-

Posts

524 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

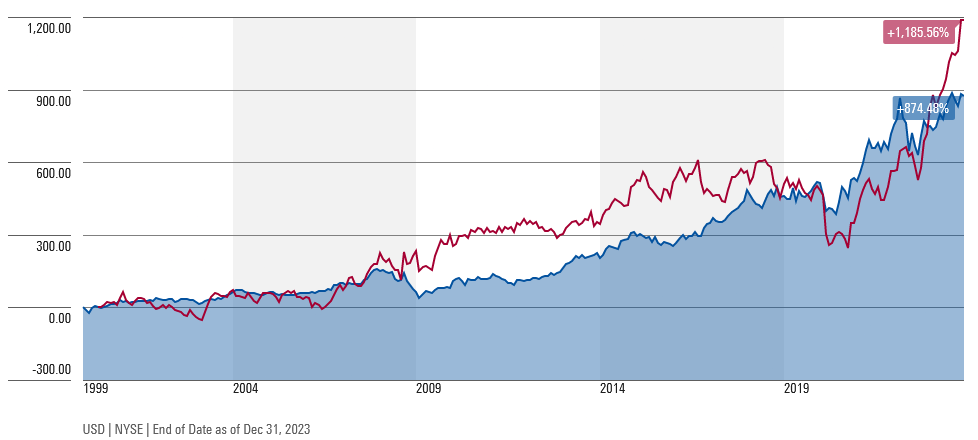

You got that right. The point is that there are stocks and fund managers out there who have vastly outperformed Berkshire but nobody will know because of the Buffett brainwash syndrome and the scam of charts without the dividends.

-

He is Asia's richest person as of today. https://www.msn.com/en-in/money/topstories/mukesh-ambani-re-enters-elite-100-billion-club-as-reliance-shares-rally/ar-AA1mQocw

-

No. Next hint: it trades on NYSE.

-

The market cap of this mining company that has left Berkshire returns far behind over more than 25 years is over 50 billion.

-

I would like to confirm that if the dividend is paid to shareholders of record on Jan18 and it takes 2 days to settle then the shareholders upto Jan16 will get paid and therefore the ex-dividend date should be Jan17 on Wednesday or is it Thursday?

-

https://economictimes.indiatimes.com/news/company/corporate-trends/indians-can-dream-now-the-potential-is-enormous-prem-watsa-chairman-fairfax-financial-holdings/articleshow/106716893.cms " We are thinking long term right . 10 to 20 years. We have 25 million capacity in T1, 25 million in T2 and we are thinking that 25 million in T2 goes to 50 million. And then we have the possibility of a third terminal to take it to 100 million capacity. The metro is already being built in Bangalore. The structure is quite impressive. And the airport city in Bangalore which is 450 acres. We want to be able to manage build and construct more airports in India because we have shown we can do .. "

-

Good catch on the $84 billion blunder even though cannot disagree that much if they are expressing their opinion of fair value in CAD$. Here is the link to more detailed interview - https://economictimes.indiatimes.com/news/company/corporate-trends/indians-can-dream-now-the-potential-is-enormous-prem-watsa-chairman-fairfax-financial-holdings/articleshow/106716893.cms

-

Newswire going verbose on negligible Orla, again! Fairfax Announces Acquisition of Additional Orla Shares TORONTO (Globe Newswire) January 10, 2024

-

https://www.msn.com/en-in/money/topstories/indias-growth-to-remain-robust-world-economy-to-slow-down-in-2024-world-bank/ar-AA1mHpIg India's growth to remain robust, world economy to slow down in 2024: World Bank [ The government’s advance estimates, released Friday, estimated that the Indian economy will grow 7.3% during the current financial year. At the projected growth rate, India will retain its crown as the world’s fastest growing major economy. ]

-

https://economictimes.indiatimes.com/news/india/indias-big-advantage-is-that-two-thirds-of-the-economy-is-consumer-oriented-says-fairfax-boss-prem-watsa/articleshow/106711744.cms [ India's big advantage is that two-thirds of the economy is consumer-oriented, says Fairfax boss Prem Watsa Fairfax has invested $7 billion in India, he said. "In next five years, we are looking at doubling that. We got a few projects already that we're working on," Watsa said. However, for India to remain an attractive investment destination, continuity will be key, he said. ]

-

Touched a new high in CAD 1300 today. Last updated: Jan 10, 2024, 5:46 PM ET Source: QuoteMedia Open 1,268.06 Day High/Low 1,300.99/1,243.46 52 Week High/Low 1,299.79/795.67

-

it is the mining company that is on the top in blue line including dividends while the Berkshire is that red line on the bottom

-

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-these-two-stocks-might-be-removed-from-the-tsx-60-scotiabank/ “TSX 60 Deletion Watch on AQN [Algonquin Power and Utilities, AQN-T] & FM [First Quantum Minerals Ltd., FM-T] — Keep an Eye on 0.2 per cent. FM and AQN have shrunk to being the two smallest stocks in the TSX 60 with only a 0.25% weight. A historical analysis of past deletions highlights a deletion danger zone below 0.2 per cent. The index committee’s decision could be swifter for AQN if it breaches 0.2 per cent given an extended period of time at low weight already. FM could be given a pass for a longer period in our view: the collapse is recent, stems from a specific event (Cobre Panama), and could be reversed. Most Likely Replacements for AQN or FM: FFH, then TFII”

-

I suppose these could be interesting due to the expected series of federal interest rate cuts this year. However each one will require quite a bit of research to figure out the credit quality of the debt issuer. I am likely clueless but the HISA (high interest savings accounts) based ETFs like CASH.to are popular.

-

The whole debate about dividend vs buyback may be dissolved if we ponder on this: The primary business is to keep the company strong and expanding for the long term. Returing capital at times of temporary undervaluation is a far secondary consideration. We get myopic based on how the dividend will affect our own unique personal situation.

-

-

mentioned at the end of this interview that succession plan is with the board and with the family. https://youtu.be/BW08lI8518A

-

Please provide some examples or tickers if you like.

-

Just getting the charts from tgam.ca and morningstar. Not sure how good is their data. Data can be garbage.

-

-