Luca

Members-

Posts

2,977 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Luca

-

GDP grew 7% after he took over and then Covid came, their actions did not end up working and they adapted, capable of change and opened up. Now China deals with the huge problems from its extreme lockdowns and of a rising rate environment. If we look back on China in a decade, this will look just like the US in 2008 and returns from then on will be just fine.

-

Meanwhile Europe and US promising no more ICE Cars and then want to get into trade wars with China when:

-

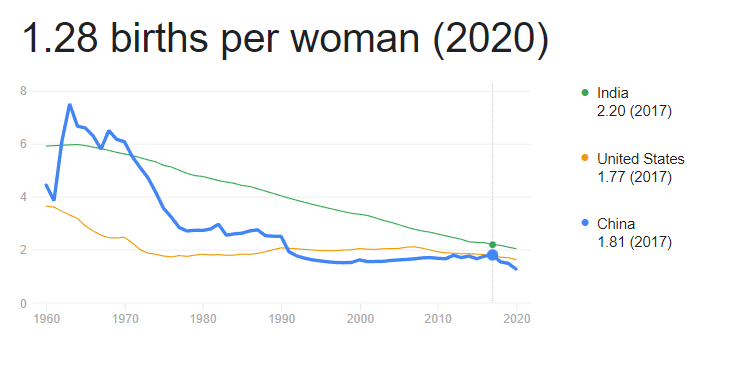

1. No centrally planned economy 2. Capable of change 3. Competitive advantages rising-->trade wars: https://www.politico.eu/article/french-urge-eu-declare-trade-war-against-china/ 4. Youth unemployement was at the same levels after 08 in the US, this too shall pass and long term investors can buy chinese companies at all time low valuations right now. 5. Birthrates shall recover at least a little bit with the right policies, i think china can do it. 6. Crime and underworld when there are 400000 cameras in Shenzhen observing everything. Their homicide rates are one of the lowest in the world.

-

Yep, as long as you compound above the interest rate you'll make money, really depends on for how much you can borrow, for how long and if you can find good investments that beat the interest paid.

-

Li Lu/Himalaya Capital, millionaire just with students loans!

Luca replied to Luca's topic in General Discussion

Very nice article thanks for sharing! -

Li Lu/Himalaya Capital, millionaire just with students loans!

Luca replied to Luca's topic in General Discussion

I mean that munger said somewhere that his initial investment with himalaya went up a considerate amount already since the start. I dont remember where he said it but somewhere to be found, i also think he mentions the exact number. -

Li Lu/Himalaya Capital, millionaire just with students loans!

Luca replied to Luca's topic in General Discussion

Yes i heard that in a talk too that he has a few hundred million with himalaya. Wasnt it that Li Lu made Munger a pretty impressive return very quickly or something? I watched the one lecture released 2 years ago but should revisit, great stuff! -

Li Lu/Himalaya Capital, millionaire just with students loans!

Luca replied to Luca's topic in General Discussion

I contacted their fund a year ago, was closed and sometimes open for endowments and family offices but was possible to leave name and they might reach out. I expect huge minimum investments if one can even get in, so isnt anything for me. Would really love to know his returns since inception, if anybody has more detail and is allowed to share please do. -

This is a story told by Mohnish Pabrai in one of his videos. Li Lu moved to the US due to China threatening him for taking part in the protests that led to the tiananmen square massacre (not really moving, he got funneled with support to survive and dont go to prison). Then he started studying again in the US(already got a chinese degree) and during his study he used the student loan FLOAT that he had for a few months (until he had to pay it back) to invest it into the stock market. Apparently after finishing multiple degrees after 3 years, he was already a millionaire by that time due to returns on the short term float. This all was around 1990-1995, a million was quite more than it is today. To me this sounds unreal and to good to be true but his results obviously speak for themselves. As of today he has around 18b under management, around 3b we can see of US holdings (Micron, Alphabet etc you know it). What do you think of this story? Everything i read about Li Lu was very impressing to me, very private investor though and little information and talks available unfortunately. Greetings to Li Lu and lets hope he publishes more of his wisdom!

-

Doesnt bother me one bit, i get more earnings power for a cheaper price, they continue to compound at high rates, win win. Buying back their shares etc

-

Continued to read about it and opened a starter today, its not cheap but also a long runway, will just let it set in my account and follow the business over time

-

Friend of mine send me this name a year ago, i pushed the idea down, reports where not available easily, couldnt find any write ups. Few weeks ago i watched the interview with the CXO, was quite impressed, then i was recommended chris mayer who still owns it (twitter thread from CXO about a new acquisition today)-->

-

Opened a position in Teqnion AB

-

Nice, i will have a look

-

Added to Evolution AB @122,24€ on gettex stock exchange

-

Starter in Evolution AB!

-

https://www.woodlockhousefamilycapital.com/post/the-best-businesses-to-own @Spekulatius mentioned chris mayer, this blog post goes a little bit into why sweden is a nice place to invest in. I didnt know but Mayer also owns Exor, FFH, Fairfax India... https://www.woodlockhousefamilycapital.com/post/woodlock-house-q4-letter

-

The Swedish Corporate Real Estate Crisis [2022 to ?]

Luca replied to John Hjorth's topic in General Discussion

Wrong Thread, my apologies -

The agreement, to my information, was the one china policy. Taiwan is part of china and China and the US will stay in strategic ambiguity and neither of them will overthrow the status quo by force, very successful for the last decades wasnt it? Pelosis Visit is provocating because she is a high government official, talked with the taiwanese government etc. Understandable that china gets agressive, right? On the other hand, i wish china would leave taiwan alone and taiwan could finally declare independence and i also understand that taiwanese people dont want to have anything to do with china, the US serves their interests more than china does.

-

What exactly do you mean by energy vampire Xi? Birthrates looked rather fine 6 years ago, i am pretty sure if anybody will be able to fix this, its China: Where exactly is the Belt and Road ,,failing,,? Can you provide some evidence that it is ,,failing,,? Real estate crisis okay, that happens, have a look in the US in 2008. Agressive behavior against Taiwan? The US agreed that taiwan belongs to china, then Pelosi with an Airplane flying there...who is agressive here? Getting seperated from your money when things get nasty? What do you mean? Evidence? Good comment from VIC: Consider also that chinese valuations are dirt cheap. Baba trading at book value, Tencent at 15x earnings excl investment portfolio. So many bargains out there... https://www.scmp.com/business/banking-finance/article/3173959/chinas-securities-watchdog-renews-call-firms-buy-back CSRC asking businesses for buybacks... You can paint an equally horrible picture for the US, drug epidemic, financial bubbles, huge political conflicts, underinvested infrastructure. What remains is that China has an incredible track record for developing their country, in many ways its ahead to any country in the world and the train keeps driving... Meanwhile some people think its a corrupt, failed state with no future. Ill take the contrarian bet here.

-

https://slkanthan.substack.com/p/secrets-of-chinas-economic-growth Nice Write up!

-

Bought back into Micron, went up 5% since i sold it but still bullish on them long term.

-

What is the intrinsic value of Fairfax's stock as of today?

Luca replied to Viking's topic in Fairfax Financial

Float at 5-7% constant for 10 years would be incredible, more than the whole current market cap. And yeah, you are getting a lot for free then!