oscarazocar

Member-

Posts

116 -

Joined

-

Last visited

Recent Profile Visitors

1,374 profile views

oscarazocar's Achievements

-

What are some examples of the big discounts in smaller stocks that you are seeing? Thanks.

-

The part on Musk's algorithm for operating companies is very good. The algorithm, plus his raw intelligence and intense focus, are the reasons for his unusual success. https://medium.com/@alastairallen/the-musk-algorithm-c241d9d0ee3d

-

National Indemnity, See's, Buffalo Evening News, GEICO, Scott Fetzer, hiring Jain, KO, AXP, Mid-American, BNSF, AAPL. Scott Fetzer is a very underrated acquisition. Berkshire paid $235m net in 1986, took out $244m (net income = FCF) in first 5 years, $309m in next 5 years, and in year 11 earned $82m net, with Scott Fetzer segment at $32m net income (peak), Kirby at $39m (peak) and World Book still earning $10m. The entire thing did about 24% IRR with minimal leverage. All that cash went into equities and other businesses at attractive prices between 1986-2000.

-

Public Company Share Repurchase-Cannibals

oscarazocar replied to nickenumbers's topic in General Discussion

APOG has a great niche business, the Large-Scale Optical segment, that makes coatings for picture frames and is very steady and highly profitable. It is different in character than the rest of the APOG businesses, less cyclical, and provides ballast if the main business has a big down cycle. -

Public Company Share Repurchase-Cannibals

oscarazocar replied to nickenumbers's topic in General Discussion

The SEB repurchase wasn't just from a "major shareholder group", but the Bresky family which still owns over 73% and has controlled and run the company for many decades. It's a very odd transaction. Why would they sell a huge block at such a large discount to tangible book value when the stock has traded above that level for many years? Presumably they would get a decent premium to tangible book value if they sold the company outright. -

I recently came across the Tsai Capital 2023 Q4 letter on Reddit, turns out that the manger, Chris Tsai, is the son of one of the 1960's Go-Go investing OG's, Gerry Tsai. https://tsaicapital.com/files/Tsai-Capital-Annual-Investor-Letter-2023.pdf https://www.nytimes.com/2008/12/28/magazine/28wwln-tsai-t.html

-

oscarazocar started following gfp

-

oscarazocar started following KJP

-

oscarazocar started following Spekulatius

-

Returns on fiber/broadband investments hugely depend on competition or lack thereof. As others have mentioned, if you are in an area with 3 or more providers, returns will be terrible. If you are the only option or there is one other mediocre compeitor, returns can be very good. Allo focuses mainly on small towns where they think they can have a high market share. Click below and you and see the places they are. It's mostly small towns in Nebraska like Kearny, Crete, and Gering. This is not competition central. They went into Lincoln because Spectrum (Charter) had a terrible local reputation and, as mentioned, I believe they got a good deal with the city who wanted competition in the broadband market. https://www.allocommunications.com/communities-that-want-allo/

-

NNI has disclosed Allo metrics over time and the penetration has been reasonably impressive. In 2017 they had 71k passings and 20k households served for 29% penetration, then ramped up and by 2020 had 150k passings and 59k households served for 40% penetration. I spoke with them several years ago and they indicated they would hit their financial targets with 50% penetration and in the 2022 letter they indicated results are ahead of initial underwriting expectations. My guess is that their Lincoln deal was probably a pretty good one given their long-time presence and deep connections there.

-

NNI is not really allocating much capital towards fiber. They invested $450 million in capex and net losses in Allo (their fiber business) through 2020, then in late 2020 sold a majority stake in the business to a private equity firm (SDC) for $260 million and retained $130+ million in preferred stock and 45% equity interest (at the time valued at $129 million), so they took out most of their invested capital. They have contributed minor amounts since, including $8 million in 2023 Q1, but Allo raised debt to fund its growth going ahead and I think there will likely be minimal future capital conributions.

-

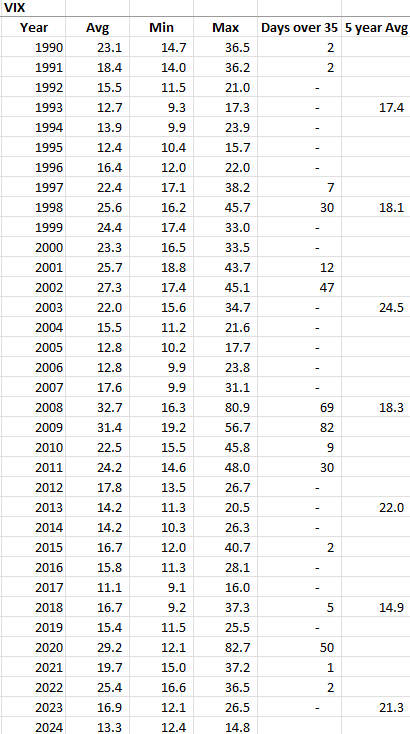

My understanding of the actual mechanics is crude, but I believe that the quoted VIX index is based off an expectation of forward 30 day market volatility derived from option prices, so it's not definitionally impossible for it to differ from market prices if you had odd and systematic behavior in the options market. Practically, I think this only happens in single companies or other, more narrow indexes. If someone was systematically selling options or CDS in huge amounts, you might see a volatility number that is artifically low (and which in turn, might present a great buying opportunity). I recall that Berkshire CDS has seen some beavior like this at times in the past. In terms of the CBOE VIX, I think the market is too big to see an impact.

-

That's just looking at the history on a spreadsheet, not terribly complicated and available to anyone with Excel and Yahoo Finance. I have no idea if someone is manipulating VIX. I am skeptical, it sounds like one of those stories that people like to tell themselves. If you look at the numbers, nothing is terribly out of line from history. I first started looking at this a few years ago after reading something about how low VIX was and how it was being supressed, and it turned out the 5 year avg was actually a tick above the long-term average. Weird behavior in what are essentially volatility indexes is often a sign that a big player is doing something dumb and suppressing the market. More or less, Nick Leeson blew up Barings in 1995 and you had the London Whale losses at JPM in 2012 from players making big dumb bets, and in both cases smart operators caught wind and bet against it. In terms of the VIX market itself, my guess is that it's too big for that kind of manipulation, but probably does move over time based on systematic behavior by market players. In terms of how I look at it, it's an effective and crude rule of thub. When VIX is over 35, it's not a surprise why, people are freaking out about something and markets are tanking. I picked 35 because it matches up almost perrfectly with my bottoms-up view of good buying opportunities over the last 20 years. GFC in 2008/2009, Europe panic in August 2011, briefly in late 2015, Christmas Eve 2018, Covid in spring 2020, Russian invasion in spring 2022. In that period, I have never seen markets tank without VIX reacting in the way you would expect.

-

VIX hasn't closed below 12 since November 2019. It hit 26 in March 2023 and 21 in October 2023. For 2023, VIX averaged 17. It was over 35 for 1 day in 2021 (Jan 27) and 2 days in 2022 (March 7/8). Fortunately, if you are a non-institutional investor, you can usually buy a full position in a day of most liquid stocks. Anyway, setting a rule like this is one way to take the pressure off - it's an external signal that tells you, "Don't worry about buying anything today, better opportunities will likely come along". Sure, you can end up waiting 5 years like 1992-1996 or 3 years like 2012-2014, and of course there are sometimes great opportunities in parts of the market when VIX is low, but as simple rules, I've found it hard to beat.

-

An approach that I have seen that seems to work pretty well for portfolios like this is to build up a group of larger positions in high quality companies over time (say 5-10% positions for 80-90% of portfolio) and then have 10-20 1% positions in other stuff. I heard Bill Miller mention this approach years ago, as he had the same problem of getting bored. The smaller stuff keeps you occupied and active and perhaps makes it easier to wait until a fat pitch comes along. Another rule would be not to take a bigger position unless the VIX is at some predetermined level, say above 30 or 35. It is remarkable when you look back how closely VIX above 30 correlates with stocks being cheap. You can see the daily price history of VIX on Yahoo Finance going back for decades. Pretty much anytime something like BRK was really cheap, the VIX was at those levels, with two notable great opportunities in BRK being in August 2011 and May 2020.

-

oscarazocar started following jmmand14

-

The Missing Billionaires - James White and Victor Haghani

oscarazocar replied to james22's topic in Books

Haghani was one of the founders of Long Term Capital Management (LTCM) and one of the key players there. He is featured in Roger Lowenstein's excellent book. https://www.amazon.com/When-Genius-Failed-Long-Term-Management/dp/0375758259 -

According to the 1986 prospectus, Gates owned 44.8% of MSFT after the offering. Paul Allen owned 24.9% and Ballmer owned 6.9%. Ballmer has sold a few chunks over time but has retained over 2/3rd of that original stake as per last report of his holdings in MSFT proxy in 2014. https://www.begintoinvest.com/wp-content/uploads/2018/03/Microsoft_prospectus.pdf