thepupil

Member-

Posts

4,311 -

Joined

-

Days Won

4

thepupil last won the day on April 25 2024

thepupil had the most liked content!

About thepupil

- Birthday 11/22/1988

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

thepupil's Achievements

-

In 2019 (when I was 31), I bought a 20 year term policy for $2mm for $900 / year. I doubt this is replicable today, but LT rates are higher so it may not be too much more expensive. That would pay off my mortgage ($700K) and give an immediate $1.3mm of walking around money and along with current other assets provide a decent lifestyle. As for management of assets, we have a few family friends that are traditional financial advisors who put you in index like things and charge 50-90 bps. they won't steal your money. they'll just put you i 70/30 diversified stuff and take their parasitic fee. I'd be fine with that. It's a low probability event. if in that low probability event, my family has to pay fees to my wife's best friend's husband at northwestern mutual to put her in index funds but doesn't have to worry, I'm fine with that. no need to get too complicated with it in my view.

-

I think this depends on the intrinsic value range of the company. Like in the last 10 years or so, I made a lot of money trading EQC on 2%-10% moves. At various times, these were huge swings in the implied value of remaining assets or just a big swing in the multiple of cash + RE. the apartment REITs are a less extreme version. There can be pretty big differences in implied unit values / cap rates and risk reward on a 20-40% move. Like let's say you buy a 5% position in a MF REIT that realistically has like 20% downside and 40% upside (basically MF REITs in late 2022) and it goes up 40%over 12 months. Let's say your view of value went up by 10%, so you now have 10% upside and 38% downside and a bigger position (7% if the portfolio was flat). You started out risking 100 bps in downside scenario to make 200 bps. now you are risking 266 bps to make 70*. Surely the risk / reward has deteriorated. Now maybe you say "i don't want to pay taxes and I'll just dilute the position down by adding to other stuff; I'm fine just earning the LT hold IRR of these assets", but at some point, one may need to take more aggressive action to improve r/r of portfolio, right? I think this is pretty straightforward when dealing with assets with a potentially more narrow range of outcomes and when one can replace the appreciated asset with relatively fungible (but better priced) risk; RE companies lend themselves to such trades, which is probably why I've made a far higher return than the LT returns of many of my holdings. Obviously this is much more complex if you're talking about less fungible companies and things with potentially wider range of outcomes. of course, levered stuff it's the opposite. a 50-100% move in stock price can be almost meaningless in terms of risk / reward. *of course there is also a "constant multiple" LT return just from holding the asset, but I mean the short to intermediate return from re-rating / multiple change

-

I think you're thinking of Bob, right? https://awealthofcommonsense.com/2014/02/worlds-worst-market-timer/ I've never checked the numbers/always taken it at face value. I think Bob is a great lesson for those who don't need money for 30, 40,50 years and a terrible one for those who need (or may need) it in 1,3,5,10.

-

I think the answer to this is "probably". Valuations very much probably have an impact on long term returns based on history. But the long term is truly a long time. 10-20+ years. and until very recently equities offered very substantial premiums to risk free alternatives. In a tax free account, I think TIPs are starting to get a little more competitive but still not there. the long term case for stocks remains, but feels less strong given valuations. I don't know what anyone should really do with that though. young people should buy risk assets, mostly, and old people should acknowledge SORR / mark to market / volatility and maybe not be 100% US equities unless they ahve a like 2-3% WR....beyond those truisms, doesn't feel like anyone should do anything differently w/ high valuations versus low versus medium. I for one thought do find it harder to index w/ US index at these levels...but I own enough US stocks/risk assets to be fine with or without the 401k portion of my NW (where I must pick some kind of index) in US stocks. it's in EM / bonds right now. my wife's is in a target fund which owns the whole world / mostly equities. small sample size. this only uses 1985 - 2024 but would suggest a strong relationship. this uses 1926 - 2017 and finds that valuations potentially do matter and have a degree of predictive power, but there is wide variance and predictions should not be single-point, but rather directional. https://www.kitces.com/blog/us-equity-valuations-investment-cape-10-diversification-stocks-sp-500/

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

Doing some basic napkin math $700mm debt 88mm shares $140mm MF NOI gonna cap slap 6.5% =0.065 $16.50/share as a bear case, going to say 5.25% / $22 as a very bulled up case. watergate is $12mm NOI /300k sf. gonna say $60mm ($200 / 20% ) as bear case, $120mm ($400 / 10%) as bull case 0.7-1.4 from watergate so napkin math = $17.25-$23.40. I’d probably say $19/$20 is realistic. At about $17 in the aftermarket, 0-37% upside with a 4.2% divvy. probably not a terrible amount of risk, but also not too too much reward either. this basically says 5.8% for larger 1980s built DC metro apartments as of 7/2024. https://berkadia.com/wp-content/uploads/2024/07/Berkadia-Mid-Year-2024-Multifamily-Report-Washington-D.C.pdf bump it to 6% for trump/doge/rates, gets you $18.50 + $1.00 for Watergate = $19.50 = $19 just to use a round number, would be a rough base case. maybe people get a little more timid because DOGE/fear of trump, but maybe not. Nov 2024: JP Morgan Note (Stock at $16.70): "We calculate ELME to trade at an implied cap rate of 6.5% whcih seems about 75 bps wide of where we anecdotally hear about transactions for similar assets" <-- perhaps they are just repeating the same stuff, but that's another high 5's guesstimate. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

$ELME pretty much saying it's for sale. I feel good about my basis of $13.25 but don't think the results going to be too exciting. but that was kind of the deal, when bought in 2023. approaching 7.5 cap, 5% divvy, hard to lose money, maybe a better target since streamlined, but nothing too exciting. here's to a good 2025 for this most mediocre of REITs! -

we taking 100% positions now?

-

I'm doing roth conversions at close to max bracket. it doesn't make sense from a net worth/current cash flow maximization standpoint but starting in 2028 my housing costs will be sustainably covered. I probably won't actually take money out then, but building the ladder now.

-

I have a good amount relative to my age..though am not as young as I once was and honestly it's hard to tell what numbers mean anymore because everyone else is getting more nominally rich too. One of my problems is only 20% of my total pre-tax liability, pre transaction costs net worth is accessible/liquid/spendable. So I feel a lot poorer than my personal capital calculator would suggest. home equity, IRA/HSA/401k/etc, a private RE investment, a small trust comprise the other 80%, all of which are illiquid/restricted/come with tax penalties. I've become more focused on increasing the accessibility/liquidity of these than maximizing the actual number...which isn't where I want it to be either.

-

I do. You just need to you know sell your soul at a job that pays for it. i aspire to one day be a “general member” and not the top airline status. That means I own my time. cant wait to join the plebes!

-

seems like a decent starting description to me. I'm old enough to remember when the republicans wanted to privatize SS, not seize it for benefit of cryptocronies / pet projects / etc. of course detail is so scant that anyone's pre-existing biases will be confirmed. arguing over the merits of a strange hypothetical SWF is almost certainly a fruitless exercise.

-

Do you enjoy the process or just the proceeds?

thepupil replied to Milu's topic in General Discussion

Was going to say this. i need at least a little process to get the proceeds. but I like the process too. I will admit to just wanting to read about stocks all the time. I want to make the proceeds so I can just do the process (ie not work…so I can…spend my time working). -

hedge funds covering boring funding shorts????

-

i guess, I think younger people should just rent if the math doesn't make sense at current rates... I don't have an answer, but the alternative to what he's doing is not obvious to me.

-

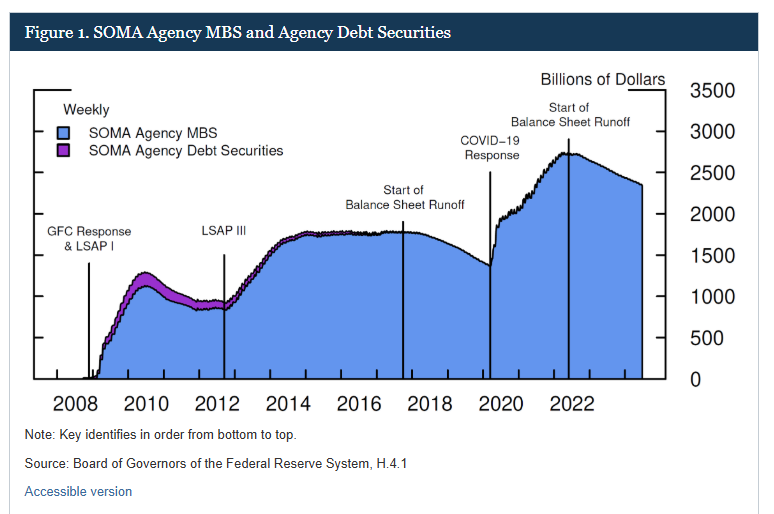

Powell can't (completely) control the 10 year or MBS spreads though. Do you think he should halt the run-off and purchase MBS in our current economy? Or should ST rates be lower in hopes that 10 yr rates go down and MBS spreads tighten? I am actually impressed with how well housing's held up in the context of 7% rates. Feels like Powell doing what is long term healthy without much short term pain. Of course, I say this from a position of privilege w/ my circa 2021 2 7/8% mtg.