-

Posts

1,444 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Posts posted by Saluki

-

-

@hasilp89 if you are curious about it, @gfp guessed it. Thanks for the input guys. Yes, the FCC licenses would be worth about twice the market cap if they were used for their original purpose, rather than the current use, for which they had to obtain FCC permission. Kind of like rezoning a property from commercial to residential. So I don't think the value to a third party is relevant because you can't use it for the original purpose unless you shut down the business, and now that you started getting contracts, it's kind of hard to undo. If I buy industrial land, pay to have it cleaned up and put up condos, I can't change my mind half way and put a refinery next to it.

They are way behind on their pace, where they thought they would have $1bln in contracts by 2023. They are about a 1/3 of the way there. But if that can happen, which is a big if, then if we make some simplifying assumptions like that you are getting 5% on that, that gets you $50mm a year coming in, with no growth and a very small office overhead. As a quick and dirty rule of thumb (I don't remember where I learned it), I think you shouldn't pay a PE more than double the growth rate. So a 10% growth rate should be no more than a 20 PE, roughly speaking, for most businesses.

I don't know what I would pay for something that COULD take in a $1bln and then not grow. I'm sure when the contracts are up, if all goes well you should be able to renew them in 20 years and it should be an inflation adjusted number that mimics the original deal. So maybe price it like a 5% bond (on whatever the revenue is) with a 20 year duration? But if they do buybacks with the money, then a 10% a year reduction in the share count would be like getting 10% growth, and if you pay 10-20x earnings on that, that would get you to between $500mm and $1bln. So in terms of enterprise value, it's on the low end of that range of reasonableness, but not a screaming buy or sell. Especially if getting to that range of reasonableness requires some events to occur which are still in the works.

Just thinking out loud here, but thanks again for the input.

-

Float is a big part of the growth story for Berkshire and Fairfax, but I'm wondering as a thought exercise how you would value it in other companies that have characteristics that resemble insurance float. For instance, if I buy an airline ticket for my vacation on July 4, I pay now but the flight doesn't happen for a few months, then after the flight happens, they pay for the fuel and salaries etc. Some companies like Walmart sell product quickly and pay suppliers slowly, so they have free use of that money to build new stores. Apple and Amazon, last time I checked have similar qualities.

Just thinking out loud here, If it's a fast grower like early Amazon, I guess you can value that float based on the rate of return on their invested capital. With insurance companies, it's based on what financial instruments they can invest it in. But with both those options, you have to give the money back.

There's a company that I've posted about before, and I won't mention the name because I'm the only person keeping the post active and I'm not trying to pump the stock, just get some input on valuing something. If they get a 20 year contract for $20 million, that income is recognized at $1 million a year. But if you get all of the money at the beginning of the contract (assume it's a patent or license or trademark) and you don't have any opportunities to reinvest in growing your business, then what is it worth? It's not really float because you don't have to pay it back. And discounting that last $1 million from 20 years to today doesn't make sense either because you don't wait twenty years to get it. You get it now, and you get to use it and never have to give it back, so from an accounting standpoint it's not income today, but from a practical standpoint it is.

If they don't have any possibility of reinvesting it in the business and you assume that it gets invested in fixed income, then would you value it like a bond? I assume you would ignore the fact that you recognize $1mm a year as income as the contract progresses, because it would be double counting? If this is the correct way to value it, then let's a wrench into it. What happens if you buyback shares? Do you value the effect of the buyback based on the value of the license/patent if you sold it off completely to a third party? Do you value the buyback based on what you paid for the patent/license, i.e. book value? Do you value it based on the stream of income vs the stock price and whether it's accretive to shareholders? Or is there some other method that would be better?

-

3 minutes ago, WFF said:

Was thinking about whether you added on CPNG given the down day. Looks like you are sizing this quite sizably. Time to read up the thread

CPNG a 2.5% position currently, and I wouldn't mind taking it to 3 or 4 at the right price. NTDOY is just under 3% and ATEX is 1% now and I'm taking it to 2%. I'm trying not to touch my biggest positions BRK (20%) GOOG (~20%) JOE (~15%) and FRFHF (10%).

I don't discuss the bigger positions as much as the smaller positions because I've already done all the research and decided to hold them for a long time, so there is nothing to discuss.

I think it boils down to what is your circle of competence and risk aversion. I like CPNG a lot, but I hate retail, so I don't know if I would ever go over a 5% initial position on it. I've held BRK and GOOG for over a decade so I wouldn't mind adding more even if they are big positions already. ATEX (telecom) and JOE (florida real estate) might be in the too hard bucket for some people, but they aren't in mine. Other favorites on here have made people a lot of money, but are in my too hard bucket and always will be. It would take years for me to learn about pharmaceuticals or biotech starting from scratch, but people can get rich on lots of things, so as my coach used to say "this isn't gymnastics, no one gives you extra points for doing things the hard way."

-

7 hours ago, Gamecock-YT said:

and I'm sure less KYC review as well

I think this is the rationale. If I recall Razzle Khan and her accomplice tried various ways to convert their stolen crypto to cash, but eventually you have to have an exchange and bank to send the cash to, and a person with an ID for the account. Although if you read "Number Go Up" you realize that KYC is not taken as seriously in some countries. If it's a gift card, it can used or sold for cash and the links to the original criminal are evanescent.

-

Sold a few very small positions that I had, which I usually buy to remind me to look deeper into a company, and made some small adds to CPNG, NTDOY and ATEX.

-

On 3/5/2024 at 5:27 PM, nsx5200 said:

IMHO, the answer is in the question. There simply not enough margin in the business to support yet another competitor and the economy of scale to achieve a decent profit is not very well known. It took Uber 37 billion in annual revenue and roughly 15 years to achieve profit... I don't know about you, even if a new company is 4x more efficient, it would take nearly 10 billion in revenue to achieve profit, and I'm not sure if 4x more efficiency can be achieved without a real breakthrough in operating style. I say there are easier fish to catch, and looking at a 37 billion 10+ year problem, unless there's a real compelling new angle to this, I would, IMHO, rather just chunk money at S&P500.

It's incredibly difficult to develop a two-sided market. If you are already using Uber/Lyft and switch from one to the other based on prices or wait times when you need it, then what would make you use a new competitor? Lower prices and wait times? If they lower prices for you they will have more customers than drivers and higher wait times. For drivers to handle the customers paying less than Uber/Lyft, you need to entice them with a bigger share of the commission. So you will be getting squeezed on both ends. And Uber/Lyft already have customers and drivers, so for a new entrant, they would need to do a lot of advertising.

They are also taking steps to make it harder for a new entrant to gain a foothold by targeting a smaller niche and building on that. Lyft has a lower price tier if you're willing to wait a few minutes. They also have larger vehicles (UberX), green vehicles, and pet taxis and have branched into food delivery and bicycle rentals. Other than ferrying medical out patients (ambulettes), I don't know where a new entrant would see enough meat on the bone to try to take a bite.

-

The 2 bull cases for BTC going up are 1) the greater fool theory, and 2) some use case for BTC that is better than what we have now.

For the greater fool theory, an ETF could help with that. I lose/forget/misplace passwords all the time. I was forced to make a new one for one of my accounts just last week. If I had a personal wallet with a lot of money in it and it would be worthless if I forgot the password, that money is as good as gone. If some fund company is doing the safekeeping of the asset, and they have people to take care of the custody aspect, and I could sue them if they lose my BTC, then this is an option that would make it more attractive to me. But it's still a pass.

People use Bitcoin, blockchain and cryptocurrency interchangeably, but they are not the same thing. For the past 15 years the true believers have told us about bitcoin will change everything someday. Here's a reality check. Pull out your smart phone right now and go your apps. After 15 years of thinking up killer use cases for bitcoin, find one app on your phone that relies on bitcoin to operate. Can't find it? So what is the killer use case?

Pay for things in a store without fees? Credit cards are free to the consumer (less than free if you include cashback etc) and they are quick. It takes a while to transfer small payments in bitcoin and the merchants don't want it. So why use it? Send money to a friend at no cost? Venmo and Paypal already do that for me. Sure, if I was sending money overseas using Western Union, there might be costs involved, but for most of what people in the developing world do, it's not needed. Anonymity? There is a record of every person who ever sent you money and everyone who you ever sent it to, so if they arrest someone who gives up the names of everyone they did business with, it's the opposite of anonymous. It's worse than cash.

-

Small adds to Anterix and Coupang.

-

I listened to the audiobook and this was really interesting. The author grew up in a very politically left household. Her mother is the author of the best selling book "Nickel and Dimed" and Rosa has childhood memories of being on labor union picket lines with her mother instead of picnics in the park. She ended up becoming a law professor at Georgetown and writes legal articles on police reform and the military, despite never having worn a uniform. So she decided to see it from the other side and volunteered to become a reserve office in Washington DC.

Many smaller cities have volunteer firefighters, but not many have volunteer police. In NYC, there are auxiliary police, who don't carry guns, and are used for crowd control during marathons or parades etc. But they are expected to radio for police if they see something, not make arrests themselves. Being an unpaid person interacting with criminals is probably not a great idea if you are a military age male in peak physical shape, but if you are a female law professor in her 30s, who is short and wouldn't be able to take a middle schooler in a fair fight, it's kind of ridiculous. DC, which is statistically a high crime city has volunteer "reserve" officers who go through the same police academy training as regular officers, and when they graduate are given a gun and a police cruiser and expected to respond to calls just like paid officers

She starts out very skeptical of police and pro-criminal but softens her stance when she sees what they have to go through and the people that they interact with. Besides the voyeuristic aspect of watching a fish out of a water, it had some interesting takes on policing that she wouldn't have if she had stayed in her ivory tower. For instance, since cities have cut budgets for drug treatment, mental health, and homeless services, whenever there is a problem involving one of these issues, the only thing they have left to respond is a police officer who has no training in that area.

There are always comments in cop shows about not wanting to arrest someone because of all the paperwork, but some of her descriptions of the bureaucracy are very eye opening.

-

I don't have a cite, and I hope I'm not misremembering. But I think it was either in the Snowball or the partnership letters where someone that he knew personally was going to sell BRK to get the money for the deposit on a house or something. And he thought that they would miss out on a lot of compounding and suggested that.

Weirdly, there's a guy in Palo Alto who would probably be worth like $200bln or something by now if he hadn't sold his 10% of Apple. Ronald Wayne - Wikipedia So missing out on early Berkshire doesn't seem so extraordinary.

-

2 hours ago, scorpioncapital said:

If they never sell it, how is it different than 'fondling Gold'? How do you derive an economic or personal lifestyle benefit from it?

Well, there is a strategy that Buffett used to recommend in the early days, to borrow against the stock. He assumed correctly that the stock would compound at a faster rate than the interest on the borrowing,

Apparently that strategy is being used again by the ultra wealthy to spend their wealth and not be taxed on the sale. You just borrow against the assets and when you die, the estate is based on the net value, including the debt, which reduces the inheritance as much as selling, but there is no tax to the decedent on sale.

-

Very interesting video on Pinduoduo by the Financial Times.

-

There doesn't seem to be a post on Investment Ideas for Ross Stores, I don't want to make one because I hate retail. But this place seems like a good place for this piece of news.

Ross Stores Reports Results for Fourth Quarter and Fiscal 2023 (yahoo.com)

The Company’s Board of Directors recently approved a new two-year $2.1 billion stock repurchase authorization for fiscal 2024 and 2025. This new program represents an 11% increase over the recently completed repurchase of $1.9 billion of common stock during 2022 and 2023 combined.

The stock is up about 50% in the past year so I don't know at what the previous buyback was finished, but even at today's prices, a $4bln buyback would be about 8% of the shares.

-

Trimmed a few shares of META. I still have a good mid size position in it, but other than sitting on my hands and doing nothing, I don't I have any advantage over the hordes of analysts looking at a trillion dollar stock, so I think I'm better off looking at things that are overlooked and unloved.

-

Small adds to BTI and ATEX. Nothing to write home about.

I've got a couple of positions that I'm on the fence about and may do nothing or sell and redeploy after earnings come out in the next couple of weeks.

-

31 minutes ago, longlake95 said:

Trying to water the flowers and pull the weeds here - letting winners run.

I've been guilty of sitting on losers too long while waiting for them to come back. I think Buffett had a great quip about the stock not knowing that you own it. I was listening to a podcast yesterday from an investor, who has a concentrated book and he had a great line about not cutting the flowers and watering the weeds, but doing the opposite. Rather than throwing good money at a bad business and hoping it will turn around he said "It's much easier to give birth than it is to resurrect the dead."

-

Small adds to ATEX. Taking it up to a 1% position.

-

Started watching Vice Principals on Max. If you like Eastbound and Down, and Righteous Gemstones, it's got a lot of the same cast and type of humor.

-

Sold out of a small position in KNOP for a small loss after earnings came out and bought some NTDOY, FF India, and sprinkled the rest around in a few small positions.

-

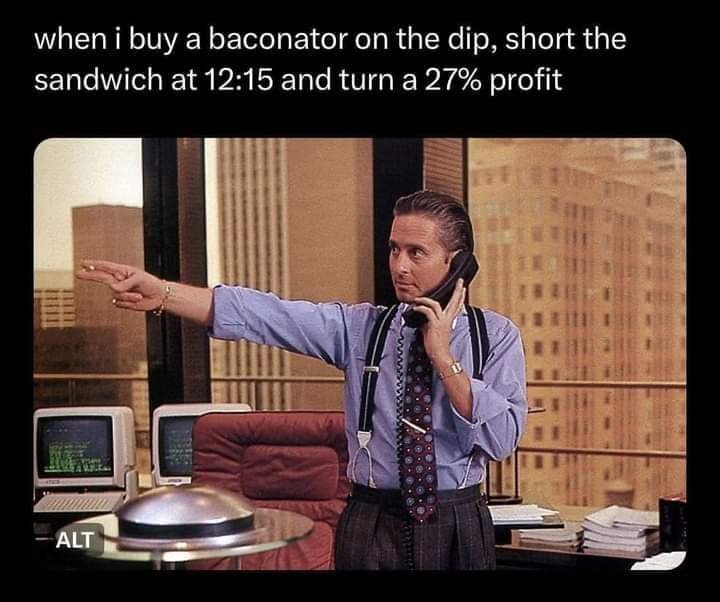

There's a lot of sharp traders on here. We gotta find a way to arbitrage this.

-

I don't know. If I went to Wendy's and the sign said a burger was $5 when I got in line and when I got to the front of the line they told me it was $8, I didn't think I would go back.

-

20 hours ago, thepupil said:

curious way to drive the stocks down...by saying he's buying in that very same interview.

I don't know man...Isn't the alternative explanation (that he actually believed what he was saying) the simplest and most consistent.

- he thought lots of people would die (lots of people died)

- he thought we should shut down for 30 days (we ended up shutting down for longer, probably a big mistake, but idk if 30 day shutdown was a mistake for society, was reasonable view to take at time w/ facts known).

- he thought the turmoil he foresaw in february 2020 was not priced into credit markets, put on a huge position in them, and made money when it got priced into credit markets.

- he thought his highs quality restaurant and hotel stocks would see it through and recover. they recovered.

- within reason, all of this was communicated in commercially reasonable real time to his limited partners for whom he tonned it.

I have zero ethical concerns with this fact pattern; everything seems quite rational and in the interest of both society and his LP's. Is he a drama queen? sure. but I still don't understand why people give him shit for this call. he was pretty much right on everything. I'm not saying he's infallible, but just don't see anything wrong with this episode.

I mean we've all got better things to do than debate what Bill ackman said 4 years ago, but for whatver reason, this is a "perception becomes a reality" thing that just seems completely inconsistent with he facts and where people extrapolate one one sound byte to draw sweeping conclusions.

March 18th 2020

He's obviously a bright guy, but sometimes his actions contradict his supposed operating manual, as with Valeant. More recently, HHH, which has been disappointing, paid $50 million for a minority interest in a celebrity chef's company. In this interview he says that he likes restaurant brands like Chipotle and Burger King because they have a system, and the system is very efficient and not prone to human error. That's the exact opposite of how a high end/ celebrity chef restaurant operates. The workers at a place like that need a LOT more training, and the menu changes constantly, which is why Chipotle with a limited menu that stays the same and where you can train a high school to make the dishes in a few hours is so good.

He says he likes companies that generate a lot of cash, since when have minor league sports teams been known for their cash generation? Even Ryan Reynolds is losing money on his soccer team.

And the anti-woke college stuff and buying into Twitter seems like he is setting himself up to run for office.

-

I'm just finishing up this book which piqued my interest due to my deep dive into the gun industry before I invested in Smith and Wesson. Sam Colt was an interesting figure. He was like Elon Musk, in that he was a really smart guy and also something of a showman. A less flattering description would be that he was scammy. This book is extremely well researched and clears up a lot of the misconceptions which are so often repeated as part of Colt's marketing that they have become accepted as truth.

He did not invent revolvers. He probably saw one on a sea voyage he made to India when he was 16 (a Collier flint lock rifle) which had multiple chambers that you advance by turning it with your hand. He thought up the advancements that made it advance one way by pulling the hammer back (like a ratchet or a bike gear that only goes one way) and came up with a few modifications to prevent "chain firing" where the spark ignites every round at once.

His life was crazy. His company failed a couple of times before he managed to get rich on the back of an order (and the marketing) from the Texas Rangers. When he needed money he used the knowledge of chemistry that he learned from making dyes at a textile mill to make laughing gas and would go from city to city as "Dr Coult" and get people high on it in auditoriums as entertainment. He came up with the idea for the revolver pistol with the innovations but they were just drawings and a guy named John Pearson, who is never credited, figured out how to turn those sketches into a working gun.

Colt was genuinely a smart guy. He worked with Morse to develop the telegraph and also had another failed company that used wires and underwater mines to blow up enemy ships. The world was smaller then and everyone knew each other so the amount of famous people you run into seems implausible in today's world. Two of his investors were brothers in law. One of them, named Whistler, had a son who painted...Whistler's Mother. In a demo of one of his pistols, it spooked a horse which was pulling John Adams carriage and killed the driver. He was so upset by this that he asked for a postponement in the closing argument he was giving. The case was about the Amistad. He didn't have a factory when a big order came in, so he partnered with Eli Whitney's son.

This book did a great job of separating fact from fiction because Colt was such a braggart and salesperson that his facts would change in retelling to fit whatever would help him sell more guns. He claimed he read about a slave uprising and imagined a pistol with many bullets to help the slave owners defend their family (the story he referred to happened a year after he came up with the gun). He claims he came up with the idea for the revolver by watching the ratchet wheel that picks up the anchor on a ship (he probably, like many people had seen the early Collier revolver rifles, or "pepperbox" pistols which had several complete barrels which rotated.)

Not something that will help your investing, but an interesting read.

-

We are on Season 3 now of The Righteous Gemstones on MAX. One of the funniest shows I've seen in a long time.

what are you selling today?

in General Discussion

Posted

Trimming a little Scorpio Tankers. I added 10% to my position about a year ago between $40 -$44 when it looked like a good setup. (I mentioned it on the STNG post at the time).

I'll keep the earlier/cheaper shares but trimming this back to my original position.