MMM20

Member-

Posts

1,891 -

Joined

-

Last visited

-

Days Won

10

MMM20 last won the day on February 10

MMM20 had the most liked content!

Recent Profile Visitors

10,623 profile views

MMM20's Achievements

-

One of the smaller players, Vireo Growth (~3.3% of TOKE), is +170% today after announcing transformative combination at ~4-5x EBITDA https://www.globenewswire.com/news-release/2024/12/18/2998880/0/en/Vireo-Growth-Inc-Announces-75-Million-Financing-and-Acquisitions-of-Four-Single-State-Operators.html Not trying to turn this into a cannabis thread but I think it speaks to how bombed out and cheap the sector is.

-

I am buying MSOS for a bounce. I am also planning to buy and hold more TOKE longer term b/c I really like the portfolio (see below) and the manager has fully waived fees until they hit $50mm in AUM. I have my own favorites (I've owned GLASF common and series B pref/warrants for ~2.5 years and averaged up a bit in the common at ~$7 this year) but I think the group as a whole is priced to high returns right now. I also own Couche-Tard and Philip Morris on their own merits as cheap/fair compounders with misunderstood tailwinds but partly b/c I think they'll also benefit from US cannabis reform at some point. My bullishness is dampened by the fact that I know I can be contrarian to a fault - and that I'm not personally comfortable with a big position in this sector for more than a month or so given the clear and obvious left tail risks like a DOJ crackdown. I figured I'd share anyway. Now watch MSTR blow me (and old man Buffett) away.

-

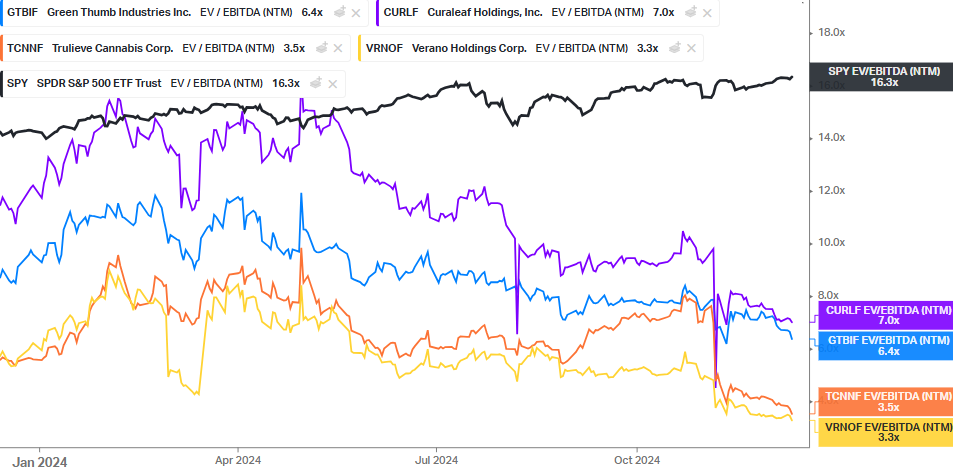

I tend to think about it on EV / (EBITDA - maintenance capex). Most of the capex has been for growth, and I think they've learned some hard lessons on that front over the past few years (though I'm not claiming every operator has found religion - some of their hands are forced by levered balance sheets and lack of access to reasonably priced capital). When I think about the bottom line, I am assuming 280E excess taxes go away in '25 or '26 at the latest. No one cares now, but that can change quickly. The obvious counterpoint is that any tax savings will be passed through to consumers. That is probably true to a certain point, but should be offset by volumes flowing to legal channels as prices get more competitive with the black market. Next, keep in mind that some of these companies are levered and interest rates are ~1.5-2x those of other businesses with similar credit profiles (aside from weed's federal status). You probably need to believe that changes with some federal reform like SAFER banking or better under the Trump admin to own the whole group longer term. But my point is to think about taxes and interest rates probabilistically along those lines and whether ~6x EBITDA-maint capex will translate to ~10-12x P/E shortly... or not. And I am mainly pointing out how oversold these are - and how much of that dynamic seems to come down to "Trump=bad", market plumbing issues, tax loss season, and multiple funds shutting down. I’m guessing we are a week away from full capitulation.

-

MMM20 started following Best Idea(s) for 2025

-

If you want a contrarian value idea on a real business (not a crypto thing that looks like an all-timer of a scam), please let me humbly suggest US cannabis. Sentiment is the worst I've ever seen. The best operators like trading at all-time low valuations, like Green Thumb ~5x EBITDA (ex-AGFY stake) with a legit operator/ capital allocator CEO and cash flows inflecting upward, and Trulieve now at ~3-4x EBITDA in the wake of Florida failing to pass recreational weed last month (and with insiders buying some more recently). We're in the middle of tax loss season and these are essentially illiquid private stubs that still mostly trade on lower Canadian exchanges, and I think that explains most of why they've gotten crushed. We're on the cusp of rescheduling to Schedule III (hearings started this month) which if confirmed would tax the US operators as normal businesses rather than at 280E's ~70% effective tax rates. This may also open up the sector to more sources of capital and listing on US exchanges (depending who you ask), which should be a major catalyst because right now most institutional investors cannot own these things because they cannot custody the shares. If confirmed, the tax change would probably start next year (and possibly with a 3 year lookback). Also, Marc Andreessen recently highlighted the banking issues on the Joe Rogan podcast. Banking reform might actually get over the finish line near/mid-term, and yet most investors have completely given up and dismissed that possibility. I think investors are wrong to assume the Trump/RFK admin will be bad for cannabis businesses - see for example https://www.forbes.com/sites/willyakowicz/2024/11/29/why-donald-trump-will-be-good-for-weed/. And if that proves correct, the MSOS ETF could ~2x from these levels and still trade at a discount to the market. So while there are real risks and some poor operators with lots of leverage, I think there's a major disconnect between sentiment/valuations and reality. And sure, it doesn't hurt that these things have Microstrategy-ish meme potential - look at NASDAQ-listed AGFY running from ~$3 to ~80 over a few weeks. I think it adds up to a good trade for a ~50% bounce at least. I'm planning to buy over the next few weeks.

-

Even if we believe this could be a real catalyst for the stock, we gotta keep in mind that this could happen any quarter, right? It's not like it's now delayed 18+ months and so outside of most investors time horizon (or otherwise dents the thesis in any way). End of hurricane season / typical run up into the ex-dividend date bigger factors IMHO, and the stock is still obviously cheap in both absolute and relative terms. Onward

-

The market’s up and peers like WRB and MKL are up about the same as FFH over this recent stretch. No denying there was some index speculation going on but I’ve noticed the stock tends to run up after hurricane season and into the Jan ex dividend date, and I bet those are bigger factors. Don’t be surprised if that overwhelms whatever short term selloff and the stock bounces over the next month or so. Of course a fool’s errand to have any confidence on that, but I felt like pushing back.

-

https://archive.ph/U8qmg The Quiet Rise of Lightly Regulated Home Insurance When major property insurers drop homeowners in Florida, California and Louisiana after hurricanes and fires, another type of company is offering coverage. Any updated thoughts on the hard market? On one hand, it feels peak-ish when these players are popping up. On the other hand, it doesn't exactly sound like capital is flooding in... “In a normal world, you would question whether anyone would actually ever buy insurance from these companies given how thinly capitalized they are.” I'm not sure what to make of it so relying on Fairfax's judgment - why I prefer investing in high quality operators with aligned capital allocators running the show. And Fairfax still isn't priced as such (@Viking).

-

Isn’t the normal volume in Fairfax nowadays much lower than Berkshire’s was at that time? I wonder if you’re mostly right but there’s still a bigger move coming closer to the date, similar to TPL ahead of its addition to the S&P 500 recently. But I won’t be surprised either way.

-

I was also correct that something shady was going on. Unless the timing of a spike - mid-day ahead of the announcement after the close - was pure coincidence

-

Similar perspective to https://frank-k-martin.com/2024/11/18/cash-as-trash-or-king/ Buffett’s “not-so-secret weapon,” as noted in the 2023 annual letter excerpt above, is to sell on good news so you have cash to buy on bad news. Only a tiny fraction of investors have the willpower to walk away from the table when they have a hot hand.

-

Cost of capital headed down across the board?

-

With respect to all the Canadians here (I love your country!), Occam's razor = something shady and borderline illegal involving the hedge fund community up there. Maybe I'm wrong about exactly what it is.

-

Let me be the first to wildly speculate that someone's leaking the news about index inclusion and funds are buying the prefs to get around insider trading laws.