oscarazocar

Member-

Posts

155 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by oscarazocar

-

Returns on fiber/broadband investments hugely depend on competition or lack thereof. As others have mentioned, if you are in an area with 3 or more providers, returns will be terrible. If you are the only option or there is one other mediocre compeitor, returns can be very good. Allo focuses mainly on small towns where they think they can have a high market share. Click below and you and see the places they are. It's mostly small towns in Nebraska like Kearny, Crete, and Gering. This is not competition central. They went into Lincoln because Spectrum (Charter) had a terrible local reputation and, as mentioned, I believe they got a good deal with the city who wanted competition in the broadband market. https://www.allocommunications.com/communities-that-want-allo/

-

NNI has disclosed Allo metrics over time and the penetration has been reasonably impressive. In 2017 they had 71k passings and 20k households served for 29% penetration, then ramped up and by 2020 had 150k passings and 59k households served for 40% penetration. I spoke with them several years ago and they indicated they would hit their financial targets with 50% penetration and in the 2022 letter they indicated results are ahead of initial underwriting expectations. My guess is that their Lincoln deal was probably a pretty good one given their long-time presence and deep connections there.

-

NNI is not really allocating much capital towards fiber. They invested $450 million in capex and net losses in Allo (their fiber business) through 2020, then in late 2020 sold a majority stake in the business to a private equity firm (SDC) for $260 million and retained $130+ million in preferred stock and 45% equity interest (at the time valued at $129 million), so they took out most of their invested capital. They have contributed minor amounts since, including $8 million in 2023 Q1, but Allo raised debt to fund its growth going ahead and I think there will likely be minimal future capital conributions.

-

My understanding of the actual mechanics is crude, but I believe that the quoted VIX index is based off an expectation of forward 30 day market volatility derived from option prices, so it's not definitionally impossible for it to differ from market prices if you had odd and systematic behavior in the options market. Practically, I think this only happens in single companies or other, more narrow indexes. If someone was systematically selling options or CDS in huge amounts, you might see a volatility number that is artifically low (and which in turn, might present a great buying opportunity). I recall that Berkshire CDS has seen some beavior like this at times in the past. In terms of the CBOE VIX, I think the market is too big to see an impact.

-

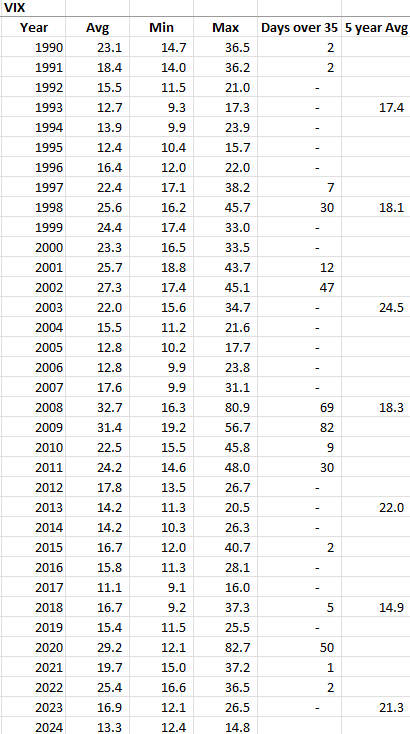

That's just looking at the history on a spreadsheet, not terribly complicated and available to anyone with Excel and Yahoo Finance. I have no idea if someone is manipulating VIX. I am skeptical, it sounds like one of those stories that people like to tell themselves. If you look at the numbers, nothing is terribly out of line from history. I first started looking at this a few years ago after reading something about how low VIX was and how it was being supressed, and it turned out the 5 year avg was actually a tick above the long-term average. Weird behavior in what are essentially volatility indexes is often a sign that a big player is doing something dumb and suppressing the market. More or less, Nick Leeson blew up Barings in 1995 and you had the London Whale losses at JPM in 2012 from players making big dumb bets, and in both cases smart operators caught wind and bet against it. In terms of the VIX market itself, my guess is that it's too big for that kind of manipulation, but probably does move over time based on systematic behavior by market players. In terms of how I look at it, it's an effective and crude rule of thub. When VIX is over 35, it's not a surprise why, people are freaking out about something and markets are tanking. I picked 35 because it matches up almost perrfectly with my bottoms-up view of good buying opportunities over the last 20 years. GFC in 2008/2009, Europe panic in August 2011, briefly in late 2015, Christmas Eve 2018, Covid in spring 2020, Russian invasion in spring 2022. In that period, I have never seen markets tank without VIX reacting in the way you would expect.

-

VIX hasn't closed below 12 since November 2019. It hit 26 in March 2023 and 21 in October 2023. For 2023, VIX averaged 17. It was over 35 for 1 day in 2021 (Jan 27) and 2 days in 2022 (March 7/8). Fortunately, if you are a non-institutional investor, you can usually buy a full position in a day of most liquid stocks. Anyway, setting a rule like this is one way to take the pressure off - it's an external signal that tells you, "Don't worry about buying anything today, better opportunities will likely come along". Sure, you can end up waiting 5 years like 1992-1996 or 3 years like 2012-2014, and of course there are sometimes great opportunities in parts of the market when VIX is low, but as simple rules, I've found it hard to beat.

-

An approach that I have seen that seems to work pretty well for portfolios like this is to build up a group of larger positions in high quality companies over time (say 5-10% positions for 80-90% of portfolio) and then have 10-20 1% positions in other stuff. I heard Bill Miller mention this approach years ago, as he had the same problem of getting bored. The smaller stuff keeps you occupied and active and perhaps makes it easier to wait until a fat pitch comes along. Another rule would be not to take a bigger position unless the VIX is at some predetermined level, say above 30 or 35. It is remarkable when you look back how closely VIX above 30 correlates with stocks being cheap. You can see the daily price history of VIX on Yahoo Finance going back for decades. Pretty much anytime something like BRK was really cheap, the VIX was at those levels, with two notable great opportunities in BRK being in August 2011 and May 2020.

-

The Missing Billionaires - James White and Victor Haghani

oscarazocar replied to james22's topic in Books

Haghani was one of the founders of Long Term Capital Management (LTCM) and one of the key players there. He is featured in Roger Lowenstein's excellent book. https://www.amazon.com/When-Genius-Failed-Long-Term-Management/dp/0375758259 -

According to the 1986 prospectus, Gates owned 44.8% of MSFT after the offering. Paul Allen owned 24.9% and Ballmer owned 6.9%. Ballmer has sold a few chunks over time but has retained over 2/3rd of that original stake as per last report of his holdings in MSFT proxy in 2014. https://www.begintoinvest.com/wp-content/uploads/2018/03/Microsoft_prospectus.pdf

-

Oddball newsletter came out in Jan/Mar/Jun/Aug/Nov of 2023, 5 issues.

-

Olson's publicly filed/known holdings are $88 million in Berkshire Hathaway stock.

-

If there is a Good Place, then Dr. Donald Pinkel has the penthouse suite. He passed away about two years ago. Dr. Pinkel more or less single-handedly revolutionized treatment for pediatric Acute Lymphoblastic Leukemia (ALL), pushing against many who told him it was pointless and that attempting to cure it would only give false hope to families. At the time he started, the survival rate for pediatric ALL was 0% and it is now 95%+. It wasn't some magic bullet, just assiduous tinkering over many years. I believe that Teddy Munger died of ALL. Here is an excellent obituary from 2022. https://www.nytimes.com/2022/03/12/health/donald-pinkel-dead.html

-

What happened to that other long thread on Pabrai cataloging his various shenanigans over the years? Was it taken down for some reason?

-

He posted on Silicon Investor extensively back in 2000. https://www.valuewalk.com/michael-burry-silicon-investor/

-

Buffett/Berkshire - general news

oscarazocar replied to fareastwarriors's topic in Berkshire Hathaway

Warner Brothers and Discovery merged in a Reverse Morris Trust transaction in April 2022 and there is basically a two year period until they can do another tax-free merger. As I recall, a Reverse Morris Trust transaction is one in which a public company spins off a division and merges it with another company, with the spun-off piece owning greater than 50% of the new entity. Liberty has used these type of transaction a few times over the years. https://www.hollywoodreporter.com/business/business-news/discovery-warnermedia-merger-favorable-tax-ruling-irs-1235068056/ -

-

Buffett/Berkshire - general news

oscarazocar replied to fareastwarriors's topic in Berkshire Hathaway

It would be very hard to dispose of those equity stakes with paying taxes, which is a big part of the reason they aren't sold. Berkshire was able to dispose of its Washington Post and Proctor & Gamble stakes through cash-rich splitoffs a little while back, but those are tricky to do and the stars have to line up. -

There is a good book form 2005 called The End of the Line on AT&T's big move into cable with the purchase of TCI and MediaOne in 1998. There is lots on John Malone in it. https://www.amazon.com/End-Line-Leslie-Cauley/dp/1439123098

-

NNI is pretty impressive and walks the walk. Management owns a lot of stock and has a long track record. The education technology business (Nelnet Business Services) is outstanding and worth a lot. It takes a little bit of effort to sort through the various pieces but it's worth the effort. https://www.nelnetinvestors.com/home/default.aspx

-

Notes from a review of the most recent annual report and proxy: When O'Shaugnessy was hired as CEO in 2014, Don Graham made a big show in the annual report about the stock option package being tied to a 5% annual hurdle. The grant was for 77,258 options (1% of the company) with 10 year duration and the CABO spin-adjusted price of those options that expire 11/3/24 is $719.15. On 9/10/20, O'Shaughnessy was awarded a brand new 10 year stock option package for the same number of options (77,258 - now over 1.6% of company due to share repurchases) with expiration 9/10/26. This time there is no hurdle and the strike price is $426.86. There has been no mention by Graham or O'Shaughnessy of this apparent change in philosophy and literal lowering of the hurdle that I have seen. Alas, O'Shaugnessey did not make a fortune on his last grant, as Graham had hoped, because GHC stock returns have been terrible. In summary, O'Shaughnessy was way underwater on his old options so they gave him a heapload of new ones at a far lower strike, many years later, without commenting on it. It's poor governance. GHC 2014 annual report commentary by Don Graham: https://www.ghco.com/static-files/8179d51c-f45e-42e2-885a-b0031e9aa73c "A key part of Tim’s compensation is a unique stock option. He joined the Company on November 3, 2014. The stock closed at $787. Tim’s option is at $1,111—the closing price the day he joined plus 3.5% a year for ten years. Adding our dividend (then roughly 1.3%), Tim won’t get any reward unless shareholders first gain about 5% per year over the life of his option. This is quite different from more common stock options, typically granted at the market price of the company on the day of the grant. As Warren has pointed out for years: companies retain some of their earnings, and by earning a normal—or even a slightly subnormal—amount on their capital employed (including retained earnings), executives can earn quite a bit over ten years even if shareholders get no reward at all. Tim will have an option on nearly 1% of our stock, but won’t begin getting rewarded for it until shareholders do. You and I should hope he makes a fortune."

-

I enjoy The Real Deal on real estate, published monthly in print. It has pretty broad coverage of the national real estate market and there are usually pretty good longer articles on various topics. I look forward to getting it. https://therealdeal.com/

-

Leaf was probably a terrible acquisition. It was public and they acquired it in June 2021. If you look at any competitors (say RedBubble), their stocks have tanked since then as a lot of the 2020/2021 e-commerce boom looks like it was more one-time due to Covid. Clyde's Restaurant Group - oof - no real discussion of that by them. Code3 was co-founded by Laura Graham O-Shaughnessey, the CEO's wife and Don Graham's daughter. Have you ever tried telling your wife it's time to shut down her money-losing company? Again, I don't think he's totally clueless. The manufacturing & healthcare acquisitions look okay, and auto dealerships seem reasonable. Don Graham would speak at the UBS conference in December when he was CEO, he no longer participates in that kind of investor stuff. There is an argument that Don Graham's CEO record was pretty mediocre as well. I believe that WPO/GHC underperformed the S&P during his tenure. He rode the newspaper into the ground. The big area of capital allocation for them, acquiring education companies, which absorbed a few billion dollars, was a huge bust. That's two pretty important whiffs. The two wins - cable & broadcasting, had a lot to do with Buffett. When Tom Murphy bought ABC in 1986, Capital Cities had to divest their cable operations as a condition for the deal to go through. Buffett arranged for a sweetheart deal where WPO got the only look and was able to buy them for $350 million, a lowball price (I believe this is detailed in the Thorndike book and one of Capital Cities books). So good for him for purchasing it, but it was with more than a little help from a friend. Even with that, he underperformed. This is an interesting topic in general. Don't get me started on this generation of the Tisches at Loews. To get good results, you can be like Berkshire and buy good businesses and hold them. Or you can be like Leucadia and buy bad businesses and sell them well. But you can't buy bad businesses and hold them.

-

I find the GHC CEO to be unimpressive. For starters, note how they handed him the big option package in 2014 and then announced the CABO spin (which people had been asking for for years) a month later, with a big pop in the stock. I also find his communications with shareholders to be weak. For example, in the December 2021 investor day, someone asks him point blank about capital allocation with GHC being down 10% since the CABO spin in 2015 and the S&P being up big. He gives some hand wavy answer about a better starting point being 6 months after the spin after the stock had "settled back down" and then says they have a 5% CAGR from there. This is nonsense. The earnings releases are telling. They are a mess, with page after page of numbers and adjustments without the important numbers being listed clearly, which are the Adj Operating Earnings of each business and how much capital is employed in each one. I just get a sense that he isn't that smart and is all over the place. I don't think he would be within a mile of this job if he wasn't married to Graham's daughter. I have owned this in the past. They have some good assets and it got crazy cheap in 2020. I think the mediocre results under the CEO's tenure are not just bad luck and are largely an accurate report card on how well he was done his job.

-

For anyone looking for good stuff on Simpson, there is a chapter on him in The Warren Buffett CEO by Robert Miles, which came out in 2003. I read this book a long time ago but recall it being quite good with chapters on many of the important managers of the 1980's/1990's: Nicely, Jain, Simpson, etc. https://www.amazon.com/Warren-Buffett-CEO-Berkshire-Hathaway/dp/0471430455

-

Buffett/Berkshire - general news

oscarazocar replied to fareastwarriors's topic in Berkshire Hathaway

See's earned $24m pretax in 1982 and $27m pretax in 1983. Corporate tax rates at the time were 46%, so if Berkshire sold they would be doing so for something like 5x pretax 1983 earnings or 5-6x aftertax proceeds (say 46% tax on $100m net gain = $79m aftertax proceeds vs. $14m net income in 1983. It wasn't an overwhelming offer, more indicative of how well the business had performed.