thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

As an example, Bank of America owns $600-$700 billion of "Debt Securities", about 2/3 of which is Agency MBS. In no world, is Bank of America comparing its MBS holdings to the prospect of buying multifamily. They're totally different. As for why they won't hold cash, well they're earning $10-$11 billion of interest on that portfolio which is low, but it's far more than zero.

-

the end buyers are totally different. The holders of treasuries and MBS are sovereigns, the Fed, banks and insurance companies, etc. the nominal cash flows of those are guaranteed by the most powerful country in the world. Inflation protection is not the point. No one is buying agency MBS expecting inflation protection. They are buying MBS to pick up some spread relative to treasuries by bearing prepayment risk and weighted average life variability. I don’t see them as comparable at all given their vastly different capital treatment and risk characteristics.

-

i like kuppy because he wrote a promotional piece on JOE that jived with me, bought calls, made 600 or so bps from 100 and moved on. followed JOE forever but he highlighted how the perception would change and catalyzed the move up. would i trust all his numbers or details or risk big money on one of his themes? No, absolutely not.

-

CXP being taken out by Pimco after strategic review involving 90 interested parties. about a 5.3% cap rate on NOI that’s down a bit. Stock about 100% off low, -20% from pre covid peak, -50% to those who bought CXP as a non traded REIT at $40 (someone told me this, this has not been confirmed by me)

-

It’s not a “loophole” and life insurance is available to everyone*. All life insurance bypasses estate tax. This is just a way of doing non traditional investments in a life insurance wrapper. it’s like variable life insurance but with hedge funds, credit etc. *though your standard Northwestern Mutual one will probably have higher commish and will invest in the general account and make a low single digit IRR.

-

I actually think we’re a bit fancy bunch, expected to get some shade for my life choices, some mustachians to argue for a 1995 Corolla / Schwinn bike purchased on Craigslist or something. it’s a bull market when a bunch of value guys are buying year old bimmers and new SUV’s

-

Didn’t know about the ceiling mode. TSLA’s price makes sense to me know.

-

Margin Debt: Down for the first time in 15 months...

thepupil replied to KFS's topic in General Discussion

i wish all the margin charts i see indexed it as a percent of account values / index values. i find the data wholly uninteresting and useless without that. -

that sounds miserable. I guess a 2012 could be older than 10 years now, so it wasn't covered under the 10/100K powertrain warranty, or did they not have that then?

-

@GregmalThere are moments where I think we are very different, and then there are moments like these. I have an RX and just bought an ES. In each case, a touch more than Highlander/Camry (I get the less optioned up ones, ~$40k each after incentives/negotiation etc. I recently read the average ES buyer is like 65. Since I rock boomer stocks, might as well rock the boomer car.

-

any reason not to Just buy a new Toyota/Lexus, Hyundai/Genesis and HODL?

-

TINA, plain and simple. I buy a boatload of index every month in my 401k because I’m 32, only got 10-30 more years of working to to grab as many risk assets as possible. Everyone I know does the same and hasn’t wavered throughout volatility over the past decade. Top 10-20% of America does nothing but buy stocks with $10-$50k+/year in their 401k’s there were like 3-4 years where I tried to be cute about it and make 2-3% in a stable value fund, probably cost me $100K+…no one’s perfect. Buy, buy, buy. top, schmop.

-

For the time being, I think you vastly underestimated how much money and buying power people have, overestimated the speed of change of where and how people wish to live, underestimated the appeal of expensive areas to wealthy high income people, failed to incorporate any practical real life experience or anecdata into your overly theoretical analysis / metaphor based on one dying industrial city (detroit), and failed to take into account hugely accommodative policy/demographic trends. we will see what the future brings! early is sometimes different than wrong!

-

EQR and AVB are up 64-80% from 10/30/2020 (pre-vaccine) CPT and MAA are also up about 60%. EQR and AVB are up moderately (8-14%) while MAA/CPT are up 44-51% from 12/30/2019. I actually think the fact that EQR and AVB are up from pre-covid is evidence of a lot of optimism regarding cities, just not as much optimism as the sunbelt. I don't think any of them are very "cheap", but the market is certainly seeing a degree of optimism in urban multifamily (rents are also spiking). So there was a very sharp/dramatic recovery in urban multifamily. I recall EQR getting as low as mid to high $300's/unit and now its $510K/unit (up from $500K / unit as of 12/2019). MAA has gone from $190K / unit pre-covid to $160K at the low to $260K now. On a long term basis, it's not clear to me which I'd rather own. I think one thing you're doing is comparing huge and liquid and well managed (CPT/MAA/CUZ) to idiosyncratic family companies (ALX, CLPR/Dolan co's/ or NEN) which makes no sense to me; if you want to compare CUZ to VNO/SLG or EQR/AVB to MAA/CPT, to make your point (which you can) then that makes sense.. ALX is a cash box and bloomberg building bond, it's not gonna do what the market does (up or down, recall it went down 15% when VNO/SLG/PGRE went down 50% (this is the actual Q12020 performance numbers). that it hasn't recovered is not evidence of lack of belief in NYC's recovery, it's due to unique security specific things. The MSG/Dolan entities also have other drivers (like the Sphere) and near term timelines regarding re-opening. EDIT: EQR and AVB are like 10-20% NY but the closest we have to a proxy for urban multifamily

-

have about 6% in NYC via ALX and CLPR. VNO/PGRE are flirting with interesting in my opinion, but not quite there. I don't think ALX or CLPR will go up or outperform over a short time horizon.

-

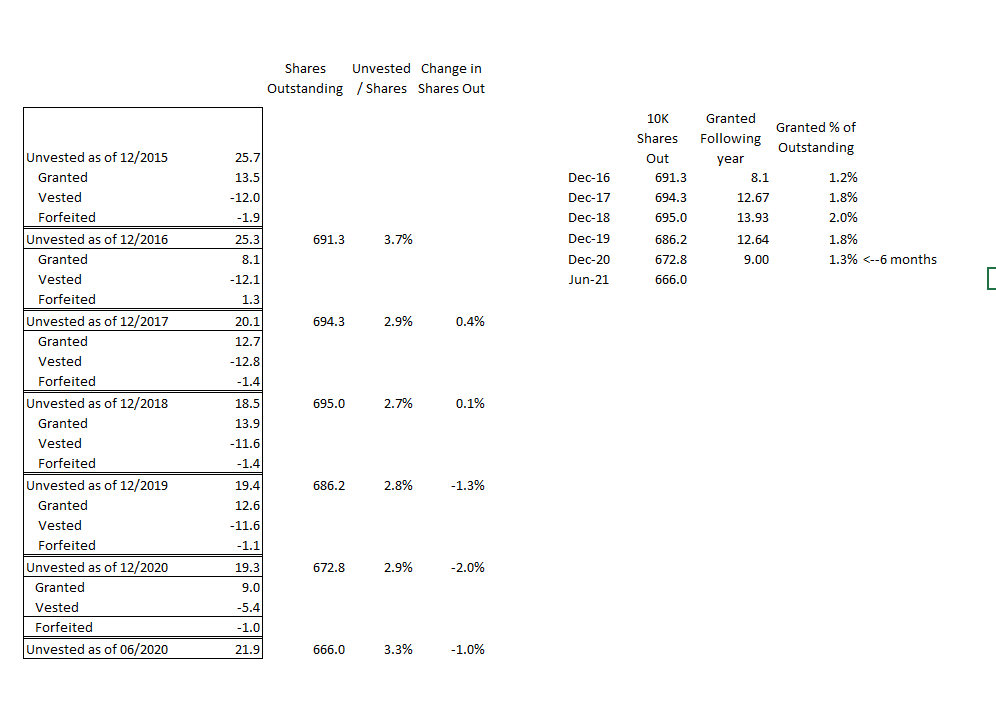

I agree it's an expense. how one should account for it is up to interpretation. how would you adjust GOOG's earnings (or market cap) on a forward looking basis to account for what you see as a systematic undercounting of stock based compensation expense? the sell side seems to add back stock comp expense, then builds in an estimate of shares outstanding (which will include the impact of RSU's). this does not seem overly aggressive to me. Said differently, JP Morgan sees Google doing $69 billion of GAAP Net income for 2021 and $76 billion of "adjusted net income" the biggest add back to which is $15 billion of stock based comp for 2021. I've snapshotted their model which shows you the SBC as an addback. JP Morgan is not saying "stock based comp isn't an expense" by adding it back. Rather, I think think they're baking in that expense by increasing the share count. Goog seems to consistently have 18-22 million of unvested shares from RSU's at any given time 2015 to present.. This is 2.7-3% of outstanding shares and they grant about 1-2%/year to employees. The share count was roughly flat 2017-9 and is now on a trajectory of -2%/yr as the gross buybacks have increased. It's true that the 12.0-13 million shares that were granted / vested in 2015 are worth $32 billion today, which is a lot more than was expensed for those shares. But I fail to connect that fact to my (or anyone's) assessment of what Google is trading at or might be worth. If you account for it by increasing shares (or rather not decreasing shares by the full amount of the buyback) then you've accounted for it, right? I feel like I'm missing something here. Your takeaway seems to be that GOOG (and companies of its ilk) are overreporting earnigns power by a substantial margin and that's not at all my takeaway from this. I think you might respond "what if they had to pay cash instead of grant RSU's wouldn't GOOG then report much lower income?". In theory that could change things, but in practice, it's hard to imagine how or why that may occur (and they are paying cash for that expense via the buyback). Overall, I think I understand what you are saying, but you seem to be making a leap that megacap tech (and the market as a whole) are making significantly less money than reported and are thus more expensive because of this. The only way I see that being true is if their collective growth suddenly slowed, their stocks fell AND you had to keep the same dollar amount of stock based comp (ie you had to grant a higher % of shares, ie it'd grow more dilutive over time). I see no evidence of that and don't have that view. It's a possibility, but not the base case, in my opinion.

-

@Cigarbutt, I'm not really sure I get your point on stock based comp. If sales/share, EBITDA/share, Cash flow/share, free cash flow / share, net income/share (<--i get that you're saying net income is overstated) are all up and to the right, then I don't understand why should penalize companies for when the stock goes up over some time frame such that issuance to employees is with hindsight more expensive. by saying "Google is actually 40x earnings" aren't you penalizing earnings for FUTURE stock outsized stock price appreciation? I've read your stuff on this twice and still don't understand.

-

if tetragon got credit for 80% of every dollar, I'd be a lot wealthier..try 35 cents.

-

How to Allocate for Yield for Bond Investments

thepupil replied to Simba's topic in General Discussion

I'd just keep it in cash if you need the money in <12 months. I'd buy I savings bonds if you need it in 12+ months. $20K/couple. if you're young and putting more than $20K/year in something w/ a 0% real return, then you either are saving a shit ton or being too conservative. cash 0% yield, 100% liquid i bonds 0% REAL deferred pre-tax yield, liquid after 1 year w/ a penalty in years 1-5 -

so are all these peeps gonna work from their apartments? office leasing is about 50% of pre-covid, which at 7% expiry / year should see occupancy decline (marketwide) by 3-4%/year with the higher quality buildings taking share (this is consistent w/ my observation at least, $SLG is signing great leases, $VNO signed the 2 largest leases of last Q after signing the largest leases last year). My question (to which i don't have an answer) is if NYC fills up with young vibrant ambitious well paid people again (which appears to be happening), will we see office leasing achieve pre-pandemic levels. we'll see. office s/d can still suck with lots of people in NYC.

-

And so on this day in in the year of our Lord Two Thousand and Twenty One, @Gregmal asks of Mr. Market where his money lay, and as manna from heaven, Mr. Market showered tendies upon him. Ask and ye shall receive.

-

Just to put on my permabull hat.... What will seem more insane in 10 years. 1. That a bunch of studios/1BR's in Phoenix traded between $20-$40K/Unit from 2000-2017 2. That someone paid $140K/unit in 2021 after someone bought it for $70K/unit in 2020 and put in $7-$10K/unit of capex. I think number 1 will seem crazier than number 2. I'm not saying that the 6/2021 purchaser didn't overpay or that I'd personally do the deal, but it's possible that it doesn't seem crazy in a decade.