Mick92

Members-

Posts

62 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Mick92

-

This has crept up to about a 33% position but I just don't see a reason to sell. They are crushing it, looks like another super quarter. Really stepping up the buybacks this year as the premium growth is stalling out.

-

Just pay your "fair" share, that's all the government wants.

-

Yep, that's basically how I'd like them to approach it.

-

Yes, I really hope Prem doesn't answer all the questions himself. I have the utmost respect for Prem as an investor, he seems like a decent guy too and he's not uncharismatic either, but, his answers to questions can be a little bit unclear at times. Perhaps Jen Allen as CFO could be suitable to refute the MW points, one by one? Or they could release a written rebuttal prior to earnings and be willing to discuss on the call. The only way I could see it going bad is if Prem decides to take it all on himself on the day and ends up with a bit of rambling Prem speak coming out.

-

I'm going to get a t-shirt printed with "No-moat Fairfax" on it.

-

FFH

-

Even if you buy this, which I don't necessarily, it doesn't really change the Fairfax thesis, they are likely going to make a ridiculous amount of money in the next few years from the core underwriting plus interest and dividends

-

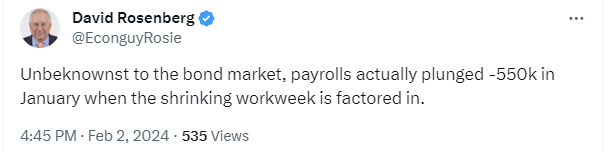

.. There's always a reason to be bearish if that's your outlook or what you're selling. Case in point Rosie, he sees nothing but bad news and he's basically been wrong forever at this point. Of course eventually there'll be a recession or some kind of crisis and him and the rest of them will look like the smartest guys in the room for a period. But buy and hold is the way to success for the vast majority. Understand what you own, don't own shit, don't worry if your stocks go down, the business cycle always comes back. Not everything will work but so long as you don't own total garbage, enough will work that you'll do just fine so long as you don't sell in a panic or blow yourself up with too much leverage. One caveat is if things were to get really insane valuation wise, like Japan prior to their crash levels. Before it reaches that point, you have to cash in your chips and go elsewhere. Otherwise, chill out and enjoy the ride.

-

I don't know, I'm sure Buffett is doing his damnest to try and set it up so that it can continue with the same philosophy in perpetuity but I'm not sure that's realistic. I'm sure Greg is a superb businessman, in the top 1%. Ajit is an incredible insurance exec, Todd and Ted both excellent investors. But they're not Buffett or Munger, realistically they are irreplaceable. Buffett, apart from everything else, may be the greatest risk manager of all time. Can you replace that overall genius at the top? Or the value of his reputation and ethics which you might dip into once every couple of decades to make a difference on something. The phone calls from people when they need to do deals, people wanting to sell to Buffett? I feel like some of this drips away. Maybe it can stay pretty much the same for 2-5 years, or even 10 years, but eventually it will change. Buffett has also been shielding it from some of the stupidity of the hyper partisan US political issues but they will probably come even more into focus after he's gone and no longer controls it. So I dunno, I'm holding and certainly not planning to sell even if Buffett goes tomorrow. I think it probably outperforms the S&P from here over the next decade. But, the day Buffett goes, I'm going to have to start monitoring it a lot more closely.

-

It's impossible to say definatively but I suspect a good chunk of it is based on Prem's reputation in the investment community. From Buffett of the north, hugely successful macro bets not that far in the rear view mirror to a maybe past it guy running an insurer in Canada, to idiot Prem torching shareholders money on Blackberry and other shitcos. All culminating in the guy screaming at him on one of the conference calls that he needed to go. But, by then the ship was turning. That was probably maximum Prem pessimism, I think he is on the rehabilitation path, but probably needs another year or two of excellent returns for the market to fully price that in and maybe the Buffett of the north nonsense starts being said again. Plus, who is buying FFH when sentiment was so low and dropping? People were bailing because of Prem maybe, but for other people looking at it, it was now an insurer, only listed in Canada, with the market mired in an apparently perpetual state of ZIRP. I dunno, it's not that surprising to me that the BV multiple just kept dropping. Right now though, I just don't see a reason to sell, it's become by far my biggest portfolio position so you have to watch it closely but everything is humming along and I think there's at least another couple of years outperformance here to be had.

-

-

PGA Effs Over 9-11 Families and Loyal Players

Mick92 replied to Parsad's topic in General Discussion

I disagree, Scheffler and Rahm are likely better players at the moment, even though world number 1 swaps around a lot, but McIlroy is well ahead in star power and was the logical person for them to weaponise in their response. I'd also include Cam Smith in the top 3 for LIV. Otherwise I agree, it was all money related and still is. -

PGA Effs Over 9-11 Families and Loyal Players

Mick92 replied to Parsad's topic in General Discussion

Yes, I think for all the guys that left, they left for the cash but with underlying reasons. Age/hard to compete any more: Mickelson, Poulter, McDowell, Stenson, Westwood Injury concerns: Koepka, De Chambeau Less golf, more family: DJ, Cam Smith Conversely, a guy like McIlroy stays because he's the current face of golf, chasing his own history and is already very well compensated. Not at LIV levels, admittedly, but he has good reason to stay. Tiger is one of the top 2 players of all time, would destroy his legacy by going and probably (almost definitely) isn't physically capable of playing 14 events anyway. So I think everyone made the choice that suited them, for better or worse. I can't really blame any of the guys for going and thought the moral outrage was completely absurd. Still pretty unsure as to how it's all going to work though. That SI article is very pro pga, but I do think some kind of sweetener for the guys that stayed or penalty for the guys that left is going to be necessary if they do end up rejoining. -

PGA Effs Over 9-11 Families and Loyal Players

Mick92 replied to Parsad's topic in General Discussion

Stunning news. I was surprised PGA agreed to it. They appeared to have stopped any significant player losses to LIV and LIV wasn't generating huge interest in their own events. Maybe fear over litigation costs if they lost the suits and what would come out during discovery on both sides. The PGA's moral high ground campaign was vile to me so I'm not surprised they can't live up to it. Monaghan is even admitting he's a hypocrite lol. Hard to get a good feel for how this pans out, structure wise, but certainly looks like the guys who went and got a huge cheque are the big financial winners and guys who stayed and turned it down are the financial losers. -

Nice growth rate. Have they moved out of the liability line? It was significant in the previous year and almost nothing this year.

-

I'd say it likely will allow them to do that but also that they won't do it. They've been clear in every communication about IFRS 17 that they intend to stick internally with their current underwriting processes.

-

I'm about 15% Nintendo. Rock solid IP and I'm a believer in the higher margin digital/sub business. I think the parks and movies will be a slower burn but there's definitely value there over time. May has Zelda coming which will be big but there's pretty much nothing slated after Pikmin 4 in July so I'm looking for a Switch 2 announcement some time in the second half of this year.

-

Finished building out a position in Nintendo (7974). Valuation seems reasonable and they have a few potential catalysts for success in the next couple of years, but happy to hold for the long term if there's no imminent re-rating.

-

On the JOE train.

-

I guess if it's fully subscribed, Fairfax can elect to take the lower priced tenders first so you run a higher risk of missing out if you only tender at the top range. If you're working under the assumption that it won't be fully subscribed, then tendering at the top end makes sense. Overall, probably all depends on how high you want the probability to be of getting the shares tendered vs the price received.

-

NCIB is suspended until the expiry of the auction according to the docs. Shame as it would be nice to see them buying back the max right now.

-

Great summary as always Viking. I think on Brit, he meant that their CAT reinsurance is just about hitting the retention for the year, so any further significant CAT events in Q4 will likely be covered by it. On the capital allocation questions, I really wish Prem would be a bit more clear about what the absolute plan is. His answers are often rambling, including talking about Peleton and Bitcoin lol. I don't think he even answered the guy about increasing the dividend but I guess we have to assume the answer to that is no. It would have been nice for him to come out and state clearly that they intend to aggressively retire shares now that the debt is down, or at least give some kind of roadmap. I'm thinking maybe the continued increase in premiums has surprised them and is going to soak up more capital than previously thought, so maybe not so much available for share reduction. But clarity would be nice!

-

Probably an accounting quirk, they had realized gains of 473 million so you then have to roll off the previously unrealized gains amounts as unrealized losses.