-

Posts

1,514 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by Saluki

-

-

6 minutes ago, Parsad said:

I think Altman's view is that this technology will be developed by someone, and the intent may or may not be beneficial to humanity...like nuclear fission. He would rather be the U.S. and Oppenheimer than Germany and Hitler. Cheers!

https://www.cnn.com/2023/10/31/tech/sam-altman-ai-risk-taker/index.html

Sam Harris had an interesting take on this. There is no reason that human (meat based) intelligence is unique vs machine intelligence. It can already do math better than meat based intelligence and it keeps getting better, but meat based intelligence has stayed the same since Cro-Magnon man. Even if you assume that machine intelligence continues to grow even 1 or 2% better each year, it's outpacing the rise in meat based intelligence and will eventually surpass us. It's when, not if.

So if you assume that wolves decided to align with us (not the other way around) because it helped them. And we got smarter and they stayed the same, it helped them out for a long time. They are now dogs and we take care of them, but if there were some covid-like disease spread from dogs to people and it was killing human babies, we would wipe out the dogs. Not only would they be powerless to stop it, they wouldn't even see it coming.

What if AI had it's purpose (to get smarter, to grow etc) and something humans were doing (contributing to climate change, bombing each other which destroys computing power as well as people, or if there are just too much of us and too many natural resources are devoted to maintaining us which could be diverted to computing power). If it decided that we were in it's way, not only could it take us out, but there is not only nothing we could do to stop it, but we wouldn't even see it coming. Maybe advanced societies eventually get taken out by their own technology, which is one possible answer to Fermi's paradox.

-

The Code Breaker book about the two women who got the Nobel prize for it is great. There are a lot of articles written about attempts by male scientists to claim credit for it as was shamefully done to Rosalind Franklin by Watson and Crick. It's ironic that in cementing the legacy of two women in the CRISPR discovery, the Latino scientist, who discovered, named it, and figured out it's role in microbial defense, is never mentioned. Francisco Mojica: https://en.wikipedia.org/wiki/Francisco_Mojica

Although if you want to channel peak wokeness, you should refer to him as a LatinX scientist .

-

Trimmed a little SWBI in my retirement account. I'll wait a full year to decide if I want to sell the shares in my taxable account. I think it's got long-term potential for compounding now that the new factory/headquarters is up and running and that capex is behind them, but I also think that a lot of the price appreciation in the past month is due to what's going on in Israel and fear/uncertainty/doubt about the current administration and gun control.

Sold most most of the small position I had in VSTO. It's still cheap but they are no longer doing a spinoff and they sold the part of the business that I was interested in, so the thesis changed.

-

I picked up a few shares a couple of months ago when it drop in $6xx range. I should've backed up the truck, but I was building a position in something else (NTDOY) at the time.

In a few weeks when people forget about it again, If it dips below book, I'll sell something and buy some more.

-

Interesting piece by Wall Street Millennial about Stansbury Research.

-

Picked up a few shares of JOE. It's starting to look interesting again, but I already am overweight in JOE. If it keeps getting cheaper (and they keep firing on all cylinders), I'll add more, but these are "great company at fair prices", not "motivated seller" prices right now.

-

If you are looking at the parent instead of the partial spinco, keep in mind that that even if in a sum of the parts analysis, the parent seems cheap, there may not be a way to unlock that value.

Prosus/Naspers for years traded at a value that was less than it's holdings in Tencent, but you can't buy one and short the other, because if they don't sell the position, the discount may not close. Ditto with Bausch Health which spun off 10% of Bausch and Lomb and kept the other 90% for themselves. That Bausch and Lomb position made BHC look like a bargain, but they were not able to spin it off or sell it because of their debt covenants and liability from lawsuits. Yahoo also eventually found a way to distribute it's BABA shares, and people made some money, but it wasn't the tax free home run that people anticipated.

-

John Neff had a term for this: Measured Participation. You can start buying small and keep adding. You don't have to eat the elephant in one big bite.

-

How to scare away the algorithmic traders on Halloween

-

Picked up a few JOE shares today when it dipped below $50. I think with one more interest rate hike we may be able to buy in the mid $40s again.

I'd add more but I'm using some of my available cash for my"snake swallowing a mouse" tax loss harvesting strategy.

I take $10k and put it in a position with the biggest loss (BABA, over -50%) and hold for 30 days, then sell the higher cost basis shares and move that amount the next biggest loss (TV), then keep doing it for the next biggest % loser. I have two more times I can do it before the end of the year for stocks that are down but still want to hold onto. That loss offsets gains, which is great because I feel like a piece of my soul dies every time I pay taxes that I could have legally avoided paying.

-

On 10/8/2023 at 4:10 PM, Morgan said:

@Saluki Just to confirm this is the correct book for Dynasties of Sea?

Dynasties of the Sea: The Shipowners and Financiers Who Expanded the Era of Free Trade by Lori Ann Larocco from 2012

It has a blurb on the cover form Donald Trump?

There is also a second edition from 2018 that covers PE/hedge funds entrance into the industry.

@Morgan yes, that's the one. It had profiles in there of people from Seaspan, Scorpio, Frontline, and some of the other major companies, so it's a good one to get a feel for some of the players and their different strategies.

-

On 10/6/2023 at 9:10 AM, backtothebeach said:

A 0.5 liter bottle of water at Cancun airport is 6-7 dollars at every shop, and of course no water fountain. It”s a mafia.

I’m in a Florida airport now. They have free water fountains (with paper cups to fight covid) and the .5 liter bottled water is $2.89 (generic)- $4.29 (Evian).

charging twice that amount in a poor country is outrageous.

-

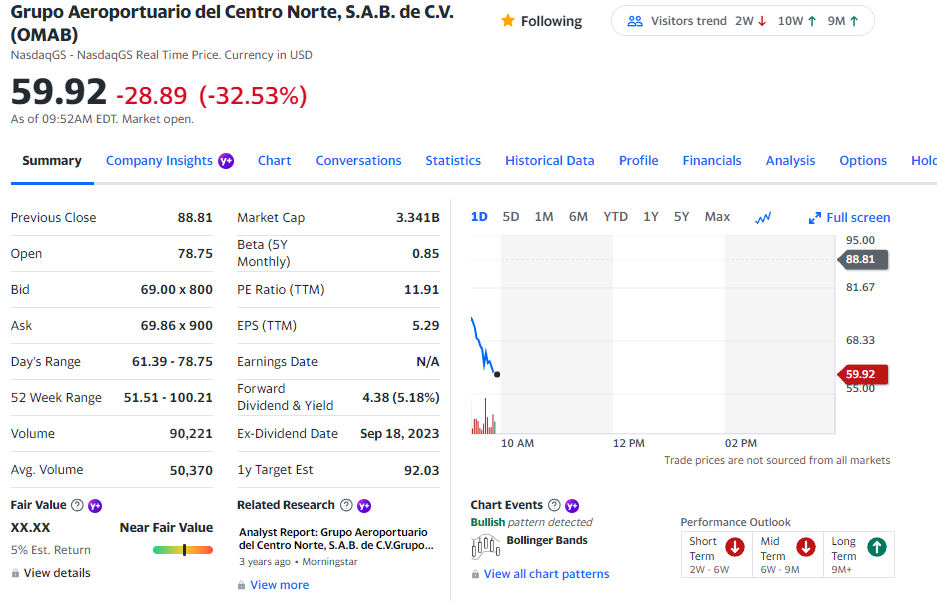

9 hours ago, Spekulatius said:

Mexican airports blowing up on tariff changes apparently:

FWIW - those Mexican airports are concessions so the assets are leased technically, not fully owned. I am not be correct as i recall from memory. They also charge very high fees comparatively speaking. Another compounder stock that became a confounder.

https://finance.yahoo.com/news/mexico-stocks-sink-government-alters-141758192.html

Looks like all 3 Mexican airport operators got a surprise today.

-

1 hour ago, Spekulatius said:

How do you define unloved? What metrics would one use to quantify "unloved"? Discount to historical valuation metrics like EV/ EBIT?

That's a great question because if you really like something then you can find some historical valuation metric to justify your decision to buy. So for example, someone on this board has been heavily talking up a certain women's underwear maker. And you can look and pick out things like price to sales where it looks cheap. But other companies like Gildan (or even Hanes) are not getting beaten down as badly, so it's not that people hate the garment business, they just hate that stock.

But if you look at something where the industry seems cheap by some valuation measure (or hopefully several), then you are not just buying a cheap company, you are trying to find the best value in the flea market. I think book value is not a great valuation metric for shipping, but if you see that they are all selling for much less than book, then you can find out if any corners of the market look promising, or companies that are making the right moves for shareholders by paying dividends, buying back stock, or paying down debt. The same goes for things in the energy industry where they have a history of buying more capacity or doing more exploration instead of returning money to shareholders. For each industry, identifying the turning point is different, so it's important to stick with what you know. In shipping, you look at the replacement order book vs the existing fleet. For things like banks, I don't know what to look at, so it's an easy "no" for me.

I think most of these decisions will involve some qualitative aspect. Maybe gun stocks or tobacco (or autos besides Tesla) will always trade at a low P/E because people hate the industries, and in those cases you will hopefully find some that have hidden growth potential, like the vaping or oral tobacco, to grow into a good outcome since the expanded P/E multiple will probably not show itself.

Buffett made a great deal on buying a Railroad, which he jokingly said is one those industries that has a bad century now and then. But if you look at WHEN he bought it, it's fascinating. RRs had been consolidating after a few went bankrupt and the government eased the rules that made it hard for them to increase rates, so that they could make money again and not rely on government subsidies. So it looks like one of those places where "theory blinds observation." If you are a person who has known that Railroads are a bad investment because it has always been for as long as you and your father, or possibly your grandfather, have been alive then you won't see it. If too many people put it in the unloved pile and it deserves to be there, then no problem. But if they are wrong about it, then it's running towards the goal with no one on the field.

-

9 hours ago, schin said:

@Saluki Where are most unloved industries for you?

I have some stuff in firearms (SWBI and a little VSTO), and a little tobacco (BTI). Shipping has been dead money for 10 years, but I have a mid position is STNG and a smaller one in NETI and a few shares in two other ones I'm still researching (KNOP and SFL). People hate oil, but VTS and OXY are mid sized positions for me, but I'm holding not buying more. People hate Chinese stocks and BABA is cheap now, but I'm down 50% on my position, so who knows. I think commercial real estate is being killed for good reasons, but a lot of it is oversold. HHH did a capital raise at $50 during the start of Covid and it's at $75 now. The pandemic is no longer an existential threat for them and they have some great assets, albeit with mediocre management that keeps changing at the top. So it probably doesn't deserve a premium, but this discount is a bit much. My Mexican cable stock, TV, is getting killed but on a SOTP basis it looks good, and the bonds were selling close to par last time I checked, so who knows about that one too. Fairfax India looks cheap enough that they are buying back shares. The Canada/India row is a nothing burger in the longterm.

-

I added a little NTDOY. Still building a position slowly when I get dividends or trim a little on something else.

-

In terms of fishing where the fish are, the small/micro caps are full of tons of junk with the occasional gem. It's like going to flea markets and estate sales. The volatility on these microcaps takes some getting used to, though. I have a tiny position in one that I am trying to keep track of until I decide if it deserves a bigger weighting. There was some minor good news this morning, but nothing that would make me want to buy more:

https://finance.yahoo.com/news/taylor-devices-announces-first-quarter-114500081.html

Within an hour of the open it was up almost 10%, then after lunch it gave up all its gains and was down 3.5% from the open.

-

This is a very easy and worthwhile read about the Glock pistol and how it went from zero to the number one handgun in the US in a few years, dominating police contracts and outcompeting rival like Smith and Wesson, Beretta and Sig Sauer who were larger and had been around for a lot longer.

Glock was an engineer in a radiator factory who had a side gig making curtain rods, hinges, and knobs in his small machine shop on an old Russian metal stamping machine. He heard about a contract for the Austrian military and thought he would have a good chance of winning it because all the companies bidding for it were foreign. So he took out books from the library to learn how guns worked and started with a clean sheet of paper. He designed a gun with much fewer parts, and therefore had fewer things that would break, that was easier to make and cheaper. After getting that contract he set his sights on the US market at the perfect time when police wanted to move away from 6 shot revolvers to pistols with higher capacity magazines.

With a US headquarters in Atlanta, near one of the largest strip clubs in the US, they would fly in police chiefs and give them strippers, booze, and envelopes of cash, they soon took over the police market. Along the way you'll learn about the tax cheating, the US executive who had jailed (and who may have been framed), and the shady Luxembourg fixer named "Panama Charlie" who hired an incompetent hitman to try to carry out the dumbest planned hit in history. There's also stuff in there about his friendship with Jorg Haider, the Austrian neo-fascist politician.

I listened to it on Audiobook as part of my research into S&W, but it's a fascinating story even if you have no interest in this type of stuff.

-

1 hour ago, WayWardCloud said:

Defenses contractors do seem like today's no-brainer and I've been toying with the idea of a defense/aero ETF. Revenues should go up meaningfully because of Ukraine as well as the escalation of tensions in the Pacific and it would also add an anti-fragile element to the portfolio. However I came to the conclusion I couldn't look at myself in the mirror if I got rich from people being killed.

The Koch family had no problem making their fortune building refineries for Stalin. Although Oil and Gas isn't as morally objectionable to most as munitions, what they did is more morally reprehensible than selling bullets to people fighting a Russian invasion. If you were talking about selling guns to North Korea or to rebel warlords in Somalia, then I would say that you are correct. But I don't think the line is as clear as it seems.

I don't have any defense companies, but I do own Smith and Wesson. Guns are used by criminals, but they are also used by law-abiding homeowners to protect their loved ones, and Police Departments are very large purchases of S&W. I'm okay with it, but I can see why others would be uncomfortable with it. But in terms of "fishing where the fish are", Bruce Greenwald said that "unpopular and unloved" industries tend to be good places to find value.

-

@Jaygo I have a medium sized position in STNG and I had a medium, now small, position in NETI (I sold half). I had been jumping in and out of few where I saw it was cheap, but I'm currently looking for things that have a moat like Offhsore WInd (NETI) where you can keep compounding and not face new entrants or more ship building like drybulk or tankers. I have a very small position now in KNOP (shuttle tankers) and SFL, which has long term contracts in a little bit of everything, but is increasing it's Ro-Ro fleet. The business model of SFL reminds me of what Sokol was doing with ATCO. Roll-on-Roll off is an oligopoly, but the Ro-Ro only companies are expensive, and it's one of those specialty things which I hope is not wide open to new entrants. KNOP is an oligopoly with Teekay, and Shuttle Tankers can work work as crude tankers in a pinch, but not vice versa, which I hope will make them more resilient. I'm still digging into KNOP and SFL and I like what I see so far, and may add more, but it's a small position for know while I study them.

-

11 hours ago, Eng12345 said:

CPNG - starting to get cheap again.

I've been adding slowly slowly to NTDOY. I also bought a small amount of CPNG and BTI yesterday. CPNG is trading at prices below what they were before their last quarterly earnings came out (which were awesome), so it's like getting more free bites at the apple.

-

Since I don't have a background in Shipping, I had to read several books to get comfortable enough to put some money to work and not be one of the "tourists" that gets scalped. Besides the excellent "Shipping Man" by trilogy and The Business of Shipping, a textbook by Breskin, I read Dynasties of the Sea, which has biographies of some of the CEOs of the largest companies.

However, this book was recommended to me by @Packer16 when we chatted at the Berkshire AGM. I had heard of the book, but said that I didn't want to read another 800 pages, but he insisted it was worth the read. I have to say he was correct. It's very detailed with information on shipping cycles and prices, formulas and charts that you won't be able to find anywhere. The long view is definitely necessary to understand what is going on.

In the same way that you can do fine in investing with reading Security Analysis by Ben Graham, you can do fine without this book, but like Security Analysis it will separate the pros from the tourists.

The hardcover was $200 and the softcover was $100, but because I'm a deep value guy at heart, I picked up a used copy of the prior edition for $10. I don't think much changes in shipping, and since it covers shipping from the time of sails and the transition to steam power, I think it's got most of what I needed. If there is ever a third edition, it will probably cover the period in 2020 where ships were used as floating oil storage and the new vessels to install offshore wind turbines, or new green fuel vessels, but 90% of what you need is what never changes (fleet size, order book, spot vs contract, financing, etc).

Highly recommend if you are interested in shipping as an investment, but for most people shipping is a terrible business so stay away

-

25 minutes ago, Jaygo said:

I truly believe that successful investing is hampered by extremely high intelligence. This stuff is not that complicated to do reasonably well and most very high IQ people need to find esoteric shit to do to feel good about themselves.

I agree. This goes back to Buffett's simple Rule number 1: Don't lose money. By way of analogy, most cancer research is into the complicated stuff like killing cancer cells, but not other cells, or keeping them from replicating. Very little research goes into prevention with things like healthier lifestyle. That is much more effective in reducing deaths from cancer because you can't die from it if you never get it. Rule Number 1. But if you spent years of your life doing complex science (or math), you probably don't want to work on the simple stuff. It's like how architects are obsessed with putting cantilevers into their designs. It'to prove that they are at a skill set above the guy who designed the extension your brother in laws house.

It's hard as you add more and more tools to your tool chest to remember that you don't have to use them. Sometimes it's chipping away the marble, not adding more clay. I remember an MMA guy telling me once about how to win a fight. "If you're on the bottom, get on top. If you're on top, stay on top." It's not impossible to win if you're on the bottom and someone is dropping elbows on your head, but it's an easier path to victory if you are on top.

-

Kurt Vonnegut's son is a doctor and also a writer like his father, but not nearly as well known. This is an essay in one of his books that gives you something to think about.

https://www.nytimes.com/2010/09/26/magazine/26lives-t.html

The less-toxic mushrooms make you very sick right away. With the ones that kill you, you feel fine at first, and then a few days later your liver dies, and you follow shortly thereafter. Feeling sick as a dog and having sweat pour off me so soon after my meal was a good sign.

It reminds me of Munger's quote about wanting to know where he was going to die so he wouldn't go there. I would guess the analogy here would be the less toxic stocks are the ones in secular decay (like Newspapers). It can look like something good, but end up being a value trap and you will slowly lose money every quarter but will be okay once you figure it out and sell, as long as you didn't eat a huge dose of it. The ones that kill you are the ones like Lehman which look like they are doing okay for years and something inside them is killing them, and when it's obvious, it's already too late.

How to prosper in the coming deflation.

in General Discussion

Posted

There's a great book called "the Other Half of Macroeconomics" by Koo. What we would experience might look like what Japan did: a balance sheet recession. Cutting interest rates might not do much because there is so much debt out there that households and businesses would be devoted to paying down debt, rather than capex and investment even if interest rates fall. Massive government spending, putting the government as the "spender of last resort" would be the way out of it, but with the current political climate I don't see that happening.