fareastwarriors

-

Posts

5,270 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by fareastwarriors

-

-

Just for kicks, I went to look at the performance of my old firm. All their equity funds are underperforming their indices for past 3,5, and 10 years. Their income stuff are beating slightly. They don't manage not exotic stuff. The benchmarks are like S&P 500, MSCI EAFE/World... So much underperformance but yet AUM up by hundreds of billions in last couple of years.

It such a good racket...

At least my old firm only charges 40-70 bps for their funds....

-

-

Might be late to the party already but SCHW.

Highly interest rate sensitive and well run business.

-

On 1/8/2022 at 10:52 AM, flesh said:

The 2020's will benefit from the baby boomers, the richest, largest generation to die thus far passing on their wealth. Myself and a half dozen close friends

all stand to inherit 400k-2m this decade. In most cases it will be spent. In others, a greater % of it will be spent than the boomers who hold it now. This is a one time

benefit creating a new delta for successive generations.

I'm waiting for my inheritance... Oh wait, I still to support my parents.

Darn!

-

More VICI

-

3 minutes ago, Longnose said:

My Costco Hotdog is still only a $1.50! Boom, now you can afford your 3x lumber

Morgan operates in WV so probably not too many Costco's nearby. Personally I go for the chicken bake since I find it way more filling!

-

Why does he constantly pump $PAR? Seems excessive

-

14 hours ago, Morgan said:

Everything I buy is up at least 15-20%. Building, HVAC supplies, tools, etc are up 35-100%. As we all know lumber went up 300%, but now it’s probably only up 100%. Oh joy.

I know you're a pro managing 100s of units but for the benefit of others, there are some ways to reduce the cost at home improvement stores.

-Buy the 10% off coupons for Home Depot and Lowe's

-Pay with gift cards bought from grocery stores using the 6% cash back credit cards (like Blue Cash Preferred) or from Staples with the 5% cash back Chase Ink Business Cash card

-If paying with credit card, at least pay with BofA cc with Platinum Honors for 5+% cash back for home improvement stores

-sign up ProRewards for Home Depot (or even share 1 account to boost savings faster)

I'm sure I missed some stuff but with the coupons and gift cards, etc, my margins are instantly better than the average landlord/contractor paying with regular credit card/cash.

14 hours ago, Morgan said:Even Egg McMuffins are up 35% in my area. A Subway footlong is up 60%. (Don’t judge my eating habits too much lol)

This is probably not worth the squeeze but I never pay retail for fast food or chains out of principle! I collect all the flyers with coupons and leave it in my truck and/or wait for promos on the apps. My Subway flyer has coupon for $6 footlong.

Edit: I'm in California so definitely not low cost area!

-

Rest in Peace

-

a bit of MSGN

a house - Investment SFH - closing this week.

-

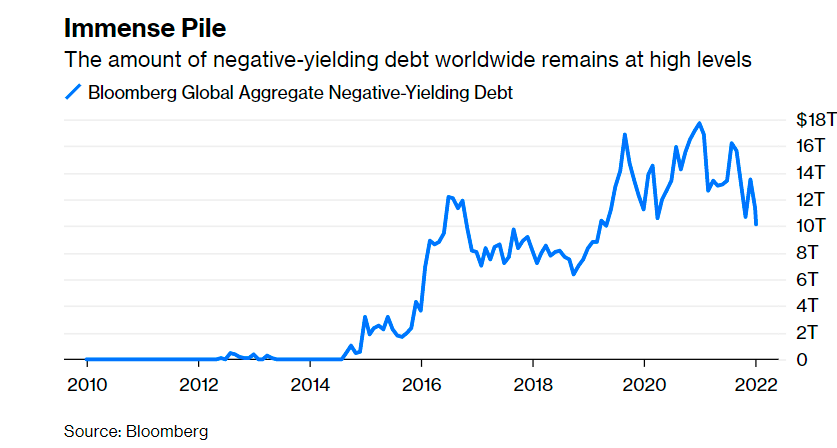

Randomly saw this. Wow, so much money out there earning negative yield. As a layperson, it's hard to comprehend.

The Most Important Number of the Week Is $10 Trillion

The amount of bonds globally that have negative yields should support the stock market for some time even as central banks turn hawkish.

-

37 minutes ago, Gregmal said:

....bubble? Nope. Maybe the 3rd inning or so.

Play ball!

I'm closing on an investment SFH next week.

-

I don't mind seeing more carnage out there. The crap is rightfully getting killed sure but the quality stuff is not down all that much.

-

VICI and TPHS

-

Apple hit a market cap of $3 trillion, tripling in valuation in under four years.

https://www.cnbc.com/2022/01/03/apple-becomes-first-us-company-to-reach-3-trillion-market-cap.html

-

Happy New Year!

To wealth, health, and love!

-

Haven't touched ibonds in years but yet I'm here for the party. Put in 10k order today.

Hope I make the cut off!

-

Merry Christmas and happy holidays! Appreciate our family and loved ones and everything we have.

Here's to another healthy and prosperous year!

-

more MSGE.

-

49 minutes ago, ValueArb said:

I bought them when I thought they hosted a professional basketball team, but sold when I found out they didn't, just the Knicks.

HAHAHAHHAHA

Knicks looked pretty decent last season but the wheels kinda came off this year again. Even as a Warriors fan, I would love to see a competitive Knicks team.

-

40 minutes ago, Gregmal said:

In an alternative universe I wish there were exit interviews for people selling stock. I dont know anyone who is selling MSGE here, but if I did I'd ask which category they fall into:

I sold a potential multi bagger with virtually no long term downside because:

a) Im scared of covid

b) I'm scared of a temporary ~20% paper loss

c) I wanted a pureplay with worse economics instead

d) I didnt know what I was doing to begin with

There's really no other category or reason for selling into the current situation. Mr Market is great though. Even in a rich market, always an opportunity somewhere.

Yea I don't get it. MSGE trades like a damn see-saw when the fundamentals didn't really change all that much.

If this is a COVID thing, There are so many other better lockdowns v reopening plays out there than MSGE...

dafuq?!?

-

1 hour ago, Pelagic said:

CLF and MSGE

I'm here for the party too.

Just MSGE though

-

the kids are all grown up

Millennials Are Supercharging the Housing Market

The generation that supposedly didn’t want to buy things now accounts for over half of all home-purchase loan applications; economists expect them to bolster demand for years

-

New York City rents jump 22.8% in November, as the rental market bounces back

The New York City rental market is regaining strength, according to the most recent rental report from Douglas Elliman and Miller Samuel.

In November, net effective median rent for Manhattan rose 16.7% compared with last year, the report found.

“We’re in many ways shocked, and we’ve been too busy to even think about it,” Douglas Elliman CEO Scott Durkin told CNBC on Thursday.

Garth Turner - Real Estate in Canada

in General Discussion

Posted

Man I really need to get out of my bubble and enjoy this big country. I just bought a $700k 2bed/1bath 900 sq ft place and I felt like I got a great deal! F'ing Cali.