-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

https://www.cnbc.com/id/37498773 Negative Reviews for Warren Buffett's Defense of Moody's to Crisis Commission Alex Crippen | @alexcrippen Published 7:39 PM ET Thu, 3 June 2010 Warren Buffett is getting a lot of negative reviews for his appearance under subpoena yesterday (Wednesday) before the Financial Crisis Inquiry Commission. In response to respectful, but pointed, questioning, Buffett argued that Moody's shouldn't bear all the blamefor giving favorable ratings to subprime mortgage loans that later went horribly bad, sparking the financial crisis we've all been living through these past few years. Almost everyone, he said, believed at the time that housing prices couldn't crash. "Look at me. I was wrong on it too." Buffett was there because his Berkshire Hathaway holding company is Moody's largest shareholder with a stake now, after months of selling, of about 13 percent, down from almost 20 percent a year ago. After the hearing, panel Chairman Phil Angelides told Reuters, "I'm not sure he fully comprehends the range of questions raised about Moody's business practices and culture." Reuter's Felix Salmon writes that it was "arguably the single worst day of Buffett's life" from a PR standpoint. Among other pans, Salmon cites Pragmatic Capitalism's criticism of Buffett's Moody's defense: "Angelides (and just about every other rational American) thinks the ratings agencies played a central role in misleading investors. The fact is plain as day to anyone who doesn't own millions of dollars worth of their stock." Bond Girl writes on Self-Evident that "Buffett has gone from being the authority on value to defending some of the most dysfunctional and socially worthless elements of the global financial system. It’s funny how heroes end up cutting themselves down to size even when no one else can." On Capital Gains and Games, Edmund Andrews calls Buffett's performance "shameful," adding that "I never thought I would ever say this, but Warren Buffett has turned into an evasive, disingenuous, bumbling buffoon." Money Watch's John Keefe writes his criticism under the headline, "Warren Buffett Shows His True Colors: Green, and Uncooperative." Kevin Hall of McClatchy Newspapers focused on one aspect of Buffett's testimony, reporting his assertion that he wasn't tipped off to problems with bonds highly rated by Moody's is a "direct contradiction" of email evidence "presented privately to the panel." On Fox Business, Charlie Gasparino accuses Buffett of "defending the most corrupt business model in corporate America" (the people issuing the debt pay for that debt to be rated, creating a conflict of interest) just because Moody's was a good investment. CNBC.com Senior Editor John Carney wrote on this site that "it would be unfair to Buffett to wonder if he is just talking his book here." But he rejects Buffett's view that increased competition among credit rating agencies (by loosening government regulations that support a "duopoly" in the business) could result in more laxity in the ratings. Carney also highlights Buffett's statement to the Commission that he looks for misrated securities because "that will give us a chance to turn a profit if we disagree." Carney's conclusion: "The same Buffett who profits from the duopoly status of the top ratings agencies also profits from the mistakes allowed to fester under our anti-competitive system. Perhaps we should think twice before anointing him our oracle when it comes to ratings agency reform." (emphasis added)

-

Fairfax India is hitting its own milestone with book value reaching above $20. https://www.fairfaxindia.ca/press-releases/fairfax-india-holdings-corporation-second-quarter-financial-results-2023-08-03/ "At June 30, 2023 common shareholders’ equity was $2,748.1 million, or book value per share of $20.10, compared to $2,642.0 million, or book value per share of $19.11, at December 31, 2022, an increase of 5.2%, ..."

-

https://www.nytimes.com/2009/03/18/business/18buffett.html Buffett Is Unusually Silent on Rating Agencies "Moody’s rated Lehman Brothers’ debt A2, putting it squarely in the investment-grade range, days before the company filed for bankruptcy. And Moody’s gave the senior unsecured debt of the American International Group, the insurance behemoth, an Aa3 rating which is even stronger than A2 the week before the government had to step in and take over the company in September as part of what has become a $170 billion bailout."

-

Ex-S&P Analyst Who Cut US Rating in 2011 Says AAA Is No God-Given Right https://finance.yahoo.com/news/ex-p-analyst-cut-us-213950106.html “The underlying fiscal position and underlying debt trajectory has picked up pace,” Beers, who is now a senior fellow at the Center For Financial Stability, said on Bloomberg Television. “AAA is the top rating any rating agency can assign, but of course, the US and any other sovereign that’s being rated has no god-given or automatic right to that.” In August 2011, Beers and John Chambers shocked markets by stripping the US of its AAA grade at S&P, dropping it by one level to AA+ for the first time in history. Fitch on Tuesday cut the US credit grade to AA+, triggering its own wave of criticism.

-

IMF: India to be fastest growing major economy in 2023 https://moderndiplomacy.eu/2023/07/30/imf-india-to-be-fastest-growing-major-economy-in-2023/ "IMF raised its 2023 growth forecast for India by 20 basis points to 6.1%, bolstering expectations that the current G20 chair will be the world’s fastest growing major economy this year"

-

I never like articles on the Motley Fool but this one is a bit better. https://www.fool.ca/2023/07/12/prem-watsa-is-back-why-fairfax-financial-stock-has-room-to-run/ "Investors getting in at these prices may need to roll with the punches, even if the stock is overdue for another one of its 10% dips. In any case, Prem Watsa has proven that he still has plenty of skill. And as a recession comes rolling in, expect Fairfax to roll with the punches. Fairfax and Watsa are back, and investors should really take notice, even if shares are near an all-time high."

-

Just to avoid any confusion and my apologies in advance for butting-in, the term nifty50 is also used for a major index of India's main market. https://www.marketwatch.com/investing/index/nifty50 "It is the world's largest derivatives exchange by number of contracts traded[a] and the third largest in cash equities by number of trades[b] for the calendar year 2022.[4] It is one of the largest stock exchanges in the world by market capitalization.[2] NSE's flagship index, the NIFTY 50, a 50 stock index is used extensively by investors in India and around the world as a barometer of the Indian capital market." https://en.wikipedia.org/wiki/National_Stock_Exchange_of_India

-

You are correct. That was an oversimplification and the comparison is quite far fetched. Still, a point to ease the fears. Insurance companies are price takes, however, the worse the hurricanes, the higher the prices they all shall be taking. Here again, the management becomes more important, companies with better management will get extra advantage.

-

https://www.businessinsider.com/personal-finance/homeowners-insurance-made-hurricane-season-florida-less-stressful-2023-7 No particular insight into FFH's hurricane exposure but it is likely nothing to see there, business as usual. Hurricane fears will keep bubbling every year, some years they will underestimate, some years overestimate. Those fears can present more opporutunities to get more in on the asset when their stocks gets depressed. Similar to tobacco companies, the demand for insurance is inelastic. People will pay regardless of price. Governments keep increasing taxes on tobacco and the hurricanes keep getting worse due to climate change. Both the tobacco companies and the insurance companies keep increasing their prices, revenues and profit. For insurance companies there is the added advantage of increasing float and increasing investment gains.

-

Central Bank Digital Currency (CBDC) https://www.msn.com/en-gb/money/technology/hdfc-bank-signs-up-over-100000-customers-in-digital-rupee-pilots/ar-AA1dNLD2 " The Reserve Bank of India (RBI) has devised the e-rupee as a digital alternative to physical cash, using blockchain distributed-ledger technology. The central bank aims to reach a target of one million CBDC transactions per day by the end of this year from 5000-10,000 currently, Deputy Governor T Rabi Sankar said on Tuesday. "

-

Someone chooses their chart start date based on their blog date. I choose March 2003 as my chart start because that is about when I left New York! Now, when I look at that chart, there is a certain feeling of pity and sympathy for Berkshire. Certainly, they can get a participation certificate, a consolation prize of sorts because they "also ran". But, just look at that growing gap, how this thing keeps falling more and more far behind throughout, oh my, what a dog!

-

-

You are right, I understand what you were doing there. Just like to point out that a change of annualized return rate from 4.6% to about 7% is huge on its own even if it looks less so when compared to some other larger number like 14%. Also, to point out, even though a start of 2006-end includes the winning macro bet before 2008, it still includes all of the losing shorting bet and thus the 2006-end can be argued to be a far more neutral starting point than the 2011-end. Overall, nobody knows the future but the point is to show how easy it is for the masses to be fooled by the numbers.

-

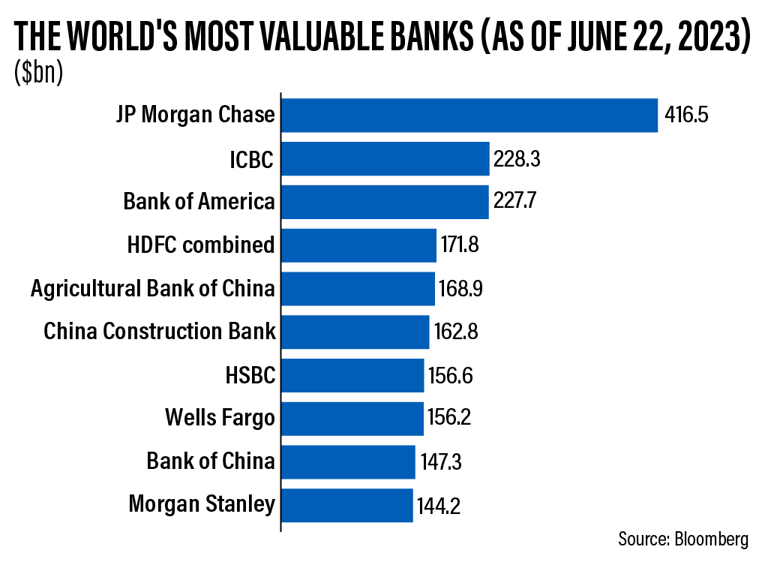

"India's HDFC Bank ascension to global top-five ..." https://www.msn.com/en-ae/money/other/how-india-s-hdfc-bank-ascension-to-global-top-five-may-stir-competition-in-the-sector/ar-AA1dElRb

-

There is nothing holy about using end of 2011 as the start date, go just 5 years further back and you get this:

-

2023 Invesco Global Sovereign Asset Management Study https://www.fundresearch.de/Invesco-Global-Sovereign-Asset-Management-Study-2023-FINAL.pdf "India exemplifies the attributes sought by sovereign investors. Viewed increasingly positively for its improved business and political stability, favourable demographics, regulatory initiatives, and a friendly environment for sovereign investors, India has now overtaken China as the most attractive Emerging Market for investing in Emerging Market debt"

-

Most self-acclaimed investment experts fail to include dividends in return calculations. Dividends make an unexpectedly extraordinary difference to total return due to compounding. Since Berkshire never paid a dividend, those making these comparisons get yet more Buffett brainwash. Prem had to write the following in 2022 letter (page 31) to remind us for our own benefit: "Don’t forget the dividends in your return calculation!"

-

India’s stock market is hitting record highs https://www.cnn.com/2023/06/28/investing/india-stock-market-boom/index.html " India’s stock market is booming as investors take a chance on one of the few bright spots in a fragile global economy. The country’s stocks are so hot that India is now home to the world’s fourth most valuable equity market, behind only the United States, China and Japan. "

-

Fear & Greed Index What emotion is driving the market now? https://www.cnn.com/markets/fear-and-greed

-

Maybe a good time to reread this post by Viking before the Q2 results.

-

Parsad Sir, Happy Birthday! (just a note that your chart likely included the dividends and that is a good thing, thanks)

-

So Warren Buffett himself is teaching us against the use of risk-adjusted return (Sharpe ratio) but we are still looking for an excuse to use the Sharpe ratio to justify our reverence for the one and only, the chosen one, the Prophet (Oracle of Omaha). This is wonderful.

-

The symptoms of brainwashing are very similar to that of an addiction. You come up with all kinds of excuses when the truth is staring you in the face. Your confusions and delusion with data is just further evidence of the brainwash effect. Are you in market without a basic charting tool that can compare total returns of two securities? Anything can happen in the future that nobody can predict but let us be rational with historical numbers.

-

Mere fundamentals like including dividends when comparing is likely more important than advanced jargon like sharpe ratio.

-