dartmonkey

Member-

Posts

309 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by dartmonkey

-

Actually, those mark to market changes have been in effect for more than 5 years now. Q2 to Q3 OXY is indeed down a bit, from $63.03 June 28 to about $52 now. Since Fairfax owns 6 million shares, that represents a loss of about $66m pretax, as gfp mentions, and maybe $53m after tax, and that is in the context of total earnings of about $1b per quarter. In the same time period, GODIGIT is up from 338 to 387, a 49 rupee gain. Fairfax owns 49% of Go Digit shares, through Digit (which also owns other things besides Go Digit,) and 68%, if one includes the convertible preferred shares Fairfax owns, so this represents 68%*923.33m shares= 627.9m shares; 49 INR = 0.58 USD, so this represents a Q2-Q3 gain of $366m, 6 times the OXY loss. I expect that only the preferred shares are market to market (they are worth 19% of Digit), whereas the 49% of Digit's common shares are accounted for as an associate (20-50%) and share gains will not show up as earnings, but even the preferreds would represent a bigger mark to market gain than the OXY loss. And there are many other gains, such as Poseidon and Eurobank (also associates, so gains would be because of their earnings, which are substantial). OXY only appears to be their biggest position because it is now the biggest position that is declared to the SEC in a 13-F, compiled on sites like Gurufocus and Dataroma. Those do not include holdings like Go Digit, Eurobank, Poseidon or of course their preferred shares or their big bond portfolio. So the OXY position, worth $379m at the end of Q2, was the biggest position in the $1.2b 13F portfolio, but total Fairfax common stocks were $7.3b, all stocks including preferred stocks were $9.9b, and all investment assets combined were $57.5b, so OXY is worth less than 1% of that.

-

The Sleep Country thing makes so much sense now! Yes, if only Sleep Country had been big enough to be in the TSX 60! But at $1.7b, it's only a third the size of Algonquin, the smallest component. We need to think bigger. I propose we buy out Canadian Tire Corp (market cap $9b), #57 in the TSX 60, and then, to be sure to get in, we become Canadian Tires Beds and Restaurants - got to get away from that 'Financials' image...

-

Hell no, but I'll take your word for it. Ok, I found their press releases, going back to Sept 2021. But what I get from the extra homework you assigned me is that they typically only make changes when they have to, usually because a big company has split (like Brookfield) or, more often, because a component has been bought out (Kirkland Lake, InterPipeline, Bausch, Shaw). I can only see one change that seems to be motivated by size (adding Intact, deleting Canopy), and the size difference was bigger than the Fairfax/Algonquin swap we fantasized about (Intact was bigger than Fairfax is, and Canopy had become much smaller than Algonquin.) So maybe Fairfax's best chance is when some current component gets merged with another component or bought out by a non-Canadian company. Then Fairfax would probably be the most likely addition, as it is the biggest Canadian company (#27) not already in the TSX 60 which is supposed to be "designed to represent leading companies in leading industries".

-

yes, but that is not the S&P TSX 60 (60 large caps), it’s the S&P TSX Composite, with 226 constituents

-

There's always a silver lining! But did the S&P make an announcement? No changes to the index at all? I can't see anything on the TSX website.

-

Just to flesh this out, Stelco accepted a buyout bid from Cleveland-Cliffs in July, at $70 a share (a 87% premium to the previous price of Stelco shares, $37.36). Payment is to be $60 in cash, $10 in CLF shares. Those CLF shares have lost almost 30% of their value in the 2 months since then, so when the deal closes, Stelco may get shares that are worth about $7, if CLF shares are still around $11.50 when the deal closes (expected in Q4). Competitor US Steel, not involved in the deal, is down 21% in the interim; I might add that SLX, a steel ETF, is down too, about 11%. I love it when Fairfax opportunistically accepts a nosebleed offer, like the pet insurance bid by JAB Holdings a couple of years ago or this Stelco bid. When I heard they were shopping Bauer/Maverik/Peak, which seems to have been a modestly successful investment (about 10% CAGR I think), I wondered why they don't just hold onto it, hoping someone develops an irresistible craving for a hockey/lacrosse equipment company. What's the hurry? Anyways, this Stelco sale is just one more happy ending in what seems like a charmed period for Fairfax. Presuming it works out, of course; the breakup fee is only 3% of the value of the transaction.

-

How does this work? I would not have expected that inflation would be necessarily bad for most insurance, since rates are readjusted every year, but maybe long-tailed insurance (asbestos for instance) might be hurt by unexpectedly high inflation. Did Jain explain his thinking?

-

I’ve gotta ask, how is it that FIH’s investments have managed to avoid all this sizzling?

-

I'd go with the street. Algonquin must be below 20 basis points now, but the Financial sector is already too big, because of all our bank concentration. I guess it depends which criterion is more important, since you can't do both. So my guess is they'll punt.

-

What do you make of the fact that the CCSP's alone are valued at $1.8b in Fairfax's Q2 report? Specifically, the transfer out of category line, and the accompanying Note 3:

-

Yes. Fairfax actually has a pretty consistent presentation: Go Digit Infoworks = "Digit" Go Digit General Insurance (GODIGIT.NS) = "Digit Insurance" Since the IPO, Digit owns 73.6% of Digit Insurance. And Fairfax owns 49% of Digit, and has the CCPS convertibles to take its ownership to 68% if that is approved by regulators. So they own or have convertibles to eventually own 68%*73.6% = 50.05% of Digit Insurance, but also 50.05% of the other assets that Digit owns, including Digit Life Insurance which may actually be worth more than we think. Here is why we may be seriously underestimating the value of Digit outside of the public Digit Insurance. Note that on p.13 of the Q2 report, they mention that private company preferred shares worth $1787m were transferred from Level 3 to Level 2, and in the note (3), they explain that this was because of the Digit Insurance IPO. Since the preferred shares (CCPS) only represent 19% of Digit, logically that would mean that Digit is worth $1787m/.19 = $9.4b, or even more, $10.7b, now that Digit shares have gone from 338 on June 30 to 383.7 at last night's close. That would mean that Fairfax's stake, 68%, would be worth $7.3b?? Could it be that the preferred shares get marked to market because they are less than 20% of Digit, while the equity shares have to be treated as an investment in associates because they are 20-50% of Digit?

-

Buffett/Berkshire - general news

dartmonkey replied to fareastwarriors's topic in Berkshire Hathaway

gas guzzling? we guzzle, and they furnish the oil that we guzzle -

Amazon threat to Duracell and other Berkshire brands

dartmonkey replied to LongTermView's topic in Berkshire Hathaway

This part seems a bit out of date! -

Yes, when Fairfax refers to "Digit", they mean Go Digit Infoworks; for instance here, where they make it clear: during the second quarter of 2024 the company's investment in Digit compulsory convertible preferred shares ("CCPS") was transferred from preferred stocks classified as Level 3 in the fair value hierarchy to Level 2 as the fair value of the CCPS is now principally determined through the traded market price of Digit's general insurance subsidiary, Digit Insurance, whereas the fair value was previously principally determined through an industry accepted discounted cash flow model. https://www.fairfax.ca/wp-content/uploads/2024_08_August_01-FFH-2024-Q2-Interim-Report-Final.pdf Given the fact that Fairfax has convertible shares that would take them to 68% of Digit (i.e. Go Digit Infoworks!), and since Digit's stake in Digit Insurance is currently 73.6%, Fairfax would own 68%*73.6%=50.06%, so your objective would already be achieved by the IPO dilution.

-

That's nicely done. I think there is one mistake though, here: Pre-IPO Valuation Total Shares Outstanding (Approx.): 917.65 million shares Pre-IPO Share Price: 272 INR Fairfax’s Effective Ownership Pre-IPO: 40.82% 49% Å~ 83.3% = 40.82% 49% Å~ 73.6% = 36.06% Calculation Total Value of Digit Insurance Pre-IPO: Fairfax’s Stake Pre-IPO: Convert to USD (assuming 1 USD = 83 INR): Post-IPO Valuation at June 30, 2024 Total Shares Outstanding: Approximately 917.65 million shares The number you quote is very close to the post-IPO count listed here: https://www.chittorgarh.com/ipo/go-digit-general-insurance-ipo/1727/, but the pre-IPO count should be 41m lower: Total Issue Size 96,126,686 shares (aggregating up to ₹2,614.65 Cr) Fresh Issue 41,360,294 shares (aggregating up to ₹1,125.00 Cr) Offer for Sale 54,766,392 shares of ₹10 (aggregating up to ₹1,489.65 Cr) Issue Type Book Built Issue IPO Listing At BSE, NSE Share holding pre issue 875,842,046 Share holding post issue 917,202,340 The more important point is whether the 49% includes or doesn't include the ownership via the convertibles. It is true that there is a note in the table on p. 14 of the Q2 report that says: "Ownership percentages include the effects of financial instruments that are considered in-substance equity." On the other hand, in the annual report (p. 13), they pretty clearly say that the 49% stake would go to 68%, if the convertibles are converted: " Confusion abounds!

-

OK, please ignore what I just wrote, since it's hard to believe that 36% of Digit Insurance is worth $1.33b and the preferreds are worth 38% more, or 50% of Digital, which would be a total of 86%. I don't know why the preferreds SEEM to be worth so much, but the answer doesn't sound right.

-

A first stab at this would be to separate it into 2 components, the equity and the convertible preferred shares. Fairfax owns 49% of Digit’s equity as regular shares, and Digit owns 73.6% of the publicly traded Digit Insurance (note 1, p.14, Q2 report), so that makes $1.33b as of June 30 and $1.45b at yesterday’s close. We can get a pretty close estimate of the value of the preferred shares because the Level 3 non-Canada non-USA preferred shares went from $1989.9m on Dec 31st to $1.9m on June 30, so that was almost certainly about $1988m worth, and we know they realized a $43.6m gain on those shares. This squares fairly well with the fact that Level 2 assets in the same line went from $286.6 on Dec 31st to $2125.8m on June 30, for an increase of $1839m. So it looks like the full stake would have been worth $1.33b+$1.84 = $3.17b on June 30, and estimating that the preferred shares gained value by the same proportion, $1.45b+$2.01b = $3.46b now.

-

Clearly they need to use equity method accounting, but I thought that was the 'carrying value' number, not the 'fair value' number. I found this on the intertubes: Using the equity method, a company reports the carrying value of its investment independent of any fair value change in the market. With a significant influence over another company’s operating and financial policies, the investor is basing their investment value on changes in the value of that company’s net assets from operating and financial activities and the resulting performances, including earnings and losses. https://www.investopedia.com/terms/e/equitymethod.asp Since Fairfax owns more than 20% but less than 50% of Digit, they would need to present carrying value based on their historical cost, adjusted by dividends received for instance. But when they present 'fair value', isn't that just their best estimate of the real value, based on objective inputs?

-

Go Digit General Insurance (GODIGIT.NS; "Digit Insurance" in Fairfax's reports) just closed at a new high, 373.9, putting the insurance company's market cap back over $4b ($4.01b). The IPO price was 286. It's a complicated calculation to see how much of this belongs to Fairfax. Here is my understanding, but I would appreciate it if someone could correct/complete this analysis. Fairfax owns 49% of the shares of Go Digit Infoworks Services Private Limited ("Digit"), and in the Q2 report, they gave this a fair value of $485.5m and a carrying value of $268.7m. Go Digit Infoworks owns 73.6% of the insurance company, which they call "Digit Insurance". So I would think that would mean that Fairfax owns .49*.736 = 36.06% ; that would mean that Fairfax's stake in the insurance company was worth .3606*$3.7b = $1.33b on June 30 and .3606*$4.01b = $1.45b now. Fairfax also owns some compulsory convertible preferred shares in Digit, and a proportion of whatever else Go Digit Infoworks owns, apart from Digit Insurance. I presume the preferred shares come with some arrangement for purchasing additional shares of Go Digit Infoworks, although as far as I know, the details of this arrangement have not been reported. Anyways, it doesn't seem to add up. $485.5m fair value as reported in Q2 seems way below the $1.33b that the insurance company alone was worth on June 30. I understand that the carrying value could be way below the fair value, but isn't the fair value now based on the share price? They state this explicitly for the value of the convertibles, but wouldn't it also be true of the shares? the company's investment in Digit compulsory convertible preferred shares ("CCPS") was transferred from preferred stocks classified as Level 3 in the fair value hierarchy to Level 2 as the fair value of the CCPS is now principally determined through the traded market price of Digit's general insurance subsidiary, Digit Insurance, whereas the fair value was previously principally determined through an industry accepted discounted cash flow model. Can anyone explain what appears to be a discrepancy here?

-

In Germany government oftentimes steps in, if the economy gets hit badly (covid…). My gut feeling is, that in the US they are more market oriented and let things go without too much intervention; but at some point they would I guess. But I am not an expert, any thoughts from someone else? Western governments often step in to provide financing, preventing bankruptcy, but they don't just give money to companies to wipe out a big loss. Many of the 'bailouts' of public companies (like GM and Chrysler, for instance), came at a pretty high cost to shareholders. Competitors like Ford who were adequately financed did not get all that market share for themselves, but then, that was not really a realistic prospect anyways - if governments had let GM and Chrysler fail (as I feel they should have), then new competitors would have sprung up from their ashes pretty quickly, as their factories, technology, dealership network etc. were purchased out of bankruptcy.

-

Watsa's projected $4b in operating earnings in the next 3 years is based on: "underwriting profit of $1.25 billion or more; interest and dividend income of at least $2.0 billion; and income from associates of $750 million, or about $125 per share after taxes, interest expense, corporate overhead and other costs." Net premiums written in 2023 were $28.9b, so $1.25b is about a CR of 96. Last year the CR was 93%; in 2022 it was 96%; 2021 it was 88%. It is true that some day, there will be a super CAT that will knock a hole in one year's earnings, but perhaps a 96% average CR is realistic. In the catastrophic 2001, the total combined ratio was 121%, although only half of that was from megacats; the CR would have been 110%, just from underreserving. What average CR do you think we should use?

-

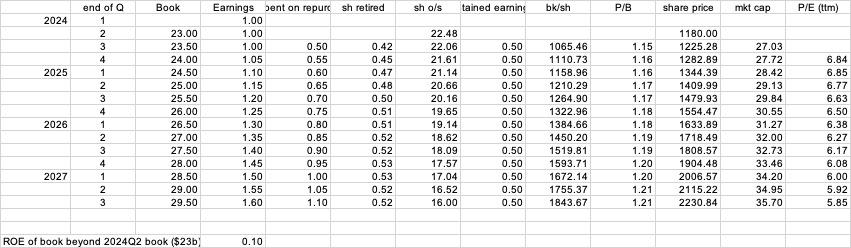

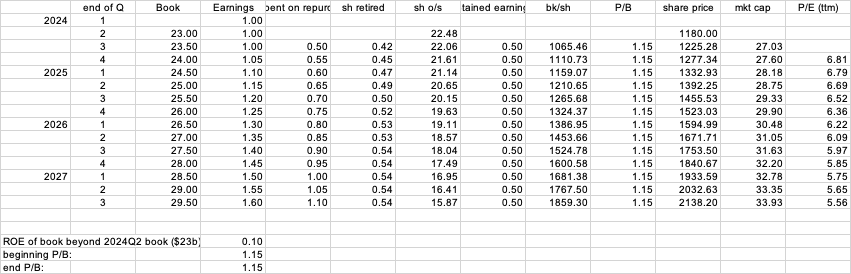

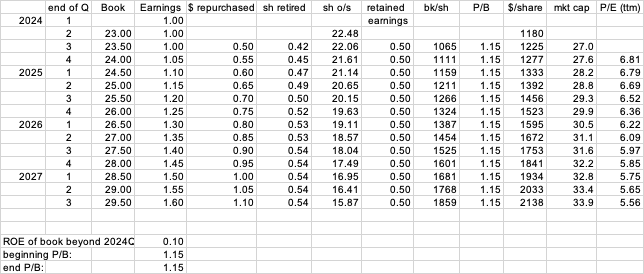

Just to show how this works, P/E=P/B*B/E = P/B÷E/B = 1.2÷15% = 8... Realistically, if Fairfax continues to do well for 3 more years, the price is not going to be the same. But you got me wondering, what might a realistically repurchase scenario look like? So I took current book of $23b, 22.48m shares outstanding at the end of Q2, share price of $1180, and $4b a year in earnings that management says we have visibility for for the next 3 years. Then I assume that half of those earnings ($2b/year) will be used for repurchases ($2b/year) and half will be retained (and invested). But since some of the earnings will be retained, book will increase over time, and there will be earnings on that extra book. So I assume that the current $23b in book will keep making $4b/year (a 17% ROE), but whatever is added to equity over the next 3 years will get a lower return (as interest rates fall, etc.), which I have very pessimistically put at 10%. Even with P/B staying at 1.15, that means share prices would almost double. Book would only go from $23b to $29.5b, but because of the 6.4m shares repurchased, book per share would almost double, as would the share price at a constant multiple of book. P/E would just come down a bit, from 7 to 6. If the P/B multiple keeps rising, say to 1.3 in 3 years, there would be a little less repurchasing, but on the other hand, the share price would be a bit higher, just over a double. ,

-

Makes sense to me. This return would be on investment assets that are currently at $66b, whereas equity is $23b, so results are levered about 3 times. So I think it is fair to say that Fairfax is currently on track to earn 21% on equity, at least in the next few years. Thoughts?

-

I didn't vote, but I would say the over and the under are about equal; in other words, I think $2000 sounds really optimistic for the price in 3 1/2 years, going from $1150, but it's the $1150 that is off, not the $2000. We have 3 1/2 years of very likely $4b earnings, so $14b, on top of the current book value of $22.5b, taking us to $36.5b. If we stay at 23m shares (i.e. no repurchases), that would be a book value of about $1543, so we would need a price:book of about 1.3 to get to $2000, up from a multiple of 1.1 right now. Seems reasonable, if the recent performance continues and there are no major new problems (like much lower interest rates, a severe recession, or a series of bad megacaps). An interesting twist is what happens if they are able to repurchase a substantial number of shares. Fairfax has repurchased 17% of its outstanding shares from 2020 to 2023, so another 20%, with the cash flooding in, seems doable if the share price stays below fair value. I won't bore people with the calculations, but share repurchases above book value actually decrease book value, and the effect on P/B would be about 11%, if there is no change in the share price. Of course, in reality, the market price will tend to track earnings per share as these increase, not book value, at least in the long term. So if share repurchases really are accretive to fair value per share, the book value multiple would have to gradually rise by to just over 1.2x book, without any change in valuation. If we repurchases 20% of shares, to hit the $2000/sh target price, we would actually need to get to a price:book of about 1.45, not 1.3. I think this is actually more likely to happen with the repurchases than if we didn't repurchase any shares. It would be just one more solid achievement under Fairfax's belt, and if shares are still trading at 5.5 times earnings in 3 years, I would be quite surprised. I guess I shouldn't be disappointed, because it would mean even more opportunities for repurchases, but someday, I would like to reduce this Fairfax stake to something more, euh, traditional.

-

Longer term, the size of Fairfax in addition to the normalization of underwriting cycle will also make it harder to earn a high ROE I think but if they can avoid major mistakes, it will be a highly satisfactory investment. As Charlie (Munger) wisely said, "Having low expectations is the secret to success and happiness in life." Maybe that's why I'm unhappy. No, seriously, you are right, but when comparing with alternative investments, I think one can also err on the side of being too pessimistic, and miss out. So I think the right approach is to be optimistic first, buy FFH shares, then decide you might have been wrong, become pessimistic (while keeping those shares), and hopefully be pleasantly surprised when your new pessimism turns out to be unwarranted.