-

Posts

12,967 -

Joined

-

Last visited

-

Days Won

42

Content Type

Profiles

Forums

Events

Everything posted by Parsad

-

Alot of people left because of the political climate on the message board. But I thought it was important to have open discussions about what was transpiring...from both sides...because that was the reality of the world around us. As uncouth as politics may be, our understanding of the world around us cannot exclude politics simply because we don't like listening to others speak their truths. But there is a time and place for it, and it was meant to revolve solely around the Politics board, so that investors weren't inundated with political posts. But the deal was that politics would go at some point...so if you can't abide by the rules, the rules will come to you. Cheers!

-

Greg's not coming back until he learns to resist his urges. Sure, his posts at times are good, but if his instinctive behavior is to stir trouble from time to time, and throw mud, that's not going to happen. And that doesn't apply just to Greg, but to others as well...I don't care which side of the political fence you are on. Learn to use Buffett's adage...if its borderline, don't do it...simple! Cheers!

-

I'm fine with that...as long as BB and Fairfax were able to capitalize on it too! Cheers!

-

If their market shorts and deflation swaps hit, and another $1.5B from BB sales...yeah, they could put more into equities in a market drop. In the last month, I had to sell all of my ODP as Staples made a bid at $42, most of my M today at $21 and we've harvested some profits in BAC when it hit $33. We're building up cash slowly whether we like it or not! I hope Fairfax is doing the same, because just look at GME and AMC today...this shit is going to blow up real good one day! Cheers!

-

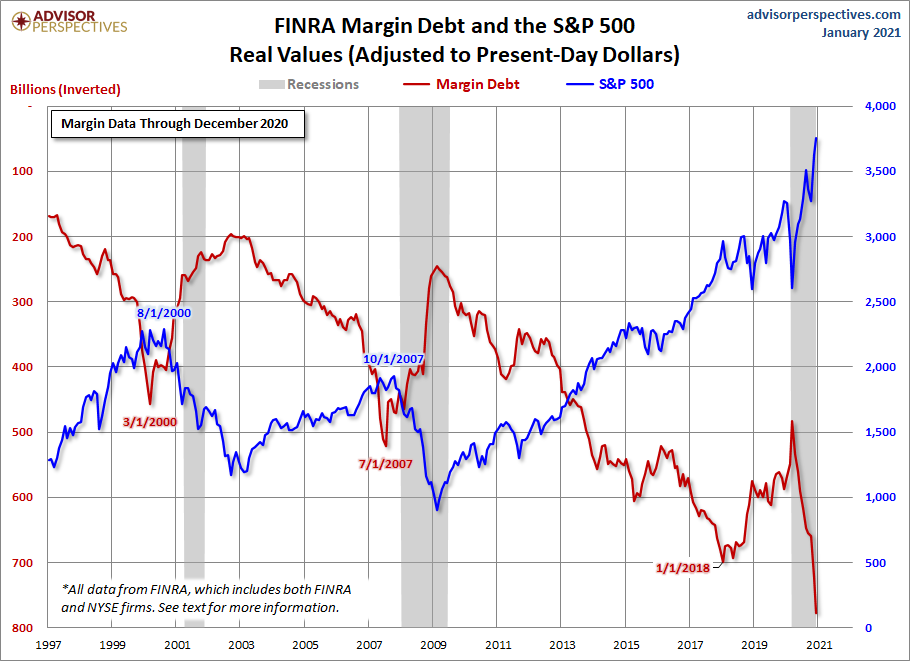

Yes, I'm expecting a broad market correction over the next year...probably towards the end of the year as the stimulus ends. Undervalued stocks will fall less, but there are fewer and fewer undervalued stocks at the moment...almost all of my undervalued stocks are now at getting close to fair value other than ATCO, WFC and FFH. I think Fairfax will be back up to book value by the AGM as the market recognizes the huge gains in Q1 and the hard market in insurance. You are seeing a massive rotation of capital into post-vaccine stocks, while you are seeing hyper movements in heavily shorted stocks. I've never seen anything like this in my 25 years of investing...and surprisingly, that 25 years included the tech bubble, 9/11, the housing and financial crisis, Trump and a pandemic! The closest that I could compare it to is 1999, but the capital flow and cycles are even more compressed...probably due to information moving faster and faster...not necessarily accurate information, just information and opinion. I see such massive bubbles in the market, debt, housing sectors, but significant denial from investors because interest rates are so low and they feel it is justified. We've seen asset bubbles pop in deflationary environments or inflationary environments. What is the likelihood that one or the other will happen...pretty good! I've avoided macro investing since 2007 and just allocated capital to where assets were cheap, but I cannot find any cheap assets any more...other than a handful of stocks. So macro becomes important again! And if the shit hits the fan again, I cannot see escaping it this time without huge, huge consequences. Governments are tapped out and investors while holding some cash, are exposed significantly to the markets and housing. We are entering the bubble of all bubbles! And at some point in time, the bubble will pop and those YOLO guys are going to start jumping off their margin balances to the ground below...see attached chart! Cheers!

-

Cubs, Greg is gone now. You're next if you don't stop the political posts. Zero tolerance going forward for board members, so everyone else, pay attention! Cheers! I would argue to simply remove or archive the whole Coronavirus thread. Nobody on here is a virologist (that I’m aware of). There are a handful of doctors. Beyond that it’s mostly just political commentary regarding lockdowns, govt decisions, etc. If all that’s desired is some type of fact sheet for Covid-19; then people should go to their respective government website (CDC.gov). Zero tolerance is open to much subjectivity in my opinion. The above exchange amount between four users is completely political. However, Greg at least provides solid content on a lot of different threads. I would argue there needs to be some gray areas. Are we allowed to discuss policies regarding taxes if it’s based around investments? KMI and the O&G stocks will certainly have policy come into play, but what’s the acceptable level of discussion? The whole Fannie thread hinges on politics while walking that fine line. Can we discuss Fed decisions? I’m not sure if it’s possible for this website, but a tool which allows users to flag a post as political would be useful. And perhaps if say 5+ users flag it as political it’s removed automatically with automation. This would help filter out noise and keep conversations of value on track. Hi Castanza, If the thread's discussion diverts into some public policy, that is fine. But if it reverts to essentially child-like name-calling, offensive remarks, you shit on me so I shit on you, type of discussions...yeah, you're gone. I had the Politics board on at the time, because I felt that there was a need to understand what was going on and for people to vent somewhere other than on threads. Contrary to popular opinion, I felt it was a necessary evil at the time...the world was in a weird place. You can have your opinion on Trump, but the undisputable fact was he was a very divisive President whose actions could have been positive, but ended up being dramatically negative. Now that he is gone, and there seems to be some semblance of law and order again, I think the experiment is over and so is COBF's involvement. It's time for a fresh start, after a nice clean shower to wash the filth off of ourselves, and focus on investing. And shortly we will get a new website, where if you want to set up a ZOOM town hall meeting for those that do want to talk politics on occasion, you can, but it will not be on the investment message board portion. Cheers!

-

Imagine... unloading BB and buying BRK at today's prices. So simple yet so unlikely. You guys make fun, but the fact remains that since 2016, BRK is up 75% to date, while BB is up 140% to date over the same period. Whether it's market exuberance, Robinhood accounts, investors recognizing that BB is not the same BB, or capital flowing to cheaper stocks from overpriced stocks...BB has done better than BRK. My point is that Prem spent 12 years as a portfolio manager then another 30 years running an insurance holding company/investment company...you really think he can't do better than BRK going forward with the universe available to him and the universe available to Berkshire? If so, why the heck are you posting on here...trolling Watsa?! Cheers! The fact also remains that since 2016 Fairfax is down more than 25% to date. I don't think it is a good time to point to stock prices as vindication of Prem and Fairfax. Prem hasn't been able to add value with shorts. He and the company have seemingly have acknowledged as much. If they can't add value with it, they should stop doing it. I'm not sure whether or not Prem/Fairfax can do better than investing in BRK. BRK isn't a bad stock at all in my estimation. BB was a big loser a month ago. The sun has now shined upon shareholders of the company and turned it around. I hope Fairfax is able to take advantage. I wouldn't, however, want to point to the BB position as evidence of the company's stock investing acumen. But ask yourself, is there a justifiable reason why Fairfax is trading where it is, or is it simply Mr. Market discounting Fairfax with no real reason? For all intents and purposes, FFH should be trading at book value, and that has nothing to do with anything Fairfax or Prem have done. It's just the market is discounting them, just like the market is inflating BB, GME or TSLA. The voting machine is in hyperdrive at the moment. I see another 50% market correction coming...the fourth major correction in just over 20 years! Cheers!

-

Not necessarily. They could issue shares and build up a war chest as others have mentioned. They could use the inflated price and acquire other operating businesses that have cash or generate a ton of free cash. They could buy put options on BB. As long as they use this inflated price and monetize in some manner that is beneficial to Fairfax and BB, it's a win. But they have to work quickly! Cheers!

-

Imagine... unloading BB and buying BRK at today's prices. So simple yet so unlikely. You guys make fun, but the fact remains that since 2016, BRK is up 75% to date, while BB is up 140% to date over the same period. Whether it's market exuberance, Robinhood accounts, investors recognizing that BB is not the same BB, or capital flowing to cheaper stocks from overpriced stocks...BB has done better than BRK. My point is that Prem spent 12 years as a portfolio manager then another 30 years running an insurance holding company/investment company...you really think he can't do better than BRK going forward with the universe available to him and the universe available to Berkshire? If so, why the heck are you posting on here...trolling Watsa?! Cheers!

-

Cubs, Greg is gone now. You're next if you don't stop the political posts. Zero tolerance going forward for board members, so everyone else, pay attention! Cheers!

-

Yeah, it's coming. I delayed it for our 19th Anniversary next month. I thought that would be more appropriate and a fresh start with Politics gone after the inauguration. New year, new start for everyone, and hopefully a much better year than 2020...in terms of Covid...not the rise in the stock market! :D Cheers!

-

It was $12.30 back in 2019...I would imagine it's well below that now. Cheers! https://finance.yahoo.com/news/fairfax-financial-holdings-thinks-blackberry-121239544.html

-

The big boys got the cash; but even the big boys wont waste capital on something that is not something, which what Blackberry was few years ago. Big Techs are not in the business of private equity, where they would buy company and surgically remove what they really like and sell off the pieces. They need to have jewel already polished and in a presentable form, and then ,,, they will pay top dollar and open their checkbooks. That is what John is doing. FFH started as a value investor in BB, but as the initial bet went off, it confused itself/role with that of a passive private equity. If you were to read Watsa' comment about BB back in 2013 in his letter, you will see how irrelevant those comments are today vis a vis what BB looks like today and where it is going. If you were to read Buffet's comment on Apple in late 2016 when he started to swing his bat at Apple in slow motion, you will see his comments are valid 4 years later and in fact have aged well. So definitely the initial thesis was off for BB and Watsa was wrong as he has freely admitted. But that "wrong" is now sunked, and now that you are in the cusp of really getting traction on that investment on the business front, and i am not talking about the short-term non-sticky YOLO, it is not time to exit BB in the way they exited Overstock. Or for that matter when they sold Johnson & Johnson and other holdings higher on the quality ladder. They seem to leave a lot of money on the table. Sure, they can use derivative intelligently as previous posts to lock in some gains. For BB only, I (the short complainer) authorize the intelligent use of shorts to offset a partial downdraft from here. As for position sizing, although myself, I complain about position sizing when it comes to FFH and its market timing (i.e. Stelco), I also admit what i like about FFH is the concentration in its common equity bets. BTW i believe we are still far from the breakeven price for FFH on the commons. I believe it is $17 USD. +1 Generally agree that selling to a party that has some synergies is the best exit strategy at the best price. I certainly hope FFH is able to do so, but if they're not currently entertaining those discussions, it could be worthwhile to consider the current rally as an encouraging environment in which to trim the position in - subject to regulatory approvals and etc. There has been multiple discussions on FFH's average price on BB. I believe all of those discussions end up with a breakeven cost of ~$10 for Fairfax's common equity. This is largely the result of doubling/tripling the position back in 2011/2012 time frame when BB was ~$6-7/share. I believe there is an interview with Prem floating around somewhere from around that time that also confirmed the $10/share breakeven. I believe that's correct. Also with the convertibles at $6, the average cost would come down even more. Regarding BB's crazy run. I bought Overstock.com at $2.99 back in March, and I also bought a ton of LEAPs. I sold out between $20-30, because I thought that was where fair value was. But the sucker went all the way up to $110+, which would have been a 80 bagger for me on the LEAPs and 40 bagger on the equity. Even back down to $60+, it's 2-3X what I sold at. So stupidity knows no bounds. BB could go to $40-50. I would hope that Fairfax as value investors would take their original capital off the table before that peak, but sometimes holding on is the right way to go after you've taken some money off...look at Tesla shareholders! Cheers!

-

Generally its the former...the LP would be left with $1.8M. If the GP reinvests their fees, then there would be X number of units issued to the GP at the month-end unit price of Y. All of the units would be priced at Y at month-end. In this case, the LP would have $2M in it, but a higher number of total units. If new capital now comes in, it would be brought in at the price of Y. The fund would now have to achieve above the monthly hurdle on the total number of units before new capital came in, but after the GP reinvestment was made...so the watermark is actually $2M. If no reinvestment by the GP, but new capital comes in, then the high watermark would be $1.8M. Cheers!

-

Who do you think is going to make more money over the next 5 years? Someone buying Berkshire today or Fairfax today? When Fairfax hit four times book in 1998...if someone didn't sell, that's their foolishness. Just like investors not taking advantage of discounts over the long-term. If you are a value investor, you never fall in love with any stock...no matter who the manager is. At some point, you sell and move to other discounted investments. Cheers! Someone buying Markel. ;D Possibly. I think it needs to get a bit cheaper...like back in March/April. It's small enough to compound faster than Berkshire. Otherwise at current valuations, I still give Fairfax the edge. Cheers!

-

Who do you think is going to make more money over the next 5 years? Someone buying Berkshire today or Fairfax today? When Fairfax hit four times book in 1998...if someone didn't sell, that's their foolishness. Just like investors not taking advantage of discounts over the long-term. If you are a value investor, you never fall in love with any stock...no matter who the manager is. At some point, you sell and move to other discounted investments. Cheers!

-

Quarterbacking is the easiest thing in the world to do, until you actually are the quarterback. Then you hear all of the bullshit from the Sunday morning couch quarterbacks about what you should be doing. Cheers! Yea...that would be true if there wasn't tons of people doing live play by play during much of the timeframe in question. Except there has been. Look at the difference between this and Berkshire. People start salivating every time there's speculation Buffett might be buying something new. People hold the breathe every time Prem does the same and are basically just praying for breakeven with half of the portfolio. Thats a big reason for the discount in the market. That discount has created wonderful buying opportunities for both short-term and long-term FFH shareholders. When was the last time someone could buy Berkshire or even Markel at similar discounts...2008/2009? Your deference to Fairfax's supposed ineptitude actually helps investors in Fairfax, because those big cyclical swings drop the price to below intrinsic value relatively regularly, and then it generally rebounds to higher historical prices. That's value investing! Cheers!

-

Quarterbacking is the easiest thing in the world to do, until you actually are the quarterback. Then you hear all of the bullshit from the Sunday morning couch quarterbacks about what you should be doing. Cheers!

-

We don't know if the stock is moving on momentum, or perhaps there is something in the works. Let's leave it up to the investment team to decide what to do. Because if something is happening, they would have a better idea of the upside. Either way, things look a lot better now than they did six months ago. Cheers!

-

Shareholders will benefit this time because we get to keep the cash (reserves are in excellent shape with redundancy in their book again last quarter) to buy back stock as they did in 1990. Their best investment at these stock levels is to participate in the hard market, monetize non core assets and buy back their own stock..that’s it. Couldn't agree more! The fact that virtually all asset classes are fully valued, they will probably get the opportunity to also exploit the bond and equities market over the next 12-24 months. But they don't need to do that to hit their targets...it would just be icing on the cake, just like the return of market price to book value. Cheers!

-

It looks like he bought at an average cost of $308 USD roughly or about $420-425 CDN per share. It says he bought in the last few days before the press release...I would imagine it was around the 9th, 10th, 11th and 12th, where the stock was around $425 CDN or less and volumes rose. If he is buying there, then I would imagine he is expecting a return of better than 15% annualized or more over the next few years. Cheers! The question then becomes is Prem expecting a 15% return a good predictor of future 15% returns. ...and one to ask: ''is 15% a realistic expectation?''. I am approaching a decade of holding FFH and I am seriously wondering if this is a realistic target as recent shareholders (10 years or less) are yet to benefit from such appreciation. It sure attracts new ( and naive) investors. I am tired of hearing the 30 years track record and while I focus on the last 10 years, I can only come to the realization that shareholders fell short of expectations. yeah , yeah ... I am still around and will for quite some time, but I needed to vent and share ;) Even during the depths of the hedge fund crisis, when Fairfax stock fell to $53 USD, I don't remember Prem buying shares in such a significant amount. Frankly, I'm shocked that he put $150M of outside capital into Fairfax...that would be a decades worth of dividends for him. And if he didn't borrow the money, I would imagine that's probably half his net worth outside of what is held in Sixty-Two Corporation. Then again, I've got half my net worth outside of Corner Market Capital in Fairfax and Atlas Corp right now, so maybe I shouldn't be surprised...and I'm very comfortable with both and think both have 50-100% upside over the next 2-3 years! Cheers! What is the thesis on ATCO? David Sokol I think that was the original thesis, but Bing Chen is an extraordinary manager himself too. Very impressed by what he's been able to do, how he leads and his investment/finance acumen. Sokol picked a winning CEO! Cheers!

-

My daughter's first music single...'Confined'

Parsad replied to jobyts's topic in General Discussion

Congratulations! Lovely, lovely voice! Keep encouraging her and good luck. Cheers! -

It should also be noted that this hard market is a global phenomenon. Not simply regional like during after a Gulf Coast hurricane or Italian earthquake. You combine catastrophe losses, with underpriced premiums in many regions where global warming is taking hold, and a global pandemic...zero interest rates, overinflated stocks, fully priced bonds...you get arguably the greatest hard market in recent memory! You bet it will. For a good 2-3 years or so until you start to get private equity, hedge fund, institutional capital coming in down the road. Cheers!

-

The rotation began back in November...alot of value stocks have been rising since then. Our portfolio shot up some 45-50% in the 4th Q and 1st Q 2021 so far. Where you have you guys been? Ironically, it began just as we started to get some large redemptions in September/October...typical! Cheers!

-

Happy New Year all! Best in 2021! Cheers!