investments (which includes float)

Let’s assume our insurance company is above average in terms of the return it earns from its total investments (which includes float) - let’s assume it earns 8% on average.

We are also going to assume there are no taxes.

The return of Random P/C Insurance Co

When we put the two together we get:

- Benefit of float (CR of 96)

- Return on investments = 8%

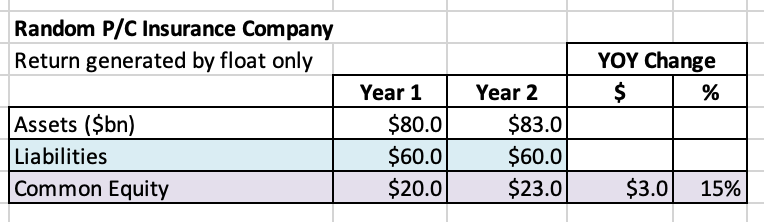

Let’s assume Random P/C Insurance Co earns a total return of 10% on its float.

This means our insurance company is earning the following:

- $30 billion float x 10% = $3 billion.

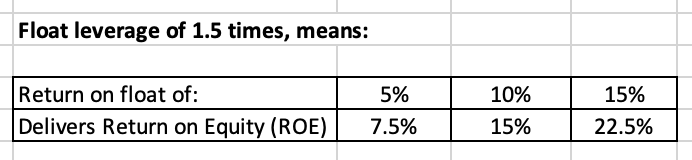

Can we calculate the actual leverage provided by the float?

Yes. Total earnings from float of $3 billion will flow though the income statement and increase retained earnings, which will then flow though to the balance sheet and increase both assets and common shareholder equity by $3 billion.

So a return from float of 10% results in an increase in common shareholders' equity of 15%.

The leverage can be calculated as follows: total float / common shareholders' equity.

In our example

- float of $30 billion / common shareholders' equity of $20 billion = 1.5 x leverage

Common equity, debt and total investments

The above increase in common shareholders' equity was driven solely by float. A company is also going to generate earnings from its common shareholders’ equity - the funds provided by shareholders. Perhaps it also uses a little debt to generate more earnings. Any returns generated by its other investments (those other than float) need to be added to the numbers above.

==========

Below Buffett summarizes how float fits into the big picture

Berkshire Hathaway 1995AR: “In more years than not, our cost of funds has been less than nothing. This access to "free" money has boosted Berkshire's performance in a major way.

“Any company's level of profitability is determined by three items:

1.) what its assets earn;

2.) what its liabilities cost; and

3.) its utilization of "leverage" - that is, the degree to which its assets are funded by liabilities rather than by equity.

“Over the years, we have done well on Point 1, having produced high returns on our assets. But we have also benefitted greatly - to a degree that is not generally well-understood - because our liabilities have cost us very little. An important reason for this low cost is that we have obtained float on very advantageous terms. The same cannot be said by many other property and casualty insurers, who may generate plenty of float, but at a cost that exceeds what the funds are worth to them. In those circumstances, leverage becomes a disadvantage.

“Since our float has cost us virtually nothing over the years, it has in effect served as equity. Of course, it differs from true equity in that it doesn't belong to us. Nevertheless, let's assume that instead of our having $3.4 billion of float at the end of 1994, we had replaced it with $3.4 billion of equity. Under this scenario, we would have owned no more assets than we did during 1995. We would, however, have had somewhat lower earnings because the cost of float was negative last year. That is, our float threw off profits. And, of course, to obtain the replacement equity, we would have needed to sell many new shares of Berkshire. The net result - more shares, equal assets and lower earnings - would have materially reduced the value of our stock. So you can understand why float wonderfully benefits a business - if it is obtained at a low cost.”

Float is better than equity?

This question is a bit of a mind bender. Because of its unique ‘cost’ (i.e. low cost or even a benefit), in the past Buffett has said that he views float as being better than equity.

BRK 1997AR: “Since 1967, when we entered the insurance business, our float has grown at an annual compounded rate of 21.7%. Better yet, it has cost us nothing, and in fact has made us money. Therein lies an accounting irony: Though our float is shown on our balance sheet as a liability, it has had a value to Berkshire greater than an equal amount of net worth would have had.”

Well, suggesting float is better than equity is perhaps a bridge too far. However, I think we can conclude that float matters a great deal. Especially today (in a high interest rate world).

Conclusion

OK. So now we know what float is and the key metrics to use to evaluate P/C insurers. Who should we start with? That is an easy question to answer. In our next post (coming Sunday), we will do a deep dive on float at Fairfax Financial to see what we can learn.

==========

How Warren Buffett Achieves Great Returns Every Year - Advantages of Insurance Float

Thanks!

-

17 hours ago, SafetyinNumbers said:

Just a reminder that consensus is much lower and if you are wondering which analyst has the low estimate for the next 5 years (only for the last three), it’s our friend at Morningstar. The declining earnings estimates (and historical volatility in earnings) basically makes it unownable for quants and for active institutional investors who use the same screens as quants in order to compete with them.Wow, what a passimism from 2025, never saw this, what is the source of this table?

-

13 hours ago, thepupil said:

I again think that the discussion on stocks vs bonds is overly binary. For me it's choice of 100% stocks 0% bonds or 60-80% stocks, 20-40% bonds. In my opinion no sane person is going to go 100% bonds/cash as that is clearly destructive to long term wealth and introduces a debasement tail risk. I'd really struggle to sleep at night having all my assets in nominal instruments. bonds have historically generated positive real returns (and will going forward), but you still don't want to have everything in them if "the big one" (in terms of currency) ever happens.

Rather than run a bunch of monte carlos or look at 1000's of historical scenarios, I prefer a more simplistic exercise.

Over the last 10 years, US stocks (defined as VTSAX) have returned 12.2%/yr. (215% cumulative)

Over the last 10 years, US bonds (defined as VBTLX) have returned 1.5% / yr. (15.6% cumulative)

Over the last 10 years, a 60/40 portfolio (defined as VBIAX) has returned 8.0%/yr (116% cumulative)

Notice how the 60/40 returned about what you'd expect. (12.2%*0.6=7.3%)+(1.5%*0.4=0.6%) = 7.3%+0.6% = 7.9%. the 60/40 portfolio did a little better in practice but there wasn't a lot of rebalancing benefit (like 0.1%/yr). the cost of decreasing volatility by investing in the balanced index has been pretty freaking huge. About 100% of starting value. Starting with $1mm, the 60/40 guy has $2.15mm and the 100% stocks guy has $3.15mm

What will that number be for the next 10 years? Well we know that absent defaults (the agg isn't going to have many defaults and neither are IG bonds), bonds will make their yield to maturity if held to the duration of the index. So the duration/maturity of the bond index isn't quite 10 years, but let's just say it is (one can buy 10 yr fixed income if one wants to). The barclays aggregate has a yield to maturity of 5.1%. So going forward, rather than make 1.5%/yr, bonds will make 5.1%/yr, if held for long enough. Let's say stocks defeat the naysayers and repeat the last decade's amazing returns, tey make 12.2%.

So a 60/40 portfolio will make about 9.3%/yr vs 100% stocks at 12.2% (assuming no rebalancing benefit). This is $2.4mm vs $3.15mm for a $1mm starting nut. There's still a big difference and a high cost of "safety" of bonds, but it's 28% less than the prior decade. ($715K of wealth difference instead of $1mm). IF you think stocks do 8%/yr instead of 12% and assume no rebalancing benefit, then the wealth difference is $220K in favor of 100% stock portfolio. The cost of lower volatility of the balanced portfolio is 78% lower than the prior decade. Of course as you get closer to or even lower than the bond yield on forward equity returns, then there is no cost to having a substantial portion in bonds.. Portfolios with bonds will end up with better returns.

So I'd frame it as something like this,

If stocks make 12%/yr (repeat wondrous bull market), the cost of incremental safety from carrying bonds will be 30% less than the prior decade, but still substantial.

If stocks make 8%/yr, then the cost of safety will be 78% less than the prior decade.

If stocks make less, there will likely be little to no cost of safety.

I can't really predict the market's next 10 years of returns. I don't know, but I think the above supports that holding bonds will have significantly less opportunity costs than it has in the past. In my view, the above logic supports a weighting to bonds significantly greater than the prior decade (which for me was basically 0). For now that's something like 20-25%, and going higher. Also, anyone who's been investing and saving for the prior decade should be many multiples richer in 2023 than in 2013. As you get richer, keeping the money instead of optimizing for absolute highest NW makes sense for many, but not all people. There are some people who are inclined to take more risk as they get wealthier. I am not one of those. My goal is to reduce dependence on my labor via accumulation of capital. my goal is not to have the highest possible net worth in 50 years. If someone who invest in all stocks ends up 10,20,30% wealthier than i do over the next decade because stocks do really well, I'm not going to care. If it's 50-100%+, I will care. But either way if stocks do very well for next decade, then I'll be just fine.I'd also posit the rebalancing benefit will probably be higher in the next decade than in the last. This tilts the math in favor of including some bonds. Also we haven't taken into account portfolio withdrawals and sequence of returns, which will tilt things further to the less volatile portfolio that has bonds.

I don't really think the inclusion of bonds in a portfolio is about market timing or predicting doom and gloom. I think it's about bond yields (nominal AND real) being substantially higher than they have been and equity yields do not appear to be any higher today than they have been; owning more bonds today than in the past 10+ years seems like a rational response to changes in relative pricing. It's fundamental investing. The inclusion of bonds will probably have lower opportunity cost than it has and may even lead to better outcomes than all stock portfolio. the era of financial repression is over (at least for now). we have positive real rates. we aren't forced to invest in just risk assets anymore.

the entirety of this ignores any potential value add from active management. it also ignores the more extreme upside/downside of longer term bonds, which I invest in to be a little more grey. A 20 yr IG bond at 6.2-6.5% is more competitive w/ equities, but also far less predictable in return over an intermediate horizon so the math isn't quite as clean as the above.

It's also very US centric. Prospective US bond returns look MUCH better if you think stocks outside the US repeat the prior decade's shittiness. tat wouldn't be my prediction, but just saying that US stock market participants have been incredibly spoiled of late relative to ex US. EM index has made 3.5%/yr for 10 years and developed international 5.1%. US bonds yields are higher today than either of those. I'd wager the ex US indices will do better going forward, but strictly backward looking.

Thanks for comment.

While discussing bonds vs equities I somehow always tend to think in terms of very long term bonds, which could mislead and I do not like them most, especially for buy and hold. I admit, that under certain circumstances, depending on valuations and alternatives, I would go up to 30 per cent (or even more, but perhaps very unlikely) cash or short term bonds (or even longer term) and was in a such position for a quite few times in the past.

But also, looking historically, 10 year rates were perhaps like 6 per cent and it was considered normal, while at the same time dotcom craze was going on successfully for quite a while. Just because now they are back to something more or less normal, perhaps does not necessarely mean the end of the world and I am not sure if it automatically merits large allocation, especially if absolute levels are still nothing special (and under required IRR, at least for me) and one can still find equities, providing at least 8-10 expected returns (even BRK still likely clears such a hurdle), if we are talking about longer term horizon.

-

Look past the exuberance for all things artificial intelligence and you find a stock market backdrop where confidence in American growth is far less robust than it seems. It’s in the dispiriting performance of banks and industrial companies, barely eking out gains in 2023 while the likes of Tesla Inc. and Nvidia Corp. double and triple. Pessimism is visible in versions of major benchmarks that pare down the influence of megacaps, such as the equal-weight S&P 500, up a relatively paltry 4% so far this year. Also alarming is the performance of small-cap stocks, whose charts show worrying signals barely seen over the past two decades. The Russell 2000 has fallen behind an index of the 1000 largest-capitalization stocks for the second month in a row, on track for its second-worst annual underperformance since 1998.

-

37 minutes ago, TwoCitiesCapital said:

I've said it before, I'll say it again. Bonds had a better return in the 70s than equities did. Short term absolutely. Intermediate did so too with some basic assumptions (didn't buy at the extreme highs, owned corporates instead of just treasuries, etc).

Equities are NOT a good inflation hedge - their duration is significantly longer than most fixed income investments and thus they're way more sensitive to accelerating interest rates and inflation.

They work best when it's low and stable. When it's moderate, they suffer more than bonds do (like in 2022 and in the 1970s). When it's high, stocks do "well" in that nominal returns do exceed bonds, but they don't come close to maintaining real purchasing power like necessary commodities do.

You want a bet on deflation? It's bonds.

You want to bet on stable/low inflation? It's stocks.

You want to bet on inflation? It's commodities - particularly food and energy.

If you're that terrified of hyper inflation, you're buying the wrong thing. If you're terrified of moderate inflation, you're still buying the wrong thing.

To each his own / let's agree to disagree:)

Fairfax 2023

in Fairfax Financial

Posted

This is a very good point! So from almost 17 to 13 per cent. Almost all improvement in CR and all structural? Also, if I recall correctly, Prem talked about scale needed, while was acused for empire building...