-

Posts

1,847 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

-

11 hours ago, Viking said:

What is the best way to value Fairfax today?

Peter Lynch: “What possible assurance do you have that (a stock you own) will go up in price? And if you are buying, how much should you pay? What you’re asking here is what makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings.” One Up On Wall Street

----------

Fairfax has been an exceptionally difficult company for investors to value for the past three years. And especially right now (given the sharp rise in the stock price). Even investors who have followed the company closely for many years are having a hard time. New investors don’t stand a chance.

Mr Market is saying Fairfax has a fair value today of $827/share (that is where it closed Sept 1, 2023). I think the stock is still wicked cheap. Others on this board feel the stock is only mildly cheap.

What is the fundamental problem?

There is no consensus of what level of earnings the collection of assets that Fairfax currently owns can deliver on a regular basis moving forward. Or what to expect for the next 3 to 5 years.

Most investors prefer to use book value as their primary tool to value Fairfax. It is an insurance company after all. And using book value is supposed to be the proper way to value an insurance company. Using book value also conveniently allows an investor to largely ignore earnings (coming up with an estimate). And given the lack of consensus around earnings for Fairfax… well isn’t that a good thing?

Well, easy and good are not the same thing.

What is the best way to value Fairfax today?

Just like any job, we need to pick the right tool. To do this we need to answer the following question.

Is Fairfax an insurance company or a turnaround play?

No, this is not a trick question. The answer, of course, is that Fairfax today is both. But we are talking here about how to value Fairfax as a company.

My view is that today Fairfax should be valued primarily through the lens of a turnaround play. Not as an insurance company.

Does it make that much of a difference?

It makes a huge difference.

Using book value (P/BV and ROE) to value insurance companies with relatively consistent financial results over a 5 or 10 year period makes a lot of sense. But using book value (P/BV and past ROE) as the primary measure to value a turnaround like Fairfax makes little sense especially when they are still in the middle of the earnings part of the turnaround.

The problem with book value (P/BV and ROE) is it is a ‘rear view mirror’ valuation measure - it does a great job of telling you what has happened. And for lots of insurance companies what ‘has happened’ is likely to continue to happen in the future. So using book value (P/BV and ROE) as a primary valuation tool makes sense.

But for a turnaround like Fairfax, where a massive amount of change is happening - which is leading to much higher earnings - focussing primarily on the past is going to mess investors up. It is going to cause them to way under estimate future earnings. This in turn is going to cause them to under value the company. And that is going to lead to poor investment decisions.

A lot of investors who follow Fairfax are probably wondering how they missed the big move in the stock over the past 31 months (since Jan 1, 2021). My guess is the key issue is too much ‘rear view mirror’ analysis and not enough ‘looking out the front windshield’ analysis. The difference between valuing a stodgy insurance company versus valuing a turnaround.

How should an investor value a turnaround?

Let’s look to Peter Lynch for some insight. Peter Lynch loved turnarounds. It was one of the 6 buckets he used to classify his stock investments. Classifying stocks properly at the beginning of the process is critical. Because the classification determined the proper method to use to analyze the stock.

To value a turnaround it is critical to:

- First, understand what went wrong.

- Second, confirm that whatever went wrong has indeed been fixed.

- Third, focus in on evaluating the assets and estimating the trajectory of future earnings.

What went wrong at Fairfax?

Fairfax has three economic engines: insurance, investments - fixed income and investments - equities/derivatives.

Fairfax’s insurance business has been a solid performer over the past decade. And their investments - fixed income economic engine has also performed well. The issue at Fairfax was the investments - equities/derivatives engine.

The good news for Fairfax was the solution to their poor performance was fully within their control. They just needed to stop doing some really dumb things (putting it politely) in one part of the company.

What was the fix?

To right the ship in the equities/derivatives engine, Fairfax did a few things:

1.) end the equity hedge/shorting strategy. The equity hedge positions were exited in late 2016. The final short position was sold in late 2020. Done.

2.) make better equity purchases. This started in 2018. Done.

3.) fix poorly performing equity purchases from 2014-2017. This started in 2018 and looks like it was completed in 2022. Done.

But Fairfax didn’t stop here. They did even more:

4.) since 2020, they have made at least one brilliant decision each year:

- Late 2020/early 2021: initiated the FFH total return swap position, giving exposure to 1.96 million Fairfax shares at $373 share (resulting in a $900 million pre-tax gain to date)

- Late 2021: buying 2 million Fairfax shares at $500/share (book value is currently $834/share and intrinsic value is likely well over $1,000).

- June 2022: sale of pet insurance business for $1.4 billion (resulting in a $992 million after-tax gain).

And the insurance gods have also been smiling on Fairfax:

5.) a hard market in P&C insurance started in Q4, 2019. And it looks like it will continue into 2024.

And if all that wasn’t enough, the macro gods also decided to smile on Fairfax, delivering to the company their biggest gift yet:

6.) after dropping interest rates to close to zero in late 2021 they pivoted and spiked rates to more than 5% in 2023. Fairfax navigated their $38 billion fixed income through the treacherous storm perfectly - and the gold ($billions) is literally raining down today.

So Fairfax not only stopped doing dumb things, they also started hitting the ball out of the park. At the same time both the insurance and macro gods started smiling on the company.

Each of these things on their own has causing earnings to grow significantly over their historical trend. Stacked one on top of the other - well earnings have exploded higher.

In short, the turnaround at Fairfax that began back around 2018 now looks complete. But importantly, the lift to earnings will likely take a few more years to fully play out.

What is happening to earnings at Fairfax

We are going to focus on operating income given this is considered the high value part of earnings for an insurance company. Operating income averaged $1 billion ($39/share) each year for 5 years from 2016-2020. From this base it has:

- Doubled to $1.8 billion in 2021.

- Tripled to $3.1 billion in 2022.

- Is on pace to quadruple to $4.3 billion in 2023.

- Is estimated to be $4.7 billion, or $207/share, which would be a quintuple from $39/share (average from 2016-2020).

How would an investor focussed primarily on book value have seen any of this coming? The answer is easy… they would have completely missed it. They probably still are.

What are we learning about Fairfax’s collection of assets?

Beginning as far back as 2021, investors were getting glimpses that something good was happening at Fairfax. In 2022, is was obvious that ‘new Fairfax’ had arrived - but the good news was masked in the top line results by the bear market in financial markets and the large unrealized losses in fixed income and equities. But the change was obvious to those of us who followed the company closely. In 2023, the story continues to improve. And 2024 looks even better.

What we are learning is Fairfax was significantly under earning on its collection of assets for much of the past decade. But all the shackles that were holding earnings down have now been removed. Management is executing exceptionally well. For the first time in the company's history, the three economic engines are all delivering record results at the same time: insurance, investments - fixed income and investments - equities/derivatives.

Investors are just starting to get a look at what the true earnings power of Fairfax is on a go forward basis. And the total number is far higher than anyone dreamed possible.

So what is the valuation of Fairfax today?

Board members probably wonder why I have been so focussed on earnings in my analysis of Fairfax the past two years. Well, now you know why. I view Fairfax currently as a turnaround type of investment - and a heavy focus on earnings and assets is the only rational way to analyze the company today.

It’s not that I don’t pay attention to book value. I do. I just have never trusted how useful it is a tool to value Fairfax today or to help me better understand its earnings power as a company.

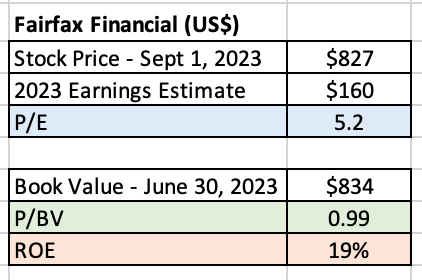

My current estimate is Fairfax will earn $160/share in 2023. I think that is a good baseline to use for earnings moving forward. If my analysis is right then that means Fairfax is trading at a PE of 5.2 x E2023 'normalized' earnings. Yes, that is nuts.

What does the future hold?

Peter Lynch: “Companies don’t stay in the same category forever. Over my years of watching stocks I’ve seen hundreds of them start out fitting one description and end up fitting another.” One up on Wall Street

Over the next couple of years we will all come to better understand Fairfax. And what its collection of assets are capable of delivering. What the true ‘normalized’ earnings power of the company is. At that point in time, the turnaround will long be over. And Fairfax will revert to being another predictable, boring old insurance company. And at that time, the valuation metrics (like book value, P/BV and ROE) generally used for valuing boring old insurance companies will again be appropriate to use for Fairfax.

If Fairfax is able to deliver strong earnings growth in the coming years the much improved results will slowly get baked into its historical numbers. That is when more traditional insurance investors will start to 'discover' how well managed Fairfax is. And how cheap the stock is. As this process plays out the P/BV multiple will likely expand significantly from 0.99 today to something more in line with peers, perhaps north of 1.3 (perhaps higher).

————-

Another reason Peter Lynch liked turnarounds:

Peter Lynch “The best thing about investing in successful turnarounds is that of all the categories of stocks, their ups and downs are least related to the general market.” One Up on Wall Street

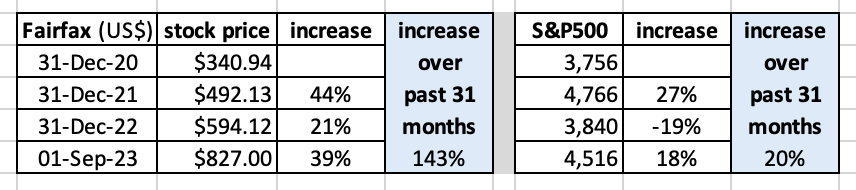

Fairfax is up 143% since January 1, 2021. S&P500 is up 20%. Fairfax’s outperformance over the S&P500 over the past 31 months has been an amazing 123%. Yes, that Peter Lynch is one smart dude.

—————

Peter Lynch on Turnarounds

“These are stocks that are battered down or they are hated companies, or they have been forgotten about. They are depressed in price but you have determined some one thing or a few things that have the potential for reversing this company’s fortunes independent of the industry getting better, or the economy getting better.

“You always have to do a balance sheet check on any company. This includes turnarounds. Do they have enough cash to make it through the next 12 months or the next 24 months? Do they have a lot of debt that’s due right now? These are important questions to answer.

“Make sure you understand and believe in the plan to restore corporate profits. It is all internal. They are doing something, either a new product, new management, cutting costs, getting rid of something. Something inside the company that allows them to improve themselves.

“Lots of turnarounds never happen, but a few winners can make up for a lot of losers. What’s important is to wait for the actual evidence of the turnaround occurring, not just the symptoms. (With) the turnaround, you have plenty of time. So just don’t buy on the hope. Wait for the reality. Turnarounds are so big it is worth waiting to get some real evidence.”

Thanks Viking! Every time you post something like this I have to debate myself how much of FFH to own is enought:)))

-

15 hours ago, SharperDingaan said:

The reality is that it is a lot less risky, & a lot more reliable, to simply invest domestically vs in china. The only people bitching are those trying to exit china, & discovering there is no market to sell into.

Pick your tribe & just get on with it.

SD

-

-

Maybe not all, but most analyst reports are a joke, just ignore them and use them for information/entertainment purposes only. I know, since in my previous life many years ago, I also wrote some of these reports:). While doing this we were joking, that "paper could suffer anything". DCF gives you ability to get almost whatever outcome your want. Generaly they all suffer very much from recency bias, otherwise they are to optimistic. Only one Sell report was issued by the department I worked in a few years and then analyst who did this was forced to leave a job, at the insistence of client, who otherwise threatened to sever his relationship with a bank. I think we were allowed at the time, but I do not remember, anyone betting any of his/her money on the research produced. Despite of everything, most people involved (clients, general public etc) took everything quite seriously, which was very interesting and bizzare expierence for me:).

-

-

5 hours ago, Parsad said:

Six bloody years and still no way to get at the funds! And people want to invest in China! Cheers!

China’s Xi Vows to Continue Opening Up Market, on Own Terms

In previous years, Xi has used the fair to reaffirm China’s commitment to opening up. There have been indications that foreign businesses are looking for more than just pledges this time around, with European Chamber President, Jens Eskelund, saying last month some executives are feeling “promise fatigue.”

-

5 hours ago, Viking said:

Lots of insurers are still sitting on large losses in their bond portfolio. The underwater fixed income securities are held in their held to maturity bucket so the losses have not flowed through the income statement. And the company line is ‘we will hold to maturity so it does not matter’. And that, of course is stupid. And makes no sense. Of course there are significant costs today for all companies that were buying fixed income duration in 2020 and 2021. Saying ‘it doesn’t matter’ is just a crafty psychological trick.

This also means earnings for these insurance companies are messed up. If you don’t book the loss today, it effectively means your earnings in prior year periods is overstated. There is no free lunch. This also means historical ROE’s from most recent years are overstated.

Perhaps it also means, that despite of not recognising losses, these companies will underearn for years and/or will behave differently in the underwriting side, hopefully keeping the insurance market harder for longer:)

-

7 hours ago, Thrifty3000 said:

According to Morningstar Travelers is currently valued at about 1.7X book value.

Precisely.

-

This is not a bad take on the situation:

Xi’s calm in the face of China’s worst economic situation in decades may have disappointed investors, but he has good political reason not to prioritize a recovery at the moment. Like all strongmen who guard their power with utmost vigilance, Xi likely knows that a pivot to the economy means delegating a lot of authority to technocrats. That’s because most specific policies to address China’s current woes are highly complex and technical. Decentralization of power is the precondition of reviving economic dynamism.

The empowerment of senior officials in charge of the economy could dilute Xi’s own influence — even though they are his acolytes. He probably remembers the experience of Mao Zedong following the Great Leap Forward famine from 1959 to 1961. After this disaster destroyed Mao’s credibility, the dictator had to step aside, ceding economic policymaking to pragmatists. But soon Mao began to regret the decision because the subsequent recovery boosted the power of the pragmatists at his expense. He had to launch the Cultural Revolution in 1966 to regain political dominance. -

4 hours ago, Castanza said:

If there is one thing you can learn from Dan Carlins series; it’s that History boils down to conquer or be conquered. History bears no remorse and grants nothing. It’s take and hold until the marauders are at your gate. Plan accordingly and maybe you’ll get 50 years of peace at best!

In 10 minutes:

-

-

28 minutes ago, Luca said:

Why would it be a problem for China to build up their army and not for the US?

Why does the US have the global single right to have all those bases and rockets stationed everywhere and other countries cant have it?

https://edition.cnn.com/2023/08/31/india/india-china-map-protest-intl-hnk/index.html

-

The US for the first time approved the transfer of weapons to Taiwan under a program usually reserved for sovereign states, the State Department said Wednesday.

-

What explains this impressive resilience? For something the size of America’s property market—where annual sales are worth about $2trn, scattered across a continent-sized economy, in which some regions are flourishing and others contracting—there is inevitably a nuanced answer. However, a good summary came in late August from Douglas Yearley, chief executive of Toll Brothers, one of America’s biggest homebuilders, during an earnings call. “There are still buyers out there. They have very few options,” he explained.

...

Many of those braving the market in order to buy homes have opted for new-builds, not existing stock. One advantage of newly built homes is that they are actually available. Thus they account for about one-third of active listings this year, up from an average of 13% over the two decades before the covid-19 pandemic, according to the National Association of Home Builders. As Daryl Fairweather of Redfin puts it: “Builders are benefiting because they don’t have competition from existing homeowners.”

-

28 minutes ago, Xerxes said:

it is like my backyard, I have trees and weeds slowly creeping over the past 10 years since I bought it.

last month, I compared a picture from 10 years ago. I was like holy shit. It is of course unplanned by the mother nature. The forest is not conspiring against me. Just taking its natural course of creeping toward my house.

but I finally drew a red line and clear everything out. The forest may not know the boundary of my backyard, but I do.

If I was ask to write a somewhat similar analogy of the situation, it would be more like one of these stories when a person in a nice and improving neighborhood for whatever reasons turns his backyard into some kind of a hole or dump, by bringing all kinds of bad behavior, waste, starts feeding 20 or so stray cats and so on, to stay safe he owns no less than 3 aggressive dogs and some arms, to keep the distance, he harass and confronts its neighbors in other ways and blames everyone except himself for his miseries:). But of course also he is paranoid and wants some privacy and keep everybody away aka Monroe doctrine:). Depending on the neighborhood and other circumstances, this situation could go on for a long time, maybe even all neighborhood could turn to shit, but more likely then not, the situation will resolve over time, at his expense:)

-

"At my last birthday, somebody asked me how old I was," the investor recalled during Berkshire's annual shareholders' meeting in 1998. "And I said, 'Well, why don't you just count the candles on the cake?' And he said he was driven back by the heat."

-

2 hours ago, Xerxes said:

I am about to finish my reading on the Mongol Empire. It is a book that I read more than 15 years ago and re-reading again as I thought it was such a fantastic book. So well written and a must read as part of Chinese, Russian and middle eastern history.

The book among many different themes cover the rise and fall of the Golden Horde of the royal line of Juji. He was Gengiz’ eldest son who established his dynasty in what is today Russia. Over centuries that semiautonomous fiefdom held sway in Western Asia but eventually succumbed to death by a thousand cuts as the world changed and a new power (Muscovy) rose. First as subjects of the Khans, than eating at the edges than swallowing their former master whole.

Sure NATO expansion to East, there was no grand conspiracy behind it. It was done slowly mostly at the behest of countries that wanted to have a new start. There was no grand directional desire to mess things up. But the upshot of that gradual unplanned attrition was that the now incumbent power in the East was getting killed by a thousand cuts. A thousand unplanned cuts from a Western point of view, (and I believe that to be the case) but a thousand planned cuts from Moscow point of view, when the same person is viewing the changing landscape from the Kremlin over the decades, and the gradual relative decline.

This is very interesting! I remember finding another book about Genghis Khan and was very surprised (because this was the the opposite of what I had learned under soviet educational system about the subject):

"The Mongol army led by Genghis Khan subjugated more lands and people in twenty-five years than the Romans did in four hundred. In nearly every country the Mongols conquered, they brought an unprecedented rise in cultural communication, expanded trade, and a blossoming of civilization. Vastly more progressive than his European or Asian counterparts, Genghis Khan abolished torture, granted universal religious freedom, and smashed feudal systems of aristocratic privilege. From the story of his rise through the tribal culture to the explosion of civilization that the Mongol Empire unleashed, this brilliant work of revisionist history is nothing less than the epic story of how the modern world was made. “Reads like the Iliad…Part travelogue, part epic narrative.” — Washington Post “It’s hard to think of anyone else who rose from such inauspicious beginnings to something so awesome, except maybe Jesus.”

But basically it again explained why this empire of Genghis Khan was so successful and thrived at its time. Because at the time it was superior to any other alternative and so the system just spread, intentionally or not, because it had what to offer for the people / nations under its rule/bootstrap? Perhaps not unlike any other empire it any particular point in history? Then came Pax Romana, Pax Britannica, Pax Americana. And so naturally all those superior systems of the time rose at the expense of the inferior systems?

So I do not know if this expansion it is planed or unplanned (https://en.wikipedia.org/wiki/Chicken_Kiev_speech), but I think that there is at least one thing which is perhaps obvious at this time: a former Soviet empire (or what is left of it) currently is a very inferior system and just does not has much or anything good at all to offer anymore. This is basically a former empire run by criminals, now turned to a war criminals on a big scale. Name me at least one country, under their influence, which is thriving or going up? More likely than not these are also failed states or on their way to it. While on the contrary, most members of Nato or EU (or both) is in peace and enjoying prosperity. So isn't all this just self explanatory? Now, what to do and how to cope with this failed former empire, which is nuclear armed to the teeth, and whose regime of course also have its own interests, I have no idea and for sure it is all very precarious and dangerous etc.

-

2 hours ago, Xerxes said:

For clarity the word “sovereignty” is not just about land/sea and the control of it. It is equally about economic, financial & political freedom to not be under the jackboot of any given power.

I suspect my fellow Westerners here are overfocused on the first part of that definition. That is understandable. Wars makes news.

ex: People’ Republic of Mongolia is a sovereign nation. But is it really ? Peel the onion, you ll see the People Republic of Mongolia is actually what they call “Outer Mongolia” and what is called “Inner Mongolia” is now a province of PRC. Peel it further, doesn’t take a genius to see while the “inner” is under de jure PRC control, the “outer” is very much under de facto influence/control of PRC.

how many nations don’t have their economic sovereignty … and you won’t bat an eye about it

This is a very good observation. I would just add, that sometimes it could be a huge, day and night (or North Korea vs South Korea, Belarus vs Baltic states etc) difference to which power a smaller countries (lesser powers) chooses to give up most of their sovereignty, when it is possible. And Ukraine is basically fighting for its right to make a choice.

-

3 hours ago, Spekulatius said:

Putin thought he was winning in May 2022. Do you think Putin makes a deal when he is winning?

By the way, Putin’s official condition to even start peace talks is that Ukraine gives up the land that they concerned back last year, because that’s now Russian in his view, since he (illegally) annexed it.

His demand for Ukraine’ neutrality is another non-starter for the Ukraine, because a neutral Ukraine just means it’s up for grabs later for Putin a few years down the road.

I think the likely end state is that Ukraine obtains NATO membership as part of the peace deal, so the borders with Russia are guaranteed by Article 5. Everything else will lead to a redo of the whole war most likely, it’s just a matter when.

I think you are right. And, as recent events showed, even if you make a deal, you could still end up like Prigozhin:)

-

23 hours ago, changegonnacome said:

If there was some kind of imperfect deal to be had in May 2022.......and Boris Johnson et al told Zelensky 'no dice' in a Churchill fever dream......then its really a terribly sad situation for every life lost on both sides since then.

Agree that the whole situation is terribly sad, but speaking about deals, didnt Prigozhin recently made a deal with Putin?

-

1 minute ago, Spekulatius said:

Mariupol is the largest city taken by the Russians.

Rostov!:)

-

-

"The primary objective of hedge funds is to generate returns, rather than to be imaginative for the sake of diversification,"

I think this is quite true. Not sure about the application on M7 at this time though:)

Russia-Ukrainian War

in General Discussion

Posted