Viking

Member-

Posts

4,651 -

Joined

-

Last visited

-

Days Won

35

Viking last won the day on April 3

Viking had the most liked content!

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Viking's Achievements

-

@nwoodman thanks for the updates. Much appreciated. I am liking this company more and more (and i already liked it a lot). Underpromise and overdeliver. Very well run. Continie to execute exceptionally well.

-

Do we know if this is a Buffett purchase? Or one of the lieutenants? Regardless, it is a vote of confidence for the P/C insurance sector. It makes sense that if Buffett wanted to play the sector he would pick someone like Chubb - one of the largest by market cap/liquidity. I think P/C insurance falls in Berkshire Hathaway's circle of competence. Anyone have any stock recommendations for P/C insurance? Asking for a friend... Getting a Berkshire Hathaway 'seal of approval' is just another tailwind for the P/C insurance sector.

-

I think this is a great point. Especially if Fairfax wants to remain primarily a P/C insurer (and not morph into a conglomerate). Aggressively buying back undervalued shares as the hard market ends is such a good decision/use of excess capital. It also means Fairfax/Prem is not focussed on empire building. Fairfax is instead clearly focussed on making decisions that build long term shareholder value. Very encouraging.

-

I like how Peter Lynch looked at insider buying/selling. "insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise." He viewed the buying as a useful input when valuing a company. Usually, insiders only buy for one reason: they think their stock offers very good value. On the other hand, insiders sell for many reasons. As a result, insiders selling tends not to be a useful input when valuing a company. The fact that Fairfax has been able to buy back a significant number of shares the past 4.5 months and has not had to pay a big premium is a big win for shareholders. Thank you Prem

-

Here is another way to look at the multiple Fairfax has been buying back shares for. In 2021, with the SIB, they paid a multiple of 0.9 x BV. Today they are paying a multiple of 1.15. The multiple on the stock has increase 0.25 x. Fairfax is a very different company today than it was in 2021. Most importantly, operating earnings have increased from $1 billion (average from 2016-2020) to $4.5 billion today. The size and quality of Fairfax's income streams has increased dramatically. Clearly, the company deserves to trade at a much higher P/BV multiple today compared to 2021. Perhaps the increase in multiple it deserves to trade at is 0.25 x. If so, then Fairfax today is buying back stock at the same (low) valuation that it was back in 2021. Anyways, I don't mean to beat this topic to death... just trying to think about it in different ways...

-

@StubbleJumper Your post has a bunch of really interesting angles to it. Below are some thoughts. As per usual, I like to stir the pot a little to hopefully generate some good discussion. And estimating 'intrinsic value' at a point in time is a really important topic. Below I bolded the part in your earlier comment that got my attention. @StubbleJumper “The value of my personal shares is independent of the size of the float. My portion of FFH's future cash flows is X/total shares outstanding. So, when 250k shares are retired, my portion of FFH's future cash flows goes up. That part is not optics. The part that might make it mostly optics is the price paid. Continuing shareholders are only better off after a repurchase if the shares were repurchased at a price that is less than intrinsic value. When FFH conducted the SIB a couple of years ago and bought back a boat-load at US$500, it was quite obviously the case that those repurchases were undertaken at a price lower than IV. But, a repurchase price of US$1,100 is probably much closer to IV and the benefit to continuing shareholders is much more limited. As an example if IV is actually US$1300 or $1400, we continuing shareholders collectively benefit by 275k*US$200 or 300...less than five bucks a share?). It's not nothing, but it doesn't move the needle all that much.” Intrinsic value is a tough thing to estimate. When Fairfax did its SIB in late 2021 did investors at the time think Fairfax was buying shares below intrinsic value? I am not so sure. It is clear today that Fairfax got a steal of a deal. With the buybacks so far in 2024, is Fairfax buying shares below intrinsic value? It appears investors think Fairfax is buying back shares today at a price that is close to intrinsic value. Just like 2021, I am not so sure that investors are getting it right. Why? Fairfax is a completely different company today than it was in late 2021 - especially when you focus on earnings. And future earnings is the critical input when calculating intrinsic value. Here is what Prem had to say at the Fairfax AGM. He said this at the very beginning of his slide presentation. “Fairfax -- and I've said it in our annual report, said it last year. I'll say it again. Fairfax has been transformed since 2017. Even we couldn't see it. If you had asked me 3 years ago, 4 years ago, I couldn't see that. Our premiums have gone up… The float has gone up, the investment portfolio, common shareholders' equity. Underwriting profit, because of this expansion in a hard market… interest and dividends… it's running at about $2 billion. … operating income of $4 billion that we can see for the next 4 years. The company has been transformed. And …because of this transformation, the intrinsic value of the company has gone up significantly.” Let me try and explain my thinking in a little more detail. Part 1 I think it is useful to dial back to November 2021. At that time, what were the facts? On December 17, 2021, Fairfax announced the SIB: to repurchase 2 million shares at $500/share, with the offer expiring on Dec 23, 2021. Of interest, at Sept 30, 2021, book value was $562. Fairfax’s SIB was made at about 0.9 x BV. https://www.fairfax.ca/press-releases/fairfax-announces-us1-0-billion-substantial-issuer-bid-and-sale-of-9-99-minority-stake-in-odyssey-group-2021-11-17/ On Nov, 16, 2021, the day before they announced the SIB, Fairfax shares closed at US$432.49. For the next month (mid Nov to mid Dec), Fairfax shares traded in a band between $440 and $460/share, well below the $500/share SIB price. Fairfax shares traded below $500/share for much of Q1, 2022. This tells me that most investors likely felt Fairfax was buying back shares in Dec 2021 at a small premium to IV. In fact, a year later, in October of 2022, Fairfax share traded briefly below $450 - a price significantly below the SIB from the previous year. Today - 30 months later - it is now obvious to investors that Fairfax’s SIB was executed at a price that was well below intrinsic value. The key take-away is this - when the SIB was executed in 2021 most investors got it completely wrong. My guess is most investors - at a point in time - have no idea what Fairfax’s actual intrinsic value is. Yes, those are fighting words. Why do I think that? Intrinsic value is a theoretical concept and a wickedly difficult thing to estimate (just ask Buffett). Especially for a company like Fairfax where so much important stuff is going on under the hood. Instead, most investors simply focus on Fairfax’s current stock price and go from there (and make the buy, sell or hold decision based on what the animal entrails tell them at a given point in time). Look at the commentary on this board when it comes to Fairfax… how much of the commentary is based primarily on a valuation framework and how much of the commentary is primarily based on where the stock price is trading? To be fair, Fairfax’s stock price has been a rocket ship to the moon the past 4 years. But intrinsic value has also been on a rocket ship to the moon. Which has gone up more? Now that is a great question. So let’s explore that a little bit next. Part 2 Fairfax is not the same company today that it was in December 2021. Its insurance business is much larger and is more profitable. Its fixed income portfolio is much larger and earning a much higher average yield. Its equity holdings are much higher quality and performing much better. Fairfax has also been best-in-class with its capital allocation decisions the past 30 months (compared to there P/C insurance companies). The magnitude of the change has even caught Fairfax by surprise. This is what Prem told us loud and clear at the AGM this year (see quote above). As a result, operating earnings have spiked higher over the past 30 months. From 2016-2020, operating earnings at Fairfax averaged $1 billion per year. Importantly, this was the reference point for investors in Fairfax in November 2021. This is likely what they were using as their core input when calculating intrinsic value. Today, operating earnings are in the $4.5 billion range. This is a 350% increase from the 2016-2020 average. This level of operating earnings is sustainable moving forward - in fact, it should actually grow nicely over time (as record earnings get re-invested by the top-notch capital allocation team at Hamblin Watsa, creating larger/new income streams). Of interest, book value has increased from $562 at Sept 30, 2021, to $940 today (March 31, 2024). Book value has increased 67% over the past 30 months. And operating earnings have increased 350%. Back in Dec 2021, Fairfax paid 0.9 x BV ($500/$562) to repurchase 2 million shares. Fast forward to today. So far in 2024, Fairfax has reduced effective shares outstanding by 605,000 or 2.6%. The total cost was $688 million or $1,090/share. Book value is $940/share so shares were purchased at a slight premium to BV of 1.15 x. Compared to the SIB in 2021, does this mean Fairfax is now buying back shares at less of a discount to intrinsic value? Or at a price that is closer to intrinsic value? Of course, the answer is - it depends. It depends on whether or not Fairfax is the same company that it was in late 2021. We know that Fairfax is not the same company. It has been transformed in recent years. Operating earnings have increased 350%. Fairfax’s earnings have improved dramatically in size and quality. Higher quality means the company should now trade at a higher multiple than it did in December 2021. Is 1.15 x BV the right multiple? No, of course not. It is much too low for a company of Fairfax’s quality. But investors won’t see it today. But guess what? It will likely be obvious to investors 30 months from now. Over the next three years, my guess is Fairfax will earn a total of somewhere between $450 to $500/share ($150 x 3 plus some growth). At the end of 2026, this would put book value at around $1,400/share. Let’s assume Fairfax should be valued at a P/BV multiple of 1.3 x. This is a low multiple for a company of Fairfax’s quality. This would put the share price at about $1,800 in 3 years time (early 2027). I view this estimate as a a reasonable baseline - could be a little higher or it could be a little lower. If this is how things play out, buying back shares today around $1,100/share will look like a steal in 3 years time (if the shares are trading at that time at around $1,800). In three years time, when investors look back to evaluate Fairfax’s repurchase of shares in 2024, my guess is they are going to conclude that Fairfax was able to buy them back at a price that was well below intrinsic value. Just like their evaluation today of the repurchase that Fairfax did in December 2021. With hindsight it will be obvious to everyone. But today? Few can see it. And that is what I love about investing. ---------- PS: what is the appropriate P/BV multiple for Fairfax? What if it is 1.5 x ? It would be great to come back to this discussion in three years time... Fairfax are value investors - and they are very good. They are aggressively buying back Fairfax stock today. That tells you loud and clear what they think about Fairfax's current valuation. And they understand the company - and its future prospects - very well.

-

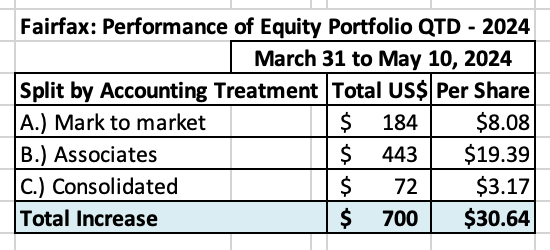

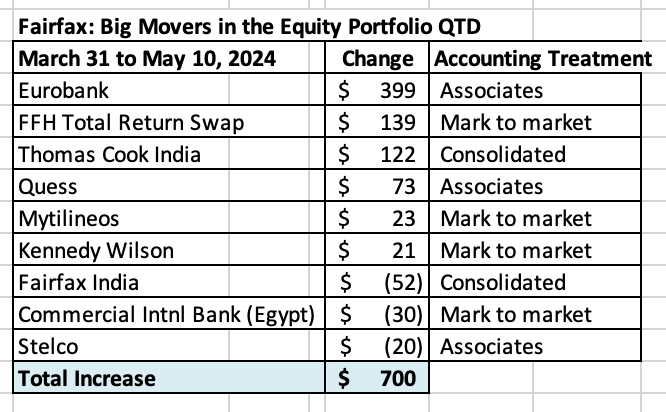

Change in value of Fairfax’s equity portfolio in Q1 - 2024 Fairfax’s equity portfolio (that I track) had a total value of about $20.4 billion at May 10, 2024. So far in Q2 it is up about $700 million (pre-tax) or 3.5%, which is a solid start to Q2-2024. As per usual, please let me know if you see any errors FYI, I include the warrant and debentures in the total. The Excel file is attached at the bottom of the post. I include the FFH-TRS position in the mark to market bucket and at its notional value. I also include warrants and debentures that Fairfax holds in the mark to market bucket. My tracker portfolio is not an exact match to Fairfax’s actual holdings. My summary has been updated to include information from Fairfax’s Q1-2024 earnings report. My tracker portfolio is useful only as a tool to perhaps understand the rough change in Fairfax’s equity portfolio (and not the precise change). Split of total holdings by accounting treatment About 49% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 51% are Associate and Consolidated holdings. Over the past couple of years, the share of the mark to market portfolio has been shrinking. This means Fairfax's quarterly results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of about $700 million = $30.64/share The mark to market change is an increase of $184 million = $8.08/share. The change in this bucket of holdings will show up in ‘net gains (losses) on investments’ (along with changes in the value of the fixed income portfolio) when Fairfax reports results each quarter. What were the big movers in the equity portfolio Q1-YTD? Eurobank is up $399 million and it is Fairfax’s largest equity holding at $2.84 billion. The FFH-TRS is up $139 million and is Fairfax’s second largest holding at $2.26 billion. Thomas Cook India is up $108 million. TCIC continues its strong performance. Quess is up $73 million. Market value is $393 million (carrying value is $432 million). Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings, the excess of fair value to carrying value is about $1.676 billion or $73/share (pre-tax). Book value at Fairfax is understated by about this amount. Associates: $1,052 million = $46/share Consolidated: $624 million = $27/share Equity Tracker Spreadsheet explained: We have separated holdings by accounting treatment: mark to market, associates – equity accounted, consolidated, other Holdings – total return swaps. We come up with the value of each holding by multiplying the share price by the number of shares. Are holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updates as new and better information becomes available. Fairfax May 10 2024.xlsx

-

@Mystery Guest , I think you might be on to something. Fairfax compounded book value at 18.4% for 38 straight years. That is a phenomenal track record. To call the company ‘no-moat’ is, of course, idiotic. Obviously, there is a moat hiding in there somewhere.

-

I do not follow Fairfax India as closely as i follow Fairfax. The big near term issue that i see is IIFL Finance - but this has been out there for months now so it should not have come as a surprise when Fairfax India reported results. What did surprise me is the explanation of the current issues the founder of IIFL, Nirmal Jain, gave at the Fairfax India AGM (see quote below). The answer he gave might come across as funny to an audience in India. I don’t think it’s the right kind of humour to use when explaining a serious problem to an audience in North America. Hopefully Fairfax uses this as an example internally of probably what not to do in the future. —————- “So RBI does (our) audit, and they've been doing it for the last 16 years of our company's existence. And this year, they found a few lapses. And based on that, we're a bit surprised because the order came, which was a complete embargo on our gold loan business. And of course, there were lapses. So I can't say that it's something which is -- we are doing everything which was in full compliance of their master circular. “But many of these things that we are doing were also industry practice. So maybe I can give analogy. I mean I don't know many of you would have traveled to India there, the traffic rules are hardly followed. The people obviously. Now -- but if you are in Canada, U.S. everywhere, then you see that even if the other side is empty and there's a 3-mile traffic jam, people still won't break the lane because somewhere -- some point in time, regulators enforce the regulations very strictly. “So what happens that in traffic police officer catch hold of somebody and sort of make him an example. And if we have a view, then I don't think that we can really crib about it, but I'll just talk about it that what happened and how we are going to overcome.”

-

@gamma78 and @valueinvesting101 great comments. Thanks for chiming in. I do find it interesting how aggressive Fairfax has been since 2018 in buying back Fairfax’s stock. Yes, Fairfax got the stock at a crazy low price. But this also has the effect of shrinking the size of the company. I like this - as we have learned with Berkshire, ever-increasing size eventually becomes a constraint on returns. Keeping Fairfax small (relatively) should help Fairfax deliver above average returns moving forward. Great points on India. Is the set-up today in India like the US back in the 1950’s? Buy a basket of ‘quality at a fair price’ and hang on for decades? Interesting idea. I have been a little bit surprised how quiet Fairfax has been in India the past couple of years. Their playbook there has been monetizing assets, increasing their ownership of BIAL and building cash. Like a spring getting loaded?

-

some quick thoughts: Wade’s summary was short, concise and well done. Investment portfolio is $65b; $46 fixed income and $19b equity Grivalia Hospitality - George K estimates One and Only development is worth entirety of GH carrying value. Kennedy Wilson debt platform is at $4.8b? and yield is 8.25% As fixed income matures, Fairfax has been leaving at short end, which is shortening avg duration a little. Allied World - reinsurance increased double digit Eurobank - share of profit of associates was $79 million; this included $45 million in one offs (adj due to sale of sub etc); underlying was $124 million, which was $30 million more than prior year. GIG ownership was increased in April from 90 to 97.1 at a cost of $127 million (mandatory tender offer) FFH-TRS: think its a great investment (shares still offer good value) Insurance: continue to see opportunities. Price increases exceed loss cost trends. Insurance subs have $3 billion in dividend capacity; paid $451 million to hold co in Q1. Expense ratio ticked higher in Q1: inclusion of GIG (has higher exp ratio), bus mix, investments in technology

-

The $1 billion bond offering closed late in March. My assumption is Fairfax will start paying interest immediately. As a result, my assumptions is they also have use of the $1 billion. If they do not have an immediate use for the $1 billion my assumption is they could buy very short term treasuries with it. if they did this we would see a small increase in interest income. $1 billion earning 5% = $50 million = $1 million per week. Now if I am way off base (perhaps my 5% is way too high?), please let me know (it wouldn’t be the first time).

-

@Spooky I think you are missing the point of my post. I don’t say this to be a jerk /confrontational. “Which investments in Fairfax's portfolio today are wonderful companies (i.e. high return on assets and growing) that can just keep compounding at high rates of return for the next 20-30 years?” Here is a re-post of what i said earlier: Investors waiting for Fairfax to buy ‘Coke’ or ‘American Express’ in 2024 will likely be sorely disappointed. For two reasons: 1.) Buffett’s brilliance wasn’t buying Coke or American Express. It was exploiting the set of circumstances that existed at the time, which served up Coke in 1988 and AMEX in 1990. 2.) Like Berkshire when it made its many brilliant moves, most investors probably won’t see it when Fairfax actually does it. Moving forward, i expect Fairfax to use ALL the capital allocation levers at their disposal. You list one above - and i do expect them to do more of that. But i also expect Fairfax to do lots of other things. Some will likely be non-traditional. What they do will largely be driven by volatility and what opportunities get served up. But in terms of ‘buying quality at a reasonable price’, on the equity side, I think their investment in BIAL would be a good recent example. Buying Allied World in 2017 for $4.9 billion would be a good recent insurance example. Fairfax’s equity book as a whole has improved significantly in quality over the past 5 years. The best example is Eurobank. Is it a quality bank today? Yes. Is it cheap? Yes. Is it poised to deliver excellent returns over the next 5 years? Yes, i think so. Is Eurobank like Coca Cola or AMEX back in the late 1980’s? No, of course not. You appear to give the two examples i provided (effectively buying back 23% of shares outstanding at 30% of current intrinsic value and a saving/earning billions from active management of their fixed income portfolio) as not really counting. I humbly disagree. Of course, that’s what makes for a great debate. When I say i think Fairfax resembles a much younger Berkshire Hathaway, it might help if i spell out what that might mean from a return perspective. If my thesis is correct, below is what i think is possible. (Of course, my thesis could be completely wrong - and this would mean my return expectations below would also be completely wrong.) Since inception Berkshire Hathaway has materially outperformed the S&P500 (dividends included). I think Berkshire’s outperformance might be 2x. I think Fairfax is poised to materially outperform the market indices over the next 5 years (I would take an average of the S&P500 and the TSX60). I think Fairfax’s outperformance could come in at 2x better. Similar to Berkshire Hathaway’s long term average level of outperformance. How will Fairfax do it? I think the set-up today for Fairfax looks a lot like a much younger Berkshire Hathaway. In my post above, i highlighted 14 factors that i thought were similar. For me this is more qualitative/philosophical type thinking than quantitative/precise type thinking. And this makes it very hard to discuss/debate - because everyone comes at it in a very different way.

-

Q1 Earnings: Answers to questions Overall, it was a boring, solid quarter. 1.) How are they allocating new capital? What did Fairfax do with $1 billion notes offering that was completed the end of March? A: Stay tuned. Cash increased to $2.5 billion. It is earning +5% so perhaps Fairfax feels no urgency to deploy it quickly. 2.) Impact of change in interest rates on reported results? A: this was about a $125 million headwind. This was higher than I expected; although I do expect the puts and takes to roughly balance out over time. "The benefit of the effect of increases in discount rates on prior year net losses on claims of $192.3 million partially offset net losses recorded on the company’s bond portfolio of $318.8 million." 3.) What is interest and dividend income? Q4, 2023 = $536.4 million Q1, 2024 = $589.8 million = a run rate of $2.36 billion for 2024 (up from $1.9b in 2023). A: Increased $53 million from last quarter. Much more than I was expecting. Is Fairfax’s investment in Kennedy Wilson’s debt platform continuing to grow? A: Yes. It increased by $160 million in Q1. 4.) Insurance What is growth in net premiums written? GIG + organic? A: Solid increase of 11.2% (5.3% was GIG) What is CR? Is it below 94%? A: Solid 93.6% (was 94.0% in Q1, 2023) What is level of reserve releases? Trend? A: TBD Brit update: ex Ki, CR was 90.2% in Q1. Importantly, company is growing top line again, as net premiums written increased 6.5% in Q1. Continuing solid performance we saw in 2023. 5.) What is share of profit of associates? A: Total of $127.7 was lower than expected. $28.6 million loss from Helios. Seasonality. Not concerned. "Consolidated share of profit of associates of $127.7 million principally reflected share of profit of $79.3 million from Eurobank, $36.0 million from EXCO Resources and $34.8 million from Poseidon, partially offset by share of loss of $28.6 million from Helios Fairfax Partners." 6.) Equities: What are investment gains from equities? A: Equities booked a $275 million gain. About what I expected (a little lower based on my tracking model but it does not capture everything Fairfax owns). For Associate holdings, what is the excess of market value to carrying value? Q1, 2024 = $1,185.6 million = $52/share 7.) Is there any adverse development for runoff? More broadly, what are the results for runoff/life bucket? A: Results were roughly as expected. 8.) What is book value per share? This increased a smaller amount than I expected; normal range. The dividend payment in January will dent this by $15/share. Q1 = $945.44 (2023YE = $939.65) 9.) Other notes: Shares Outstanding During the first quarter of 2024 the company purchased 240,734 of its subordinate voting shares for cancellation at an aggregate cost of $260.3 million ($1,081/share). Fairfax is now buying back shares at a premium to book value. They continue to see this as an attractive price to pay. At March 31, 2024 there were 22,831,173 common shares effectively outstanding. Interest expense Was $151.5 million in Q1; about $20 million more than I expected. And it does not include a full quarter of the $1 billion in new borrowings that closed in late March (while this is being held, the interest being earned will show up in interest income). Comprehensive income Unrealized foreign currency translation losses were $228.4 million in Q1. Yes, the US$ was very strong.

-

What were the key drivers of Berkshire Hathaway’s success when the company was in its prime? I have ranked the key drivers by importance. Did i get the list right? What is missing? Did i get the order right? If not, what is the new order? 1.) Buffett the man is a genius. As an investor. He has also been a very good manager. 2.) Control - Buffett has voting control. Gave Buffett free rein to run the company as he saw fit Without this, Berkshire Hathaway never would have evolved as it did 3.) Capital allocation skills of management. Primarily Buffett, but also includes Charlie Munger, Ajit Jain, Greg Abel etc. Value investing framework: shifted over the years (as Berkshire Hathaway grew in size) from deep value to quality at a reasonable price 4.) Insurance Float Provides a low cost, stable and growing source of funds/capital that Buffett used to make many outstanding investments. When combined with 3.) magnified returns. Float loses its value when interest rates are very low, like they were from 2010-2020. Float increases greatly in value when interest rates are high like they are today. 5.) Long term focus Fits hand and glove with the ‘buy and hold’ value investing framework. Investments: able to take advantage of market volatility. Also fits hand in glove with the P/C insurance cycle - which can run in 15 year cycles (hard to soft and back to hard). 6.) Invest a significant portion of the investment portfolio in equities. Embrace volatility Earn a much higher return, compared to a bond only portfolio. 7.) Culture Insurance and investments - operations decentralized Capital allocation - managed by Buffett / small corporate office 8.) Businesses generated enormous cash flow. Both insurance and investments: was reinvested well, creating new income streams. Virtuous circle. 9.) The company was small. capital allocation decisions made had a relatively quick and material impact on the performance of the company 10.) Power of compounding Attributes 1 to 9 - all happening at the same time - is a very powerful elixir, especially if it can be maintained for decades. time is the friend of the wonderful business 11.) Favourable external environment There was lots of volatility in financial markets. This provided continuous supply of opportunities to deploy large amounts of capital at very attractive rates of return.

(1).thumb.png.afef2977f5053cb2dd62f46c5f452643.png)