-

Posts

331 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by VersaillesinNY

-

-

RIP Charlie. You will be missed.

-

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

-

Brooklyn Investor post on Buffett/Berkshire

VersaillesinNY replied to Liberty's topic in Berkshire Hathaway

https://brklyninvestor.com/2023/10/20/interest-rates-some-books-etc/ -

Byron Trott & BDT Capital Partners

VersaillesinNY replied to DooDiligence's topic in General Discussion

Byron Trott, chairman and CEO, BDT Capital Partners - May 28, 2020 -

Buffett/Berkshire - general news

VersaillesinNY replied to fareastwarriors's topic in Berkshire Hathaway

Todd Combs - Investing, the Last Liberal Art, Oct 9th, 2023 https://www.joincolossus.com/episodes/14034172/combs-todd-combs-investing-the-last-liberal-art?tab=transcript -

Brooklyn Investor post on Buffett/Berkshire

VersaillesinNY replied to Liberty's topic in Berkshire Hathaway

He is back: http://brklyninvestor.com/ -

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

https://www.bloomberg.com/news/videos/2023-06-07/druckenmiller-on-how-ai-is-dominating-his-long-portfolio?sref=iO3LZPgY -

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

-

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

Stanley's interview starts at 2 hours and 6 min: Transcript: https://tidalwave.substack.com/p/transcript-druckenmiller-april-2023 -

You are confusing Sequoia Fund (Ruane Cunniff) with Sequoia Capital (Venture Capital), the second did mark down its FTX investment to $0.

-

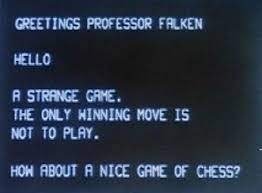

Joshua : Greetings, Professor Falken. Stephen Falken : Hello Joshua Joshua : A strange game. The only winning move is not to play. How about a nice game of chess? WarGames, 1983

-

Semper-Vic-Partners-L.P.-Letter-to-Investors-April-2020.pdfLetter-to-Investor-LP-2021Q4.pdfthomas-russo-value-investing-conference-march-15-2018.pdfSemper-Vic-Partners-LP-Letter-to-Investor-August-2021.pdf

-

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

CNBC Transcript: Duquesne Family Office Chairman & CEO Stanley Druckenmiller Speaks with CNBC’s Joe Kernen Live During the CNBC Delivering Alpha Conference https://www.cnbc.com/2022/09/28/cnbc-transcript-duquesne-family-office-chairman-ceo-stanley-druckenmiller-speaks-with-cnbcs-joe-kernen-live-during-the-cnbc-delivering-alpha-conference-today.html -

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

-

RIP Mr Lou Simpson. Some insight on Lou Simpson and how he works From Concentrated Investing: Strategies of the World's Greatest Concentrated Value Investors: Buffett has described Simpson as having “the rare combination of temperamental and intellectual characteristics that produce outstanding long-term investment performance.” In particular, Buffett admired Simpson’s ability to invest in stocks with below-average risk, and yet generate returns that were the best in the insurance industry, a hallmark of Buffett’s. Simpson’s investing for GEICO often paralleled Buffett’s efforts at Berkshire. And students of Buffett’s style will recognize his influence in Simpson’s process: seek undervalued businesses with proven track records, strong management, a high likelihood of continued steady growth, pricing power, financial strength, and a history of rewarding shareholders. “He has this great ability to understand what’s going to be a good business,” said Glenn Greenberg, a longtime friend who is now managing partner at Brave Warrior Capital Management. (Simpson considers Glenn an excellent investor and they have ended up owning the same stocks numerous times over the past 30 years.) “And it’s concentrated because there aren’t that many really good businesses.” Simpson has an unassuming manner and puts people at ease. He has a wide circle of acquaintances, which assists in gaining insights into companies and industries he is researching. He is also a master of understatement, so much so that in conversation the import of his observations aren’t understood until long after the discussion is over. Like the man, Simpson’s office is unassuming. It is situated in a low-key, nondescript office building in Naples, Florida, an 8- to 10-minute drive from his home. A passerby would have no clue about the business being transacted in it. It is also unusually quiet. He says that he has always tried to block out as much noise as possible. There are no interruptions; no ringing phones, no Bloomberg in the office—Simpson keeps it in the entranceway, separate from the office, so that he has to stand up from his desk to look something up if he needs it. “If I have the Bloomberg on, I find I am looking at what the market is doing,” he said. “I really like to be the one who is parsing the information, rather than having a lot of irrelevant information thrown at me.” His desk, like the rest of his office, kitchen, and meeting rooms, is clutter free. His work life is similarly low key. He is disciplined about exercising before work, and arrives at his office long before market hours. Simpson reads everything he can find about companies that have caught his eye. He doesn’t search for investments in analyst reports, or by speaking to sell-side researchers. lou-simpson-1987-profile.pdf A Maestro of Investments in the Style of Buffett - The New York Times.pdf

-

Another Name From The Past Gets His Comeuppance!

VersaillesinNY replied to Parsad's topic in General Discussion

https://www.manhattanda.org/d-a-vance-michael-steinhardt-surrenders-180-stolen-antiquities-valued-at-70-million/ -

Another Name From The Past Gets His Comeuppance!

VersaillesinNY replied to Parsad's topic in General Discussion

Steinhardt might have illegally purchased some cursed antique objects or did he publicly bashed Warren Buffett in 2011, maybe both. "You can fool people some of the time, but you can't fool them all of the time." — Aesop -

Buffett/Berkshire - general news

VersaillesinNY replied to fareastwarriors's topic in Berkshire Hathaway

This link works: https://www.bbc.co.uk/programmes/p0b4hdtb Skip first 2 min Steven Pinker, Tim Harford, Charlie Munger -

Buffett/Berkshire - general news

VersaillesinNY replied to fareastwarriors's topic in Berkshire Hathaway

Enjoy! https://www.youtube.com/channel/UCvvR2wp795uqsmh6F-Rq6TA/videos -

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

Stanley Druckenmiller: “The greatest investors make large concentrated bets where they have a lot of conviction” https://thehustle.co/stanley-druckenmiller-q-and-a-trung-phanin -

Stanley Druckenmiller interview (2018)

VersaillesinNY replied to Liberty's topic in General Discussion

2021 Student Investment Fund Annual Meeting Keynote by Stanley Druckenmiller