-

Posts

1,852 -

Joined

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by UK

-

-

BofA Global Research projects they will increase earnings by an average of 19% over the next 12 months, more than double the an 8% estimated rise for the rest of the S&P 500.

They will need strong results to justify premium valuations. Those companies trade at an overall trailing price-to-earnings ratio of about 40 times, versus 15 times for the S&P 500 excluding those companies, according to BofA.

Their results may be crucial to the market as a whole. Fueled by their recent gains, megacap stocks have climbed to dominate benchmark indexes, causing headaches for some managers of active funds. In the S&P 500, the seven stocks comprise 27.9% of the index's weight.

“It’s also how do these big companies, which are carrying the market ... guide for the rest of the year and into 2024,” he said.

Overall, the seven companies account for 14.3% of overall S&P 500 estimated earnings for the second quarter, and 9.3% of estimated revenue, according to Tajinder Dhillon, senior research analyst at Refinitiv.

But many investors say the corporate giants are nevertheless here to stay as critical holdings. Yung-Yu Ma, chief investment officer at BMO Wealth Management said that while “there is a lot priced in” to megacaps’ valuations, that did not mean they are overvalued.

"If you think about the megacaps broadly ... they have gone from a core holding of a portfolio to an almost absolute necessary major component of the portfolio once you factor in trends such as AI," he said.

-

3 hours ago, Gregmal said:

Over the years I’ve gone from doing the mandatory finance shit like always having Bloomberg and CNBC on, reading every headline article about macro, scouring Wall Street Journal, and “watching the Fed/big hedge fund guys”…to literally paying zero attention to any of that stuff and just focusing on specific investment situations that I think are interesting. I’ve also started evaluating investments through the lens that they are private investments or businesses I wholly own. Anyone see Buffett, Prem or Flatt day trading their company stock price fluctuations? And that is not to say that each of those dudes and their businesses have not seen absolutely massive potential macro clouds here and there over the course of the past 5 years…sometimes you just have to realize stocks are businesses. You need to think like an owner and not a piker.

Something to think about. Thanks for sharing!

-

Call it a bubble or an artificial-intelligence-driven hype cycle. But here’s another way of looking at the rally that sent the tech-heavy Nasdaq-100 to its best-ever first-half performance: a narrative round trip.

Only about a half-dozen companies are responsible for virtually all of the advance, leading to a lot of investor angst over how precarious the gains feel. But it’s possible to look at the same set of facts and conclude that nothing has changed in the market over the past 18 months. The clutch of technology giants that dominate the market got crushed when it seemed as if the US Federal Reserve would drive the economy into a recession, and in 2023 that view has been reconsidered.

...

“The problem with market timing is it’s inconsistent with the underlying philosophy of investing in stocks, which is that stocks really are for the long run,” says Ed Yardeni, founder of Yardeni Research Inc. “And if you get out, you have to be smart enough to get back in.”

-

10 minutes ago, Spekulatius said:

Some of the consumer good companies have lost a lot of unit volume and don't seem to give a damn. I read CAG earnings release and they mention pricing +17%, but revenue is only up 6.6%. This implies they have lost 9% ij volume YoY.

https://app.tikr.com/stock/transcript?cid=26893&tid=2602239&e=1841627946&ts=2850614&ref=o94y6y

Seem kind of scary though to lose 9% of the volume, but what do I know. I think Pepsi also lost unit volumes. Do People really eat less Slim Jim's or Doritos or do they buy store brands?

https://www.wsj.com/articles/pepsi-pep-q2-earnings-report-2023-2f9d2b0

Pepsi said its companywide organic sales, which strip out currency and merger impacts, rose 13% from a year earlier in the second quarter—stronger than analyst expectations for a 10% rise, according to Visible Alpha. This was largely due to big, double-digit price increases, as underlying sales volumes fell slightly from a year earlier. But in the Frito-Lay North America division, maker of snacks like Cheetos and Doritos, volumes actually rose 1%, bringing organic sales growth in the division to 14%.

-

Some interesting info on market sentiment:

“At the index level we went from deeply bearish sentiment in the fall to the other extreme right now especially in tech. I don’t think it’s fair to say that’s true for every sector,”

-

14 hours ago, Sweet said:

I find myself with a very large cash position for the first time in about 5 years. I’m not sure the exact percentage but I’m somewhere between 60-70% cash right now.

My large cash position is not by design, I exited some positions earlier in the year and haven’t found anything to buy. I’m not bearish on the market, yes I think there are areas of the market which are expensive, but there many which aren’t.

I could buy bonds but IBKR are offering 4.5% on cash held in USD so I don’t see much point in going down that route.

I can see areas of potential opportunity from rising rates and reduced money supply but nothing I want to pick at yet.

I can’t be the only one sitting with more cash than they are comfortable with?

Personally I hate owning meaningful part of portfolio in cash or long term bonds (I want much more than 4-5 per cent, even from government bonds, which happened to me only once) for a longer term and I would not put more than 20-30 per cent portfolio in cash, even if markets seem somewhat expensive/exuberant and greedy (last time I felt this way in 2021), if it is possible to find something at least fairly valued, meaning with an expected return of >8-10 per cent. I like BRK as a theoretical benchmark and real alternative and I think it met very well this criteria in 2021 and still meets today (and perhaps every year since 2007, even including some periods of being more noticeably undervalued). To go to >50 cash, I really have not such real experience, but maybe it would be possible to imagine (also depending on long term rates etc) if market would trade at something like >30 normalized PE, with BRK>1.6-1.8 PBV and it would be impossible to find anything else sensible, without seriously compromising quality. But it seems that even during such periods like 2000 it was possible to find something with reasonable valuations and I hope it will be the case in the future:). Also for me the similar thinking applies to the other side, meaning if I feel the market is cheap (maybe already <15 normalized PE or even better if less), off substantially and with a lot of fear in it, then, depending on the opportunities, I would consider adding 20-30 per cent leverage. So most of the time I am about 100 per cent invested, but while being 70-80 per cent invested (defensive for me), I still have capacity to add about 60-40 per cent to my long exposure, if something exiting comes along, as last time I felt was the case with the market (and especially big tech etc) last year. I think if today I was given 100 per cent cash portfolio I would put at least 50-60 per cent of it into BRK and FFH (and this one is not even at 8-10 but more likely at >15 per cent expected return) on Monday and then in near future add to them / some other things until being 80-90 invested. Maybe even only with SNP500 available, I think I would still put 50 per cent of cash it into it and then think what and when to do with the rest.

-

51 minutes ago, John Hjorth said:

Bloomberg [July 6th 2023] : Russia Gas Giant Warns of Sanctions Risk for Ukraine Energy Firm.

This has the potential to turn really bad - for both Europe and Russia. I have mentioned the gas pipelines in Ukraine before upstream in this topic and their importance, everyone seem to skip or disregard this matter / issue.

Gazprom PJSC CEO Alexei Miller has for long now looked like something dragged inside the house by the cat, when he has been seen in videos. I think nobody envies him his job.

Really bad, when international trade gets messed up with geopolitics.

Personally I speculate that this could evolve and escalate into something worse than last autumn and winter in the European gas markets.

I am not sure, but it seems that these remaining flows is about 9 per cent of total pre war EU gas import from Russia? Still could be painful for some countries (including Hungary), but maybe manageable / already not the issue for most EU?

-

Maybe this is also very timely for today:

Time again to move to something like the last year regime of worrying of higher for longer rates / braking of something / possibilities of large mistakes by central banks?

-

https://www.wsj.com/articles/home-builder-stocks-are-booming-as-homeowners-stay-put-df748479

“It’s a perfect example of the market where just when you think there’s nothing that can go right for a group, that’s when things start to go right,” Hickey said.

-

53 minutes ago, Spekulatius said:

Looks like the top is in for ChatGPT. In any case, some of the initial excitement seems to wear off:

https://www.wsj.com/articles/ai-boom-stems-techs-downturn-a669b4a3?mod=hp_lead_pos1

SoftBank Group Chief Executive Masayoshi Son said last month that he plans to end a lull in investing and focus on AI after the ChatGPT chatbot rekindled his excitement about the future. “The time is approaching for us to go on the counteroffensive,” Son said at the annual meeting of the Japanese technology-investment company. “I want SoftBank to lead the AI revolution.”

-

12 hours ago, Parsad said:

Yup, and they've delayed the amount of the headsets due to production issues...now only planning 400,000 units through 2023. All of the big tech stocks are expensive...GOOGL might be the cheapest actually now. At 5% risk free rate...30 times earnings or more for these stocks...hmmm! Cheers!

I think maybe 10-year yield is more appropriate for risk free rate measure and currently it is at ~4 per cent. So bonds trade at like 25x multiple with no growth, but more importantly for the longer term, with no inflation protection. So assuming business such as Apple is as safe as heaven (lets trust WB here:)), global, with a strong pricing power and still growing, it is easy to rationalize choosing such business over bonds at the same or even somewhat higher multiple as it trades currently (25 vs 30). What would be your choice if you had to make a decision and lock it in for the next 10 or more years (and maybe this is the thinking of BRK)? However you have to draw a line somewhere, because at very low or zero yields this kind of math will lead you to the moon:). And in reality I am not sure at all that all of these big tech companies are completely risk free from some disruption risk (including AI) in the next 10 years, or even geopolitical (Apple and China?) or other risks (regulatory etc). So maybe for me anything of such size trading above 25x or 30x makes me very uncomfortable. Especially after seeing were those same, very special, companies (and I would definitely would not put all 8 in that category), were trading just some 6-8 month ago:). GOOGL and META both still trades at estimated 20x for the next year, almost in line/not much above the market, maybe still nothing to worry about, especially if you are sure AI will not disrupt search in any negative way and META will not fall into some another, real or imaginary, crisis:). And the sentiment around them is completely different from the last year, but maybe it will last much longer and gets even more positive (as we also seen before). So again I could rationalize to continue owning some of these big tech. But on the other hand the interesting exercise to contemplate: if and how much of these big tech companies I would put in the portfolio today if by some accident I was about to start with 100 per cent cash?

-

-

4 hours ago, Gmthebeau said:

I traded TSLA, AAPL, GOOG, MSFT, and AMZN off the bottom but sold all of them recently. I think they are all back to too expensive. Doesn't mean they won't go higher but they are likely to give it all back and then some at some point. Buffett also held Coke in 1998 at a PE of nearly 50. He later admitted he should have sold it.

Interesting. May I ask what have you bought instead of these:)?

-

4 hours ago, Gregmal said:

If nothing else, wouldnt somewhat of a contrarian approach be to get long-ish the non supercap tech and even short the index? Bet that beats bonds over the next 6-12 months as well.

Yes, I think moving to something more reasonably priced or even what could still be considered cheap (or even some cash) is a logical thing to do, especially if market keeps doing in 2H, what it did in the 1H. I already moved maybe about halfway this direction Vs start of the year, by reducing leverage and adding somewhat to non big tech (mostly FFH and also some JOE). But timing this right is very difficult and tiring and I still own 2 of these 8 darlings.

-

1 hour ago, mattee2264 said:

2023 First Half Returns... The Enormous Eight... $NVDA: +190% $META: +138% $TSLA: +113% $AMZN: +55% $AAPL: +50% $NFLX: +49% $MSFT: +43% $GOOGL: +36%

Everyone Else... S&P 500 Equal Weight ETF $RSP: +7% S&P Small Cap ETF $IJR: +6%

This is a pretty good summary of the first half of the year.

Any predictions for what the corresponding second half numbers might be?

Despite being very exited about some of these enormous eight just 6-8 month ago, I in no way expected that situation with long duration assets in general and big tech in particular will reverse so quickly and to a such extreme. I think I still can live with a multiples of 20x or even 25x for a really good companies with an improving results (as most of these probably are), but now some of them are getting into 30+ territory, which is maybe already disturbing for a such large and in some cases slowing businesses? But Apple is one of these and BRK continues to hold like half portfolio in it and I am also not sure what to think about it. So...more questions than answers and no predictions from me:)

-

3 hours ago, Viking said:

@UK i will give you a portfolio update as of today. But please note, i am ok with concentrated positions. This strategy has worked well for me for +20 years but it is not for everyone. Please note, I might decide to change my position tomorrow and i will not provide an update. I have no desire to provide daily, weekly or monthly portfolio updates. Because it messes with my head too much (i start to feel responsible for everyone else). People need to do their own research. And come to their own conclusions. And not get overly influenced by what some anonymous blogger is posting.

Having got that out of the way, Fairfax has been may largest position since late 2020. ‘The story’ at the company continues to improve every quarter. As a result, despite the incredible run-up, i think the stock is still dirt cheap. So i continue to hold a concentrated position. I consider 30% to be a minimum position for me today (given what i know today). Currently i am at a 45% weighting. And I move around quite a bit (around the edges).

I am also 35% cash today. The remainder is split pretty evenly between 3 other buckets: oil, banks and Canadian high yielding dividend stocks. I move around i these holdings quite a bit.

—————If you look at most successful investors most of their outperformance was the result of only a couple of holdings that performed spectacularly well over 5 or 10 years.

My view is these turbocharged opportunities only come along every couple of years (something you understand very well that is dirt cheap with catalysts). So when you find one you have to be patient and ride it for as long as possible. Because the next one might be years away.

My fear right now with Fairfax isn’t holding too much… it is holding too little. My fear is lightening up (locking in big gains) and then having the stock take off higher on me.

My biggest mistake investing is selling my big winners too early. Selling because they went up a lot. And then they kept going higher… My mistake was selling using price as my guide. So i am trying to be more patient in situations where the fundamentals continue to improve - like the situation with Fairfax today.

—————

My average return over the past 20 years is 19% per year. Over that 20 year span i have had two down years (of -4% each year). So my strategy works for me. I also spend LOTS of time on investing… because i really enjoy it.

People need to figure out their own strategy. Something that fits their knowledge, emotional make-up, situation, interest, time etc. There are no short cuts.

Thanks very much for your answer!

-

16 minutes ago, Viking said:

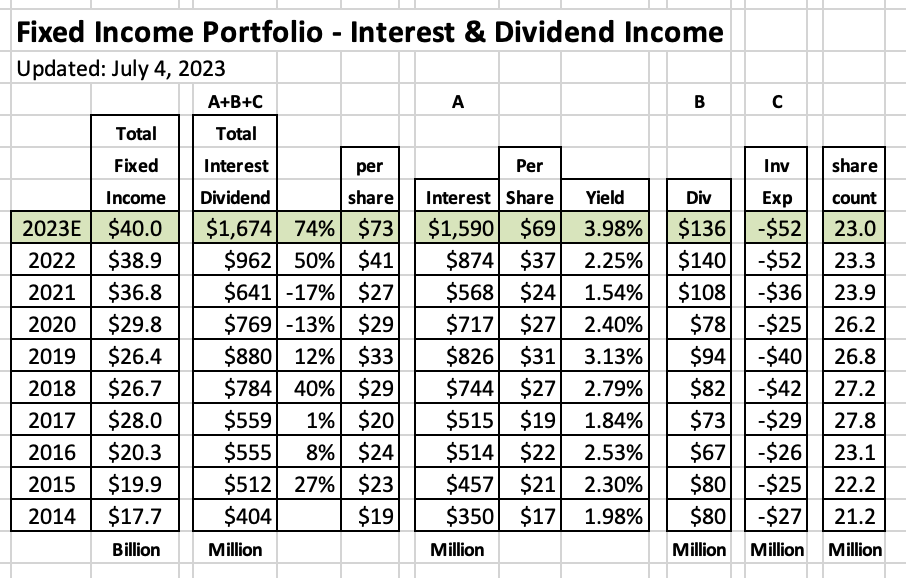

Of all of the many positive developments at Fairfax over the past 18 months, the spike in interest rates (and subsequent increase in interest income) is the most exciting for shareholders. That is because the interest and dividend bucket is now the biggest driver of earnings for Fairfax.

Fairfax has done a masterful job over the past 2 years of navigating the extreme volatility we have seen in interest rates. In Q4 2021, Fairfax did two things: they moved their average duration to 1.2 years and shifted their fixed income portfolio to high quality government securities. In 2022, as interest rates spiked higher, they began extending duration - in Q4, 2002 the average duration had been increased to 1.6 years. The positioning in late 2021 protected Fairfax’s balance sheet when interest rates spiked in 2022 (saving them billions in unrealized losses). It also allowed them to take advantage of much higher interest rates. As a result, Fairfax earned record interest and dividend income in 2022. And 2023 is going to blow 2022 out of the water.

What did we learn when Fairfax reported Q1 results?

The big news was they had pushed the average duration of their fixed income portfolio out to 2.5 years. This is a significant development. Because it means the record interest and dividend income will continue for 2023, 2024 and into 2025 - this earnings stream is now predictable and durable. Investors and analysts like this.

What did we learn in Q2?

We learned four very important things in Q2:

1.) Central banks are not done raising interest rates. This is because inflation (especially core readings) is still too high. And parts of the economy are starting to grow again (like housing) and employment remains tight. So, some central banks who had paused rate hikes in early 2023, like Canada and UK, have been forced to start hiking rates again. And despite the recent pause, Powell has telegraphed the Fed will be hiking the US rates at least one more time (and likely two) in the coming months.

In addition to the US, Fairfax has significant fixed income holdings in Canada, the UK and Europe. The average duration of their fixed income portfolio is still quite low at 2.5 years (especially when compared to peers, who are closer to 4 years). A higher for longer interest rate regime means Fairfax will be able to roll their maturing bonds into higher yielding securities - which should deliver even higher interest income.

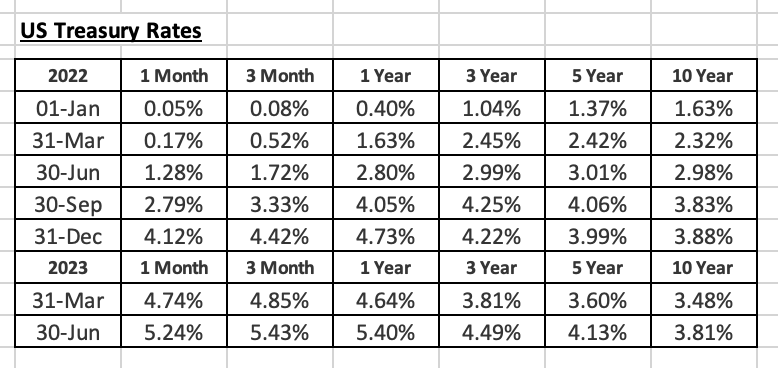

2.) Interest rates are rising again. It looked like treasury yields peaked out March 8 in the US. At the end of March yields had plummeted. Fast forward three months to the end of June and treasury yields have spiked higher, with durations of 3 years and less setting new highs.

Fairfax is being given another opportunity to increase the average duration of their fixed income portfolio if they want to. Doing so would lock in meaningful interest income beyond 2025.

3.) Higher interest rates are causing parts of the financial market to crack, with the meltdown in US regional banks in April the most recent example. Some regional banks have been forced to sell loans at a heavy discount to raise liquidity. In partnership with Fairfax, Kennedy Wilson purchased $2.3 billion (face value) in loans from PacWest Bank. Fairfax will earn 10% on its $2 billion investment, which will generate about $200 million in interest income (mostly) and investment gains (expected 10% total return).

4.) Dividend income is headed higher. Extending its close partnership with Kennedy Wilson, Fairfax also invested $200 million in preferred shares with a 6% dividend. This will deliver an incremental $12 million in dividend income to Fairfax each year. (As part of the deal, Fairfax also received warrants for 12.3 million shares of KW with a strike price of $16.21.)

Fairfax has most of its fixed income portfolio in government bonds. One of the big advantages of this positioning in the current environment is it allows Fairfax to be very opportunistic to quickly take advantage of temporary market dislocations, like we have just seen with the KW/PacWest transaction. Smart.

As central banks continue to increase interest rates it is possible the US could enter a recession later in 2023 or 2024. If this happens it is normal for credit spreads to dramatically widen. Fairfax has stated they are ready to shift a chunk of their fixed income portfolio from government into corporate bonds should yields on the latter pop higher. The cat is ready to pounce.

Over the past 20 months we have been getting a master-class from Fairfax on the benefits of active management of a fixed income portfolio.

What does all this mean for Fairfax?

Record interest and dividend income is going even higher. The already good ‘fundamentals’ of Fairfax continue to get better.

What do the actual numbers look like?

Interest and Dividend Income:

- 2021 = $641 million ($27/share).

- 2022 = $962 million ($41/share) = 54% increase YOY.

- 2023E = $1.674 billion ($73/share) = 76% increase YOY.

Fairfax’s share price is $753. The company is trading today for 10 x 2023E interest and dividend income. Compare that to any other insurer… that is NUTS. Especially given the durability of this earnings stream and the quality of the bond portfolio.

—————

Interest & dividend income = interest income + dividend income - investment expenses.

Interest income:

- Fairfax has a fixed income portfolio of about $40 billion. Interest income will come in around $1.59 billion in 2023 = yield of 3.98%. This is up from 2.25% in 2022 and 1.54% in 2021.

Dividend income:

- Fairfax currently earns about $135 to $140 million per year in dividends from its equity holdings.

Investment expenses:

- Fairfax incurred investment expenses of $52 million in 2022, up from $36 million in 2021. My estimate for 2023 is $52 million.

FYI, Fairfax did not break out interest, dividends and investment expenses when they reported Q1 earnings (they just reported the total number).

Check out the unbelievable move in Treasury yields over the past 18 months from Jan 1, 2022 to June 30, 2023.

Viking, thank you for sharing you analysis and thinking on FFH! Given you extensive knowledge and conviction on possible opportunity with FFH still present, may I ask you, what are your thoughts on position sizing with FFH? Given that FFH is still an insurance and somewhat levered company, what would be max position size in FFH you could still sleep well with?

-

9 hours ago, cubsfan said:

A little clip on the US military response to the Wagner Group in Syria:

https://www.washingtonpost.com/world/2023/06/30/wagner-syria-russia-battle-united-states/

And the incident also offered an early indication of the tensions to come between Prigozhin and Russia’s military leadership. The apparent loss of dozens of Wagner fighters in a single night in Syria allegedly infuriated Prigozhin, who earlier this month put out his account of the 2018 events on the social media platform Telegram. In his telling, the Wagner expedition was supposed to be the advance force of an “anti-ISIS” operation that would secure control over the plant and its environs with air support from the Russian military. But that support never came, and Prigozhin was left fuming at Defense Minister Sergei Shoigu and Russian Gen. Valery Gerasimov for allowing his fighters to become U.S. cannon fodder. According to U.S. officials in 2018, their Russian counterparts denied involvement in the battle and, during emergency discussions as the fighting raged, assented to the use of American air power on the scene. A U.S. official told my colleagues five years ago that it was “striking how the Russians themselves have been quick to distance themselves” from what he described as an operation “under Syrian command and in response to Syrian directive.” “The Russian high command in Syria assured us it was not their people,” Defense Secretary Jim Mattis told senators in testimony in April 2018. He said he directed Gen. Joseph F. Dunford Jr., chairman of the Joint Chiefs of Staff, “for the [attacking] force, then, to be annihilated.”

-

6 hours ago, Spooky said:

Still talking about his super bubble eh?

From the same article:

Grantham, the co-founder of the Boston-based money manager Grantham Mayo Van Otterloo, has been warning of signs of froth in the stock market since at least 2015.

GMO’s flagship Benchmark-Free Allocation Fund is up 4.5% this year, trailing the broader market. Since its 2003 inception, the fund’s annualized total return is 6.3%, compared with 9.9% for the S&P 500, according to FactSet data going back to Aug. 25, 2003.

-

-

That enthusiasm is strong enough to propel the broader stock market over the next couple of quarters, Grantham says, but ultimately it won’t prevent the bubble from bursting. GMO predicts that, after that happens, value will eventually set the market’s trajectory again.

-

-

-

10 hours ago, Parsad said:

Should we lock this thread and move to the "Have We Reached The Top" thread?

The bottom hit pretty much in June 2022 and then again in October 2022. S&P500 is up about 17% from the October 14, 2022 bottom and the Nasdaq is up almost 25% during the same period.

I certainly don't think this will be a straight forward market for the next 18-24 months, but you had two good buying opportunities last year and markets are up...especially tech.

Time to let the market run until it hits a top and people fret about something else. To me, I think it's going to be CRE and RRE...as well as possible sovereign debt issues around the world...but those may be a year or so away.

Cheers!

Technically, we should wait until +20 from the bottom before moving, but maybe it would be more convenient to just merge both threads into one "Have We Reached The Top/Bottom":)))

What are you listening to ? (Music thread)

in General Discussion

Posted

Remembered while thinking about this Magnificent 7 problem:)