-

Posts

1,847 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

This from older generation sounds better?

9 hours ago, Spekulatius said:Hmmm - don't like the music:

My guess is that this is this generation Rocky horror picture show. What can I say. This commentator in youtube says it all:

@ungreth74

1 year ago

Jazmin Bean songs are much like finding a severed head gift wrapped in pink ribbons on your doorstep. You can't be sure if you're supposed to feel horrified or delighted.

-

2 minutes ago, Luca said:

So i built up a position that wont kill me if it goes to 0 although i think that is very unlikely. Now its up to china to execute, how much can they grow GDP over the next decade two decades? There are so many people still poor, so much potential for development and i think the CCP can really do this, with ups and downs. Just own a big strong moaty company in that region, how can it not be worth significantly more with all these tailwinds? Hold it through the ups and downs, regulations will continue but tencent is still rocking, they will still release their games, people will still use wechat, people will still play league of legends, they will continue being a great investor worldwide etc.

I agree with you on Tencent/Prosus. But I disagree with "cut off from china like with russia is unimaginable lets be serious". Maybe it is just my imagination, but especially after this whole "unlimited friendship" situation, I can imagine even much worse things than cut off. And I am just afraid to play Russian roulette here, especially with some meaningfull alocation. I tried it in 2021, but after war in Ukraine and Xi not returning to normal, changed my mind.

-

21 minutes ago, Luca said:

This was a brilliant move by Deng and got China where it is now. Xi never says anywhere that he wants to isolate (see quotes i attached). The economies just have changed so radically that China is not only a manufacturing hub that was able to drive massive expansion of US capital but they are direct competitors and partly even superior. Thats why the tone in relations is changing.

Back then we produced our cars in china and sold them our cars.

Now they produce their own cars and send them to us and we might even end up producing their cars?

Complete change of the reality and thats what Dalio calls changing world order.

If i look at the US markets and their administration and at Chinas markets and Chinas administration, i see a LOT of strenght in China. Not saying the US is weak or anything, big amazing businesses, tons of IP and money, technology etc.

But its a country id bet on to be a significant player for the future, Xi WANTS China to be a significant player.

I kinda agree with you on achievements of China and its companies etc.

And yet with the latest policies of Xi they somehow ended up on the ‘wrong side of history’ in the eyes of US/west.

The whole thing escalates almost weekly. Tariffs, more and more sanctions, aid for Taiwan etc.

Or just look: https://www.theguardian.com/us-news/2023/may/09/ron-desantis-bills-ban-chinese-citizens-buying-land-florida

How can you be sure this is not going to end badly? Or badly at least for western investors in China?

-

On January 31, 1979, Deng Xiaoping, China’s paramount leader of the post-Mao era, boarded a plane for a historic visit to the United States. Deng was in very high spirits. How could he not be in such a bright mood? A few weeks prior, the People’s Republic of China (PRC) and the United States of America established diplomatic relations. This was a gigantic achievement for Deng, as it allowed him to accomplish a critical step toward his plan to launch China’s grand “reform and opening-up” project. The United States, as Deng then perceived, should play a central role in China’s drive toward modernity and beyond. Deng was not a talkative person, especially when he was with his associates. Yet he talked a lot during the cross-Pacific flight. Reportedly, Deng said something of the following effect to his associates: As we look back, we find that all of those countries that were with the United States have been rich, whereas all of those against the United States have remained poor. We shall be with the United States.

Luca, is this still the same with Xi?

-

-

6 hours ago, crs223 said:

I’ve never heard this, and I’ll never forget it… thank you.

-

Again, a lot of focus is on what China does, with a hope that, to borrow from Tencents presentation, maybe Xi/CCP will one day "complete self-inspection and corresponding rectification" (funny line from page 14, isnt it?).

However, in this whole situation China is not the only actor and it seems things are going to the wrong direction, with US and Taiwan elections on the horizon.

-

Wall Street firms are raising new funds to acquire office buildings, apartments and other troubled commercial real estate, looking to scoop up properties at a fraction of the price investors paid a few years ago. Cohen & Steers, Goldman Sachs, EQT Exeter and BGO, formerly known as BentallGreenOak, are among the prominent names raising billions of dollars for funds to target distressed assets and other real estate with slumping values, according to regulatory filings. “The last few weeks, I’ve been saying, ‘holy mackerel, they’re coming out of the woodwork,’” said Kevin Gannon, chief executive of Robert A. Stanger & Co., an investment-banking firm that tracks real-estate fundraising.

-

43 minutes ago, zippy1 said:

Maybe this is a case of "if there is no good things to say, don't say anything?"

Also:

Taking the pulse of China’s $18 trillion economy is getting tougher for foreign visitors who previously could count on holding informative meetings with key policy makers. While “old friends” such as Bill Gates and Henry Kissinger have gained access to the highest rungs of power in widely publicized visits this year, it’s been a different story for bankers, economists and businesspeople returning after three years of closed borders. Accounts from more than a dozen people, some who asked not to be identified to speak freely, describe dinner invitations that were seen as potential ethics breaches and politely declined, silence around taboo topics such as deflation and bland party speak replacing the honest exchange of ideas. Once-familiar officials, they said, are now fearful of breaching newly broadened anti-espionage laws as President Xi Jinping grows more wary of the US and its allies. Cliff Kupchan, chairman of political risk consultancy Eurasia Group, said he was still able to meet with long-time contacts on his first trip since the pandemic in over three years, but they were more reticent about expressing their views or had shifted toward the official line. “The number of Xi Jinping quotes I got was far more than any previous trip,” he said.

The deepening opacity — coming as China’s economic rebound falters — threatens to further undermine the already wavering confidence of foreign businesses and investors, rattled in part by a crackdown on consulting companies earlier this year. One gauge of foreign direct investment has slumped to the lowest level in 25 years and overseas funds aren’t buying into the stock market’s recent rally.

-

2 hours ago, Luca said:

Absolute contrarian indicator, should make people really excited about value in China

Luca, I definitely agree with you on contrarian situation here and big excitement on a micro level/valuations, especially on Prosus/Tencent. But it seems to me that all political/geopolitical/macro situation just continues to go to the wrong direction. And in order to succeed just beeing contrarian is not enought. But I hope things still could change and you will also be right in the end.

-

1

1

-

-

3 hours ago, zippy1 said:

"...stops releasing youth unemployment numbers"

Funny, but yet another wrong step. Fact or propaganda:)?

-

The country of 40 million people last year welcomed more than one million permanent and temporary immigrants, Statistics Canada said. That influx generated a population growth of 2.7%; the increase of 1.05 million people was nearly equivalent to last year’s increase in the U.S., a country with more than eight times Canada’s population. In the next two years, Canadian officials say they will boost the number of permanent newcomers by almost a third, with most being skilled migrants such as carpenters, computer scientists and healthcare workers who qualify under a merit-based points system.

-

https://www.wsj.com/articles/global-economy-economic-losers-fba30b53

The world’s biggest economies are offering huge subsidies in a cutthroat race to win the industries of the future. The losers: all the countries that can’t pay up. New tax credits for manufacturing batteries, solar-power equipment and other green technology are drawing a flood of capital to the U.S. The European Union is trying to respond with its own green-energy support package. Japan has announced plans for $150 billion of borrowing to finance a wave of investment in green technology. All of them are working to become less dependent on China, which has a big lead in areas including batteries and the minerals to make them.

-

Not only have reinsurers in some cases raised the cost of coverage, but they have also moved up the starting point for when they will begin to absorb losses. Thus, the amount of losses that primary insurers have to take before reinsurance kicks in is in many cases getting larger. Reinsurers are now typically seeking to start at the level of catastrophe losses that occur around once every 10 years, rather than the more typical starting point of one-in-three-year or -five-year events, Gallagher Re said in its January report. Clearly, the insurance industry as a whole needs to keep adjusting to worse events, more often. That won’t happen without cost.

-

On 8/7/2023 at 3:15 AM, StubbleJumper said:

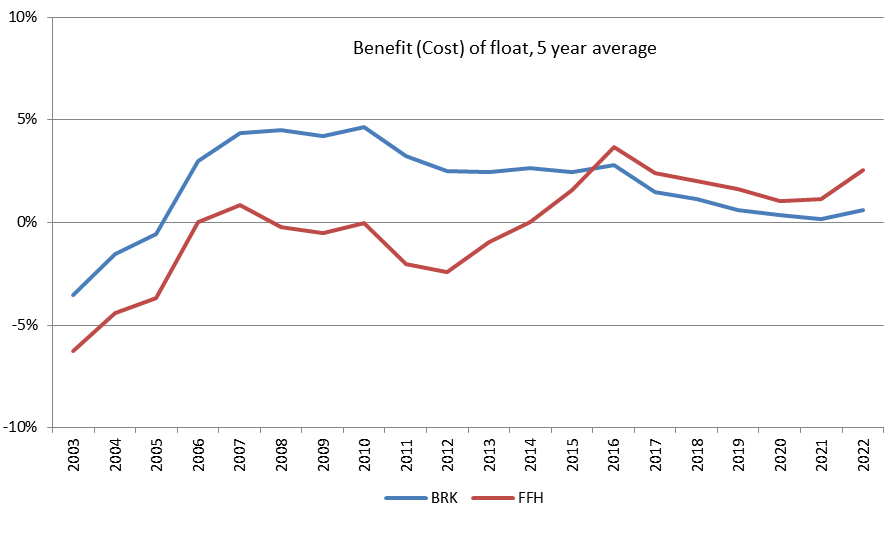

One of the most interesting bits that FFH publishes every year is a table depicting FFH's financing differential that appears in Prem's annual letter. In the early years, he provided the table in its entirety, but over the past 15 years or so, he's only provided an excerpt. A number of months ago, I went through the annual letters and constructed the long term series to the best of my ability (see attached).

The table shows how CRs and long term Canadian fixed income rates have evolved. The long and the short of it is that the financing differential (long-term bond rate less cost of float) has typically been in the low single digits, with only occasional years higher than 5%. The unfortunate thing is that the table uses long Canadian bonds, which made a great deal of sense 25 years ago when FFH was mainly a long-tail Canadian insurer. But, at this point, FFH is effectively a US insurance company with the lion's share of its fixed income investments in shorter-term US treasuries. A more instructive table would therefore replace the Canadian long-bond return with a 2 or 3 year US treasury, or perhaps a 5 year US treasury. But, in any case, suffice it to say that when you can easily find a 5% treasury bond, you don't usually also see a -6% cost of float (ie, a 94 CR). We are currently seeing a financing differential of about 11 percent, which is outstanding...and likely unsustainable. That enormous financing differential is likely to be competed away as capital enters the industry and companies get a bit more aggressive about growing their book.

That leads me to yet another interesting observation about FFH shareholders. Allied, Odyssey and Northbridge all have plenty of capital to enable an underwriting expansion. It's fascinating to me that shareholders have not been haranguing Prem during the conference calls to grow those books more aggressively.

SJ

Not sure if I did it without mistakes, but it is quite interesting if you compare this data of FFH with BRK!

-

11 hours ago, ValueMaven said:

Has anyone looked at the JNJ-KVUE swap? It's an interesting one.

You buy 99 shares of JNJ and swap it into KVUE at a meaningful discount. It's about a 17% return in 2 weeks time.

If you buy 100 shares you want be guaranteed a full swap, and if you buy 99 shares and don't allocate the full 99 shares, then you will lose out as well. KVUE also has sold off and seems cheap to me given its business and moat. Hedge Funds cant do this (99 share issue) and most retail is unaware of the transaction.

Thanks!

https://www.barrons.com/articles/jnj-kenvue-stock-price-odd-lot-rule-96aa9b74

Also: One potential positive is that arbitragers have been buying J&J and selling short Kenvue to take advantage of the 7.5% spread. This has depressed Kenvue by about 3% since the deal was announced in July while J&J is up about 2%. This could mean that Kenvue may appreciate once the deal is done and that trade is unwound. When General Electric did an exchange offer for Synchrony Financial in 2015, GE stock outperformed before the deal and Synchrony outperformed GE immediately thereafter.

And: https://finance.yahoo.com/news/kenvue-set-join-p-500-224200805.html

-

3 hours ago, rkbabang said:

In the short to medium term I'm far more bullish on fission nuclear power. I think the US is going to eventually get off its ass and reduce the regulatory burden and allow advanced reactors to be built and built more quickly. Even if the US doesn't do this other parts of the world will.

Nuclear Power Will Grow "Exponentially" In Low-Carbon World – Citigroup White Paper

https://www.wealthbriefing.com/html/article.php?id=198695

I'm invested in SRUUF right now and am looking for other ways to take advantage of this trend as well.

Fusion is interesting, and will probably eventually be how humanity generates its power, but it's not really actionable yet for an individual investor.

Sweden said it needs to treble nuclear power capacity over the next couple of decades to meet a surge in electricity demand. At least 10 new conventional reactors need to be built by 2045, Romina Pourmokhtari, the nation’s climate and energy minister, said in a statement on Wednesday. The biggest Nordic nation has six reactors in operation today. Sweden needs all the new power capacity it can get as demand is poised to double in the next few decades amid the electrification of industries and transportation. New nuclear plants are at the heart of the government’s strategy to expand power output.

-

A lot of "regulations are over" promises recently, yet almost every week there is some kind of new announcement.

-

10 hours ago, SafetyinNumbers said:

All else being equal (rates stay flat, premiums are growing) discounting the reserves under IFRS results in higher underwriting profit than under the old paradigm. While FFH is still reporting the old combined ratio metrics, when I calculate the combined ratio from the disclosure I get a lower IFRS-adjusted combined ratio. That makes intuitive sense.Besides the discounting of new reserves, by moving one period forward, the balance of reserves accrete each quarter. That offsets some of the benefit but is also included in the adjusted combined ratio. If rates are coming down, that should increase the accretion as the whole reserve balance is discounted at a lower rate and we are moving forward a quarter. There should be an offsetting gain in bonds but I can see in that scenario how the IFRS adjusted combined ratio may not be lower than the reported combined ratio but I don’t know if it’s possible to do a sensitivity given the reserves are opaque.

Intact Financial discloses two combined ratios to illustrate the difference when they report with almost a 400bps difference between the two last quarter. You can see the spread is smaller last year when the interest rate curve was lower.

I’m not sure if I’m right in how I’m interpreting it despite formerly practicing as a CA/CPA and having a MAcc so if anyone knows better please share.

Thanks very much!

I guess, on the other hand, all this again is also a very good remainder (at least for me) that with an insurance business you really have to trust managment a lot.

I remember I first tried to look at some insurance companies (other than BRK) in 2010 or 2011, after BRK invested in Munich RE and also when AIG was starting its second life:). This is when I also discovered this board and FFH for the first time:). Maybe WB letters and warnings on insurance had a big influence, but at that time I came to a very simple (stupid?) conclusion: no other insurance company other than BRK is investable for me at that time (good sleep), at least for big/high conviction position. I bought some FFH in 2012, but generally just went with BRK for large allocation, which was also quite cheap in 2011-2012 period. Even today, together with other leveraged financials (also after some very different expierence of investing in banks: worked generally really good with US, not so with EU:)) I do not like these companies: no traditional pricing power, high leverage and all the dangers of "creating profits" with pen, dancing till the music stops etc. More so when they are not owner operated etc. On the other hand BRK (and some other companies) has proved, that a well run insurance operation, especially combined with well run investment side of the business, could do wonders for investors. So the crux with FFH, at least for me, is do I trust them with that? I think (or hope), that the answer after the last decade is finally yes with FFH? So I would be very worried if something bad came out of their insurance operations or if they would made another very big insurance acquisition. But it seems so far so good on this side?

-

On 8/7/2023 at 6:12 PM, Viking said:

4.) Effects of discounting and risk adjustment (IFRS 17). Interest rate changes drive this bucket. My estimates here could be a little messed up. Given I am forecasting interest rates to remain about where they are today, I am leaving this number the same over the forecast period (at my estimate for June 30, 2023).

Viking, thanks for update!

I am not sure I understand this IFRS 17 effect correctly (or at all:)), but wouldnt constant rates imply, that this line more likely would be a zero in the future, as only further rising rates would translate into some positive number (and vice versa)?

'On the mechanics of IFRS 17':

-

I think it is very healthy when we still have such opinions from analysts, especially when they are obviously wrong:). If you read only COBF, these days consensus on FFH almost worryingly too cheery. But when I speak about FFH with some other investors, I am still getting a lot of push back and/or very low interest. These views are usually because of expierence of the decade from 2010 and they just do not want to dig deeper, or to change the old opinion, or to dig at all, but also maybe because FFH is quite complex and in the insurance business. Anyway, if or when this Morningstar analyst will upgrade FFH to some 'medium moat' and a price with the multiple of 1.3 or 1.5 BV in the next 3 years, he probably will be another 50 or 100 per cent to late and at that time expected returns will be much lower:)

-

-

https://fortune.com/2023/08/05/black-swan-hedge-fund-mark-spitznagel-interview-taleb-credit-bubble/

I hoped that Spitznagel would help me find a simple yet practical solution to protect your portfolio from worst-case scenarios (or tail risks)—after all, that is his “bread and butter.” But his answer wasn’t what I anticipated. When you ask the man who has written multiple books on risk mitigation—his latest is called Safe Haven: Investing for Financial Storms—how retail investors can protect their capital, you expect to hear a few of the typical options: gold, Treasurys, or maybe the Swiss Franc. Instead of all that, Spitznagel warned that when it comes to safe-haven investing, “the cure is often worse than the disease.” If risk mitigation isn’t cost effective and supportive of higher overall returns in the long term, then it’s not worth it. In his view, most of the classic safe-haven strategies used by retail investors fall into this category. There is some good news, however. A recession or market downturn may come—and Spitznagel says he’s worried about what he calls the “greatest credit bubble in human history” and a “tinderbox” economy—but perhaps paradoxically, he doesn’t expect even that to be the end of the world for retail investors focused on building wealth for the future. It may take time, he said, but markets always recover, even from unexpected, economy-crushing black swan events. In spite of the potential for economic disaster, Spitznagel believes that retail investors should probably just listen to the timeless advice of Berkshire Hathaway chairman Warren Buffett: Focus on the long haul and don’t bet against America.

-

And Tom, one other point on the buying back. In our annual report we said that our book value per share grew at 18.8% from inception compounded at 18.8%. Our stock price sometimes compounds above and sometimes below. Well at the end of 2022 we said what stock price Canadian dollars would make the book value compound and the stock price compound the same? And that number we put in our annual report was CAD 1375 1-3-7-5. That just makes it same. Book value is our first indication. Our book value we think is very understated and our book value -- our intrinsic value which I'll leave you guys to estimate is worth a lot more than the book value. But that's how we look at it. So at the end of the year CAD 1375, if we can buy our shares we think we're doing all shareholders that we're doing well by all shareholders by buying back the stock. Fran, next question?

Michael Burry’s current holdings

in General Discussion

Posted

https://www.wsj.com/finance/investing/how-to-get-rich-and-famous-from-a-stock-market-crash-6914580a