-

Posts

1,514 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by Saluki

-

-

Sold the last of my BRK in my retirement account and redeployed to FRFHF, FFXDF, TV and BTI.

-

Twitter is free and it's a cesspool. I'm glad there is a small fee that cuts out 95% of the trolls and wallstreetbets crowd.

-

FFH, Fairfax India, and a little BTI and TAYD.

-

Sold half of my BRK in my retirement account and moved it to FFH, Fairfax India, and a little BTI and TAYD. Still have all my BRK shares in my taxable account and they will probably have to pry them from my cold dead hands one day (far in the future, hopefully).

-

I have mixed feelings about this book, which I just finished. While it's interesting to get a take on Lehman from someone who was working there at the time, you don't see all the moving pieces from the trading desk. The book by Ace Greenberg on Bear Stearns was much more illuminating.

Some things which were not to my liking: The author. He talks like every other overconfident trader I've ever met and doesn't consider that he could be wrong. Just like a car salesman can't tell you what is going on in the auto industry, how much insight does a trader hearing bits and pieces second hand really know about the risk management part of a trading house? He says things that he heard, but are clearly wrong, like blaming the implosion in real estate on that right wing shibboleth of saying that allowing low income borrowers to buy houses that they couldn't afford was the underlying cause of the cracks in the market. 40% of home sales during that era were homes that were purchased for investment, or second vacation homes. But why let facts get in the way of a good bro story?

He overstates his role and Lehman's role in the grand scheme of things. He couldn't get into Wall Street out of school, and actually peddled meat to supermarkets to get sales experience. Then he started a blog where they analyzed new bond issues (ONLINE!) and when it was bought out, that got his foot in the door at Wall Street. He got in by the back door. He really lays it on thick about how respected and storied Lehman was and how they admired his trading skill. He is obviously biased and won't admit that he's talking about how hot his girlfriend is, who you've never seen, because the other trading houses weren't falling over themselves to hire the meat salesman with a blog. He talks about Lehman like it was in the same league as Goldman, Morgan Stanley or JP Morgan, and not that many people (including me) looked at Lehman as the second tier and did business with them because they took clients and risks that other more respectable houses could pass on.

He has some weird hang up on diversity and kept making snide comments about it. He thinks it contributed to Lehman's demise because managers were encouraged to go to diversity presentations and "shake hands with lesbians". He points to the appointment of Erin Callan at the 11th hour as proof of this thesis. After all the overconfident straight white guys with full heads of hair loaded the company up to 44x leverage, their hedge funds imploded, David Einhorn shorted them, and they wasted the little cash they had left to buy back their stock, he thinks that the Callan was a diversity hire and therefore she's responsible? By the time she was elevated in 2007, you could've put the most overconfident, straightest, whitest guy with the fullest head of hair and most expensive suit there and it wouldn't make a difference.

Some of trading stories and characters are interesting, but I feel like this is a Rashomon retelling of the great financial crisis where everyone has a different take on the same facts, but one in which they are the hero and everyone else is the villain.

-

Not all heroes wear capes. This person put all the Berkshire AGM videos online and edited out a lout of the dead time, long questions and pauses and knocked off about half hour in each one. Since I like to listen at 2x speed, he or she saved me about an hour of listening time on each one.

-

If you love grilling, get it, you can afford it. My dad has a "quincho" which is like a covered gazebo with a special large charcoal pit for grilling, where the grill can go up and down with a winch (?). I'm sure it costs more than an Egg, and he loves it.

I'm sure the people who buy these, are in two camps. People who love old school grilling and people who want to show off. I see the same phenomenom everywhere. In jiu jitsu, a common brand of uniform is Fuji (like the Honda Civic of BJJ Gis). It's $80, and people usually have several because they take a couple of days to air dry. There are several "high end" brands like Shoyoroll which are $350. And there are some minor things that people love about them (the inside of the collar is foam, not cotton, so it dries faster; it has a liner on the inside which makes it less harsh on your skin etc.). And the people who buy them either train everyday and are really good, or they are the people who have a lot of money. If you have ten Shoyorolls, that's the price of a used car.

When I sold cameras, a lot of people bought Nikon SLR cameras. Some where professionals who appreciated that it had metal everywhere vs brands like Canon where the flange that attaches to lens is plastic. Other people had no business buying an SLR but they bought it because it was a signaling device.

So I don't know which camp everyone is in, but if it makes your grilling experience more enjoyable, even if you are grilling alone, then go for it. I'm not the ideal customer. I used to have a charcoal BBQ and I enjoyed the process but eventually switched to propane b/c it's just so much easier. But I have friends who have smokers and will cook something for hours and I love being invited over when they do.

-

2 hours ago, Spekulatius said:

Comcast did a great job with Telemundo. Telemundo has gained a lot of market share in Spanish language TV from Univision as they weren’t from distinct second to going toe to toe.

OT - since Peacock carries Telemundo and Telemundo carriers many sports event, subscribing to Peacock is great way to get streaming access to live sports event (on top of the stuff that NBC carries), if you don’t mind Spanish speaking commentators. I restarted my subscription to Peacock just to watch the Woman soccer Worldcup on Peacock.

Telemundo has improved a lot. It went from 80/20 Univision/Telemundo to something like 40/30. For must of the competition Univision had programming (telenovelas) imported from Mexico and the longest running, most popular variety show (Sabado Gigante) in history. Telemundo tried to compete by buying programming from other latin american countries that was very country-specific and didn't catch on, or later stuff from Azteca in Mexico, which was like the wanna be Televisa. Telemundo also tried to produce Spanish versions of US TV programs, like Charlie's Angels, in the US which was expensive and never caught on. It was like they were trying a lot of different things and none of them worked because it was like a Buffet with lots of different foods but where all the food was mediocre, instead of a restaurant that only sold burgers but did it well. Eventually, Telemundo got a few things going for them. The host ofUnivision's Sabado Gigante retired, Telemundo got a hit with "Ugly Betty" and a few other shows, and the sports helped a lot. Part of the decline in Univision's market share is the growth of digital media. Unlike immigrants, US born Latinos can watch programs in English on other platforms, or use their time online with YouTube/Facebook/TikTok etc. I think the shrinking of the dominant position because of digital alternatives, and the fact that US born Latinos may prefer to watch English language programs, is something that I didn't fully appreciate until I read this book, but Televisa/Univision still looks cheap to me and I still think the parts are worth more than the whole and I'd be very happy if Univision was spun off to shareholders eventually. Hell, a tracking stock with Telemundo might be interesting to me too, at the right price.

-

I think it's outrageously priced, but the distinctive green color and shape is a clue. It's like the red bottoms on a woman's shoe or the little alligator on a polo shirt. You want people to know that you bought something really expensive, so that people can envy you because you are the type of person who can drop that much money on a grill.

-

5 minutes ago, FCharlie said:

If you go back, way back to 2008, Eddie Lampert was filing form 4s buying hundreds of thousands, sometimes millions of shares of AutoNation at prices between $5-$13 per share. At the time Eddie owned about 58 million shares. Today AutoNation has only 44 million shares outstanding. Eddie has needed to sell periodically for years or he'd take the company private. That's a pretty nice problem to have. Very similar situation with Eddie and AutoZone. If he'd never sold a share of that he'd basically have taken the company private by now. I don't think either company is leaving anyone holding any bags. It's just their preferred method of capital allocation.

https://www.sec.gov/Archives/edgar/data/350698/000089375008000610/xslF345X03/edgar.xml

https://www.sec.gov/Archives/edgar/data/350698/000089375008000602/xslF345X03/edgar.xml

https://www.sec.gov/Archives/edgar/data/350698/000089375008000598/xslF345X03/edgar.xml

http://openinsider.com/search?q=An

Cannon ,Coleman and Lower have all sold over $1mm in the past few months too. I'm not long or short AN, but if I was I would ask "well, that's Eddie's reason for selling, but why are the other ones selling?" You may be right and it's a great company selling at a 6PE with nothing wrong with it, but digging deeper and understanding the bear case might help you avoid an unforced error.

Usually the really cheap stuff has some hair on it. I've made money dumpster diving, just know what you are buying and the what the problems are. Good luck.

-

52 minutes ago, Sweet said:

How is this trading at a PE of 6? What’s the bad news story?Eddie Lampert sold more than $20mm of AN stock in the past couple of months. One way to look at this is that the buybacks are great for current shareholders. Another way is that the insiders are using the cash register to keep the price high so they can sell out and leave you holding the bag. Which is it? I don't know.

Olin has a similar look. They are buying back 26% of the shares but several insiders are selling hundreds of millions in stock. Why?

STNG is buying back 20% of their shares, but I haven't seen insider selling, so I'm holding. But if I saw the company buying while insiders are selling, I would definitely want to understand why.

-

1 minute ago, thepupil said:

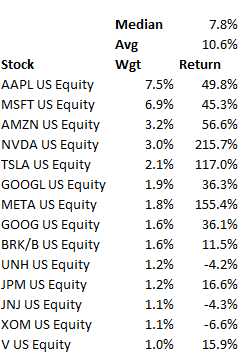

The median and average of S&P 500 stock is up 8% and 11% YTD.

For the top 10, those #'s are 48% and 72%.

Everyone should be accountable for their performance. Part of the whole point of indexing is to ensure that you capture the big winners in a given year, so narrow contribution to an index's performance does not invalidate those who index (and in fact could be seen as a validation as it illustrates how hard it can be to outperform).

with that said, it's probably been one of the more extreme short term periods

In my work provided retirement account, I have index funds so I like to think of my portfolio a little like what Nassim Taleb describes as a barbell. The SP500 is cap weighted so, regardless of whether you agree with the valuation of the high flyers, it is set up to capture the high fliers because they are added to the index as they start to get big.

With that exposure to large cap growth on one end of the barbell like a ballast, I feel okay investing on the other end in small caps, special situations, and commodity shitcos that are dirt cheap. Overall, my risk weighting is moderate.

-

Bezos had an interesting take on the internet many years ago. He analogized it to electricity. When people got electricity into their houses, they only used it for light. Then they figured out other things they could do with it like a washing machine, then a radio, then a TV. So the internet, he said, was only in it's early innings. It's entirely possible that AI will continue to improve and do things that we can't even envision now. But like the internet, there are winners and losers. Amazon won, and arguably consumers, because by putting all the retailers online, it drove down margins and wiped out a lot of retail. So early retailers thought it was great until everyone else showed up. If you are a copyrighter or graphic designer this is scary. When Apple started using multiple fonts and automatic Kerning, the work of a lot of low level typesetters and graphic designers disappeared overnight. Instagram filters make it easier to take pictures so it's harder to be a photographer, but easier to be an influencer.

Like the early internet, it may be hard to pick the winners. Where is Pets.com and where is Netscape? But like the gold rush, the people selling the picks and shovels will probably do well. So maybe not ChatGPT, but the servers (AWS, GOOG, MSFT) where the data is stored, or the chips needed to make AI work by crunching the numbers. The problem is that everyone knows this. So is it better to buy now and put it your coffee can portfolio or wait till the next tech crash like in 2000, when AMZN was selling for single digits per share?

-

Trimmed a little META. Facebook and Instagram are incredible sticky platforms and money makers. But I don't know anything useful about the metaverse and I don't use Twitter or Threads. If Zuckerberg thinks he can incorporate AI into his portfolio companies and make the advertising engine run better, maybe that's true, but I'm not an AI guy so I can't judge that either. I'd feel comfortable keeping about 80% of my position and deploying that sell money to areas where I have better visibility and that are more squarely in my circle of competence. And AAPL had another couple of doubles from this market cap, but I'm sure the odds of a couple of doubles are better starting from a smaller base.

-

I just received my copy in the mail. My thought is that Neff knocked the ball out of the park during the 70s and 80s, during a period of very high inflation. If inflation continues to be an issue, or gets worse, it might have some valuable insights into what has performed well for him, and what was his process for finding and analyzing these things. Is it better to have a company with no debt, so they don't roll over their debt into higher interest rate debt? Is it better to have a company with debt since they have locked in financing (for a time) at a lower rate? Asset light vs asset heavy? Asset heavy with little capex, like real estate, vs asset heavy with lots of capex like a refinery?

Looking forward to this one.

-

6 minutes ago, Spooky said:

On FFH, for me the universe of good opportunities has shrunk considerably since June - October 2022 when I was plowing funds into great companies but I still have excess capital / cash coming in the door that needs to find a home. FFH still seems pretty cheap compared to other options out there. My position sizing is still fairly small all things considered but I'm still learning about the company (thanks to all of the people on this board for their detailed analysis).

THIS! I loved Google in the 80s, but at 120? JOE at 34 looks great to buy, at 54, not so much. VTS at 16 is a go, at 34 it's a NO. I've owned FFH since 2018 or 19 and I'd rather buy at 80% of book, but I don't have a lot of other choices, and if they are making $1.5 bln in the bond portfolio alone from rolling things over at higher interest rates, that is a huge tailwind for FFH. Among my high conviction, long term ideas, this is a good one. Some of the other cheaper stuff I'm buying are trading sardines. Some energy stuff still looks cheap, but I have a lot already. The only shares of FFH that I've sold are in my retirement account, which I threw into Fairfax India at 11. At 14, it's not as attractive. So making the best of the hands that are available, this is a pretty good bet for the medium-long term.

-

3 minutes ago, Castanza said:

Held it in my Roth so it was easier to sell for sure. More so just a trade on oil prices and wanted to allocate more to Fairfax. If we get back below $20 again I’ll take a look again. I still like the company. Mgmt was buying around $16 so that number is in the back of my mind.

Makes sense, I know someone who's been trading it in his retirement account and he's made 3 "roundtrips" already where he's bought low and sold high, so he's doing better on it than I am. But as a recovering dumpster diver I've sold many times where I thought "I wouldn't buy it at these prices, so I should sell". And most people are not as cheap as me, so they keep buying and I feel like I left money on the table. I'm trying to train myself to sell at certain points (a pre-determined target price, or after earnings are out). If I sell before earnings, then I might be reacting to "mr market" which would be a mistake.

-

21 minutes ago, Malmqky said:

Fairfax is a 25% position otherwise I’d buy more.

Starter in CI and ELV while I research them more

I just checked and FFH is 9% for me so I'm adding as funds become available. Out of my largest holdings (BRK, GOOG, JOE and FFH), it's the only one that still looks attractive to add to at these prices.

-

For those that are interested in Shipping, this is a good channel, with very few followers:

https://www.youtube.com/@CapitalLinkInc

You used to have to pay and travel to attend these events, but when the lockdown happened, they just posted them online for free. Some of the videos have low triple digit views so the sector is underfollowed. It's probably because they haven't made money in 10 years, but now a lot of money is being made in shipping and people are still having PTSD.

My suggestion is not to binge watch, but pick a sector and then go through the videos of the conference where it's discussed. VLCCs, Product Tankers, Container Ships, Drybulk, Offshore Wind, Offshore drilling, LNG, etc.

-

I check this site every few days. It's more useful than Dataroma or the other popular sites because it will show which purchases were option exercises and which were bought using their own money. Nothing ground breaking, but if you ignore the small buys and see a large buy with an "M" for multiple next to it, that means that several insiders were buying, or one was buying on multiple days and it may warrant a further look.

-

1 minute ago, Castanza said:

Sold remaining VTS, Trimmed CASH 1/3

Any reason you sold VTS? I'm on the fence about selling in my retirement account but figured I would wait until after the conference call in a couple of weeks. For the shares in my taxable account, I figured I would sell after 366 days to get the better tax treatment.

I sold a small position that I had in Intrepid Potash for only a little more than I bought it a few months ago. There are better things to own right now and the CEO sold a couple million dollars worth, which is not a great sign.

-

Trimmed in my retirement account and bought a little FFH and STNG

EDIT: added a little BTI in my taxable account after I sold IPI.

-

trimmed a little more META in my retirement account. Tomorrow the last 10% should be gone. Still keeping META in my taxable account.

-

Just finishing up this book which was released in paperback a couple of months ago. Very interesting read about the early days of cable and Spanish TV in the US. It focuses on Univision (started and half owned by Televisa) and Telemundo (who has been a distant second in the US until recently). I learned some things that I didn't know, like that "retransmission consent" for cable channels came about from an FCC case where Televisa sued because someone was picking up their signal and broadcasting over their cable system without paying. Interestingly, the first satellite /cable transmissions were not from US companies, they were also from Televisa. They beamed the programs to Univision's cable systems in the US where before they ferried them over from Mexico in vans every week. They innovated a lot of things that are common practices now.

Univision grew immensely due to an extremely favorable deal negotiated by Televisa, because they were secretly larger owners than was permitted under US law. The Televisa founder planned on eventually taking it over so he gave them a sweetheart deal. He eventually married a US citizen and was planning on buying Univision but was double crossed when it was sold out from under him to Haim Saban, of Power Rangers fame, for $13.7 bln dollars. Lots of other double crosses in the book and people playing Telemundo and Univision against each other.

If you're interested in Televisa (TV) or Telemundo (owned by Comcast), there isn't a lot of information available and this is a great source to get the history and all the players involved. And for me it's a reminder that the due diligence doesn't stop after you buy a stock. Keep digging and learning.

Univision, Telemundo, and the Rise of Spanish-Language Television in the United States - Craig Allen

in Books

Posted

It's talked about in the Televisa thread I think. A breakup (or spinoffs) are the best bet. It would be trading at 2-3x what is now if MegaCable had agreed to merge with them instead of overbuilding in TV's territory and fighting city by city. So that and the capex for upgrading the cable network are probably what is dragging down the stock. Satellite TV is a melting ice cube too, but still profitable.

A spinoff of Univision would be great, but that hasn't been talked about. They did announce that they will spinoff the Soccer Team, and the Soccer Stadium ahead of the next world cup. That should help with unlocking value because the pieces are hard to value. How much is a stadium in Mexico city worth? So if they are publicly traded that should provide clarity.

Spinning off the stadium will prevent them from incurring capex to upgrade the stadium before the games, and a spinoff of the Soccer Team in Mexico city should help with visibility too. Some teams, like Manchester United trade at incredible values, but how much are the non (Yankees, Red Sox, etc) teams worth?

There are some other things that aren't core assets, like publishing or TV and Radio that could be sold, but I haven't heard anything about that. I think cash-wise they are fine. They got $4bln in cash and stock from Univision in exchange for giving them all Televisa's prior content.