-

Posts

1,514 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by Saluki

-

-

2 hours ago, scorpioncapital said:

If they never sell it, how is it different than 'fondling Gold'? How do you derive an economic or personal lifestyle benefit from it?

Well, there is a strategy that Buffett used to recommend in the early days, to borrow against the stock. He assumed correctly that the stock would compound at a faster rate than the interest on the borrowing,

Apparently that strategy is being used again by the ultra wealthy to spend their wealth and not be taxed on the sale. You just borrow against the assets and when you die, the estate is based on the net value, including the debt, which reduces the inheritance as much as selling, but there is no tax to the decedent on sale.

-

Very interesting video on Pinduoduo by the Financial Times.

-

There doesn't seem to be a post on Investment Ideas for Ross Stores, I don't want to make one because I hate retail. But this place seems like a good place for this piece of news.

Ross Stores Reports Results for Fourth Quarter and Fiscal 2023 (yahoo.com)

The Company’s Board of Directors recently approved a new two-year $2.1 billion stock repurchase authorization for fiscal 2024 and 2025. This new program represents an 11% increase over the recently completed repurchase of $1.9 billion of common stock during 2022 and 2023 combined.

The stock is up about 50% in the past year so I don't know at what the previous buyback was finished, but even at today's prices, a $4bln buyback would be about 8% of the shares.

-

Trimmed a few shares of META. I still have a good mid size position in it, but other than sitting on my hands and doing nothing, I don't I have any advantage over the hordes of analysts looking at a trillion dollar stock, so I think I'm better off looking at things that are overlooked and unloved.

-

Small adds to BTI and ATEX. Nothing to write home about.

I've got a couple of positions that I'm on the fence about and may do nothing or sell and redeploy after earnings come out in the next couple of weeks.

-

31 minutes ago, longlake95 said:

Trying to water the flowers and pull the weeds here - letting winners run.

I've been guilty of sitting on losers too long while waiting for them to come back. I think Buffett had a great quip about the stock not knowing that you own it. I was listening to a podcast yesterday from an investor, who has a concentrated book and he had a great line about not cutting the flowers and watering the weeds, but doing the opposite. Rather than throwing good money at a bad business and hoping it will turn around he said "It's much easier to give birth than it is to resurrect the dead."

-

Small adds to ATEX. Taking it up to a 1% position.

-

Started watching Vice Principals on Max. If you like Eastbound and Down, and Righteous Gemstones, it's got a lot of the same cast and type of humor.

-

Sold out of a small position in KNOP for a small loss after earnings came out and bought some NTDOY, FF India, and sprinkled the rest around in a few small positions.

-

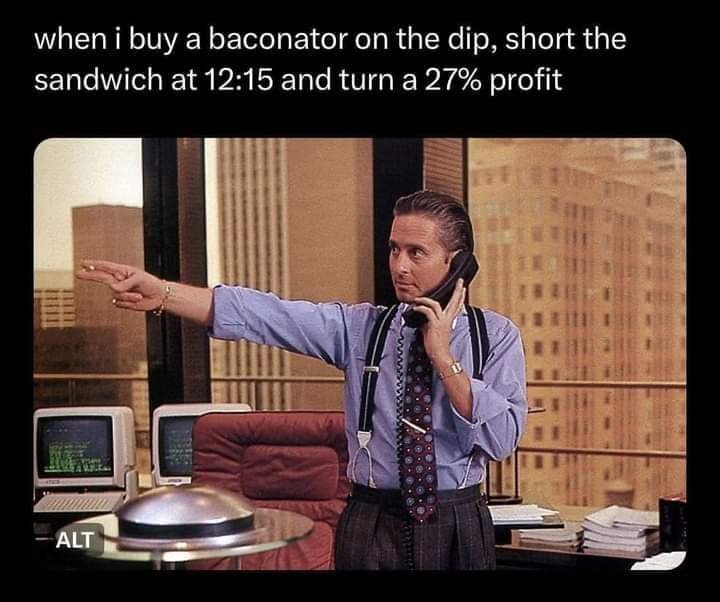

There's a lot of sharp traders on here. We gotta find a way to arbitrage this.

-

I don't know. If I went to Wendy's and the sign said a burger was $5 when I got in line and when I got to the front of the line they told me it was $8, I didn't think I would go back.

-

20 hours ago, thepupil said:

curious way to drive the stocks down...by saying he's buying in that very same interview.

I don't know man...Isn't the alternative explanation (that he actually believed what he was saying) the simplest and most consistent.

- he thought lots of people would die (lots of people died)

- he thought we should shut down for 30 days (we ended up shutting down for longer, probably a big mistake, but idk if 30 day shutdown was a mistake for society, was reasonable view to take at time w/ facts known).

- he thought the turmoil he foresaw in february 2020 was not priced into credit markets, put on a huge position in them, and made money when it got priced into credit markets.

- he thought his highs quality restaurant and hotel stocks would see it through and recover. they recovered.

- within reason, all of this was communicated in commercially reasonable real time to his limited partners for whom he tonned it.

I have zero ethical concerns with this fact pattern; everything seems quite rational and in the interest of both society and his LP's. Is he a drama queen? sure. but I still don't understand why people give him shit for this call. he was pretty much right on everything. I'm not saying he's infallible, but just don't see anything wrong with this episode.

I mean we've all got better things to do than debate what Bill ackman said 4 years ago, but for whatver reason, this is a "perception becomes a reality" thing that just seems completely inconsistent with he facts and where people extrapolate one one sound byte to draw sweeping conclusions.

March 18th 2020

He's obviously a bright guy, but sometimes his actions contradict his supposed operating manual, as with Valeant. More recently, HHH, which has been disappointing, paid $50 million for a minority interest in a celebrity chef's company. In this interview he says that he likes restaurant brands like Chipotle and Burger King because they have a system, and the system is very efficient and not prone to human error. That's the exact opposite of how a high end/ celebrity chef restaurant operates. The workers at a place like that need a LOT more training, and the menu changes constantly, which is why Chipotle with a limited menu that stays the same and where you can train a high school to make the dishes in a few hours is so good.

He says he likes companies that generate a lot of cash, since when have minor league sports teams been known for their cash generation? Even Ryan Reynolds is losing money on his soccer team.

And the anti-woke college stuff and buying into Twitter seems like he is setting himself up to run for office.

-

I'm just finishing up this book which piqued my interest due to my deep dive into the gun industry before I invested in Smith and Wesson. Sam Colt was an interesting figure. He was like Elon Musk, in that he was a really smart guy and also something of a showman. A less flattering description would be that he was scammy. This book is extremely well researched and clears up a lot of the misconceptions which are so often repeated as part of Colt's marketing that they have become accepted as truth.

He did not invent revolvers. He probably saw one on a sea voyage he made to India when he was 16 (a Collier flint lock rifle) which had multiple chambers that you advance by turning it with your hand. He thought up the advancements that made it advance one way by pulling the hammer back (like a ratchet or a bike gear that only goes one way) and came up with a few modifications to prevent "chain firing" where the spark ignites every round at once.

His life was crazy. His company failed a couple of times before he managed to get rich on the back of an order (and the marketing) from the Texas Rangers. When he needed money he used the knowledge of chemistry that he learned from making dyes at a textile mill to make laughing gas and would go from city to city as "Dr Coult" and get people high on it in auditoriums as entertainment. He came up with the idea for the revolver pistol with the innovations but they were just drawings and a guy named John Pearson, who is never credited, figured out how to turn those sketches into a working gun.

Colt was genuinely a smart guy. He worked with Morse to develop the telegraph and also had another failed company that used wires and underwater mines to blow up enemy ships. The world was smaller then and everyone knew each other so the amount of famous people you run into seems implausible in today's world. Two of his investors were brothers in law. One of them, named Whistler, had a son who painted...Whistler's Mother. In a demo of one of his pistols, it spooked a horse which was pulling John Adams carriage and killed the driver. He was so upset by this that he asked for a postponement in the closing argument he was giving. The case was about the Amistad. He didn't have a factory when a big order came in, so he partnered with Eli Whitney's son.

This book did a great job of separating fact from fiction because Colt was such a braggart and salesperson that his facts would change in retelling to fit whatever would help him sell more guns. He claimed he read about a slave uprising and imagined a pistol with many bullets to help the slave owners defend their family (the story he referred to happened a year after he came up with the gun). He claims he came up with the idea for the revolver by watching the ratchet wheel that picks up the anchor on a ship (he probably, like many people had seen the early Collier revolver rifles, or "pepperbox" pistols which had several complete barrels which rotated.)

Not something that will help your investing, but an interesting read.

-

We are on Season 3 now of The Righteous Gemstones on MAX. One of the funniest shows I've seen in a long time.

-

Recent update on the business side of the Red Sea attacks.

-

small add to NTDOY

-

8 minutes ago, Castanza said:

Wow wild story for sure! What caused them to go after Fairfax to begin with? Pretty cool to see this board or at least the members on here play a role in all of it.

btw - I'm in my early 30's

I wasn't a shareholder back then, but

short shrift - The Globe and Mail

-

-

Tiger Cub Stephen Mandel and Burry both have good sized positions in Square.

DATAROMA Superinvestor Ownership

It's trading at less than 2x sales and the restaurant checkout appears to be everywhere now, but it's down a lot from the high $200 price after the news articles came out about their Cashapp and lax anti-money laundering making it the preferred app for drug dealers, hookers and other con artists.

-

1 minute ago, ValueArb said:

I believe Burry bought BABA as well in his latest 13F.

I noticed that also. Big position for both Burry and Tepper. It's strange that Burry has bought (and sold) BABA before at these prices and not held on. So much churn in Burry's portfolio, that it's hard to decipher what the thinking is.

-

If I recall, FFH had an investment in Indian Ag (pulse crops?). I wonder if this will have an effect on that business? I did notice that FF India was down yesterday (so was everything), and I still like both companies, but would add to FF India before FFH.

Although protests are obviously bad if you own an airport and make money from tourism.

-

I'm sure everyone enjoys today because in addition to being Valentines Day, it's also when the 13Fs are due. Has anyone noticed any big adds, or new names that aren't usually on the radar?

I'll start:

Pat Dorsey, who runs a concentrated portfolio with 9 positions, just added a 9% position in Danaher this quarter.

https://www.dataroma.com/m/holdings.php?m=DA

(He trimmed Meta, Alphabet and Smartsheet)

-

Small adds to OXY, JOE and TV. I had a resting sell order for some SWBI shares at $14 and I got a fill yesterday, so I had to do something with it.

-

Trimmed a few shares of GOOG in my retirement account and bought a little OXY and TV. I placed a limit order on Fairfax India after the dip yesterday but I didn't get a fill

I was tempted to trim to HHH, but I think I'll wait for after the spinoff which should allow me to sell the part I never liked in the first place and keep the good part.

Why did so many smart investors miss making a killing on BRK stock?

in Berkshire Hathaway

Posted

I don't have a cite, and I hope I'm not misremembering. But I think it was either in the Snowball or the partnership letters where someone that he knew personally was going to sell BRK to get the money for the deposit on a house or something. And he thought that they would miss out on a lot of compounding and suggested that.

Weirdly, there's a guy in Palo Alto who would probably be worth like $200bln or something by now if he hadn't sold his 10% of Apple. Ronald Wayne - Wikipedia So missing out on early Berkshire doesn't seem so extraordinary.