gfp

-

Posts

4,806 -

Joined

-

Last visited

-

Days Won

8

Content Type

Profiles

Forums

Events

Posts posted by gfp

-

-

11 minutes ago, Gmthebeau said:

I can assure you Buffett doesn't read twitter.

No way!

-

I mean he does make it easy to tease him since he is also actively recruiting initial investors for his proposed macro hedge fund on twitter (don't think that would be legal over here in the states, no?). But Alfonso isn't so bad, he is correct about QT being completely sterilized and ineffective. (QE was basically pointless as well, although it probably tightened MBS spreads somewhat).

But you are right, these guys on twitter all have something to sell ya. Except Bill (wabuffo)! Who gives away his best stuff for free

-

I'm not sure they need to replace Charlie's seat on the board. He wasn't an independent director and they already have two other vice chairmen. They can take their time if they do intend to nominate someone.

-

Just to make sure I have this right, the approximate market cap of this company is something like $314m USD ?

-

4 hours ago, Sweet said:

I’m not consistent but I’m trying to be 1) fully invested unless there is an exceptional reason not to be, 2) to ignore the noise and compelling doomsday macro predictions which are nearly always wrong, 3) to be patient and buy good companies when they are on sale, 4) to buy something I know and I’ve thought about owning before, this way I can stomach the swings, and to 5) hold it as for as long as there are no better opportunities.

In terms of how that is implemented in practise Vinod1 recently described my thinking almost exactly. I don’t think I can write it up better than he did so here is what he wrote:

“I assume I have no ideas and there is not much value I can add unless I can make compelling case otherwise.

So I start with a 100% index portfolio.

If I find a really compelling investment, I would invest up to my position sizing limit for that specific investment risk that I tolerate. I would sell that much of index fund to fund this investment.

The more stocks I find, the less I have in index funds.

Starting with 100% cash instead of 100% in index funds has many disadvantages.

- It puts pressure on you to find ideas. Many many ideas and really really quick. Not a recipe for patience and acting only when you have overwhelming evidence in your favor.

- If you do not have many ideas, you do not end up making crappy investments. No "I like this, seems pretty good, let me take a 1% stab at this".

- You do not have cash drag

- You are not tempted to market time or reduce allocation because "markets seems rich" and I cannot find anything in my competence. This is actually the bane of many value investment managers.”

After many years I’ve come to the same view as Vinod1.

When choosing a stock it has to be has to pass the ‘holy shit why are people not buying this’ gut check. If I’m cracking out the excel sheet and cranking numbers into a DCF just to make sure I’ve a ‘margin of safety’ then I almost certainly don’t have a margin of safety. It should be obvious.

Generally I don't like small positions. I had a five bagger in a month once, but the position was less than 1% when I took it - so who tf cares - I was still poor. I normally size stocks at 10% - 25% but sometimes I’ve been 100% into a sector index that’s been hit by a wrecking ball.

I’m generally adverse to leverage but I might use it one day.

I’m not that old either so I can be fairly aggressive when an opportunity arises, but I’ll have to turn it down as the years slip by.

I also don’t tell people the stocks I actively own. My insights are that interesting, but more importantly it allows me to be detached from the stock. I can pull the chord on that sucker anytime I want and don’t have to defend that decision. If I’m pimping said stock it makes it much harder to sell it.

good post sweet - lots of wisdom here

-

-

I'm curious what the idea is here. Is your thesis that the pipeline that transports oil from kurdistan to turkey will be reopened sometime soon or what?

-

Yeah, Interactive Brokers lists it as LSE, it doesn't appear to be difficult to transact in. Anyone that can execute trades on the LSE should be able to buy some. Or you could try the US OTC listed GUKYF if you can't get access to the LSE. I don't think you are going to find call options, LEAPS or otherwise. Be careful...

-

Interactive brokers seems to let me trade GKP in London with no problem, but obviously the market is closed so I don't know for sure. I am not in Canada though.

Have you tried to place an order for the somewhat illiquid unsponsored ADR, ticker GUKYF on the US OTC markets?

I don't think you will find listed options on this company but I'm not an expert in London market options.

-

Just to be clear, the ticker of the investment you are trying to make is GKP in London? Or that was just an example and you want to buy something more obscure?

-

And remember also that "construction jobs" includes all of the infrastructure type jobs that are still ramping. The lady standing on the interstate holding a sign that says 'yield' and 'stop' is a construction worker. The huge federal spending on this stuff got pushed down to the states, where it sits for a while before making its way into the actual economy. There is a lag before that federal deficit stimulus shows up in a private construction company's pocket.

And of course existing home sales being frozen out of the market is a huge tailwind for new construction. It is their primary competition. Mortgage rates have already peaked and are coming down. Large national builders can offer creative financing buy-downs for buyers. New construction is generally a lot more inexpensive to insure. Right there you have hit a number of the pain points for home buyers currently.

-

Yeah I thought the 2 & 20 line was lazy analysis as well. I am aware of the 1.5% on invested capital and .5% on uninvested capital plus 20% over a 5% hurdle language, but do we know if the 5% hurdle is annually compounding or just 5% over the last high water mark?

At a lot of funds, when they have a hurdle rate and a high water mark - the hurdle doesn't compound annually if they don't exceed it. So the 5% annually you think you are getting "for free" turns out to be 5% over a multi-year period after a drawdown and isn't nearly what it sounded like. Does that make sense? An annually compounding 5% hurdle vs a simple 5% hurdle over the last high water mark.

-

edit: This is the VIC post, not my own work. It seems like it was written by

https://www.linkedin.com/in/rajpgokul/?originalSubdomain=in

----------------------------------------------------------------------------------------------

Description

Fairfax India - Solid portfolio of investments available at a 40%+ discount to NAV !

Elevator Pitch:

Fairfax India has a portfolio of growth businesses trading at reasonable valuations. The IPO of Bangalore airport (largest asset in the portfolio) would be a key catalyst in the next 2 years and will show how attractively it has been marked by the management. The fee structure is exorbitant (2/20 structure like a PE fund), but a mix of factors (entry discount, share buybacks, cheap leverage etc) will allow investors to get similar (if not better) returns as the underlying growth in NAV (~15% expected CAGR over the next 5 years).

Investment Thesis:

Fairfax India owns 59% of the Bangalore airport after the recent acquisition of 10% additional stake from Siemens. This is the crown jewel of Fairfax India and pretty much equates to 1.6 billion USD in value. This would translate into 85% of the current market cap and 54% of overall NAV/ Book value. Thus, a bet on Fairfax India is a bet on Bangalore airport, at least in the next 3-5 year time frame.

Bangalore Airport:

Bangalore Airport is an extremely attractive asset to own. I believe that the true discovered value of the airport in a domestic IPO process would be upwards of 4 billion USD compared with the management’s mark of 2.7 billion USD. The reason for the conservative marking of the asset would be due to the recent transaction of Fairfax India buying 10% stake from Siemens around these levels. In my view, Siemens was an uneconomic seller (they got this stake in return for building the asset in 2007) and Fairfax India was able to get an attractive deal for themselves.

In 2019, Fairfax was able to sell part of the Bangalore airport to OMERS at a similar valuation to the current mark. The peer valuations of other Indian airports are 3X higher now than 4 years back. The Bangalore airport would have a rousing welcome in Indian markets and be bid up by domestic investors as high quality long duration assets which benefit from urban consumption growth are rare.

Bangalore has been India’s fastest growing city for the last 2-3 decades (not only in India, but globally as well) and is well exposed to secular trends like technology, electronics manufacturing etc to drive further growth. The Bangalore airport has the concession until 2068 (almost 45 years from now). The airport when opened was far outside the city, but the city continues to develop towards the airport with multiple infrastructure projects to connect the airport with the city. The airport within the next 3 years would be well connected by Metro and Suburban trains in addition to the strong road infrastructure that has already been built. This is important as the airport has almost 460 acres of land that it can develop and lease.

The airport has a regulated ROE of 16% on passenger fees and then unregulated income from retail, advertising, parking rentals, etc. Within the Indian airport space, Delhi was amongst the first airports that went to private hands. As per their last results, the regulated passenger revenue was just 1/3rd of the total revenues and the remaining 2/3rd was from unregulated sources (Land rental & retail - 33%, Duty Free & F/B - 19%, Parking & Ads - 6% and Others - 8%). This shows that an investment in the airport is a bet on the discretionary consumption trend of Bangalore. As India gets richer and more Indians travel and spend money on retail/ F&B etc, Bangalore airport will achieve higher operating leverage and profits will grow exponentially. That is a no brainer bet from a 10-20 year view (FWIW, I live in the suburbs of Bangalore and have absolute conviction on the city’s growth).

The airport has been growing passenger volumes at double digit rate over the last 10 years and we can expect the same going forward as well. Bangalore airport is expected to achieve full capacity by 2030 with almost 90 million yearly passengers. To put that in perspective, London’s Heathrow in 2019 (pre-COVID peak) flew 80 million passengers. The city is expected to start searching for land for a 2nd airport within the next few years as it continues to grow (current population is 13 million people).

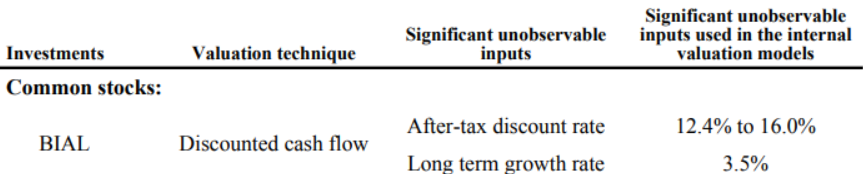

The absolute valuation of 2.6 billion USD for Bangalore airport looks attractive from a general thumb check across similar assets in India and globally. The management uses the following conservative inputs to calculate their value.

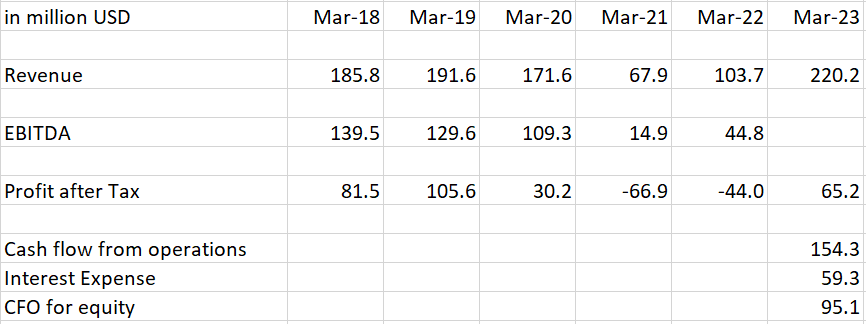

From the private filings of the Bangalore airport, the approximate data points are as follows:

The airport opened its new Terminal 2 last year and that creates accounting entries that are difficult to normalise. Also, there are certain tax writebacks that make it difficult to analyse the true earnings power. Indian passenger traffic has smartly recovered from COVID and 2024 and 2025 should be good years for the airport.

Public Equity Portfolio:

Fairfax India has a public equity portfolio that as of today is equivalent to 1.25 billion USD. The major value in this comes from IIFL group and CSB Bank (almost 1 billion USD).

We are bullish on IIFL Finance (largest position in our global portfolio and we own around 1.5% of the firm). The group is run by a wonderful owner-operator who understands capital efficiency and shareholder value creation. The stock trades at <10X earnings and 2.3X price to book with ROE and growth of 20%+.

We don’t own CSB Bank directly, but it is a well run mid sized bank with a good management team that wants to scale up the business 10 fold over the next decade. The stock trades at 12X earnings and <2X book value with a healthy 18% ROE.

The rest of the portfolio (IIFL securities, 5 Paisa, Fairchem Organics etc) are good businesses that are trading at reasonable valuations. There are no large valuation or growth risks that I see in their public portfolio.

Private Portfolio:

The largest allocations in the private portfolio outside of Bangalore airport are Sanmar (300 million USD) and NSE (176 million USD). Fairfax has investments in the holding company of Sanmar in line with the promoter family, but majority of the underlying value of the group is in the listed firm - Chemplast Sanmar. You can see from the market cap of the listed firm that the marking of the holding asset is reasonable. Fairfax’s indirect holding of the listed firm is approximately worth 220 million USD and the group has other large assets outside the listed firm in Egypt. Another way to check their valuation is that the pro-forma profit before tax of Sanmar for Fairfax’s stake was 39 million USD in 2022 (7.7X multiple on 2022 PBT).

NSE is India’s largest stock exchange and should have a listing over the next few years. The exchange has been growing leaps and bounds with increasing equity participation in the country. It is a good asset that we should be happy to own for the next decade (marked at 19X 2022 earnings). The unlisted shares change hands currently at 25%+ higher than the valuation assigned by Fairfax team.

The rest of the private portfolio is worth 350 million USD that is spread over 6-7 businesses. I don't have any strong views on them and are not material to our thesis.

Valuation & other factors:

The stock is trading at less than 60% of the underlying portfolio and I believe that is a large discount despite the high fee structure. The firm has been buying back shares (along with the parent Fairfax Financial) and the shares outstanding has reduced by 1.25% this year (they have retired 11% of outstanding shares in the last 5 years). I expect the share buybacks to accelerate as we get closer to the Bangalore airport IPO. The net debt is around 400 million USD, but has a 5 year tenure with 5% fixed cost.

While the discount can theoretically widen even further from current levels, I believe that the current discount of 40% is on the higher end and the management can buy back shares aggressively if it persists (especially once the Bangalore airport listing gives them more liquidity). There are multiple levers of shareholder returns in Fairfax India - NAV compounding, discount narrowing, share buybacks etc.

The biggest catalyst for the idea continues to be the expected IPO of the Bangalore airport. If the IPO doesn’t happen, then it is equivalent to paying a PE fund a 2/20 fee structure to get access to a good private deal (positive is that we are buying it at a 40% discount). So, the overall Risk-Reward looks attractive to us.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.Catalyst

Bangalore Airport IPO, Share Buybacks

-

I don't know about land / farm prices being "cheap" in America. We have a family farm in Indiana (USA) and my Uncle is currently managing it. He told me a "medium quality farm in Indiana near our farm sold for $13,400 / acre recently." Now that price doesn't make sense to me for raw farmland at all. I see the financials, I know what the farm produces on average over time. There is tax. It just doesn't seem undervalued to me at all. Maybe somewhere else there is productive ag land that is much cheaper but $13,400/acre for Indiana farmland is just strange. I think @boilermaker75 has a similar farm in his family. Maybe he can chime in and tell me $13k is way off the mark and my uncle is smoking crack.

-

Thanks dealraker - nice to see BNSF take intermodal business from UNP.

-

1 hour ago, Luca said:

Putting my Fairfax Dividend to work: Put two buy orders in for CEIX @NYSE and JOE @NYSE

Nice! I hadn't noticed it hit this morning. I love Fairfax dividend day. Something about getting it all at once that makes it seem like a lot.

-

-

1 hour ago, ValueArb said:

TTM earnings are a third of the peak.

What are you talking about?

https://www.macrotrends.net/stocks/charts/AAPL/apple/net-income

And Revenues up 20% total over 9 years? Haven't they doubled? (while over 1/3 of shares retired)

https://www.macrotrends.net/stocks/charts/AAPL/apple/revenue

No wonder you guys think it's such a dog.

Just remember that this company has returned $600 Billion in excess capital it generated and didn't need in its business in the last 6 years that Buffett has owned it. $600 Billion out the door and the market says what's left is worth $3T.

-

$825 Billion

-

I guess you folks are just going to be disappointed then

-

Sometimes it's just best to let Warren and Charlie explain it themselves -

-

18 minutes ago, Sweet said:

I once had a fat gain on options which I was desperate to split across years for tax purposes. So I waited and exercised them. I ended up waiting too long such that any savings I might have made in tax was lost many times more in not just selling earlier. So it’s easy to make the exact argument you just made in the moment but it can be a mistake even just a few months later.

Because number might go down on a brokerage statement? This isn't an options position. The company isn't going poof anytime soon.

-

Well the fastest and surest way to destroy a bunch of money would be realizing a $140 Billion capital gain and paying the tax to the treasury. There goes $30 Billion that won't work on your behalf ever again.

So now he's turned $177 Billion of Apple stock into $147 Billion in cash. Now what? He is not in any way constrained by his cash levels when it comes to buying back Berkshire shares currently. God forbid he invests the $147 Billion in a stock that might go down!

Pretend this chart is the pretax earnings of a wholly owned Berkshire subsidiary like the Railroad or something. Pretend it's called Acme and Berkshire bought it in 2018 and it's doing well. There is no daily quote or capital gain or deferred capital gains tax, just a wholly owned subsidiary that is doing well. Would you think it was a problem? Would you need to IPO BNSF for $140 Billion in taxable cash tomorrow just because you could?

Warren spends so much time with Ted and Todd discussing what really makes a good business. They are super rare and even rarer at size. Not easy to replace.

-

It's funny how much ink is spilled obsessing over Berkshire's "Apple problem!" Like an investment working out perfectly and (perhaps) getting ahead of itself is some kind of big problem. I don't think Buffett frets about the position being $177 Billion. I think the rest of Berkshire will continue to get larger and nobody will care about $177 Billion any more. The numbers are going to get larger. When Berkshire is allocating capital over a $2 Trillion asset base and Apple is 15% of it and still buying in shares and growing their dividend I don't think people will obsess over the insane 15% concentration.

Imagine Warren makes a new public market investment with a $50 Billion cost basis this year. That would not be unexpected or crazy. You would hope it would work out and be a good investment. So you would have another huge $200 Billion problem to obsess over!

Some things at BRK never change. #numberGoUp

Have We Hit The Top?

in General Discussion

Posted

Yeah, the Eurozone is now 5 consecutive quarters of essentially zero economic growth. But it's not a recession. Technically