dartmonkey

Member-

Posts

309 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by dartmonkey

-

Wow, those are some great prices, as low as $1613. I bought another 5% or so yesterday, but only got $1263. In fact, looking at historical prices yesterday, Yahoo Finance says the low price was $1656 yesterday, so I don't feel so bad. But how could Fairfax purchase these shares so cheaply? That was a nice day's work for whoever is in charge of buying back shares, a $138m investment already up 6%...

-

There are 2 numbers we often see publicized, one of them being the numbers like the above for Helene, which are toal losses, and the other is a much smaller number, which is insured losses. Helene's total number might easily be $50b, but insured losses are currently estimated as being about $6-12b by reputable agencies like Verisk, AON and Moody's. Every catastrophe is different, but a common rule of thumb is that Berkshire gets 3% of insured losses, and Fairfax gets 1%. That would mean we might guess that Fairfax would be on the hook for as much as $120m for Helene, pre-tax, which would be bad, but not awful. As flooding losses increas, the initial $5b estimate will turn out to be too low, but not far too low.

-

Aw shucks, and here I was thinking I was going to get some of it via Fairfax.

-

-

The comparison should be the same, whether in USD or CAD, and in CAD, I see GWO as being $43.1b and FFH at $40.6, but maybe they were reversed when you commented. And the TSX doesn't use market cap, they make some kind of adjustment for float, so who knows which is first on that basis. OK, thanks, I didn't know that.

-

I see Great-West Life as still maintaining a sizeable lead over Fairfax, with a market cap of $43b - maybe you are looking at the US listing with the market cap in USD? They are another obstacle for getting into the TSX 60, I suppose. If they accepted a heavier overweighting for financials, wouldn't GWO get first dibs? Another reason for changing Fairfax to Chicken and Mattresses Co.

-

I should say. Insured losses for Helene are currently estimated at $6.5b, with not much preceding it, and we are 2/3 of the way through the season, so a central estimate of about $100b for the whole season does seem a tad on the high side.

-

$1285, within centimeters of the all-time high set yesterday. For context, Fairfax closed at 1,041.43 on Feb 7 and dropped to as low as $909 on Feb 8, with the publication of the junky Muddy Waters screed. A week later, it closed back at 1,041.52 as that report was thouroughly debunked by Fairfax. With the publication of solid results in the annual report and two solid reports for Q1 and Q2, and a steady stream of positive developments for the company, the share price closed yesterday 22% higher, at 1,265.98, and it's up another $15 so far today. You would think that after going from a dividend-adjsted share price of $335 on Jan 1st, 2001 to $459 at the beginning of 2022, $644 for 2023 and $1030 for 2024, shares might be getting pricey at today's price of $1285, but that is still 7.8x the last 4 quarters' net income. If there's one thing nicer than a stock that has moved up a lot, it's a stock that has moved up a lot and that is still bargain priced.

-

Thanks Viking, very helpful to see these changes, even if the consolidated holdings are harder to guess at. Some additional excess to fair value in the associates, with FIH, hopefully, too. In the mark to market bucket, I'm curious, you have smaller holdings going down from $65m (Ensign) to Johnson & Johnson ($13m), and then 'Remaining Smaller Holdings' worth $2145m (unchanged from June 30). It's hard to believe there are enough tiny holdings to get up to the equivalent of 200+ stakes worth $10m or smaller, or is it? Where do you get this figure?

-

So it looks like they could not find a buyer at the price they wanted. We will find out in Feb what this acquisition was valued at. ...I don’t know if that’s the right read. It seems like Sagard was a seller but management was not so that explains why FFH wants to stay in the deal. Sagard likely wanted to run the process to make sure they were getting a fair price. Presumably it was a price that FFH can still earn a 15% return which is what PE would be looking for as well. Looks like I got what I hoped for, Fairfax hanging on, and it seems that it was Sagard that wanted to get out. I much prefer having Fairfax the buyer of an asset they know well, from a motivated seller. If at some point someone desperately wants to own the #1 hockey brand, maybe Fairfax would sell, but in the meantime, they have a nice asset at what may be a nice price.

-

Looks like insured losses from Helene will be about $5b, from various sources. In the past, Fairfax has often shouldered about 1% of these, is that a fair rule of thumb? Meaning about $50m pre-tax, very manageable. Initial projections were a bit higher, and could have been worse if Helene had come closer to Tallahassee.

-

Of course you are free to object to my interpretation, but notice that the only mention of a criterion being overridden is in favour of sector balancing. In point 2, they say that selecting larger securities may be overridden by sector weight, but in point 4 they do NOT say that sector weights may be overridden for the purposes of selecting the larger securities. In other words, the 2 criteria may be contradictory, and in that case, one of them can be overridden, the one about size...

-

No, I didn't know that. Doing that again would just make the financial sector more overweight, but at least there's a precedent. It seems that, as they mention, changes tend to occur when they have no choice, like when a company leaves the TSX Composite (usually via a merger, but also via bankruptcy), so Fairfax probably just has to wait for the merger of one of the current constituents, like for instance if someone bought out Algonquin or Gildan or something like that, and hope they don't add a non-financial that's smaller than Fairfax.

-

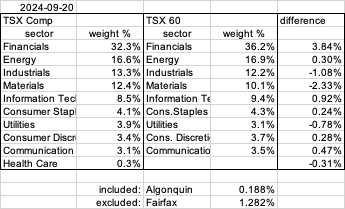

Algonquin has continued its gradual slide (along with most of the oil and gas sector), and now has a market cap of $5.65b, less than half its value when it was included in the TSX 60 in June 2020 and now less than 0.19% of the index. For comparison, FFH is now $38b, but as the inclusion rules note (point iv), sector weighting trumps size. Sector weights are to mimic the sector weights of the TSX Composite, currently with 226 constituents. Sector weights for TSX Composite and TSX 60 are currently as follows: Excluding Algonquin would mostly correct the Energy overweighting, but including Fairfax would add another 1.3% to Financials which are already overweighted by 3.8%. And TSX 60 criteria already state pretty clearly that the index aims to have the bigger TSX stocks included (point 2), but that sector weight trumps size (point 4) and minimu turnover is preferable (point 5) , so we may be out in the cold for a while longer. Additions to the S&P/TSX 60 [my emphasis] 1. To be eligible for inclusion in the S&P/TSX 60 index, securities must be constituents of the S&P/TSX Composite. 2. When adding securities to the S&P/TSX 60 index, the Index Committee generally selects amongst the larger securities, in terms of float QMV, in the S&P/TSX Composite. Size may, however, be overridden for purposes of sector balance as described in item 4 below. 3. When adding securities to the S&P/TSX 60 index, the Index Committee generally selects securities with float turnover of at least 0.35. This is a guideline only and may be changed at the discretion of the Index Committee. In addition, this range may be overridden for purposes of sector balance described in item 4 below. 4. Security selection for the S&P/TSX 60 index is conducted with a view to achieving sector balance that is reflective of the GICS sector weights in the S&P/TSX Composite. 5. Minimum index turnover is preferable. Changes are made to the S&P/TSX 60 index on an as needed basis. The most common cause of deletion is merger or acquisition of a company. Other common reasons for deletion include bankruptcy, restructuring or other corporate actions. If a company substantially fails to meet one or more of the aforementioned guidelines for inclusion or if a company fails to meet the rules for continued inclusion in the S&P/TSX Composite, it is removed. The timing of removals is at the discretion of the Index Committee. https://www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-tsx-canadian-indices.pdf

-

Have they talked about when they might reduce the CSB bank* stake? They were told in 2019 to commit to 5 years, and then to reduce from 51% to 15% before 12 years: As part of the deal, the RBI has asked for a five-year lock-in for Fairfax and asked it to get down its holding in the bank to 15 per cent in 12 years, the sources said. https://economictimes.indiatimes.com/industry/banking/finance/banking/rbi-lets-watsas-fairfax-to-buy-51-per-cent-in-catholic-syrian-bank/articleshow/56260554.cms That would be pretty good timing, actually. They were at 49.7% at 2023 year end, and announced a reduction to 40% in June of this year, " in compliance with the RBI’s dilution schedule." I presume the RBI will be giving them some guidance about how quickly they should sell the rest, if they acquire 60% of IDBI. That remaining 40% of CSB would be worth $269m now, and every little bit helps, if they're trying to get to $6b for the cash acquisition! === *CSB is Catholic Syrian Bank, so CSB bank is redundant. I better get used to it, they clearly don't want us to remember what CSB stood for: "We have rebranded ourselves in the year 2019 by changing our name as “CSB Bank Limited”, to address region and community related perceptional issues associated with our previous brand name." More interesting Catholic Syrian history here: https://www.forbesindia.com/article/boardroom/catholic-syrian-gods-own-bank/12582/1

-

You are right: « The government, which owns 45.48% in IDBI Bank, and state-owned Life Insurance Corp of India (LIFI.NS), opens new tab which holds 49.24%, together plan to sell 60.7% of the lender. The sale process was first announced in 2022. » Still, even $6b is a big morcel for $2b FIH to swallow.

-

The tool of issuing shares to acquire a company would be useful if the market price of FIH shares were higher, but in the case of IDBI, we are looking at an all cash acquisition in the ballpark of ~$10b, by a company that is worth $2b, so it is hard to imagine financing this with share issuance anyways. It's not even so obvious how Fairfax plans to do this, with its market cap of $29b, given the insurance regulators breathing down its neck. Since it looks like Fairfax may be the frontrunner in this IDBI privatization (https://www.business-standard.com/companies/news/canada-based-firm-fairfax-offers-all-cash-deal-to-acquire-idbi-bank-124031800325_1.html), it will be interesting to see how they set up the the financing, but surely FIH by itself will not be able to get very far.

-

It doesn't necessarily mean the rest of the season will be equally mild, and it doesn't necessarily mean the rest of the season will be worse. September 10 is the date with the most hurricanes, and September 12 is the median date, so we're about a week past halfway through now. The NOAA forecast for this year was for 8-13 hurricanes, including 4-7 major ones (category 3 or more), a little worse than the average for the last 30 years which has been 7 hurricanes, 3 of them major. So far, there have been 4 hurricanes, 1 of them major, so it is looking like we are headed for an average year. I don't think there's any reason for there to be any 'catching up' (and chatgpt agrees with me) : the average number of hurricanes after a mild first half of the season is... average, which means, we are now most likely to have a full season that is slightly below average. https://bmcnoldy.blogspot.com/2021/09/when-is-peak-of-hurricane-season.html

-

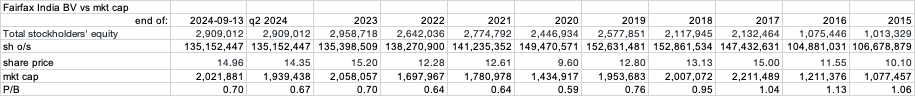

From $14.97 today, share price might go quite rapidly, in much less than 10 years in any case, if shares are really worth $25 already (1.2x book; they currently trade at 0.67 book) or, with a BIAL IPO, $35. That would mean to get to 17% CAGR in, say, 5 years, we would need the price to be at $33 in 5 years, which may already be the fair value as soon as the IPO happens. We can't say what the CAGR has been over 10 years, since FIH had its IP at the end of January 2015 and it wasn't until the middle of 2016 that it had invested most of its funds : By the middle of 2016, Fairfax India made two more investment commitments and had essentially fully committed the entire $1billion that it had raised. Since it was continuing to see excellent new investment opportunities, in September2016 Fairfax India obtained a $225million two-year secured term loan from a syndicate of Canadian banks. By yearend it made two more investments and committed to a third one. In two years Fairfax India deployed or had commitments for its entire $1.2billion of investable funds. Given these circumstances, on January13, 2017 Fairfax India issued 42.6million shares at $11.75 per share in a public offering and a private placement to OMERS and Fairfax Financial, raising gross proceeds of $500million. So if we take the end of 2016 as baseline, we had a share price of $11.55 and a book value of $10.25. So in 7 1/2 years, the share price is up 4% p.a. and book value per share is up 10% p.a. For the prospects of this investment going forward, it is much better that the share price is trailing so far behind the book value, as this just gets added to future prospects instead of past performance. It means that annual returns like 17% in the next 5 years, or a few points more, given accumulating earnings or share count reductions, and perhaps a few points more, presuming some value is added in the next 5 years...

-

$25 would be 1.2x book, sounds like we are already there, for fair value, and that would be 12% p.a. If BIAL is worth anything like its peers, maybe $35, or 16% p.a. Hypothetical fair value doesn’t pay the mortgage, but since I can afford to wait, with catalysts just around the corner (famous last words), it seems like it would be a shame to fold my cards now.

-

It seemed like a good idea at the time. But this bad trend can't last more than a year or two, can it*? Trading way beneath book value of its components seems like more of a reason to be a buyer than a seller. *That was supposed to be sarcasm. Here are the numbers, more than 5 years significantly beneath par:

-

It sure has been disappointing so far, but it seems like a lot could go right. Public investments up 12% since June 30, and with BIAL 2/3 of the private investments, it's hard to know exactly what value is being created but air traffic is up, the IPO will arrive some day and there is a lot of upside. I think their record for investments that have been monetized is actually pretty good, but it has been a test of our patience, that's for sure.

-

I think owning these swaps is pretty much the economic equivalent of just buying back shares, so I would be interested to hear what management thinks about selling the TRSs and using the cash to buy back shares - would it give a roughly equivalent outcome? Are there advantages (I presume there must be) to holding the TRSs indefinitely, rather than buying back the equivalent number of shares with the proceeds of the TRSs? Do the TRSs better satisfy capital requirements for insurance companies, for instance? And one additional quesiton that occurs to me, given the fact that there is now a 2% tax on buybacks, is this avoided (or postponed) by holding the swaps instead of actually doing the buybacks? Since management is unlikely to spell this out for us, I would be curious to hear thoughts from members of this board about this comparison!

-

Those 65,243 shares were repurchased from August 2 to August 30. All but 6000 were purchased in the second half of the month. And only 8500 were repurchased in July. June was much more active, but we already had those numbers in Q2, when we were told that 854,031 shares were repurchased for cancellation in Q1 and Q2. Before we get too excited, 73,743 shares in 2 months is actually a pretty slow pace - that pace would give us 221k in Q3 and Q4, a much slower pace than the first half of the year, and only barely getting us over 1m shares for the year, a little less than 5% of the 23.1m implied shares outstanding. If they really want to move the needle, they may have to make a substantial issuer bid (SIB). As you say, maybe they are waiting for more confidence about the rest of the hurricane season, after what has turned out to be a very mild first half. We haven't discussed the 2% tax on repurchases in Canada; it seems this has not slowed down Fairfax very much.

-

Sleep Country should be higher than #7, I would think: 33.9m shares times C$35, so C$1.2b = $875m US. I presume this will be carried at that acquisition value? Thomas Cook is down a bit, from $871m to something like $760m; Quess is up a lot, from $370 to $471. Fairfax India is heading for a quarter close about level, from $827m to $837m by my calculation. So if Sleep County is at $875m as I expect, it looks like it would be #4, or #3 if you don't include the Fairfax swaps.